Alex1Powell Categories Crypto

So what is exactly #ODAP and why this makes $QNT one of the most significant and, regarding #crypto mcap, undervalued projects?

Time for a THREAD⬇️

1/ODAP is the protocol for communication between gateways, primarily with an enterprise focus.

So banks, central banks etc. would run a gateway in Overledger Network and ODAP would be the protocol for gateways to communicate with each other in a secure and trustless manner. $QNT

Attending @ietf 109 to discuss our ODAP proposal with @MIT today. We\u2019re in the secdispatch session. They even have a virtual conference centre. #IETF109 https://t.co/2i9d5JxtR0 pic.twitter.com/osv2LCEUGx

— Gilbert Verdian (@gverdian) November 16, 2020

2/ #ODAP Interfaces are the open source connectors that will connect a gateway to #blockchains and any existing network / API. That is based on the standards from work done at ISO TC 307 which 57 countries are working towards.

$QNT CEO Gilbert Verdian is the founder of TC307.

3/We know from the submitted drafts via #IETF (the Internet Engineering Task Force) $QNT is working on #ODAP with:

✅@MIT

✅@intel

but, there’s more to the story as we found out from Gilbert that US Government, Juniper, payment and telecom companies are also there.

4/So how it all started with #ODAP?

Let’s go back to $QNT CEO Gilbert Verdian’s interview with Santiago Velez on #RealVision (October 14th) and try to put all the pieces of the puzzle together.

I’ll forward his words ⬇️

The #Blockchain Revolution and Economic Changes

— Real Vision (@RealVision) October 28, 2020

What kind of world does @gverdian envision? How will @quant_network change the existing structure to benefit us all?

Real Vision journalists examine @gverdian & @Santiag78758327 latest interview.https://t.co/dfDAjDFbF3

121 crypto theses for 2021.

(not investment advice)

Should I do a 121 tweet thread on the theses for you ingrates, or would you like me to delete my account?

— Ryan Selkis (@twobitidiot) December 10, 2020

Only two options:

2/ Get the full report here!

It's on the industry's banned books list, so you know it's good and deliciously irreverent.

3/ 1.1 Buy BTC. Buy ETH. Buy DeFi.

(political speech, not investment advice)

There's real fundamental drivers behind these assets today vs. 2017. I think we'll hit $100k / BTC next year, and $3 trillion of crypto market cap next cycle.

4/ 1.2 Buy BTC.

Not my advice, but it is from Paul Tudor Jones, Stanley Druckenmiller, Cathie Wood, Bill Miller, Raoul Pal, Chamath, and dozens of other institutional investors.

