USDINR - a breakout that will not bode well for the equities

78+ https://t.co/AWqZxF5B1L

Can you anticipate a breakout? Yes

— The_Chartist \U0001f4c8 (@charts_zone) June 10, 2022

the attached tweet.

now the chart is for USDINR https://t.co/Vb2wKaCvTB pic.twitter.com/INo0GC4fGY

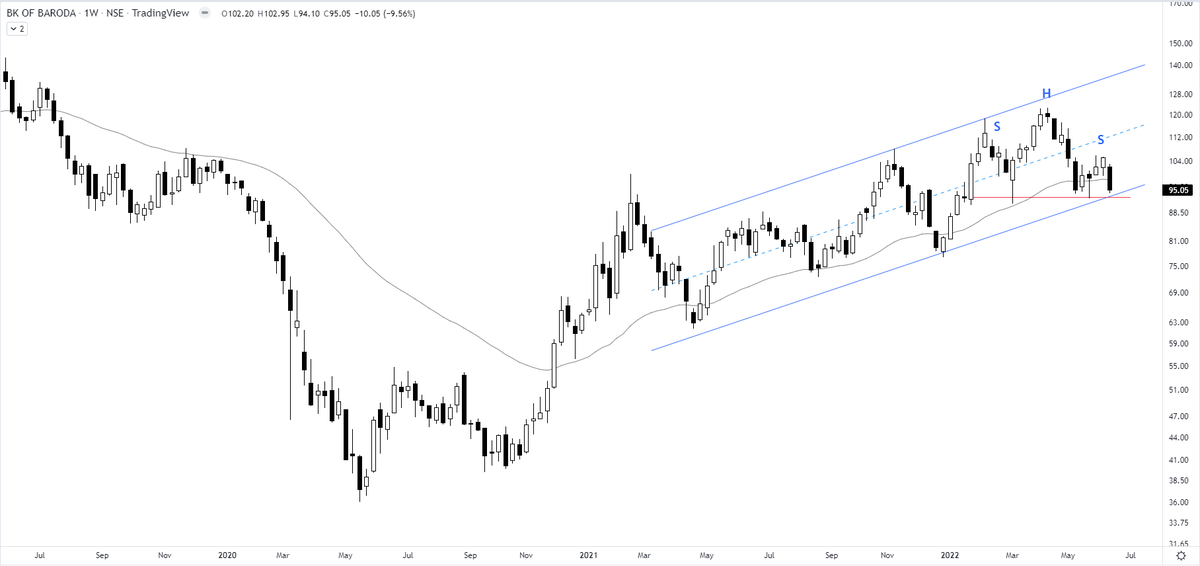

Adani Ports - updated chart. Fast forward & the stock is almost at the same level. However, the symmetrical triangle met its target exactly and became a part of a major triangle.

— The_Chartist \U0001f4c8 (@charts_zone) December 14, 2021

What makes it interesting is support is also 200 MA which adds another confluence point https://t.co/Tx52lzy9ZV pic.twitter.com/Cq67WNCHS3

