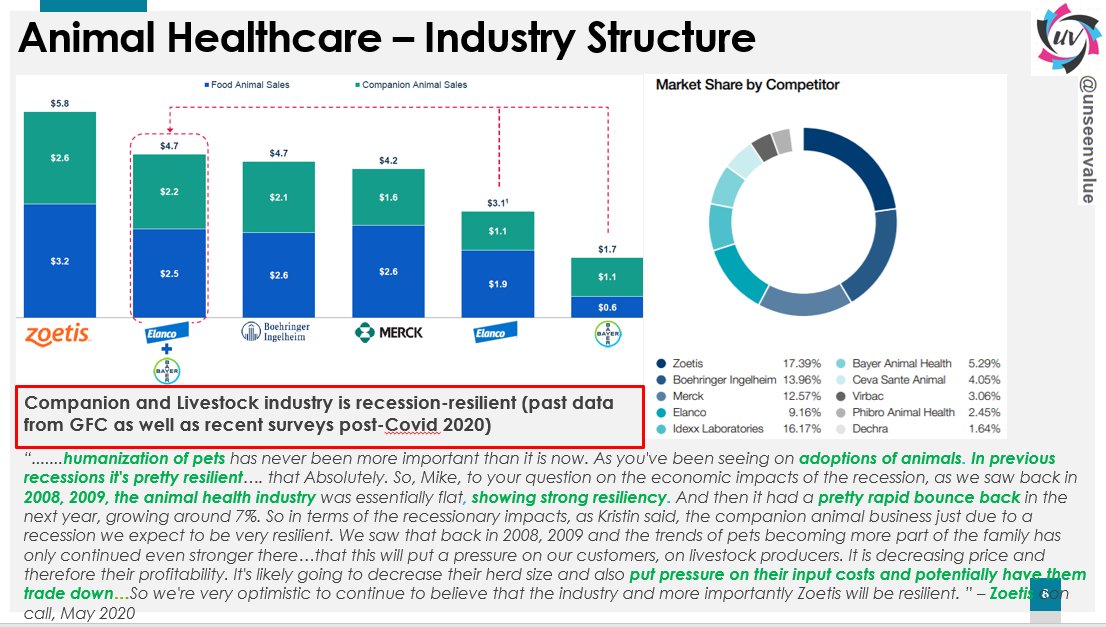

@sahil_vi @AdityaKhemka5 @soicfinance #SeQuent is investing in enhancing the terminal value of the business. This should provide better valuations fresh entry next year. Given the fact that it was 40+ in 2018, even a 400+ by 2028 would mean a very healthy 25-26% CAGR ex dividends.

D: Invested. Add more next year.

More from Sajal Kapoor

5 webinars/conclaves since May 2020 and over 100 stock ideas shared. Still not enough :)

Twitter should be like that airport shuttle service, the moment you walk out (start following someone) - there should be a chauffeur (new stock idea) ready to drive you to your destination!

[Free CDMO Masterclass #18] https://t.co/208eQbYKEF

[Free Art of Investing] https://t.co/bHvUqnpiTE

[Paid IIC Dec 2020 on SeQuent] https://t.co/3iDO438Et9

[Charity fund raise on Unseen Trends in Biotechnology] https://t.co/eNi1x1qwhH

[Q&A on APIs]

Twitter should be like that airport shuttle service, the moment you walk out (start following someone) - there should be a chauffeur (new stock idea) ready to drive you to your destination!

[Free CDMO Masterclass #18] https://t.co/208eQbYKEF

[Free Art of Investing] https://t.co/bHvUqnpiTE

[Paid IIC Dec 2020 on SeQuent] https://t.co/3iDO438Et9

[Charity fund raise on Unseen Trends in Biotechnology] https://t.co/eNi1x1qwhH

[Q&A on APIs]

More from Uvlearnings

Only 1 hospital chain has these all packed in to 1 entity, IMHO. That chain also is the only chain in the world that trades near 1x replacement cost. But how can we buy it? It makes losses! -ve RoE!! Doesn't appear in quant filters, ignored due to RoE = Moat rhetoric. PAT is God.

How many hospitals in India have globally comparable healthcare quality and high end molecular diagnostics, genomics diagnostics, AI/ML, Robotics for timely, accurate diagnosis and best possible prognosis, treatment at affordable cost?

— Sajal Kapoor (@unseenvalue) June 21, 2021

Any thoughts @tusharbohra @AdityaKhemka5 https://t.co/6Mhpu5Dru1

@shuchi_nahar @AnyBodyCanFly Created this thread in 2018, as saw this coming. Covid actually accelerated the trend … next disruption will be lead by biosciences. Unseen today be seen few years out

Technology is enabling new ways of credibly accessing medical knowledge via smart phones / tablets.

— Conviction | Patience (@unseenvalue) November 8, 2018

Android, iOS have > 5k health / fitness apps like @Medscape, pointing to a future where the Tech. drives a part of medical knowledge and therapeutic guidance instead of a Doctor!