CodyyyGardner Categories Crypto

2/ 4th Amendment. In theory any government search and seizure of personal information should occur only after government obtains a warrant from a judge. To get a warrant they'll need to specifically describe the thing to be searched and explain why they've suspicion of crime.

3/ The Bank Secrecy Act is a bulk financial record surveillance law that forces banks and other financial institutions (crypto exchanges included) to collect personal information from customers and report it to government without any warrant or individual suspicion.

4/ The BSA's constitutionality as a warrantless search was challenged in the 1970s and the court narrowly upheld the law (and this is important) as it was applied by Treasury at the time. Since then its application has been significantly expanded and that's been unchallenged.

5/ the cases were Shultz https://t.co/BtAfdXMSBh and Miller https://t.co/nngic7231N. The Court said that warrants are not required if government searches information bank customers have already handed over to a third party (bank). This became known as the third party doctrine.

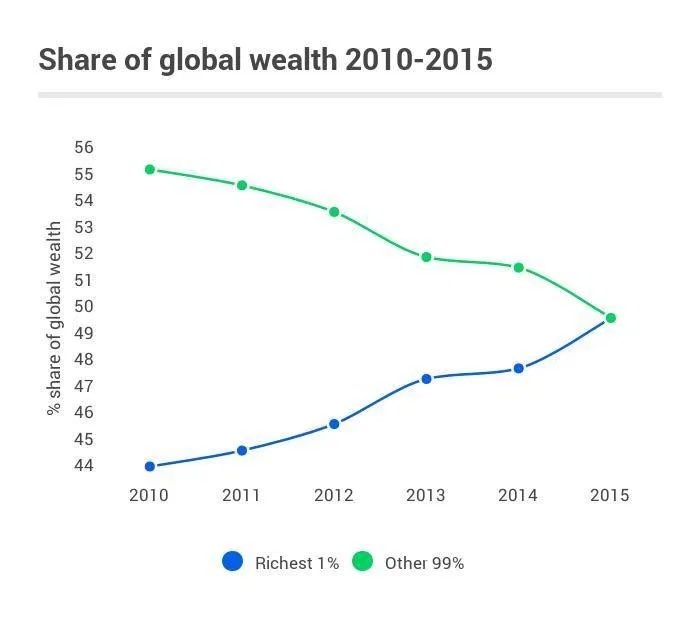

On #Bitcoin\u2018s 12th birthday, Satoshi Nakamoto just became the 40th richest person in the world.

— Ryan Watkins (@RyanWatkins_) January 3, 2021

$34 billion and counting \U0001f680 pic.twitter.com/hIE0he9O93

I remember the polite discussion about liquidity, clearing, custody, spreads, etc. By the end, they were laughing at us. There is something about *institutional* ridicule that allows those who had just blown up the world to deride others even when the institutions are disgraced.

Bitcoin at the time felt totally sketchy as a financial instrument as it was tied to contraband. But I didn’t see it as money. If I did, I would be unimaginably wealthy if I didn’t lose it all to digital theft, accidental loss or spending it . But I am an idiot in these matters.

The reason I was interested in it was more complex. If Bitcoin was digital gold, and gold was a quantum mechanical wave, then some group had created a:

1) Novel

2) Locally enforced

3) Digital

4) Conservation law

Called the blockchain. And money was but one thing it could be.

Can you imagine. Some group was creating as-if physics inside the network. Bitcoins to me were ‘waves’ propagating not in vector bundles, but on networked computers as substrate.

This was genius. I reasoned at the time that it didn’t make sense to me as a medium of exchange.

I came across a few posts which I found immensely thought-provoking by @cburniske @RaoulGMI @DegenSpartan (see below):

2/

https://t.co/xztuB0Tfd5

https://t.co/670x6ErykB

https://t.co/1xEba2Usjk

I think the general CT community / retail are super bullish on crypto in general right now and rightfully so. The narratives I hear are: 1) Institutions are coming in, 2) money printing goes brrrr and

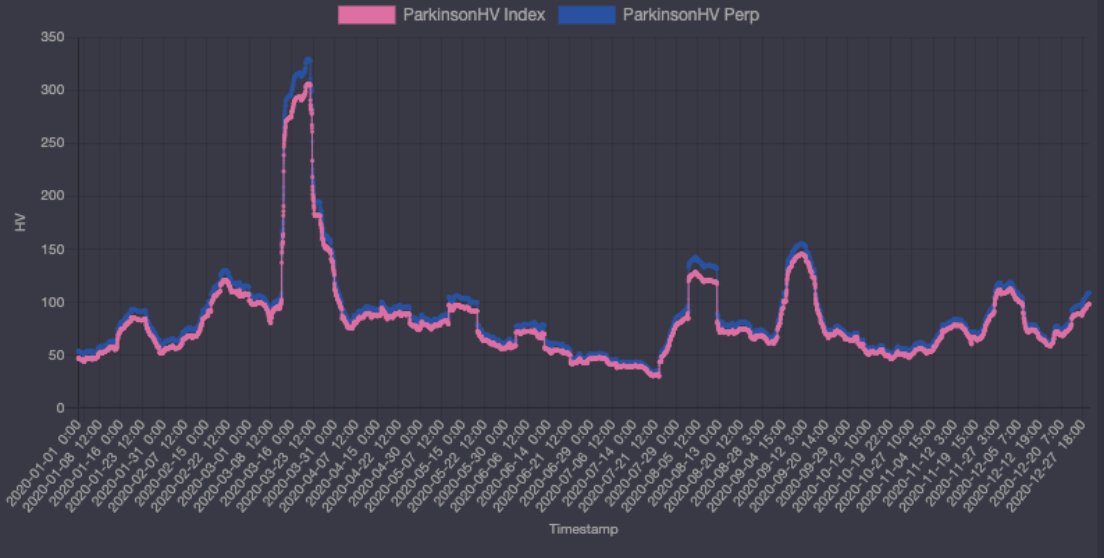

1/ The euphoria is intoxicating, but #crypto is in need of a pullback and consolidation if $BTC wants to reach into the $100Ks and $ETH into the mid-to-high thousands.