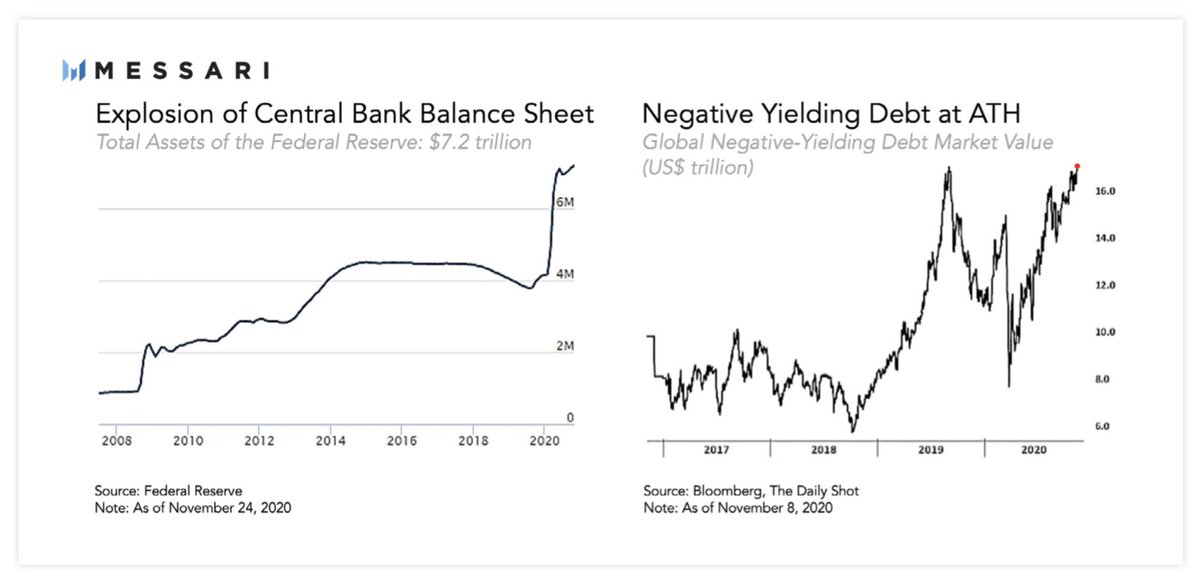

The digital gold narrative has stuck because of this:

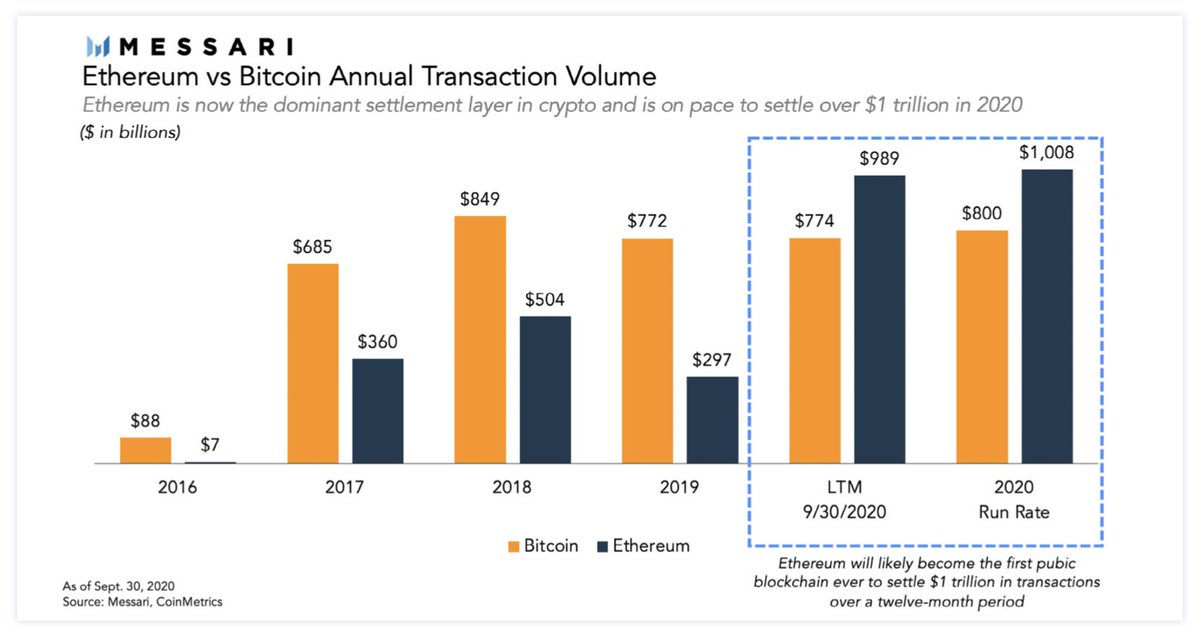

5/ 1.3 Buy ETH.

Ethereum is the everything marketplace + settlement layer for a new decentralized financial system.

It will clear $1 trillion of on-chain transactions this year; the beacon chain upgrade has gone smoothly so far; ETHE will pull in big $$$ (more on that later).

A how-it-started salute thread to the first #Bitcoin news article on its 10th anniversary.

