Crypto_Carlosa's Categories

Crypto_Carlosa's Authors

Latest Saves

Take a look at the wallet on Ethereum that deployed the Mirror yield farming contracts. Mirror was created by TFL. You can unpack a decent amount of the story by tracing transfers from this wallet... (1/19)

537 days ago, the address now known as 'Wormhole: Deployer 4' was funded with initial gas from the Ethereum wallet that initiated Mirror's contract deployals. I've linked both the wallet address and the gas transfer. (2/19) https://t.co/AxTm94HUti

At several points in time, this Wormhole-related address (remember who owns Wormhole? Hi again @KanavKariya) owned most of the Mirror LPs on Ethereum. They thus farmed most of the MIR rewards, which would allow them to have a disproportionate say in governance decisions. (3/19)

But they don't want anyone to know this. I have found evidence that this wallet and related wallets try very hard to make it look like MIR governance is not majority-controlled by a single entity - they do so by splitting up MIR between several fresh anonymous wallets. (4/19)

2/ I understand the last 72 hours have been extremely tough on all of you - know that I am resolved to work with every one of you to weather this crisis, and we will build our way out of this.

Together.

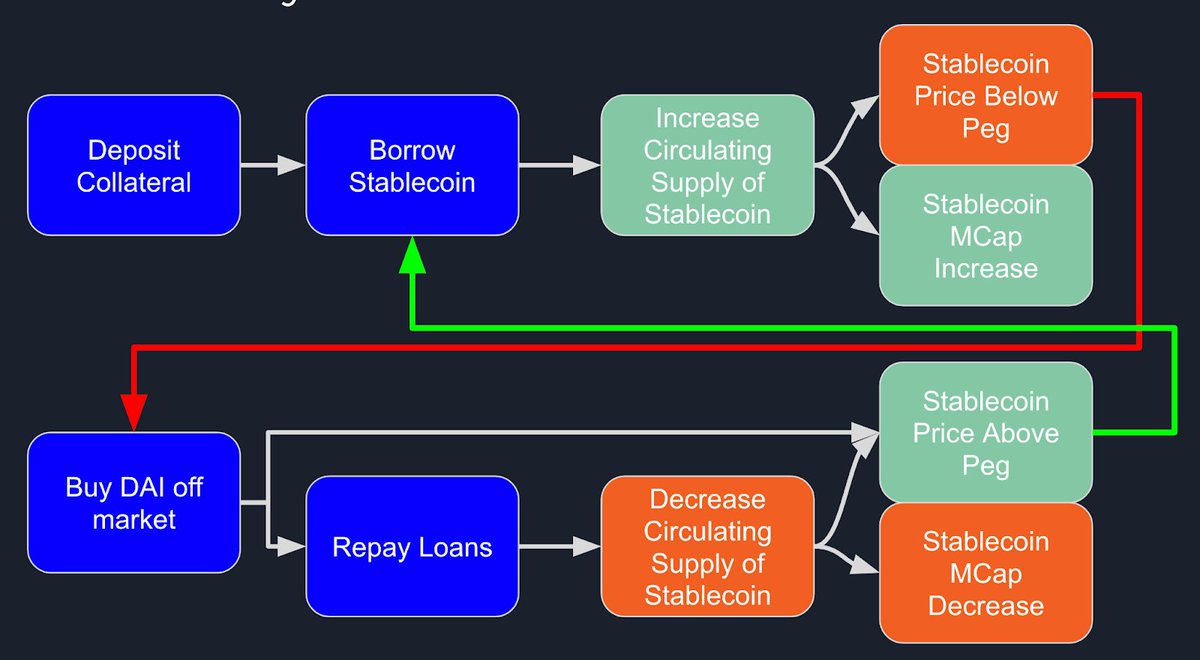

3/ First, if you don’t understand how Terra’s peg stabilization mechanism works, here is a good overview:

Update on Luna Tokenomics

— Pedro Ojeda (@pedroexplore1) May 11, 2022

+

How to predict when depeg will end.

Bringing back my \u201cdeath spiraling Luna\u201d model. Turns out it was accurate. All of those \u201cDidn\u2019t age well\u201d jabs at it Didn\u2019t Age Well.

