Alex1Powell Authors BlueToothDDS

Will attempt to deep dives on each to build on some of my musings from earlier in the year on this topic 🤗 https://t.co/Amlnje1Qiq

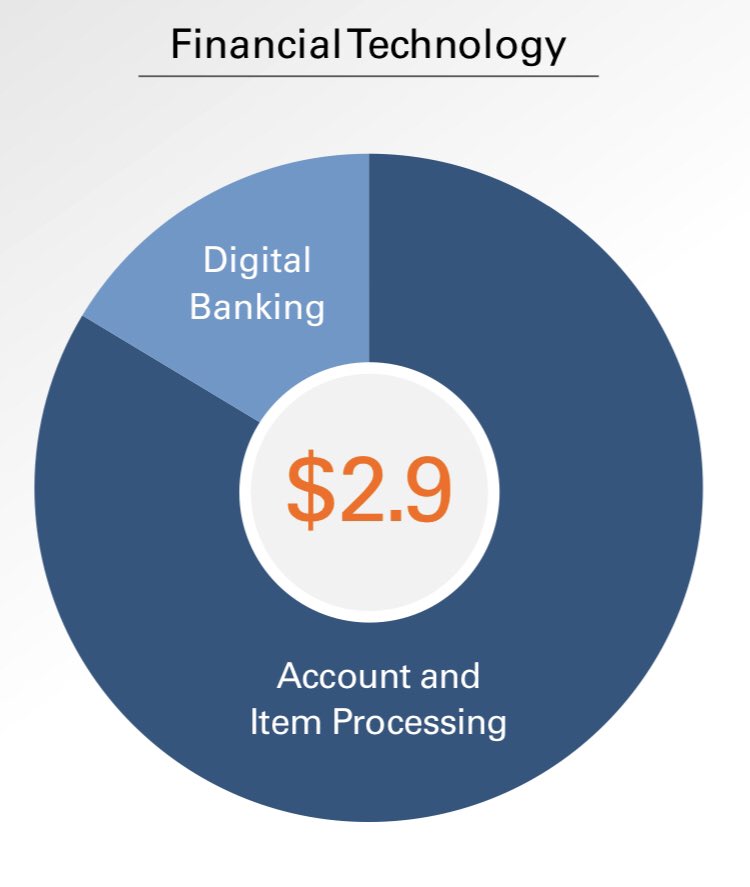

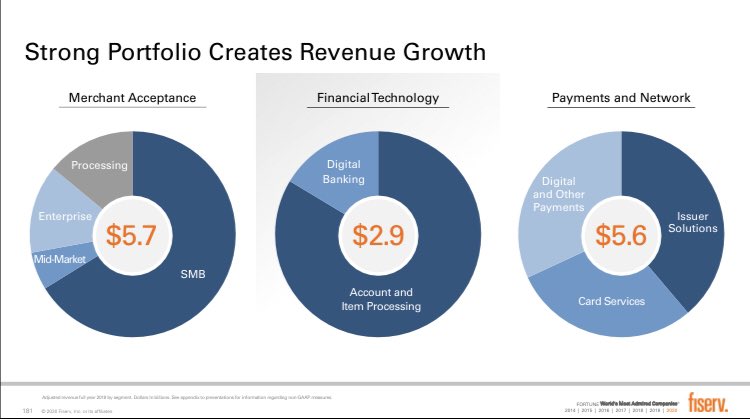

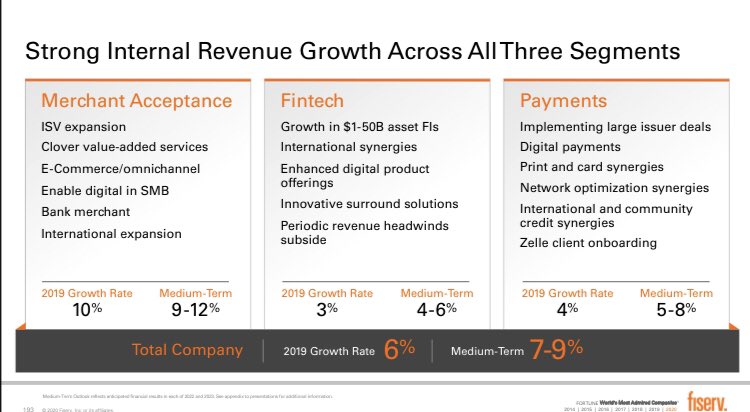

3) The revenue mix of $FISV today (post FDC merger) is roughly ~40% merchant acquiring, ~45% issuer processing and other payments related services, and ~15% core bank processing. Will take these in turn, then highlight growth levers I\u2019m most excited to watch in the coming years pic.twitter.com/yhvkCQrsF8

— BlueToothDDS (@BlueToothDDS) March 6, 2020

Will also try to bridge to an earlier thread laying out the $FISV growth algorithm and the operational/financial levers that support its medium-term outlook of 15-20% FCF/share growth

Here we focus on the top line, most notably the impressive acceleration across all 3 segments https://t.co/8HzMhEC5Bj

12) $FISV has both operational levers ($0.6B revenue synergies, $1.4B combined cost synergies + add\u2019l cost take out) and financial levers ($30B+ deployable FCF) to support its 15-20% compounded FCF/share growth

— BlueToothDDS (@BlueToothDDS) December 9, 2020

... and this is all before underlying business momentum (tomorrow) pic.twitter.com/JBtlGQIfBT

