SAnngeri's Categories

SAnngeri's Authors

Latest Saves

Time to pause ?

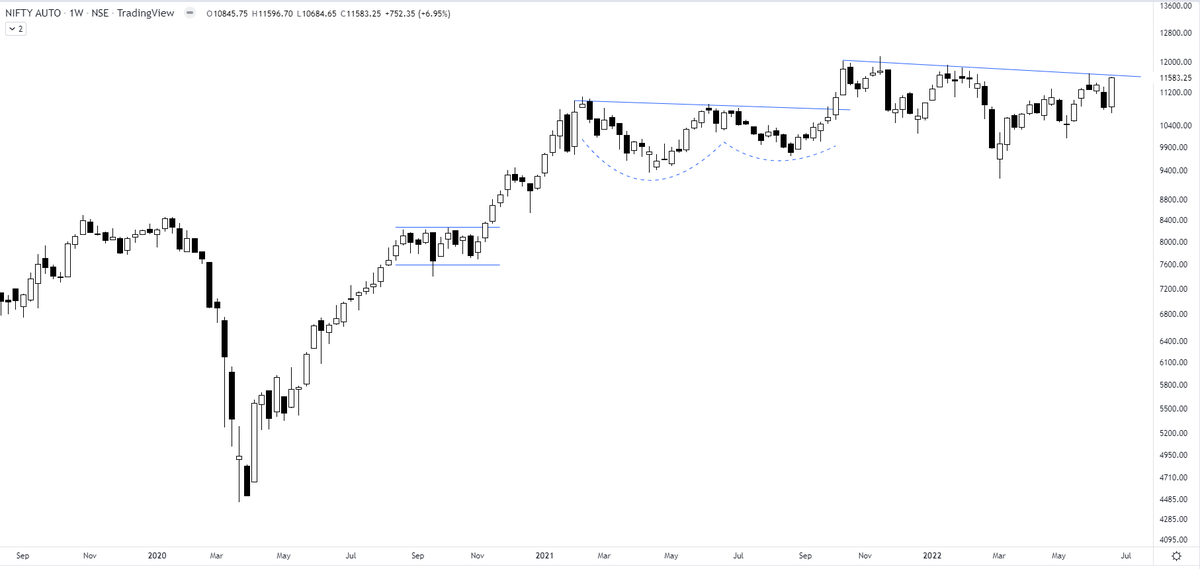

Even chart says the samething https://t.co/1OJTjqp0ay

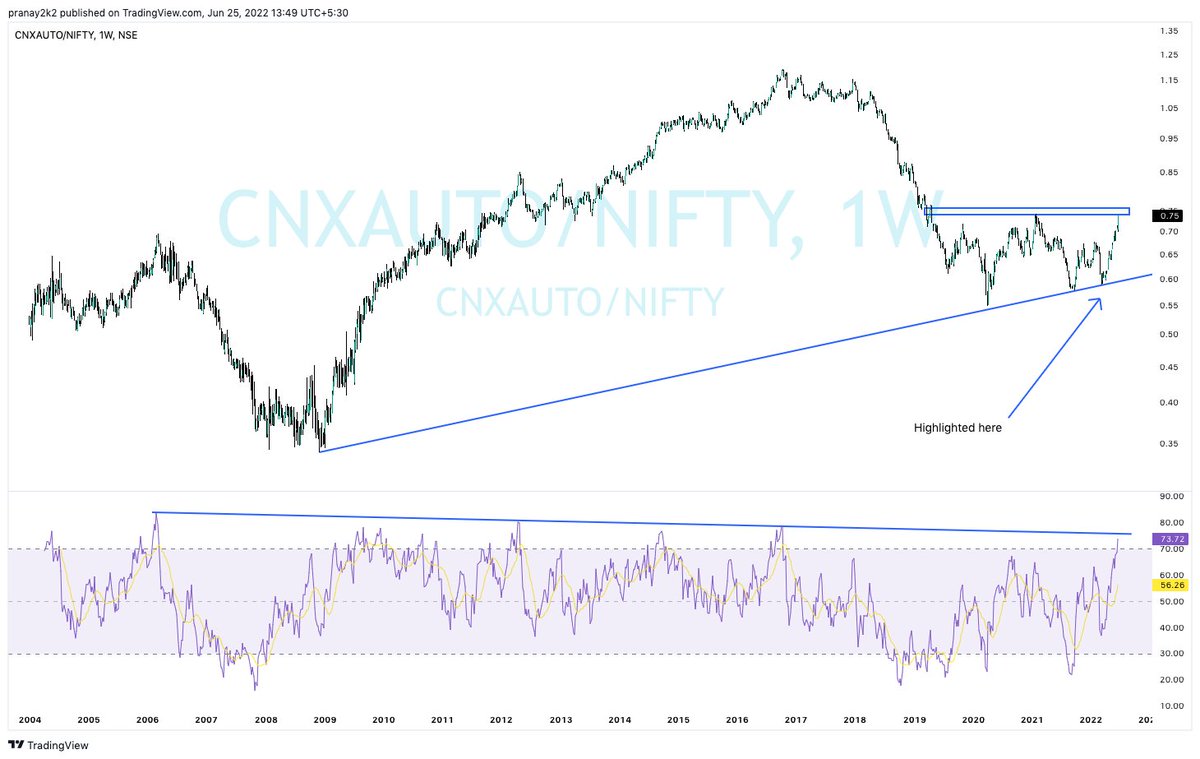

Are we ready for BOOM BOOM in auto sector ?\U0001f9d0#CNXAUTO

— Pranay Prasun (@PranayPrasun) April 2, 2022

~ Weekly ratio chart against #NIFTY indicates bottom and going forward it may outperform \U0001f91e