🎂🎂🎂🎂🎂🎂🎂🎂🎂🎂

2/ The first MSM article on #Bitcoin appeared in @pcworld on December 10, 2010.

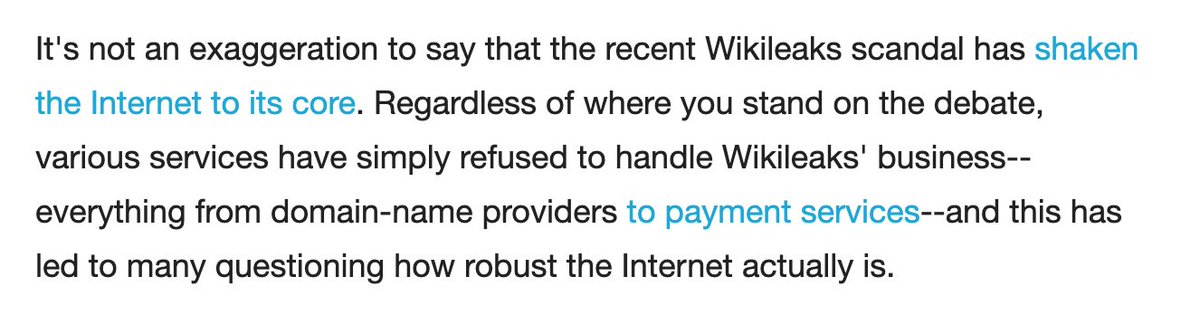

A few articles before it referenced BTC (in brief or in passing), but this article had a new narrative: Bitcoin for censorship-resistant payments.

3/ @wikileaks had been de-platformed by PayPal and the author was out to explore how #Bitcoin, an upstart digital money might come to its aid.

How about an entire currency based on peer-to-peer technology?

4/ The idea was weeks old – first suggested by @nardoism in November – but it proved polarizing.

@orionwl thought Wikileaks accepting #Bitcoin would be a “great moment.” @jgarzik argued it might encourage governments to attack the network.

https://t.co/X6vGklqrB0

5/ But if Bitcoiners were split on the idea. The author made it clear he thought #Bitcoin might be ready for primetime.

After all, he argued #BTC was then increasingly being used in trade.

A thread about man vs. machine.

https://t.co/mGRJ852xVb

Alameda won't be participating in this, but it does present a chance to explain how we think about the value of man vs. machine in our trading. https://t.co/62yGWAS1C3

