1. I have extensive stock watchlists based on tickers I have either played in the past or have been watching with the intent of playing in the future. Especially with options, it is hard to jump into a stock not knowing how it acts.

📚Thread: How I Make Watchlists📝

There are countless ways to make watchlists. Each trader looks for particular things in a setup that fits their style. There is no science here. My goal is to share a simplistic strategy on how to become SELF-SUFFICIENT with watchlists. 🤝

1. I have extensive stock watchlists based on tickers I have either played in the past or have been watching with the intent of playing in the future. Especially with options, it is hard to jump into a stock not knowing how it acts.

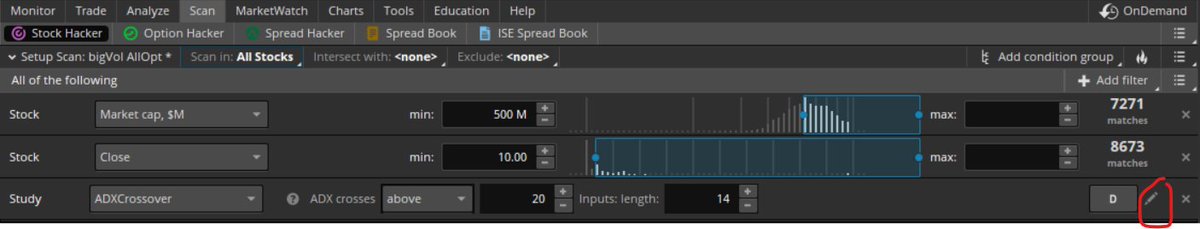

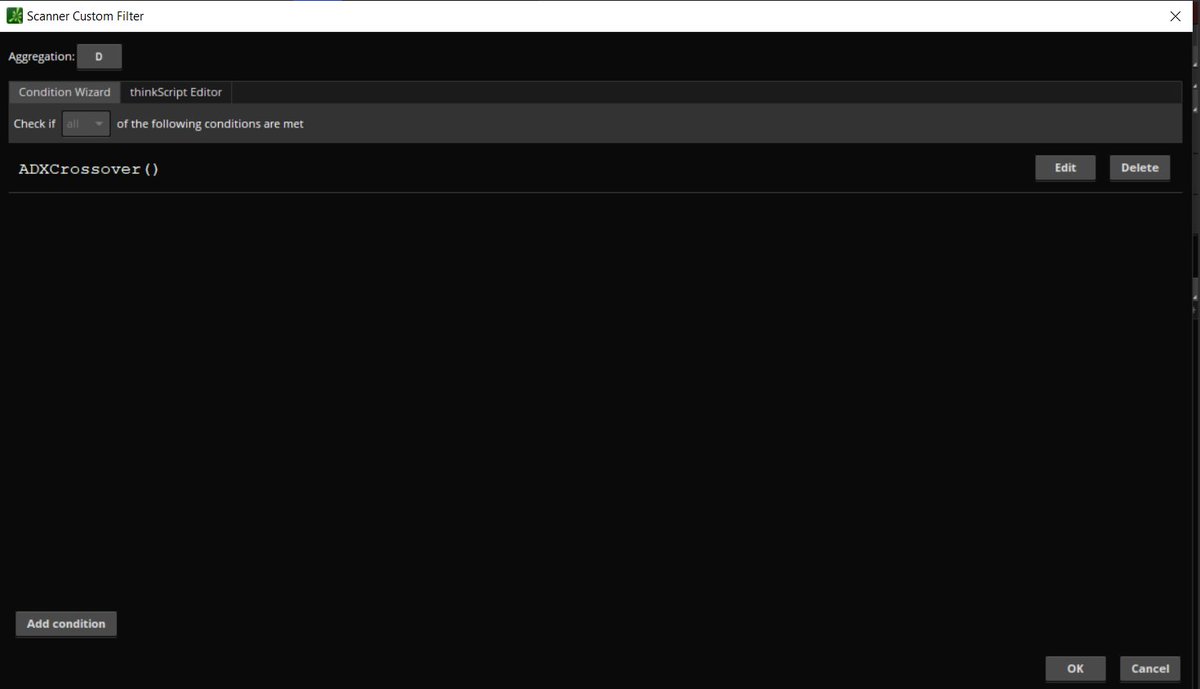

Start with sector watchlists. In addition, have one "general" watchlist with assortments of familiar & trending stocks

I look for charts with significant breakout or breakdown potential. If it is easy to identify both

Knowing when to enter and exit trades independently is the key to being self-sufficient. I try to keep it very simple when it comes to entries and exits.

Wait for confirmation over your trigger level - I use 5min candle. If you enter after confirmation and it falls back below resistance, cut and reassess. Wait for the break, do not try to call the break.

More from Watchlist

Everyone knows Apple, Amazon, Microsoft...