Let’s start with Merchant:

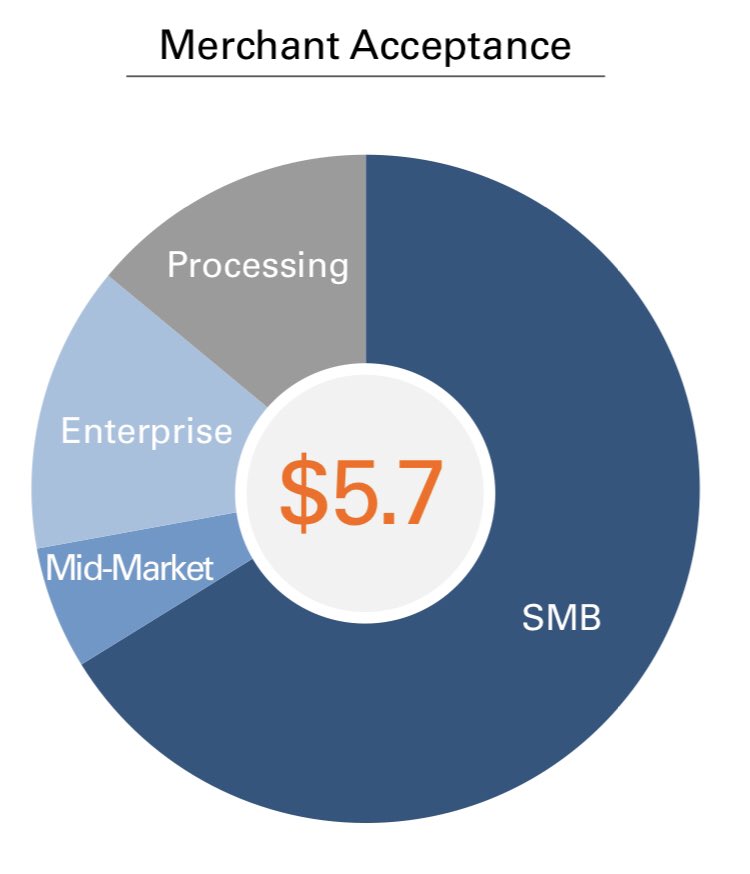

1) This segment, which ~40% of $FISV revenue today, is the #1 merchant acquirer globally processing $3T+ annually for 6M merchants worldwide

2/3 of revenue is from SMBs, ~20% from mid-to-enterprise merchants, remaining ~15% is wholesale processing

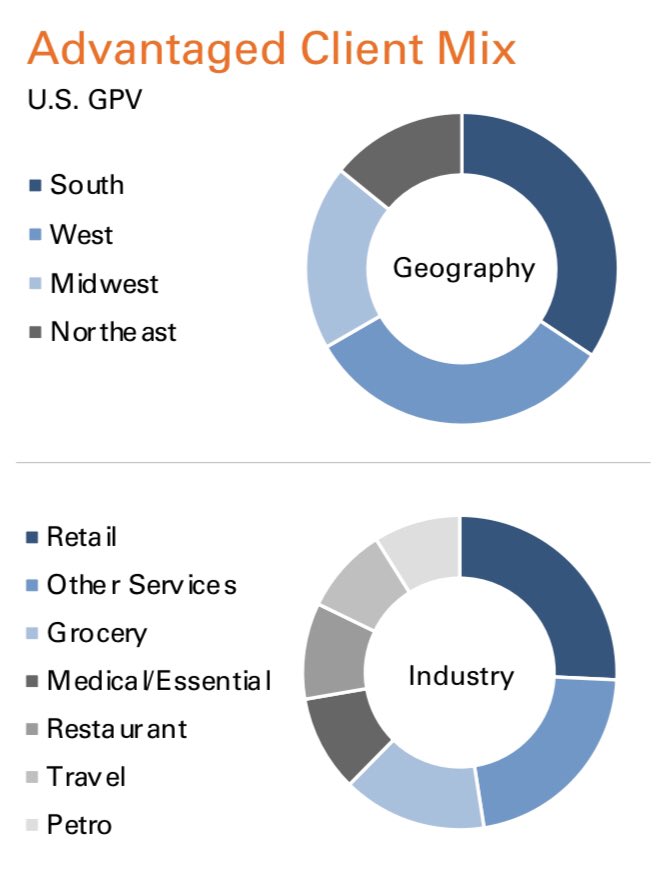

2) 🇺🇸 is 3/4 of the $FISV Merchant segment and the scale of this business is unmatched: it processes 40% of all in-person purchases in the US, covers 80% of all US zip codes and accounts for 10% of US GDP. This book of business is the most balanced in the industry https://t.co/Qlkk7lz3jQ

4) $FISV merchant business is the largest US acquirer processing $2.4 trillion of payments annually (including through JVs with BAC, WFC, PNC, C) accounting for 10% of \U0001f1fa\U0001f1f8 GDP. This segment includes Clover, which focuses on SMBs and is $105B runrate today growing at 40%+ annually pic.twitter.com/M5j4mbeiJX

— BlueToothDDS (@BlueToothDDS) March 6, 2020

3) Internationally, $FISV Merchant has strong position in EMEA (top 3 through various JVs and alliances) and several high growth countries, among others: India 🇮🇳 (top 3 with ~15% share), Argentina 🇦🇷 (~50% market share today), Brazil 🇧🇷 (routing ~30% of all electronic payments)