— Sam Trabucco (@AlamedaTrabucco) May 26, 2020

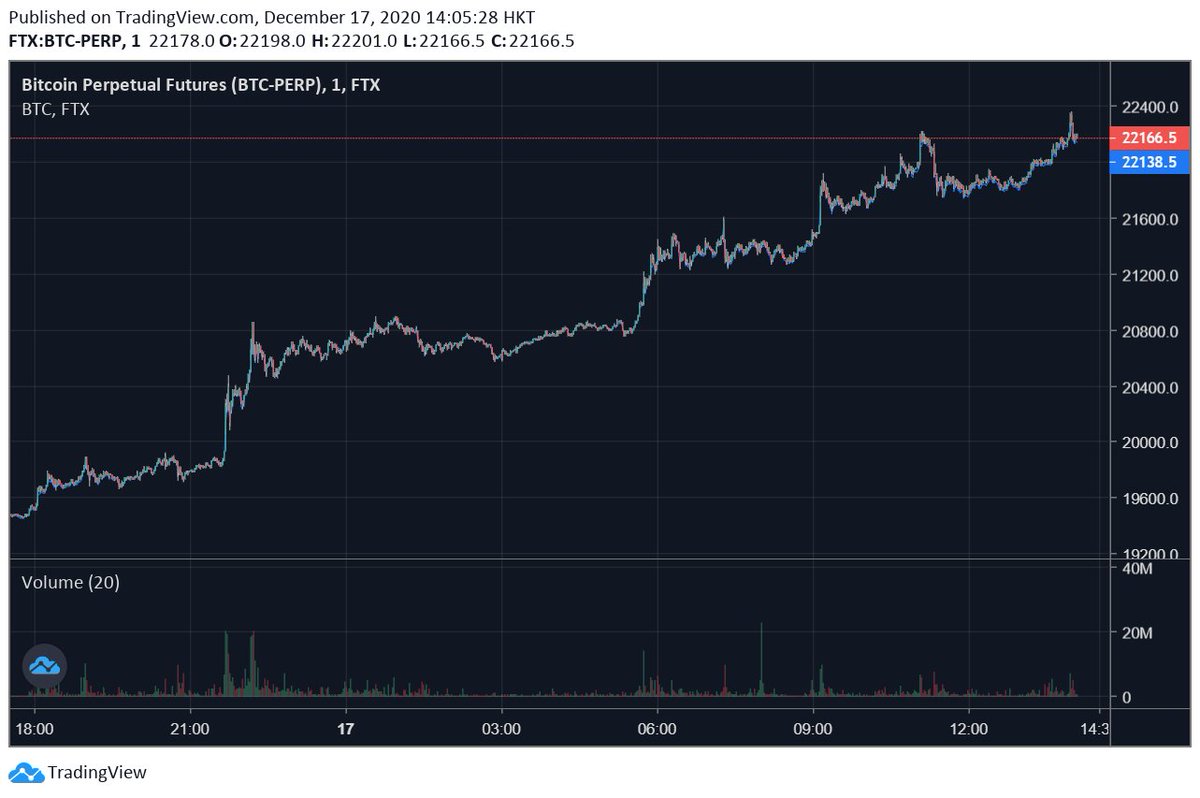

As has been pointed out, I've been adamant that the rallies in the past month or so have been heavily fueled by rampant liquidations on both BitMEX and Binance. And they have! But they were also fueled by organic buying among U.S. investors, as has been a popular narrative.

If anything, the narratives surrounding various U.S. funds and other companies buying BTC have gotten *stronger* in the past week or two than they were around Thanksgiving. More and more funds have announced their crypto holdings or plans to acquire them.

