Collaborated with @niki_poojary

1. Best Sources of knowledge for a beginner in option selling?

Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

2. Top YouTube Channel for Options Learning?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

3. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high probability trades.

4. Risk Management is a must for option selling

If you don't learn to manage your risk, making money in trading is going to be an extremely difficult endeavor

Have some rules:

1. Risk no more than 0.25% per trade as a beginner

2. Risk no more than 2% in a day for the first year

• Psychological mistakes to avoid

• Iron fly strategy

• Calenders strategy

• 3 great books on trading stocks.

• Various risks and how to manage.

• How breakout stocks behave.

• Solutions for peak margin.

Psychological mistakes to

Why few traders are going bankrupt after attaining huge success.

— Mitesh Patel (@Mitesh_Engr) September 4, 2021

Could be the following psychology.

During initial days trader is generating huge ROI with less capital.

Iron fly strategy

There are many strategies in market \U0001f4c9and it's possible to get monthly 4% return consistently if you master \U0001f4aain one strategy .

— Kavita (@Kavitastocks) September 4, 2021

One of those strategies which I like is Iron Fly\u2708\ufe0f

Few important points on Iron fly stategy

Calenders strategy to give you consistent

Here is the detailed information of about strategy,

— itrade(DJ) (@ITRADE191) September 4, 2021

Entry time : 9.30 - 10

Exit : Upto you

Strategy :

Sell weekly ATM CE & PE at almost equal price

For ex : Sell Nifty 17250 CE at 50 and Nifty 17250 PE at 48 so it will become short straddle

Compounding is

If it takes 15 Long Years (180+ months) to Build the First Crore Rupees, the Second will take a Few Years Lesser. The Third will be Effortless & The Fourth Happens Seamlessly.

— Fundamental Investor \u2122 \U0001f1ee\U0001f1f3 (@FI_InvestIndia) September 5, 2021

This is the Power of Patience, Base Effect & Compounding !!!#FI

Many people were asking us in the comments, how we managed.

Explained transparently what we did.

Hope you get something to learn from this. 😀👍

Sep 23, 2021 - Weekly expiry, preceded by the FOMC meet and not to mention the gap up which then turned out to be a trending day

— Nikita Poojary (@niki_poojary) September 25, 2021

Here\u2019s how the strangles were converted into straddles & how the positions were managed!

Time for a Thread \U0001f9f5

Here are 36 of his best tweets to learn from: 🧵

How to Improve at

How To Improve At Trading,

— Trade With Trend (@ST_PYI) April 30, 2020

1. Take 1 Method.

2. Execute 100 Trades.

3. Document those 100 Trades.

4. Analyze mistakes after every 20 Trades.

5. Aim to not repeat those mistakes.

In 1 Year, You will surpass your Wildest Imagination in terms of what you will achieve.

How to Succeed In Short Term, Swing & Positional

To Succeed In Short Term, Swing & Positional Trading,

— Trade With Trend (@ST_PYI) April 10, 2021

1) Begin with Sector Analysis (Strongest Sector)

2) Then, Stocks within the Strongest Sector

3) Check for Long Term Trend

4) Identify Entry ONLY in the Direction Of Trend.

Give this a Try. Your Growth will be Exponential.

How to improve your results in swing

In Swing Trading,

— Trade With Trend (@ST_PYI) July 31, 2021

Never Buy a Stock that is below 50 Day SMA

Always align with Broader market Trend

Focus on High Beta Stocks & Sectors

Select Stocks that are Trending (Not in a Range)

And, look for Volume expansion over last 10 days

Follow this. Your results will Improve.

Simple Strategy for a Swing

Simple Strategy for Swing Trader,

— Trade With Trend (@ST_PYI) August 12, 2020

1) 50 DMA should be rising (Align with Trend)

2) Wait for a Pullback at 50 DMA

3) Confirm with Hammer / Bullish Engulfing (Plus Volumes)

4) Use Stochastic Or RSI to confirm Pullback

5) Use Swing Low as SL

6) Stick to Quality Stocks

On Scanners, Setups, Straddles, Strangles, Mitesh Patel Sir, Mark Minervini & more.