~ Don't expect quick returns as its weekly chart pic.twitter.com/cUaugZBerL

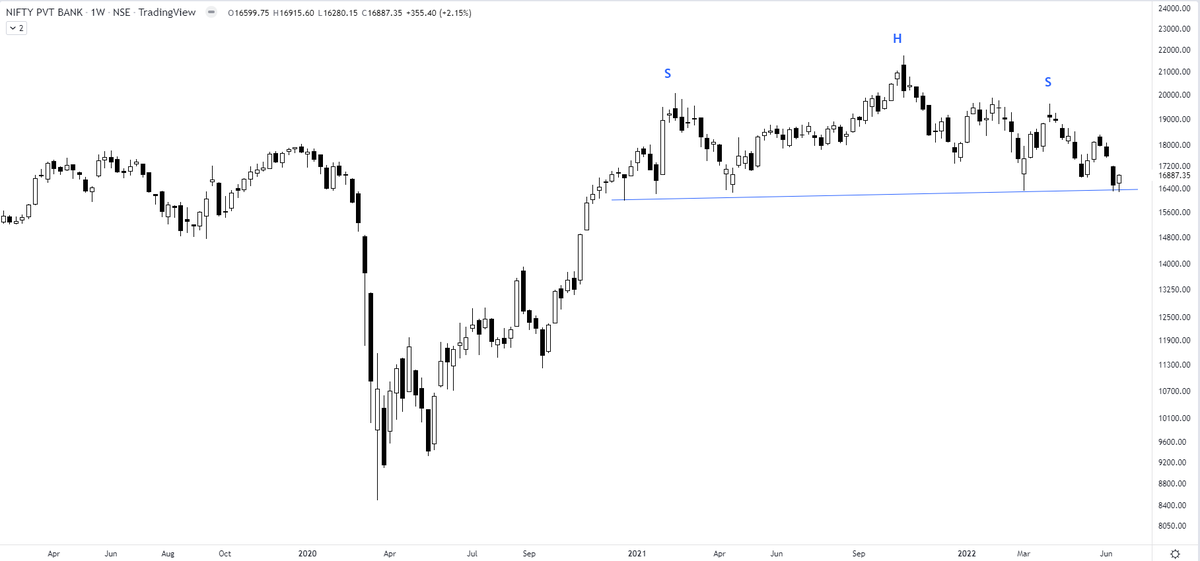

Nifty Private Bank https://t.co/BwG1DKhhLc

I am watching a big bearish H&S top building up in Nifty Private Bank Index. Any breakdown will result in increased volatility in respective charts. For traders - definitely not a spot to be in. The index has to move beyond 19900 to negate the pattern. pic.twitter.com/IGFeyNrtQV

