AnmolNarula11's Categories

AnmolNarula11's Authors

Latest Saves

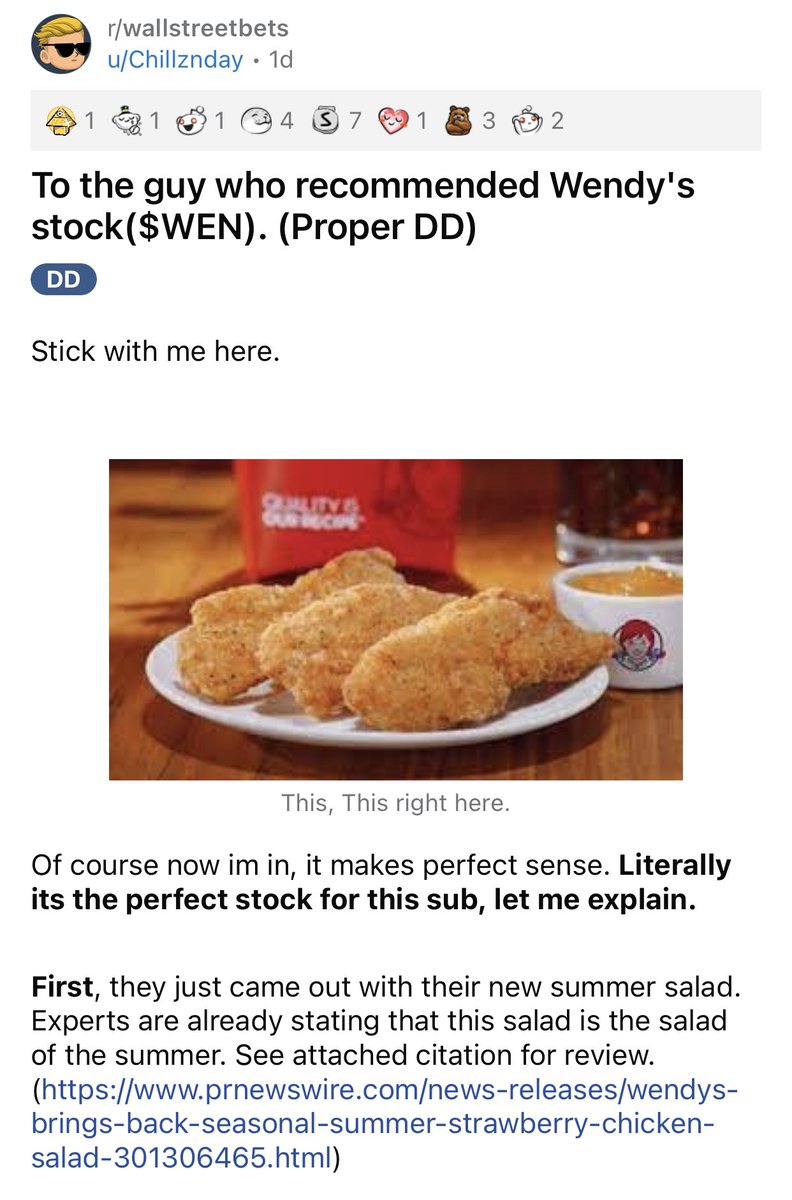

The Wall Street Bets due diligence on Wendy’s is gold.

The catalysts are:

◻️ The release of a new summer salad

◻️ The @Wendys Twitter account, which has mastered “meta pragmatic roasting” (which is effective with younger people)

◻️ The fact it literally sells chicken tendies

OP:

Here’s a more fundamentals-driven analysis of Wendy’s

https://t.co/A2k19S9M7J

😂😂😂

Further Wendy’s analysis from @CliffordAsness !!

The catalysts are:

◻️ The release of a new summer salad

◻️ The @Wendys Twitter account, which has mastered “meta pragmatic roasting” (which is effective with younger people)

◻️ The fact it literally sells chicken tendies

OP:

Here’s a more fundamentals-driven analysis of Wendy’s

https://t.co/A2k19S9M7J

😂😂😂

\u201cThe name of the company is Wendy\u2019s International $WEN. It is a cutting edge high tech firm out of rural Ohio that is awaiting imminent patent approval on the next generation of summer salads that have both huge military and civilian applications.\u201d pic.twitter.com/qmk4hkKL3N

— u/1ronyman (@1ronyman1) June 8, 2021

Further Wendy’s analysis from @CliffordAsness !!

Building conviction on existing portfolio stocks is complex topic. I am still learning and have only 2-3 years exp. Lot of learning is inspired from @varinder_bansal as part of omkara family, listening to old colleage @connectgurmeet on news channel and @unseenvalue posts

https://t.co/KQkupOeFzp financial statements and results on quarterly basis to evaluate whether your thesis on company is still intact through growth in revenue, profits and cash. You cannot rely only on whats app forwards or brokerage updates.

2.Quarterly Con-Calls post result covering enviornment of the sector in which company operates, future expansion plans, & companies confidence in responding to fund managers. (For eg, in my evening walks, i listen to con-calls on You tube rather than music to utilize the time.)

3. High conviction is build when you compare py qtr or py year con call scripts and see whether company giving forward statements were met in subsequent quarters or not. For eg company said they will be doing CAPEX for 100 crores in FY 2020 and then we can see current state.