1/24

\U0001f9f5

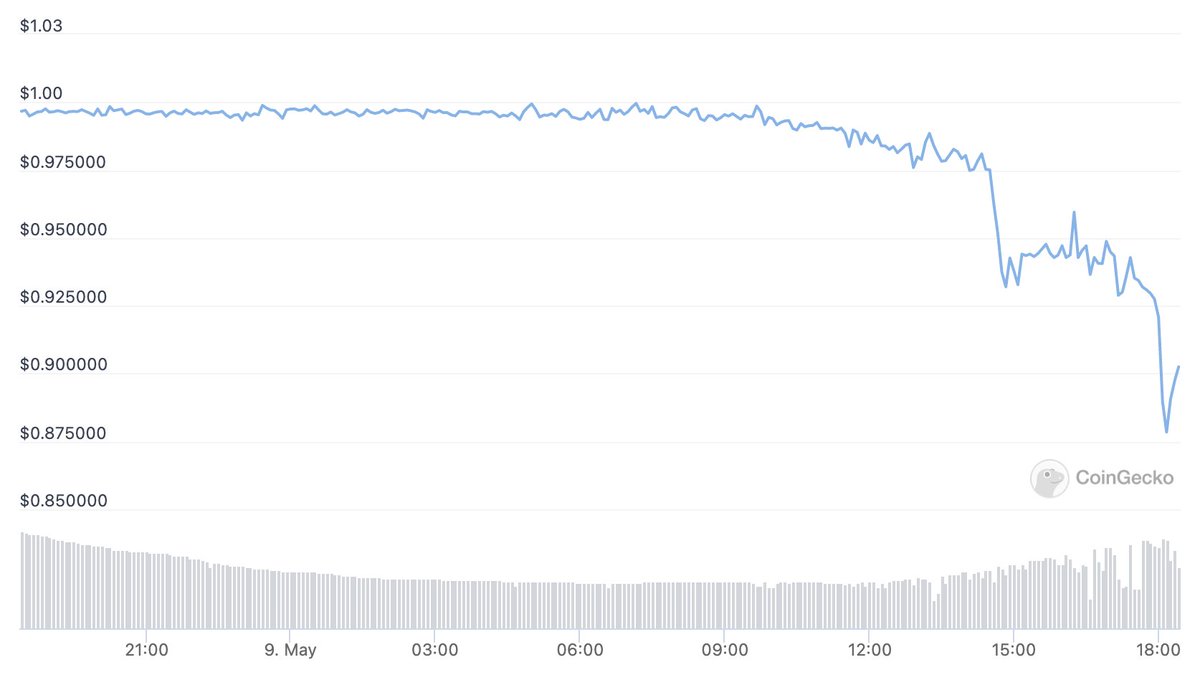

4/ A review of the current situation: UST is currently trading at 50 cents, a significant deviation from its intended peg at $1.

5/ The price stabilization mechanism is absorbing UST supply (over 10% of total supply), but the cost of absorbing so much stablecoins at the same time has stretched out the on-chain swap spread to 40%, and Luna price has diminished dramatically absorbing the arbs.

Hint is in Anchor protocol and the status of Curve UST pool. @anchor_protocol @terra_money

@terra_money 1/ There were series of notable events that happened during the recent UST depeg event.

In this thread, I will share my thoughts on what caused the depeg.

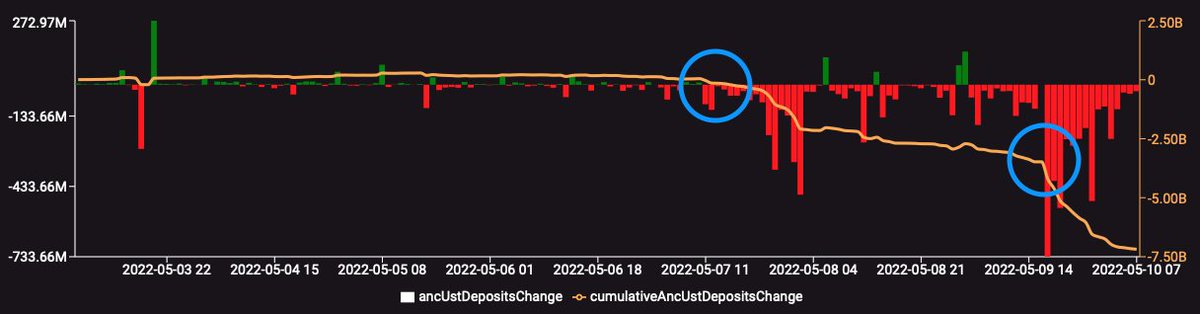

@terra_money 2/ May 7th, 2022. 9 pm was the time that starts the depeg event.