— The_Chartist \U0001f4c8 (@charts_zone) June 19, 2022

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

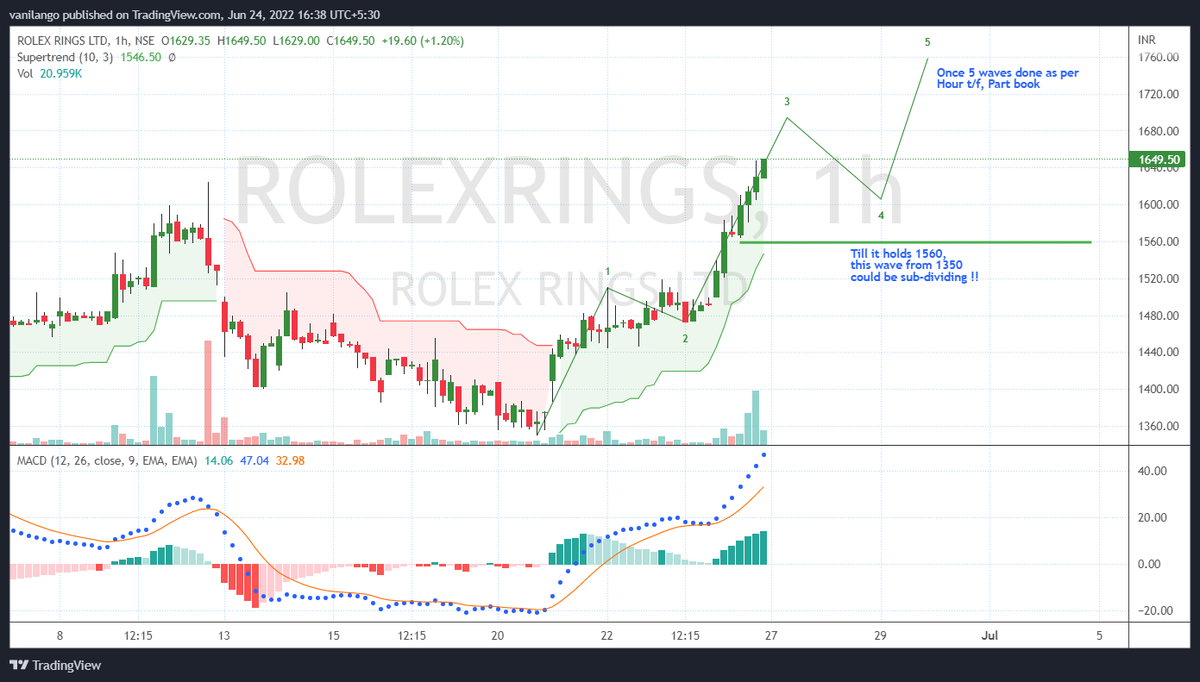

I'll go with 5th is getting done soon.

There is one more possibility that 3rd wave is sub-dividing !!

IF so it must hold last rise #retracement https://t.co/a6BBHIWrZk

ROLEX RINGS

— manav (@manav1418) June 24, 2022

Elliot counts (possible scenario's)

Which wave count is correct as per you\U0001f64f

please guide....!!@nakulvibhor @nishkumar1977 @JustNifty @piyushchaudhry @KrunallThakkar pic.twitter.com/h97J8Ycuf5