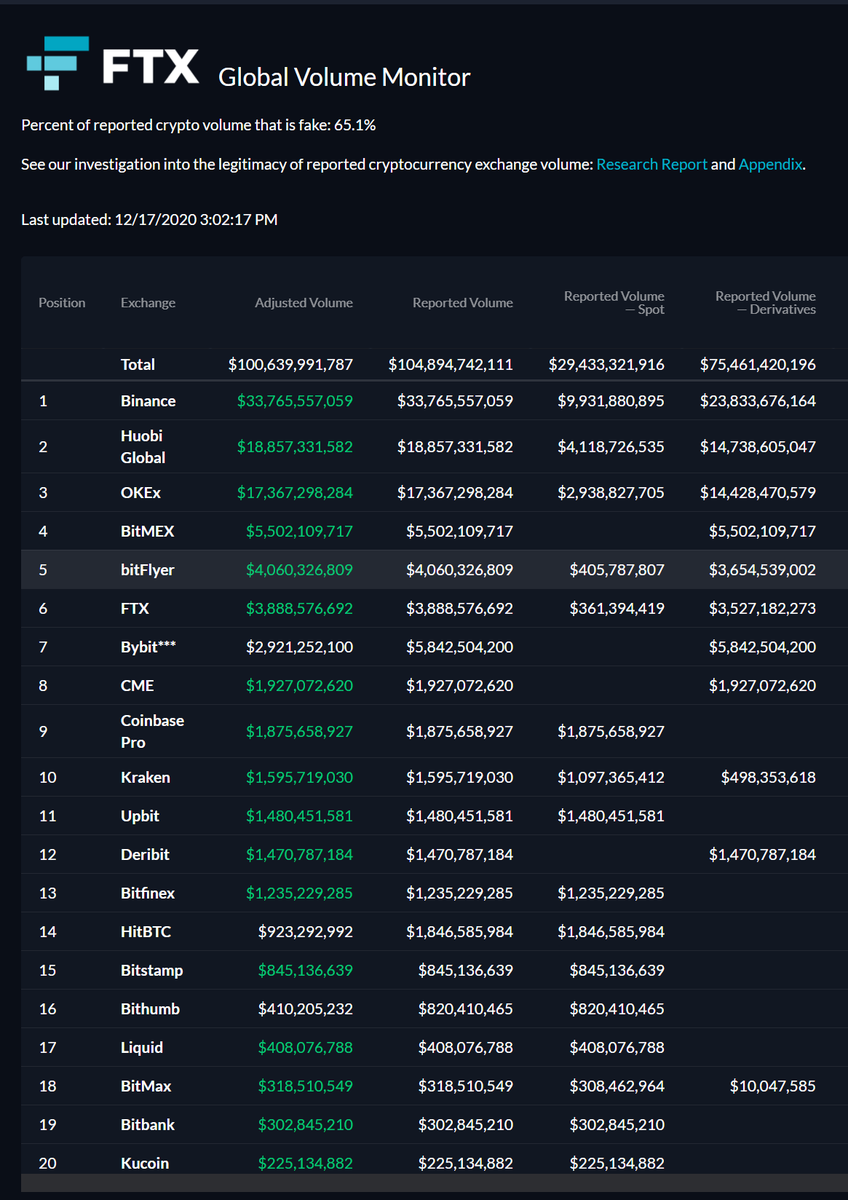

And direct signs of all this exist. Take a look at FTX's volume monitor: U.S. trading hubs like Coinbase having more volume than normal *is* a signal that U.S. customers are doing *something*, and when BTC is going up ...

(Coinbase even crashed from "heightened activity :P).

The DOW recently announced their new crypto indices, CME is listing ETH futures, Microstrategy putting $650M into BTC, GBTC AUM continuing to balloon, these all point in the same direction, and that direction is a resounding "up" for the crypto markets.

This thread is as predictable as you\u2019d expect: lots of replies handwaving about \u201cinnovation\u201d and \u201cblockchain\u201d, while ignoring that \u2018stablecoin\u2019 is just another word for payments infra.

— Angus Champion de Crespigny (@anguschampion) December 4, 2020

People get so caught up in the tech they don\u2019t realise the ultimate result is the same. https://t.co/OC2auSh0uX

Posing the question that way implies that there are only two options: (1) Fintech PSPs aren't banks, and therefore shouldn't have to get stnd. bank charters or abide by the reg's that go w/ such to gain access to public settlement facilities. That's what many stablecoin fans say.

(2) fintech PSPs are banks; and therefore must be get bank charters and be subject to the same regulations ordinary banks must abide by. That's the answer offered by the STABLE Act

The second answer relies, not unreasonably, on the standard regulatory definition of a bank as a "deposit taking" institution. But IMHO it's that definition that's problematic, and that renders the conventional bank-nonbank dichotomy so.

For conventional banks aren't just "deposit taking institutions." They combine deposit taking with lending. It's this combined set of activities, not deposit taking per se, that (rightly or wrongly) supplies the rationale for many bank regulations, including deposit insurance.

Since then, he has been following it for more than 10-years through three distinct periods he calls; “Ealy stages (2009–2013)”, “Becoming Mainstream (2014–2017)”, and “#Altcoin Explosion (2018 -2020)”

Although the value of #Bitcoin and other #Cryptos have increased, they did not become as successful as he thought they could...

The technology behind #Bitcoin, #Blockchain, is a great #innovation but has some significant issues. Below, we provide our CEO’s analysis of these issues across 3 categories; https://t.co/7OTtWyDep9 2.Governance and 3.Scalability

The lack of #security in #Blockchains is almost there by design: a hack, a password loss, or hard disk crash is permanent, and the transaction cannot be reversed. You need to make backups, but not too many and you can never really trust a third-party with them...