First, UST deposits in Anchor protocol started to exit, which means more circulating UST in the market → sell pressure.

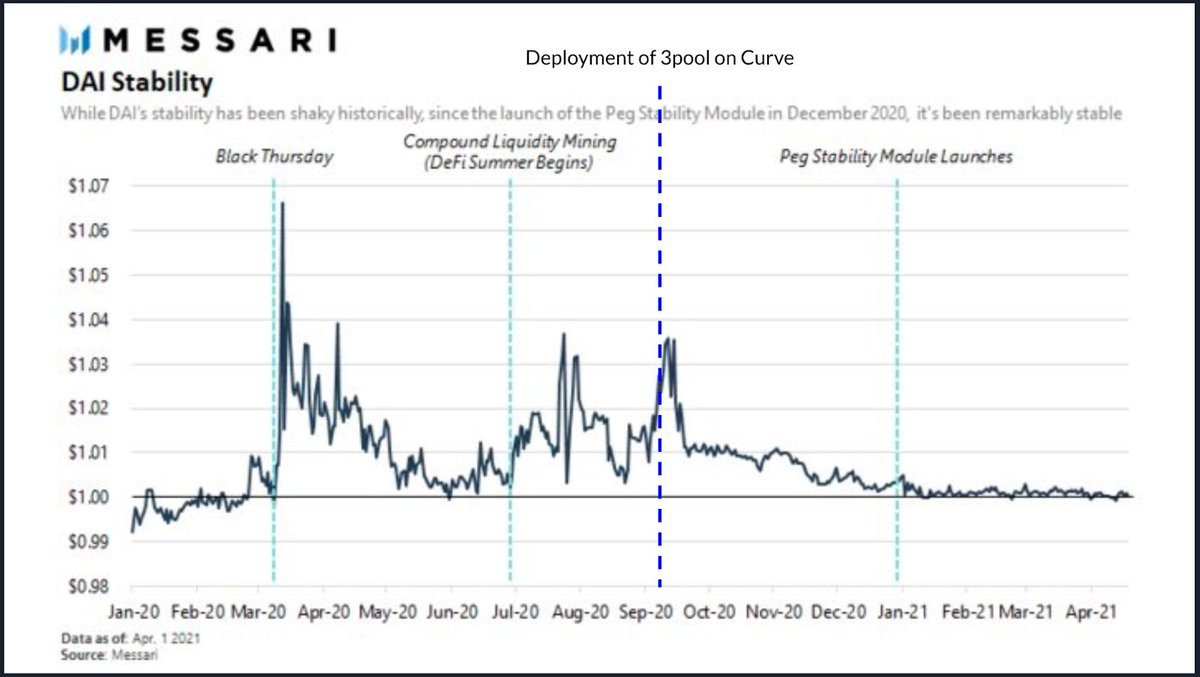

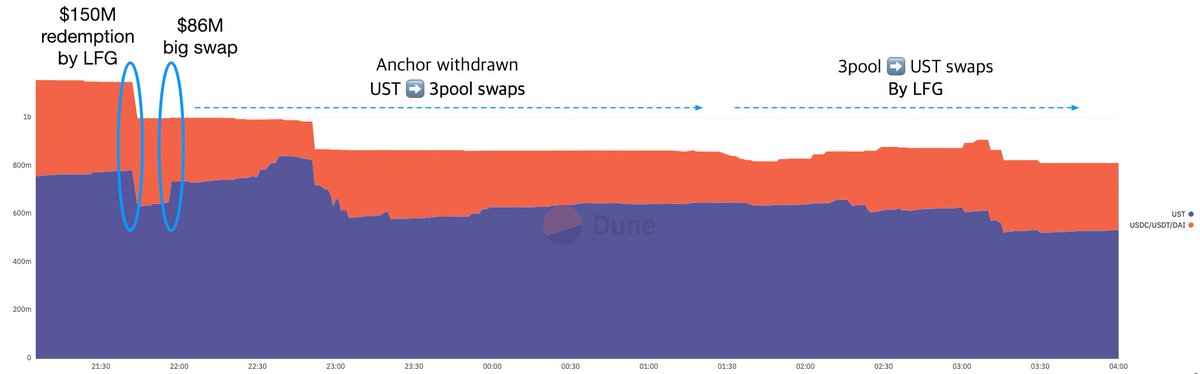

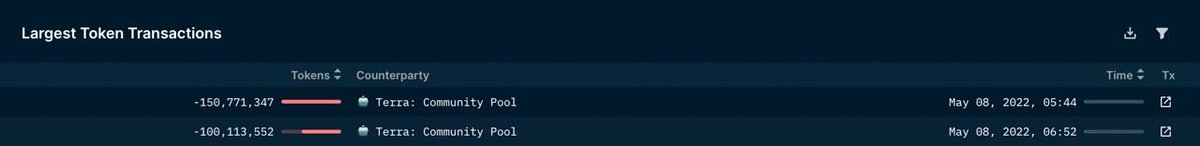

@terra_money 3/ Simultaneously, 150M UST was withdrawn from Curve wormhole UST3CRV pool followed by large UST → USDC swap that caused significant imbalance between UST(85%) and 3CRV(15%) in the pool.

@terra_money 4/ However, some address made series of transactions to restore the balance in the Curve pool. Here are lists of relevant transactions.

https://t.co/gx9nr7kNcN (05-08-22, 02:30 AM)

https://t.co/bPKhvgfT72 (05-08-22, 02:40 AM)

https://t.co/8Yd056olrL (05-08-22, 03:00 AM)

Everyone is talking about the $UST attack right now, including Janet Yellen. But no one is talking about how much money the attacker made (or how brilliant it was). Lets dig in🧵

Our story starts in late March, when the Luna Foundation Guard (or LFG) starts buying BTC to help back $UST. LFG started accumulating BTC on 3/22, and by March 26th had a $1bn+ BTC position. This is leg #1 that made this trade (or attack)

The @LFG_org now #hodl 24,954.96 #Bitcoin at a total balance of $1,109,824,161.90 USD in the Atlas Reserve.

— LFG_Reserve (@LFG_Reserve) March 26, 2022

The second leg comes in the form of the 4pool Frax announcement for $UST on April 1st. This added the second leg needed to help execute the strategy in a capital efficient way (liquidity will be lower and then the attack is on).

1/ Introducing the 4pool - between @fraxfinance, TFL and @redactedcartel we pretty much own all the cvx

— Do Kwon \U0001f315 (@stablekwon) April 1, 2022

UST-FRAX-USDC-USDT

Curve wars are over, all emissions are going to the 4pool https://t.co/LNJs7CAfcV

