Alex1Powell Categories Crypto

7 days

30 days

All time

Recent

Popular

1/ Why the price to sales ratio (P/S) is a useful tool for crypto investors 👇

The price to sales ratio compares a protocol’s market cap to its revenues. A low ratio could imply that the protocol is undervalued and vice versa.

2/ The P/S ratio is an ideal valuation method for early-stage protocols, which often have little or no net income.

Instead, the P/S ratio focuses on the usage of a protocol, by tracking the total fees paid (revenue) by the users of its service. More info: https://t.co/XlHI7XPTvI

3/ We’re in a historically unique position, with early-stage & high-growth startups operating transparently on-chain.

This transparency makes it possible to find protocols with high usage relative to market cap.

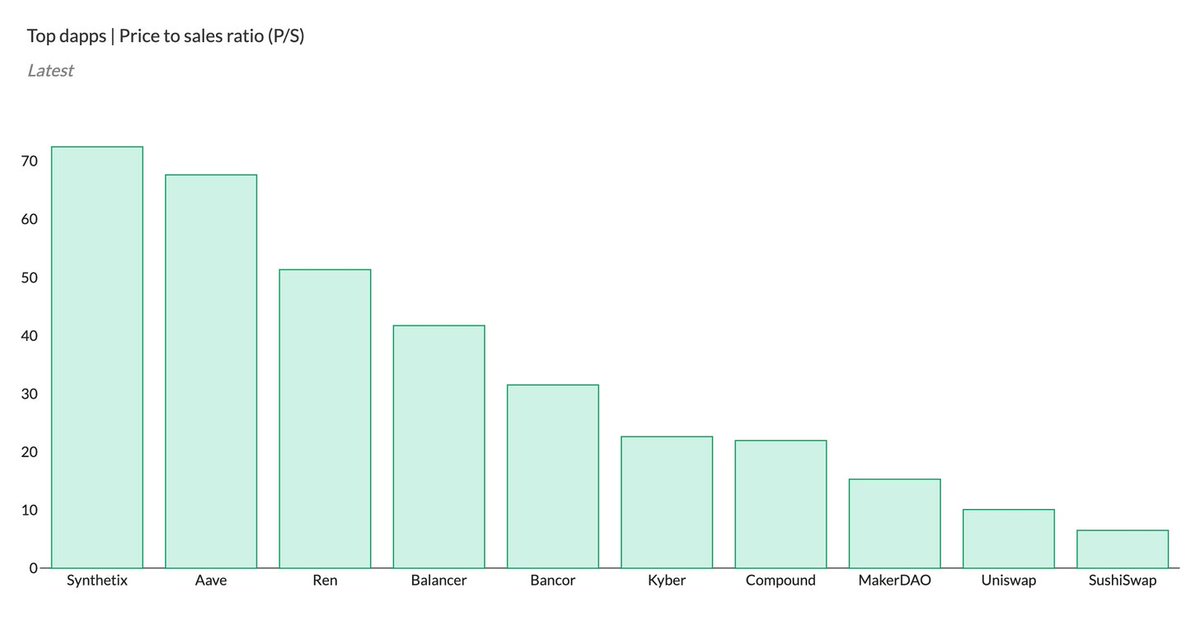

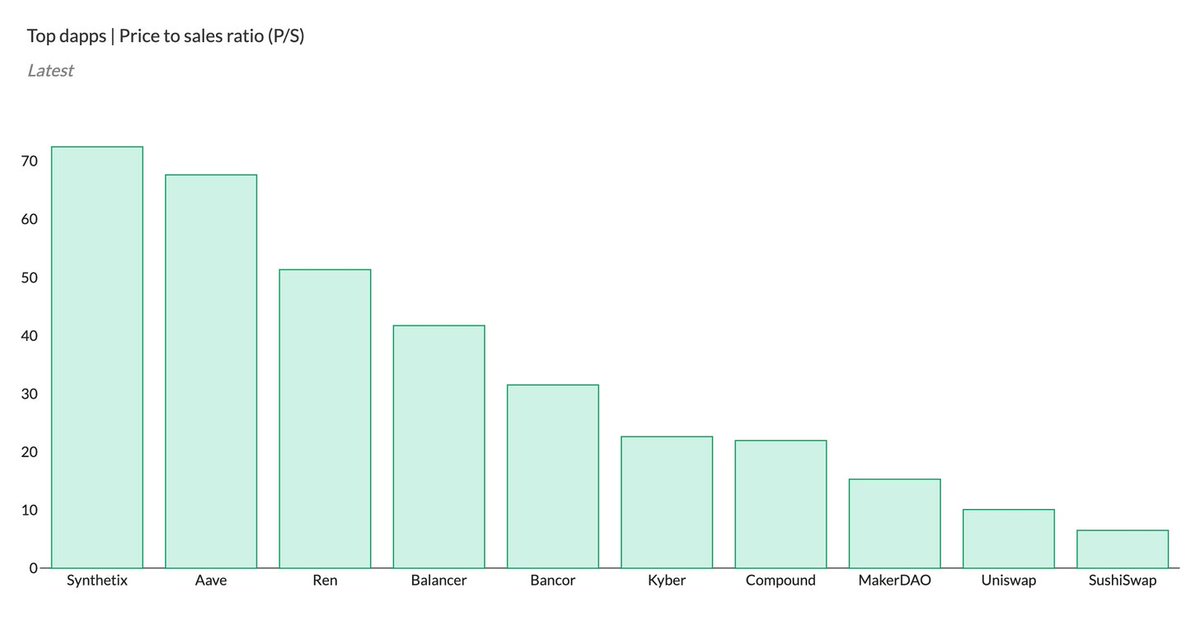

4/ Top dapps from Token Terminal sorted based on the price to sales (P/S) ratio.

Note: Maker has gone from a high P/S ratio to #3 in a matter of months after raising the stability fees for DAI.

Also, two currently similar AMMs (Uniswap & SushiSwap) have the lowest P/S ratios.

5/ Let's look at the P/S ratios from a historical perspective.

The P/S ratio is calculated by dividing a project’s fully-diluted market cap by its annualized revenues.

The metric itself does not tell us about the growth patterns in a protocol’s market cap or revenues.

The price to sales ratio compares a protocol’s market cap to its revenues. A low ratio could imply that the protocol is undervalued and vice versa.

2/ The P/S ratio is an ideal valuation method for early-stage protocols, which often have little or no net income.

Instead, the P/S ratio focuses on the usage of a protocol, by tracking the total fees paid (revenue) by the users of its service. More info: https://t.co/XlHI7XPTvI

3/ We’re in a historically unique position, with early-stage & high-growth startups operating transparently on-chain.

This transparency makes it possible to find protocols with high usage relative to market cap.

4/ Top dapps from Token Terminal sorted based on the price to sales (P/S) ratio.

Note: Maker has gone from a high P/S ratio to #3 in a matter of months after raising the stability fees for DAI.

Also, two currently similar AMMs (Uniswap & SushiSwap) have the lowest P/S ratios.

5/ Let's look at the P/S ratios from a historical perspective.

The P/S ratio is calculated by dividing a project’s fully-diluted market cap by its annualized revenues.

The metric itself does not tell us about the growth patterns in a protocol’s market cap or revenues.