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ https://t.co/jJW01WpJQh

▪️

4. Screeners

@Finviz is great for screening by sector/industry

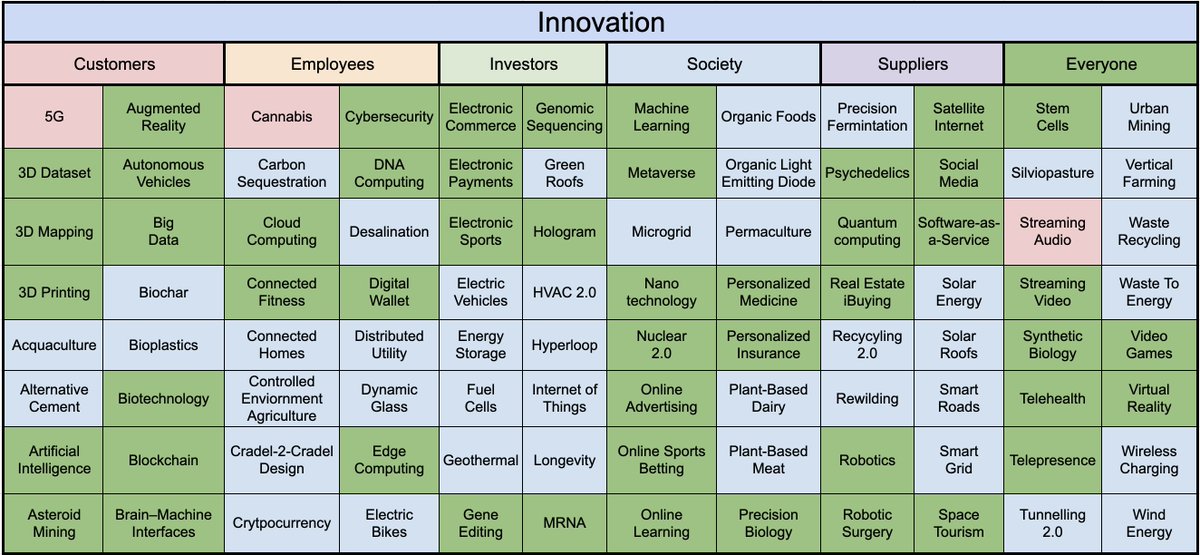

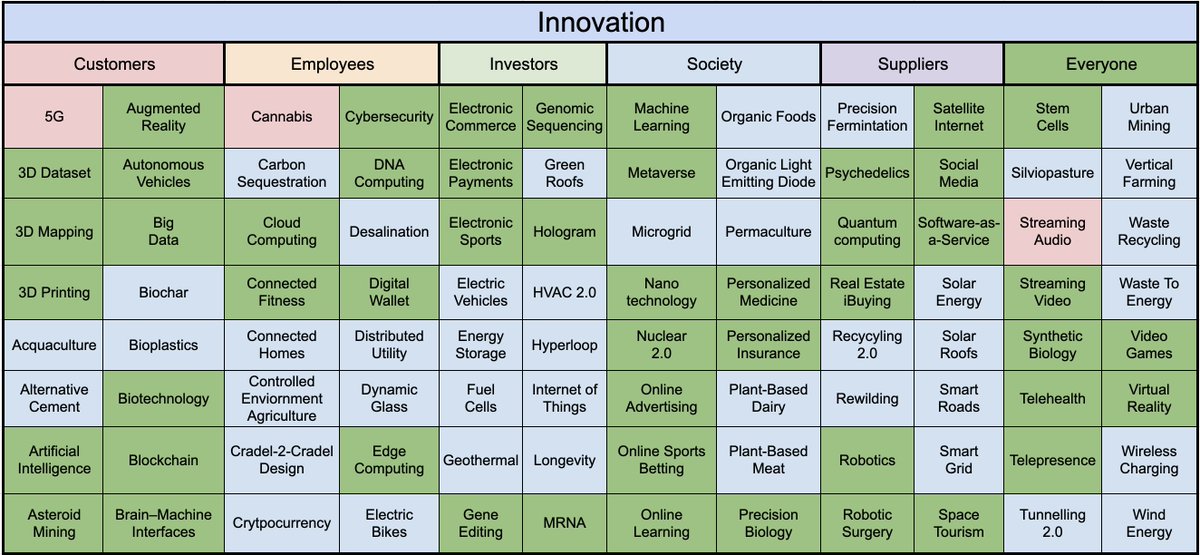

@Stockcard is great for screening by themes (like the mega-trends listed below)

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More

Here are some of the big investors that track:

— Brian Feroldi (@BrianFeroldi) February 17, 2021

Altarock Partners

AKO Capital

Appaloosa

Akre Capital

Broad Run

Dorsey Asset

Duquense

Ensemble

Fundsmith

Polen Capital

Third Point

Here are their current top 10 holdings (in order) and links to their latest buys/sells \u2b07\ufe0f

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ https://t.co/jJW01WpJQh

▪️

4. Screeners

@Finviz is great for screening by sector/industry

@Stockcard is great for screening by themes (like the mega-trends listed below)