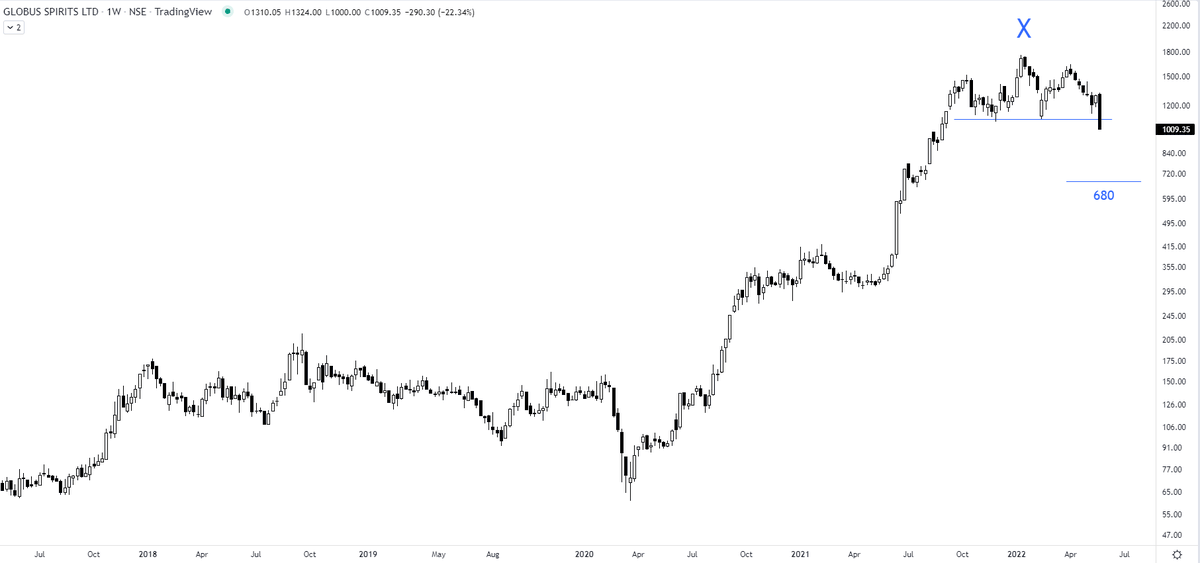

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q

Target opened as per the pattern is 8900 https://t.co/nRqYqPnPB3

Tata Elxsi - I waited for the trigger today but to no avail. The setup is still the best with price consolidating right in the RS zone. Waiting for the breakout till then no action. pic.twitter.com/LnOPswWgAp

— The_Chartist \U0001f4c8 (@charts_zone) March 16, 2022

Some went into the watchlist and some were actionable where my few long positions are already open.

— The_Chartist \U0001f4c8 (@charts_zone) December 25, 2021

What am I looking at in the charts? Flat base formation breakouts/Pullbacks/Trendline support. Keep it simple. Ex attached.

29/95 for further funda scans. P<100 (I don't trade) https://t.co/y4PKUBrA44 pic.twitter.com/e9cvcrKsnu

ITC - how beautifully the price patterns work. All of a sudden an increased momentum right from the support of the channel boundary. Has a minor resistance to nail down in the middle.

— The_Chartist \U0001f4c8 (@charts_zone) March 18, 2022

Anyone observing it would have gone aggressive at lower end for a swing move pic.twitter.com/YqxkdFlJXQ

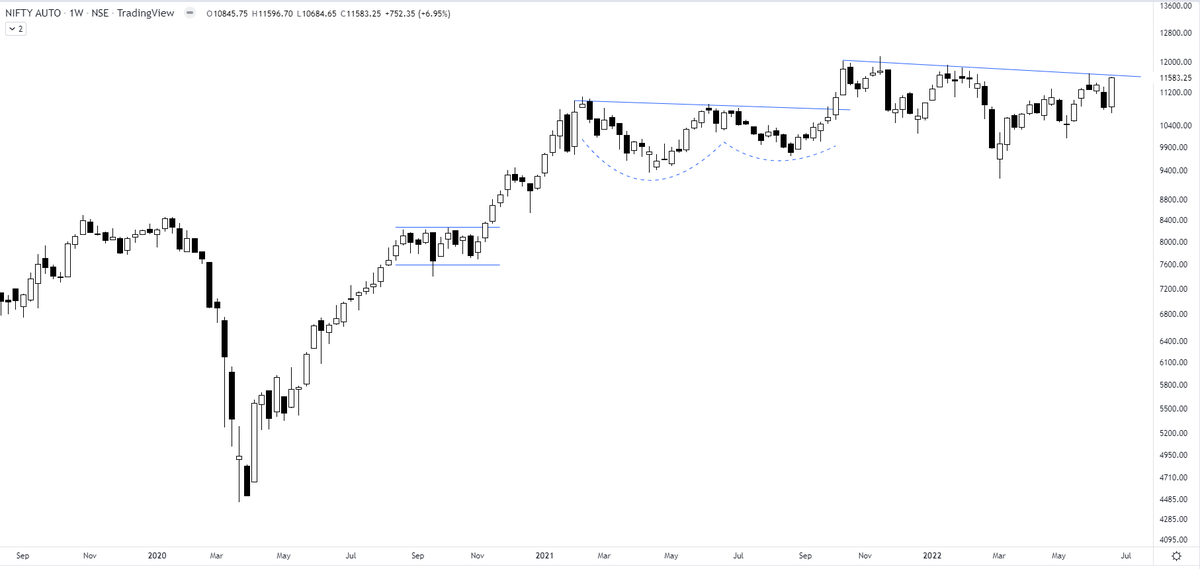

A bullish flag pattern right after the breakout. Although the broader rectangle target of 1190 is way more than this bullish flag target https://t.co/wdAzb7SS7L

Interesting chart of Mahindra & Mahindra consolidating in a rectangle pattern & the price not falling back to the lower support. pic.twitter.com/GJ7rCfkB9f

— The_Chartist \U0001f4c8 (@charts_zone) May 26, 2022

This exercise will tell you about your inherent strengths & weaknesses. 👇👇

How to record a trading journal (TJ) & what to analyze?

— The_Chartist \U0001f4c8 (@charts_zone) December 14, 2021

What is in a TJ?

Buy Date

Stock Name

The time frame you analyzed (D/W/M)

Long/Short?

Buy Price

SL

Sell Price

Risk took (% of capital)

Sell date

No. of days held

P/L

P/L as % of capital

Buy Reason?