4. Profits not growing qtr or qt or yr on yr is not the sign for low conviction. You need to screen the balance sheet to see if the company has taken huge R&D expenditure which they believe is right for company as they build new products for future years, then that make sense

https://t.co/KQkupOeFzp financial statements and results on quarterly basis to evaluate whether your thesis on company is still intact through growth in revenue, profits and cash. You cannot rely only on whats app forwards or brokerage updates.

2.Quarterly Con-Calls post result covering enviornment of the sector in which company operates, future expansion plans, & companies confidence in responding to fund managers. (For eg, in my evening walks, i listen to con-calls on You tube rather than music to utilize the time.)

3. High conviction is build when you compare py qtr or py year con call scripts and see whether company giving forward statements were met in subsequent quarters or not. For eg company said they will be doing CAPEX for 100 crores in FY 2020 and then we can see current state.

4. Profits not growing qtr or qt or yr on yr is not the sign for low conviction. You need to screen the balance sheet to see if the company has taken huge R&D expenditure which they believe is right for company as they build new products for future years, then that make sense

EV/tonne of the mentioned companies currently

Anjani - 100

Deccan Cem - 40

KCP - 44 (will be lower if value to other biz given)

NCL - 61 (has boards biz too)

Sagar - 59

Anjani - 100

Deccan Cem - 40

KCP - 44 (will be lower if value to other biz given)

NCL - 61 (has boards biz too)

Sagar - 59

EV/tonne of the companies in that region.

— Jiten Parmar (@jitenkparmar) July 8, 2020

Anjani Portland - 42

Deccan Cem - 20

KCP - conglomerate (has Vietnam sugar, hotel, engg too) - 43 (on mcap)

NCL - 31 (has boards biz too)

Sagar - 47

No recommendations. Just data.

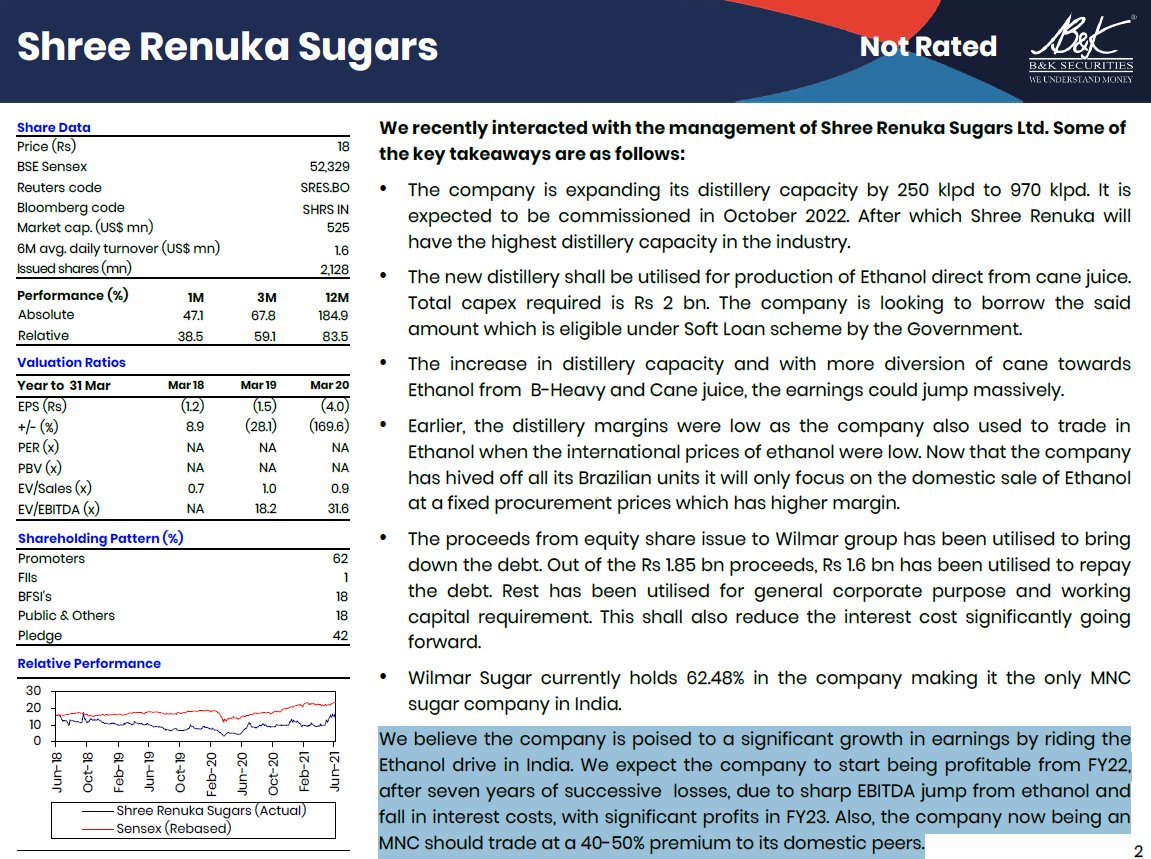

A thread I had done in sugar industry last year. A few things could have changed. But, I think there are huge challenges to the E20 story. Do we have underlying dynamics in place. Do read how much time it took for Brazil.

Disc: Invested in sugar only as tactical play.

Disc: Invested in sugar only as tactical play.

Sugar Industry Insights (Feb 25, 2020)

— Jiten Parmar (@jitenkparmar) February 25, 2020

Last few years sugar industry has been a beneficiary of government largesse. Sugar cycle turned in 2015. Post that there has been surplus production.