BREAKING NEWS Thread: 1/6

From a very reliable source in the 'Tunnel... there will be a UK-EU trade deal agreed next week. I quote:

"Britain has CAVED. Unless someone in Westminster does something really stupid between now and then a deal will be signed."

More from Uk

A short thread on why I am dubious that the government can lawfully impose charges on travellers entering the UK for quarantine and testing (proposed at £1,750 and £210)

1/

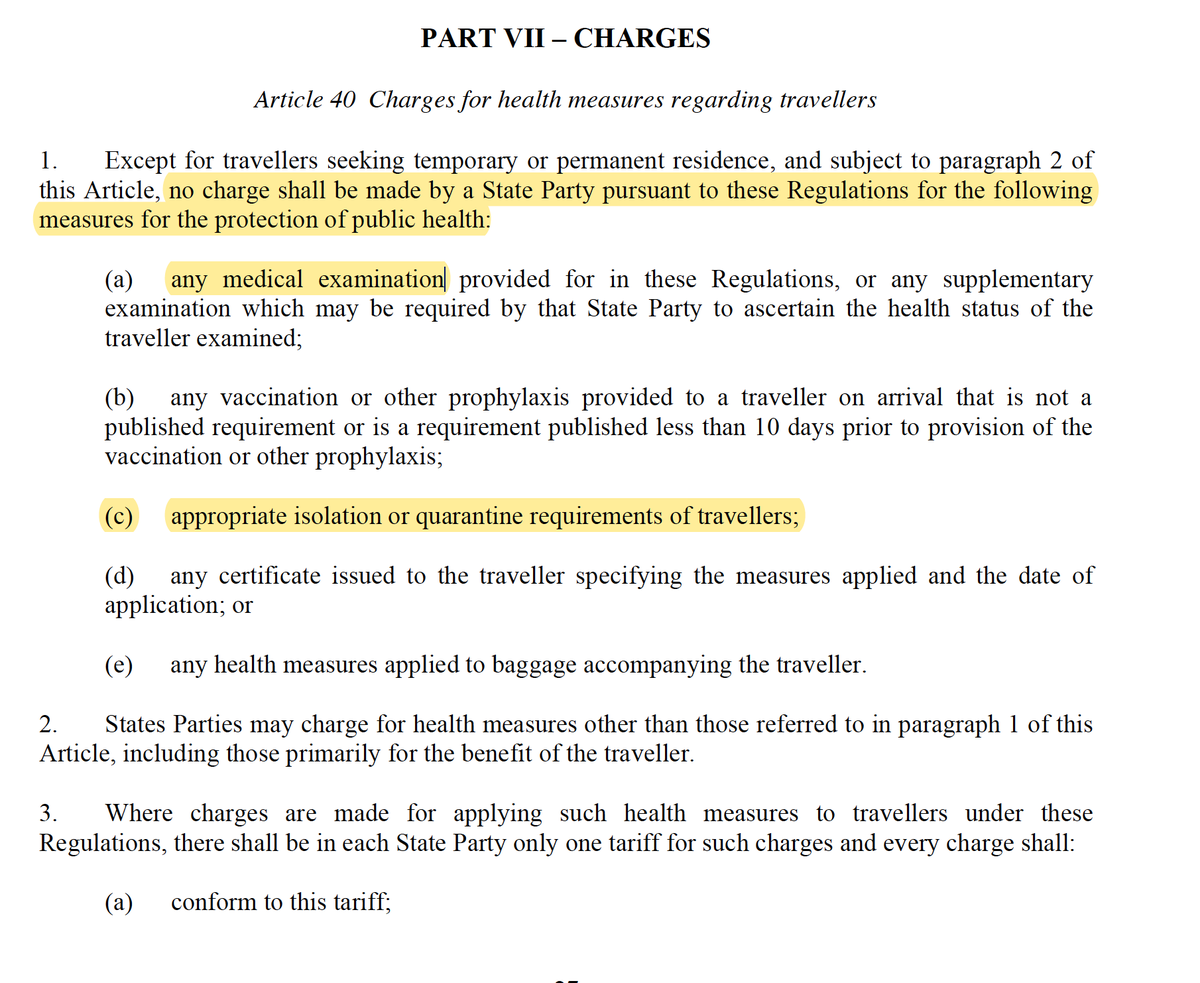

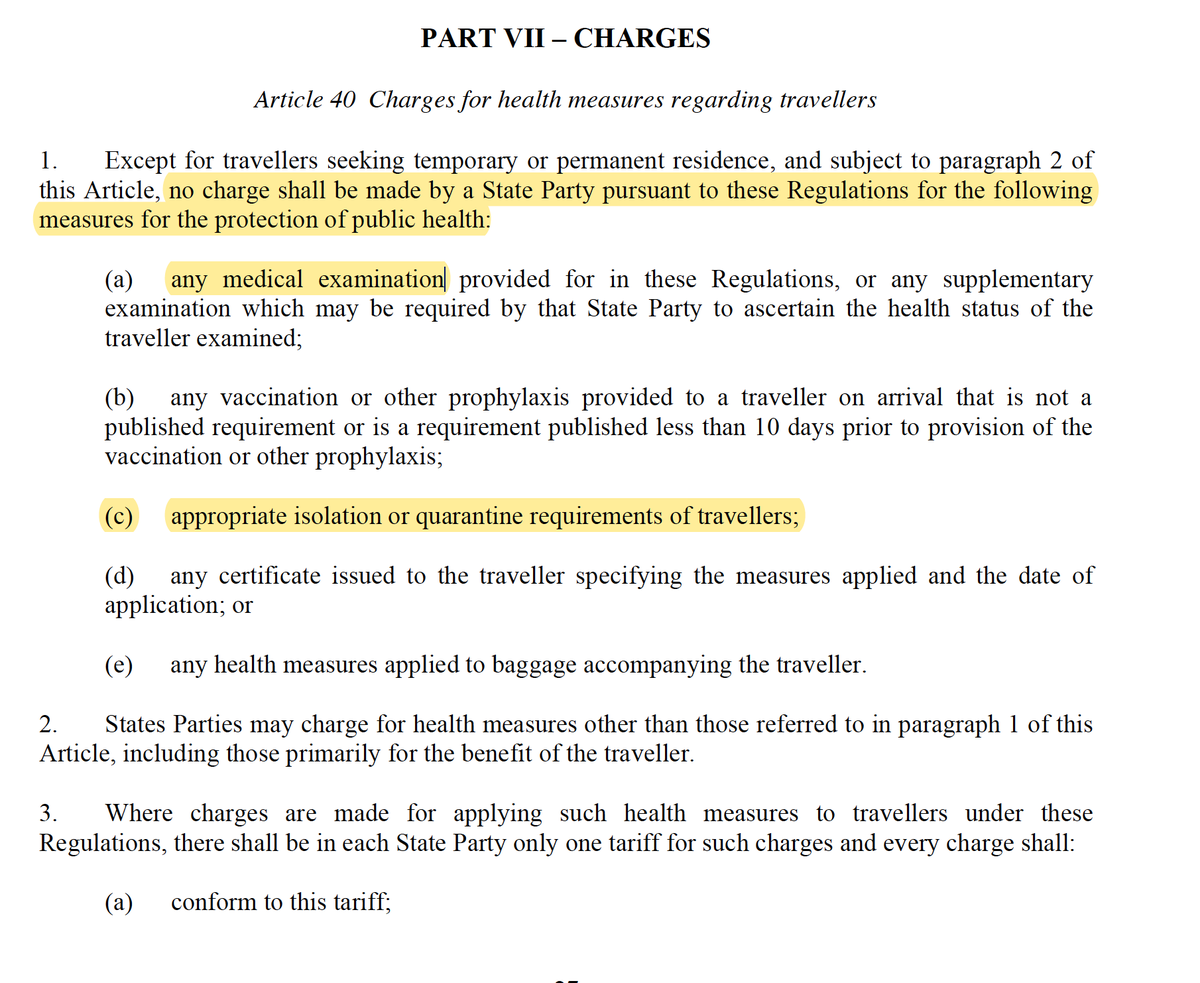

The UK has signed up to the International Health Regulations (IHA) 2005. These therefore create binding international legal obligations on the UK.

The IHA explicitly prevent charging for travellers' quarantine or medical examinations.