Invested capital/trade pic.twitter.com/WnrvmYuOV0

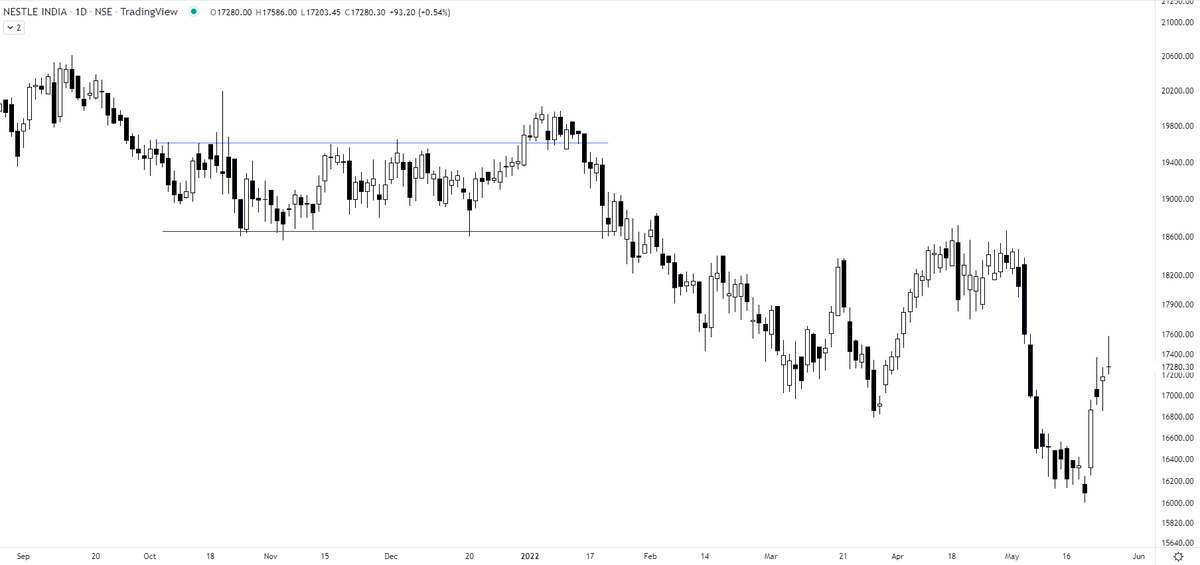

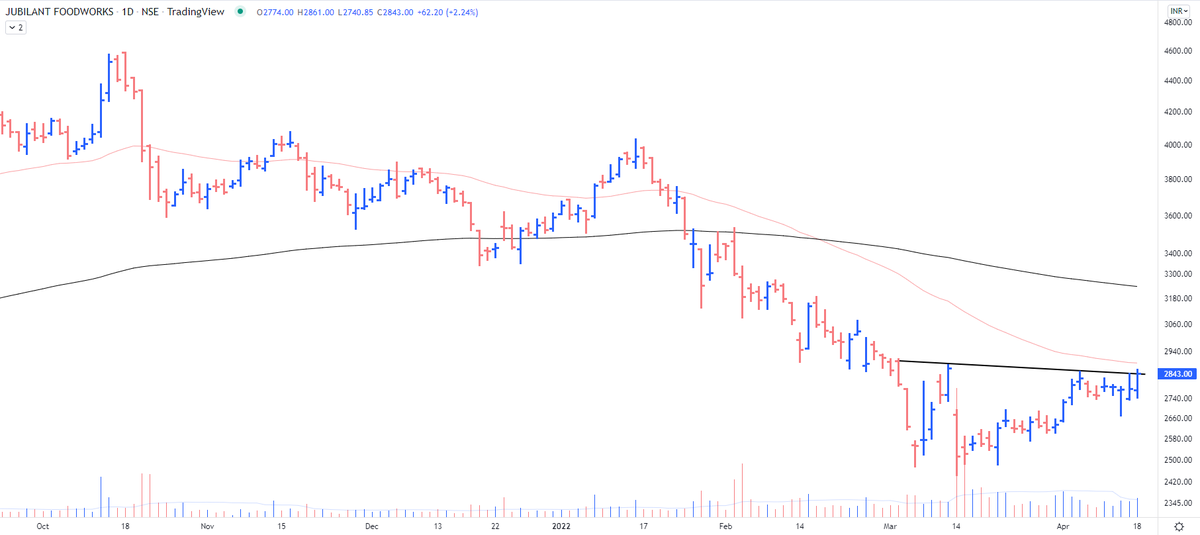

Holding this from lower levels - the reason being capitulation.

Jubilant Foodworks https://t.co/M1vLYEbkef

The selling climax is accompanied by volume bars of such magnitude that I highlighted in the chart. In almost all cases, they signify that even the last bull has thrown in the towel & there is no further selling left. Will observe in this case.

— The_Chartist \U0001f4c8 (@charts_zone) March 15, 2022

Jubilant Food pic.twitter.com/j7bGSdhkRW