— Chris Burniske (@cburniske) January 6, 2021

3/ 3) US gov transition is +ve for crypto.

While I agree in general with these 3 narratives, I want to also be mindful of time horizons of those narratives and the scale / magnitude / speed of which those play out.

4/ 1st - let's look at @cburniske post on the concerns of the over-frothy sentiment in the last several weeks in crypto. I share that same concern and try to balance this out ongoingly with Wall Street's famous phrase "climbing the wall of worry".

5/ Crypto is generally a pretty illiquid market (from an institutional perspective), whale traders pump and dump all the time on a day-to-day / week-by-week basis

Not financial advice

2) Overview

- LTO Network (https://t.co/LJUDzLMCb5) is a hybrid blockchain solution that connects to existing systems enabling efficient collaboration on complex and multi stakeholder processes. It is led by a great team of serial entrepreneurs.

3) - In other words, LTO gives institutions access to blockchain without requiring them to overhaul legacy systems.

- Businesses don’t want an IT overhaul, but want communication with existing systems that only share process data and updates users via their own systems.

4) - This is the power of LTO network – changing unstructured communications into structured communications and driving efficiency for traditional businesses and institutions.

5) - On December 17, 2020 LTO Network and VIDT Datalink merged sales, marketing and development resources to form a “larger organization…better positioned to serve multinationals around the globe…”

Ah yes, New Year's Eve. A time to reflect, look forward, celebrate, and throwback Long Reads Sunday style with the BEST BITCOIN TWEETS OF 2020.

Strap TF in, it's time for a thread!

👇👇👇👇

2) Let's start by going back to February.

Even before the full impact of COVID-19 kicked in, bitcoiners were thinking big about the epoch shifts we were in the midst

Welcome to the Fourth Turning. At this time, we have entered the "crisis stage" as defined by the generational shift currently in progress. Boomers are retiring, handing the reins to Gen-X, and Millennials are entering their wage-earning years. Let's look at some data.

— Hans HODL (@hansthered) February 22, 2020

3) When the markets DID start to finally react, bitcoiners were quick off the draw to point out that, whatever the risk the virus posed, the economic threat was significantly predetermined by fragility borne of decades of decisions.

THIS ISN\u2019T #coronavirus!!! \U0001f62cThis is result of ~50 yrs of Western economies consuming more than they produced, finally coming home to roost. The virus was just the pin that pricked the debt bubble & revealed the magnitude of the solvency problem. Stay safe out there \U0001f64f

— Caitlin Long \U0001f511 (@CaitlinLong_) March 9, 2020

4) Focus quickly shifted to a global dollar shortage and what it might mean across industries - The "Dollar Wrecking Ball" as @RaoulGMI put it.

Just an update from me, in case you are interested...

— Raoul Pal (@RaoulGMI) March 18, 2020

Ive just closed all short positions in equities, oil and HYG and had closed bonds a while ago. I am now 100% focussed on the on the US dollar, which is a wrecking ball.

1/

5) As every market (including BTC) crashed on the infamous March "Black Thursday," Coinbase buying told a story that would be persistent throughout the year - the bitcoin community scooping underpriced corn as others fled to

HUGELY bullish dynamics for Bitcoin right now:

— Hunter Horsley (@HHorsley) March 18, 2020

- BTC flat during HISTORIC risk-off days in markets.

- 72% on Coinbase buying.

- The Halvening is 50 days away.

- Billions in buys coming when levered longs return.

- And if 1% of >$2T+ of stimulus finds its way to Bitcoin...

Olivier, I tried to reach out, and proposed to meet in person pre-fork to collaboratively discuss and write notes, on the economic & tech case for bitcoin with you, @rogerkver & a few others. You suddenly stopped responding. I think you'd be a lot richer if you had gone ahead.

— Adam Back (@adam3us) January 10, 2021

@tyler @Blockstream @rogerkver Once we establish the fact that non-mining full nudes are not required, which I have discussed with you for years (and you still fail to recognize), we can talk about the effects you caused and will cause by refusing to increase the blocksize limit.

@tyler @Blockstream @rogerkver Ridiculous transaction fees: - Noone will use Bitcoin as a currency for payments. Those who did, ditched it (Steam, etc). Bitcoin is a P2P electronic cash system (title of whitepaper), not just a atore of value. - People now have to resort to using centralized exchanges.

@tyler @Blockstream @rogerkver - Bitcoin was designed to simply and easily increase the blocksize limit. It was actually 1 line in the code and was absurdly easily changed (compared to Segwit, dont get me started). Satoshi put the limit in place as a temporary fix for a ddos issue (prove me wrong, I was there)

@tyler @Blockstream @rogerkver - You and a couple of co-conspirators wanted the limit to stay in place. From Blockstreams business perspective, that makes total sense. From an end-useds perspective, you screwed everyone. I fought and convinced miners/companies to remove the limit. They agreed. You stopped it.