Collaborated on these with my awesome friend and business partner @niki_poojary.

🧵Here are my top threads of 2021:

1. Best 15 scanners experts are using.

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

2. 12 Trading Setups used by expert

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

3. How to Sell Straddles, different methods by different top traders.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

4. Option Wheel Strategy: Consistent income

A THREAD:

— Aditya Todmal (@AdityaTodmal) December 5, 2020

BEST OPTIONS STRATEGY FOR CONSISTENT INCOME -

OPTIONS WHEEL STRATEGY

Everything to know about this strategy I'm posting in this thread.

(1/12) pic.twitter.com/F0o4wIMjgf

Thread's on:

• How to find targets and exit criteria?

• Shanon's Demon (Investing)

• Tradingview scanner- Intraday/BTST

• 90-degree angle inflection point for profit-booking

• Importance of Leverage

Other cool tweets as well.

🧵Shannon's Demon - an investing "thought exercise"

This account writes the best threads, if you like the threads I make, you will surely love this account. Must

1/

— 10-K Diver (@10kdiver) October 23, 2021

Get a cup of coffee.

In this thread, I'll walk you through Shannon's Demon.

This is an investing "thought exercise" -- posed by the great scientist Claude Shannon.

Solving this exercise can teach us a lot about favorable vs unfavorable long-term bets, position sizing, etc.

🧵Finding expected targets and exit criteria to look for to exit the

How to find out the expected targets and what should be the exit criteria when you enter a trade - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) October 25, 2021

Possible ways to find out the target:

Check if any patterns forming - it gets quite easy to figure out the targets that way. (1/15)

🧵Trading View Scanner process to trade in momentum stocks.

Trading view scanner process -

— Vikrant (@Trading0secrets) October 23, 2021

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today) https://t.co/GGWSZXYMth

🧵90-degree angle inflection point for

The 90 degree angle inflection point in a stock is a signal to book profit

— Nikita Poojary (@niki_poojary) October 24, 2021

Lets understand with a recent example of a stock #IRCTC \U0001f683\U0001f68b

Time for a thread\U0001f9f5

Some knowledgeable tweets/threads by me...

I will keep adding to this thread over time

Starting with:

1. Option Synthetics Explained

2. Best free Data website - Icici Direct

3. Per order vs Per lot brokerage

4. Best youtube channel - Power of Stocks

A thread on Option Synthetics

1. Increase your returns

2. Margin requirements/costs are less

3. Save on STT/other charges

4. Develop a better understanding of

A THREAD ON OPTIONS SYNTHETICS, LONG READ:

— Aditya Todmal (@AdityaTodmal) August 16, 2020

With synthetics you can increase your returns as the margin requirements/costs are less. Everyone wanting to become a top trader needs to know this and get their concepts cleared because many people don't know what they're doing

(1/11)

Best free website to get Data from - ICICI DIRECT

Advantages:

1. Quantitative Analysis in one place

2. Easy to find stocks where action taking place

3. Find the exact price levels at which OI is being

Best FREE website for FNO Heatmap - ICICI DIRECThttps://t.co/honvUA9lmx

— Aditya Todmal (@AdityaTodmal) January 24, 2021

Advantages:

1. Quantitative Analysis in one place

2. Easy to find stocks where action taking place

3. Find the exact price levels at which OI is being added.

(1/5) pic.twitter.com/Pvk8i8EfIT

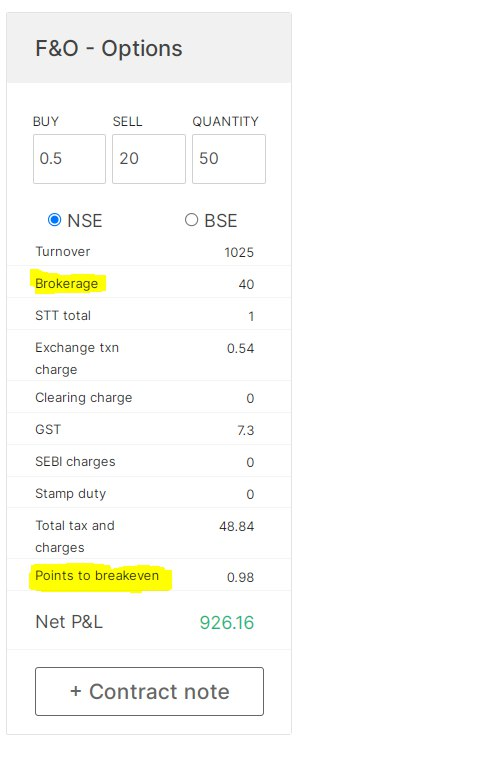

PER ORDER Vs PER LOT brokerage

Which one is better?

Read the thread to know why one is clearly better than the

PER ORDER Vs PER LOT brokerage

— Aditya Todmal (@AdityaTodmal) May 23, 2021

Which one is better?

Read the thread to know why one is clearly better than the other.

A THREAD ...

Finally, Check out Subhasish Pani Channel - Power of Stocks

My favorite Youtuber from the trading community without a doubt.

Spend your weekend learning from his channel.

The best YouTuber I have ever seen from the trading industry.

— Aditya Todmal (@AdityaTodmal) January 23, 2021

Power of Stocks - Subhasish Pani

Guys do go over his daily analysis videos to become better.

1. Superb logics

2. Great Risk Reward

3. Consistency

4. Prepared for all scenarioshttps://t.co/I5wGmwIYUq

🧵on

• Uses of RSI

• Rakesh Jhunjhunwala

• Volume Analysis

• Cash Investing Strategy

• How should new entrants learn quickly?

• How to use Nifty to beat its own returns?

• Compilations of many threads

🧵Superb Thread on RSI

1. Uses of RSI.

2. Investment strategy based on

#RSI is a common indicator which most of us use in the stock market.

— Yash Mehta (@YMehta_) October 22, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d64d\U0001d64e\U0001d644"

Like\U0001f44d & Retweet\U0001f504 for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using RSI in the end.

1/16

🧵How did Rakesh Jhunjhunwala make his money from trading? Covered very well.

Rakesh Jhunjhunwala became rich initially by Trading and not Investing.

— ARJUN BHATIA (@ArjunB9591) October 21, 2021

Thread on the same \U0001f9f5

It is called genius because Jhunjhunwala made Rs 20 lakh to Rs 15,000 crore in 30 years through the stock market. And that Rs 20 lakh was also borrowed money at 20% interest. pic.twitter.com/ZkGU4iG5UR

🧵Amazing thread on various indicators.

(@Prashantshah267)

This is not a thread from the current week but @ArjunB9591 brought this to my notice so I shared it.

Thread of threads I have written on the Twitter:

— Prashant Shah (@Prashantshah267) November 29, 2020

Link to my books, blogs and videos:https://t.co/yZjlVPpKs4

🧵on Volume

Full #volume anlaysis thread \U0001f9f5

— Vikrant (@Trading0secrets) October 20, 2021

One thing which big player can never hide - VOLUME https://t.co/MjtFq384N0

• Lessons learned from Trading Mistakes

• Moneycontrol article on a pro option seller

• Rakesh Jhunjhunwala investing strategy.

• What do you really need?

• Stocks to invest for long term

A thread 🧵

Best Trading books to read - check the comments section for some great

What's the best trading book you've ever read?