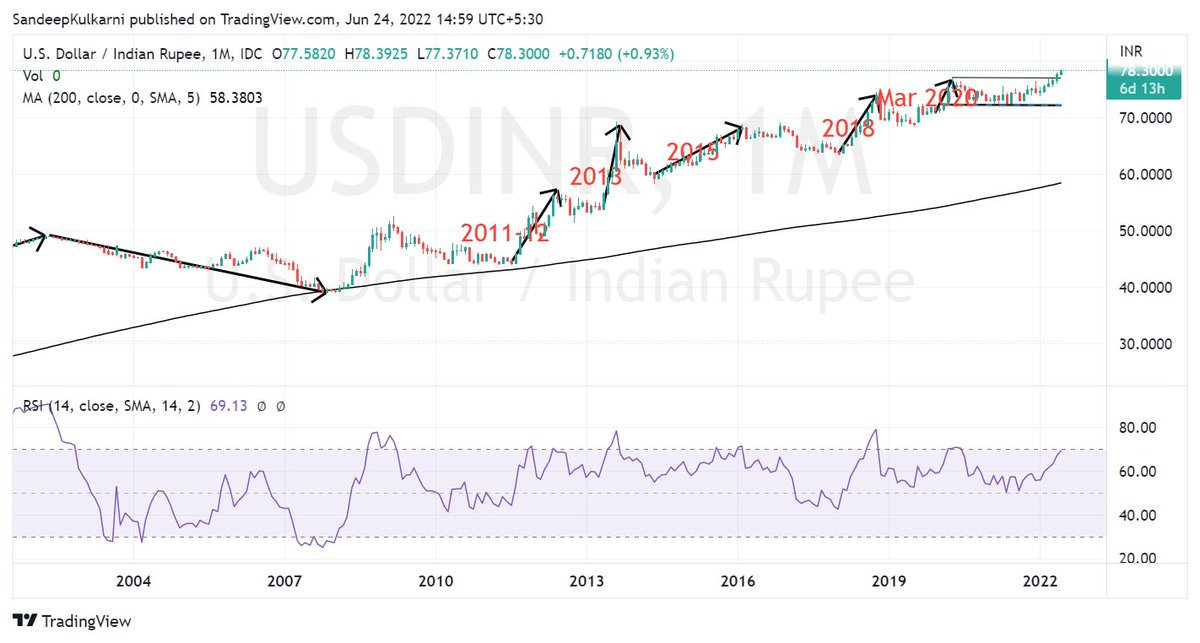

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

We know how our stock market has weathered the FII selling.

— Sandeep Kulkarni (@moneyworks4u_fa) June 10, 2022

But the equally big story is how Rupee has weathered $50bn+ outflows since Oct 2021. Hats off to RBI Governor Das & his team for having the vision of building huge reserves in his tenure. pic.twitter.com/CVuF9dM361

100+ points done and counting

@ctrameshraja sir you had nudged me on this below 700 https://t.co/lMPqvWLLUm

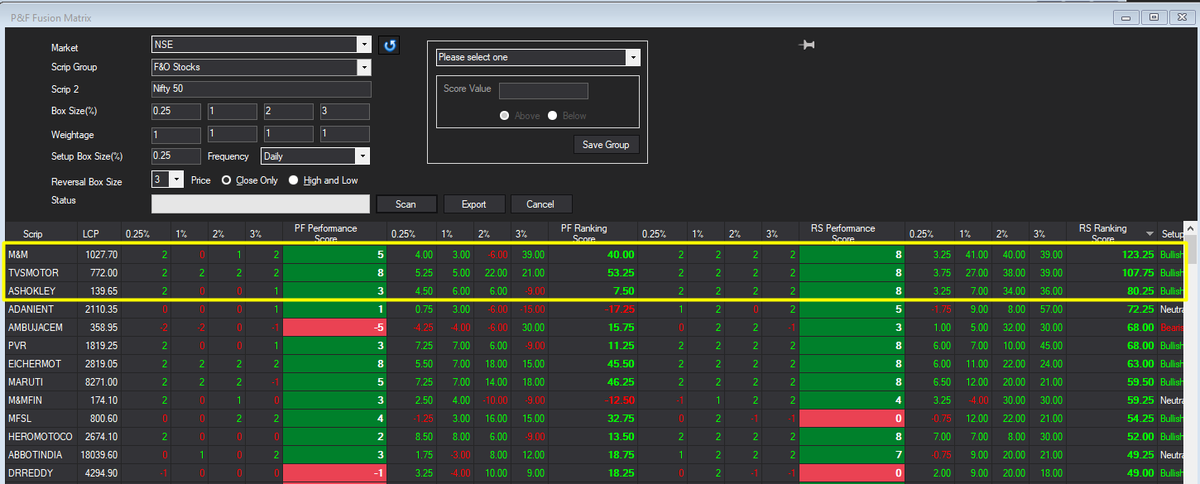

#FusionMatrix - top three outperforming stocks are from Auto Sector. @shivaji_1983 we discussed this today#MNM (M&M)#TVSMOTOR#ASHOKLEY https://t.co/n6J2oKT4aO pic.twitter.com/iOxKEveBSn

— DTBhat (@dtbhat) June 23, 2022