While Financially Analyzing Businesses (esp Small Leaders), this is THE Order:

- Cash Flow Statement (Focus on Operating Cash)

- Cash Position

- Balance Sheet Strength

- Never Miss Receivables

- P&L

Cash >> Balance Sheet >> Finally P&L

#FI

More from Valuation

Can value investing strategies be improved by adding intangible assets?

👾 The Asset-Light Economy

🔮 The Dark Matter of Finance

🏰 Intangible Moats

📉 The Disruption of Value

👨🎓 Fixing the "Value Factor"

(Not investment advice)

🧵

(0/10) Full paper here 📘

Blog

https://t.co/omtrn9kfvt

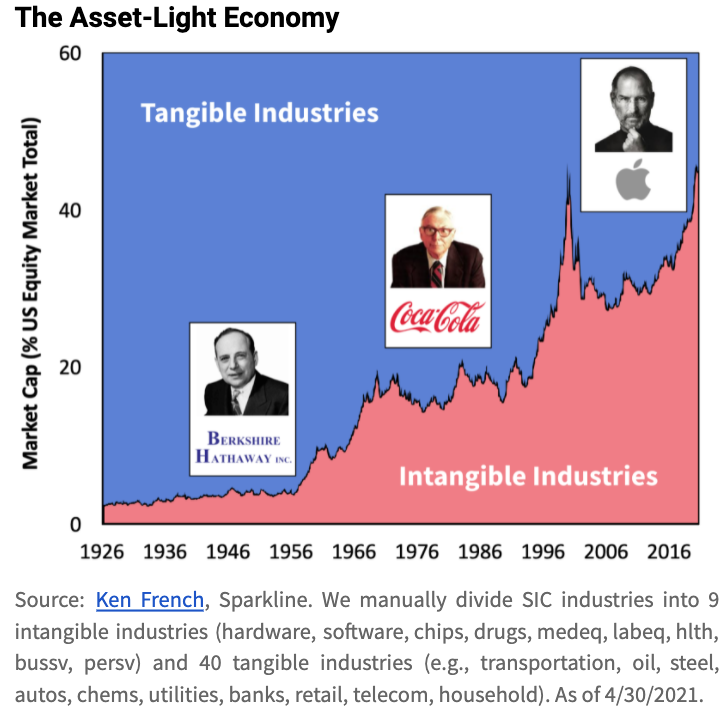

(1/10) The Asset-Light Economy 👾

“The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy."

- Warren Buffett

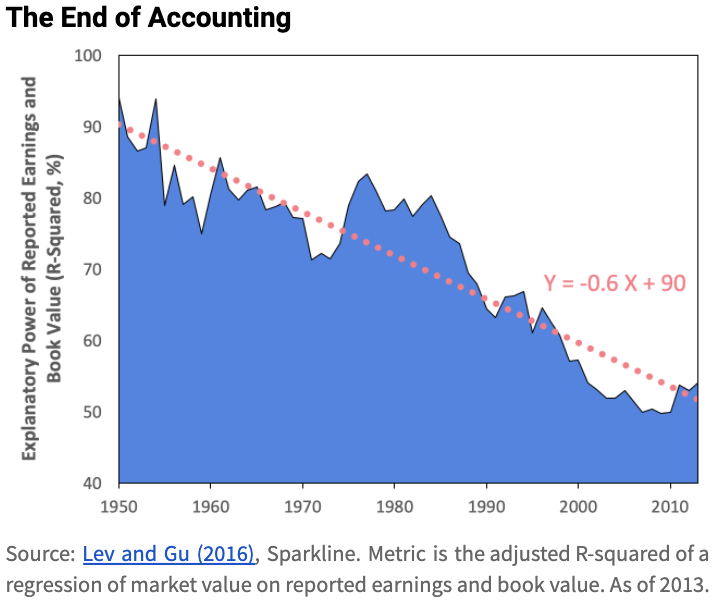

(2/10) The End of Accounting 🧮

“The constant rise in the importance of intangibles in companies’ performance and value creation, yet suppressed by accounting and reporting practices, renders financial information increasingly irrelevant.”

- Baruch Lev and Feng Gu

(3/10) The Dark Matter of Finance 🔮

While intangible matter holds the financial universe together, it is not visible to the naked eye. Unstructured data contains info on intangibles but is large, noisy, and resistant to standard statistical analysis.

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.