— Steve Burns (@SJosephBurns) September 30, 2021

Lessons learned from some trading

Trading Mistakes & Lessons Learnt \U0001f9f5

— Sourabh Sisodiya, CFA (@sourabhsiso19) September 30, 2021

1) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

#trading #mistakes pic.twitter.com/4MYFlCS9Hi

In spite of being rejected in many things, we can still be

I had been rejected many times in my life few are:

— ASAN (@Atulsingh_asan) September 30, 2021

-I was Rejected in a BPO job interview 2006

-I was Rejected in Indian Idol 2011

But Market accepted me as a student since 2013 and journey on

Don\u2019t lose hope when you rejected by someone, keep trying you will succeed.#ASAN

Moneycontrol article on @Pathik_Trader to learn how to trade breakouts with good risk management & position

Small article on my trading journey covered by Shishir in moneycontrol. Thanks a lot shishir.\U0001f942\U0001f942

— Pathik (@Pathik_Trader) September 27, 2021

It's kind of dream come true moment. \U0001f60d\U0001f942

Thank you everyone for inspiration & support. Special thanks to @sanstocktrader@Stockengg @VRtrendfollower\U0001f942\U0001f942https://t.co/0fk2gpd1qv

But 98.8% missed out on the best content on this platform.

Here are the best threads from Q1 2022:

Collaborated with @niki_poojary

Topic: Mistakes in trading as an option

10 mistakes in my 14 years of trading as an option seller \U0001f9f5

— Sarang Sood (@SarangSood) March 19, 2022

Topic: How to filter stocks with their entry and exit

If you're a swing/positional/trend follower, then this thread is for you. In this one, I will be covering how to filter stocks, how to take entry and the exit plans. \U0001f9f5 (1/21)

— Sheetal Rijhwani (@RijhwaniSheetal) February 27, 2022

Topic: Myth of an "edge" in overnight option

A thread addressing the myth of "Edge" in overnight option selling, got many questions around this after the F2f scession!

— Bandi Shreyas (@BandiShreyas) January 9, 2022

Assume you sell a 0.05 delta call option every month at the beginning of the month (basically an option that is 0.05 probability

Topic: Best threads on Investing and

Here are the\U0001f51fbest threads you can ever read on investing and trading -

— Anshika Sharma\u26a1 (@Anshi_________) March 5, 2022

A thread\U0001f498

What does it mean?

7 tweets that will teach you about its basics (and much more):🧵

Collaborated with @niki_poojary

1/ What is CPR?

The basics of CPR, how it's calculated, and TC and BC in CPR.

User: @ZerodhaVarsity.

One can also gauge the trend whether bullish or bearish.

Explained in very simple words

@ZerodhaVarsity 2/ What are the Uses of CPR?

User: @YMehta_

A thread that provides examples along with the concept.

Also includes an Intraday Trading Setup on 5 min

#CPR is an indicator which is used for #Intraday in Stock Market.

— Yash Mehta (@YMehta_) November 19, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d63e\U0001d64b\U0001d64d"

Like\u2764\ufe0f& Retweet\U0001f501for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using CPR in the end.

1/24

@ZerodhaVarsity @YMehta_ 3/ How to analyze trends with CPR?

User: @cprbykgs

How to interpret CPR based on the candles forming either above or below the daily and weekly CPR.

He is the most famous guy when it comes to CPR, so go through his Twitter and Youtube

CPR indicator trend analysis:

— Gomathi Shankar (@cprbykgs) January 25, 2022

Candles below daily & weekly CPR \U0001f43b

Candles above daily CPR but below weekly CPR early confirmation of \U0001f402

Candles above daily + weekly CPR strong confirmation of \U0001f402

Isn\u2019t it simple?#cprbykgs #cprindicator #nifty #banknifty

@ZerodhaVarsity @YMehta_ @cprbykgs 4/ Interpreting longer timeframes with CPR

User: @cprbykgs

Trend Reversals with CPR when the trend is bullish and it enters the daily CPR

#banknifty

— Gomathi Shankar (@cprbykgs) July 9, 2021

Candles above monthly CPR- Bullish

Candles above weekly CPR- Bullish

Now, whenever candles enter daily CPR range it indicates weakness of current trend & early signs of trend reversal.

So, wait for the candles to exit the daily CPR range then take the trade. (1/4) pic.twitter.com/7vaaLMCrV8