We don't know when the attacker borrowed 100k BTC to start the position, other than that it was sold into Kwon's buying (still speculation). LFG bought 15k BTC between March 27th and April 11th, so lets just take the average price between these dates ($42k).

So you have a ~$4.2bn short position built. Over the same time, the attacker builds a $1bn OTC position in $UST. The stage is now set to create a run on the bank and get paid on your BTC short. In anticipation of the 4pool, LFG initially removes $150mm from 3pool liquidity.

Here's everything you need to know.

The $UST Depeg Thread:

👇

$UST is a dollar-pegged stablecoin that has depegged twice in the last few days, now hovering around $0.90 to the dollar.

Just a reminder on how $UST works:

You can always redeem $LUNA for $UST dollar-for-dollar, and vice versa.

If $LUNA is at $50, you can redeem it for 50 $UST.

Similarly you can redeem 50 $UST for 1

A thread about all the opportunities in the Terra $LUNA ecosystem:

— Route 2 FI (@Route2FI) January 7, 2022

In this thread, I'll focus on the nr. 2 biggest ecosystem in terms of TVL in DeFi ($16.8b).

There are plenty of opportunities in crypto to earn yield.

Let's look at how you can make it with Terra $LUNA

/THREAD pic.twitter.com/SKmEY3cBOT

It's worth noting you can always redeem 1 $UST for $1 worth of $LUNA, even if $UST is worth <$1.

It's meant to be a stabilizing mechanism:

If $UST is trading at $0.99, arbitrageurs can buy it and redeem it for $1 of $LUNA.

We all know Stablecoins Require Utility™ to maintain demand and defend their peg.

So where does $UST get utility?

Simple, Anchor Protocol.

Anchor Protocol is (nominally) a money market, but the important tl;dr is it pays you 19.5% to stake $UST.