https://t.co/n4oWE8x5Vg /2

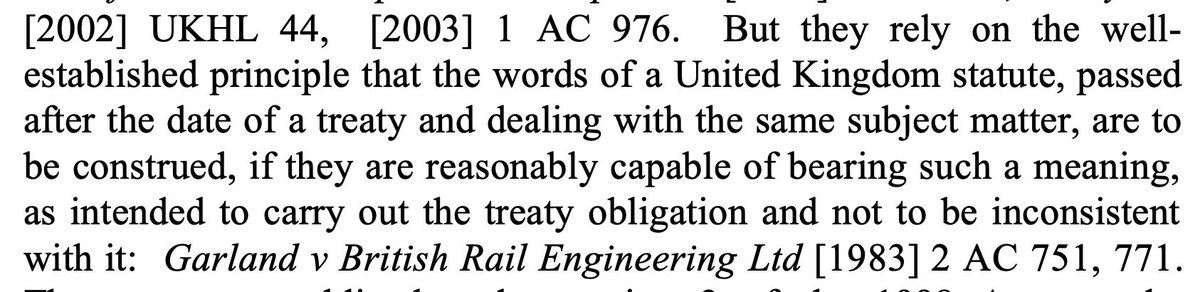

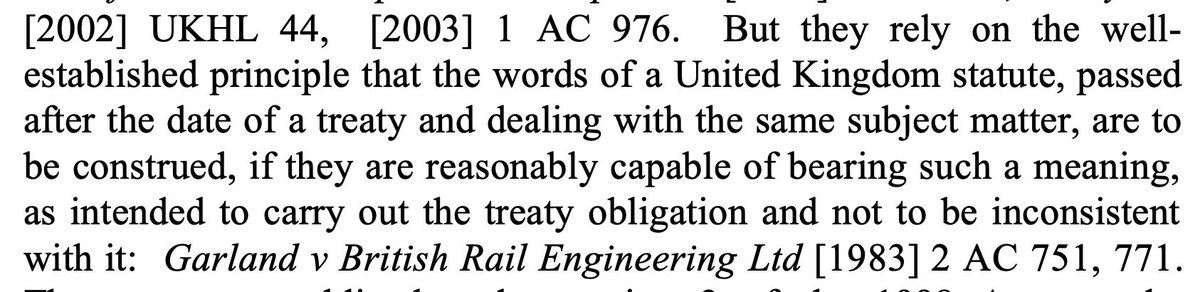

International law is not actionable in a UK court unless it has been implemented in law.

But it can be used as an aide to interpretation where a statute isn't clear as to what powers it grants.

See e.g. Lord Bingham in A v SSHD https://t.co/RXmib1qGYD

/3

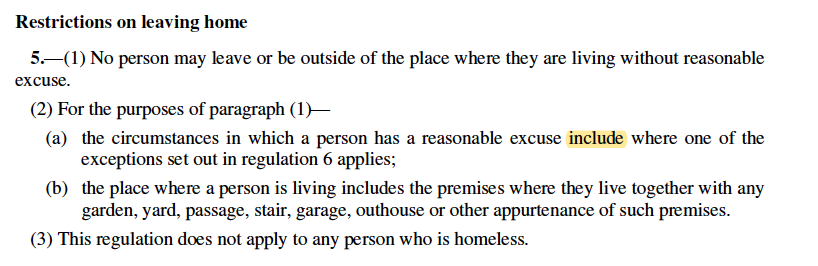

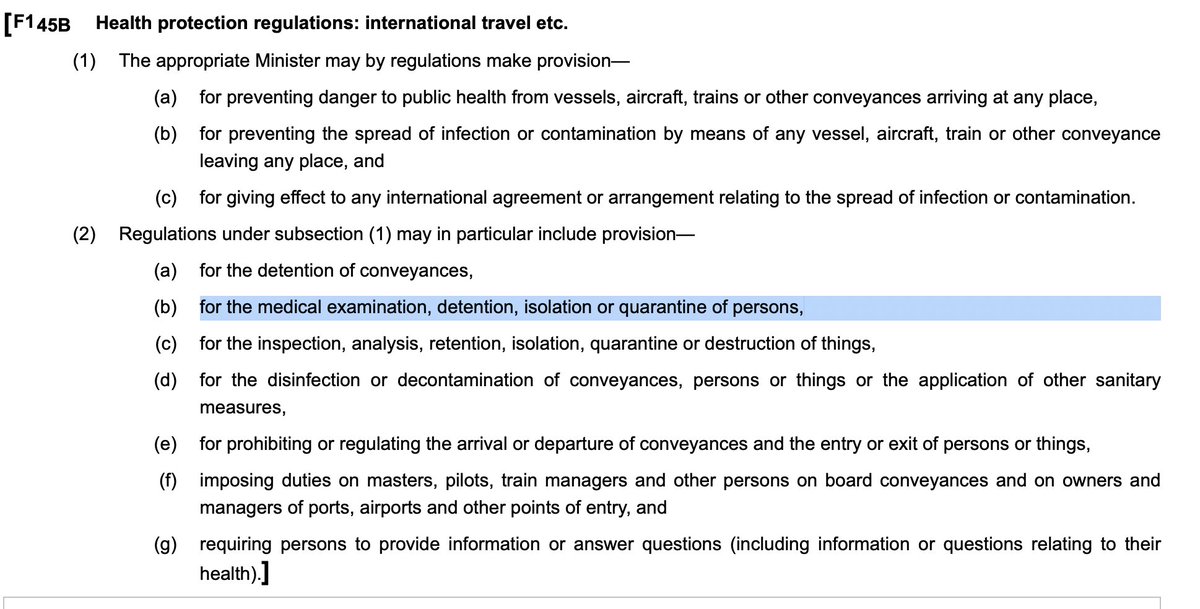

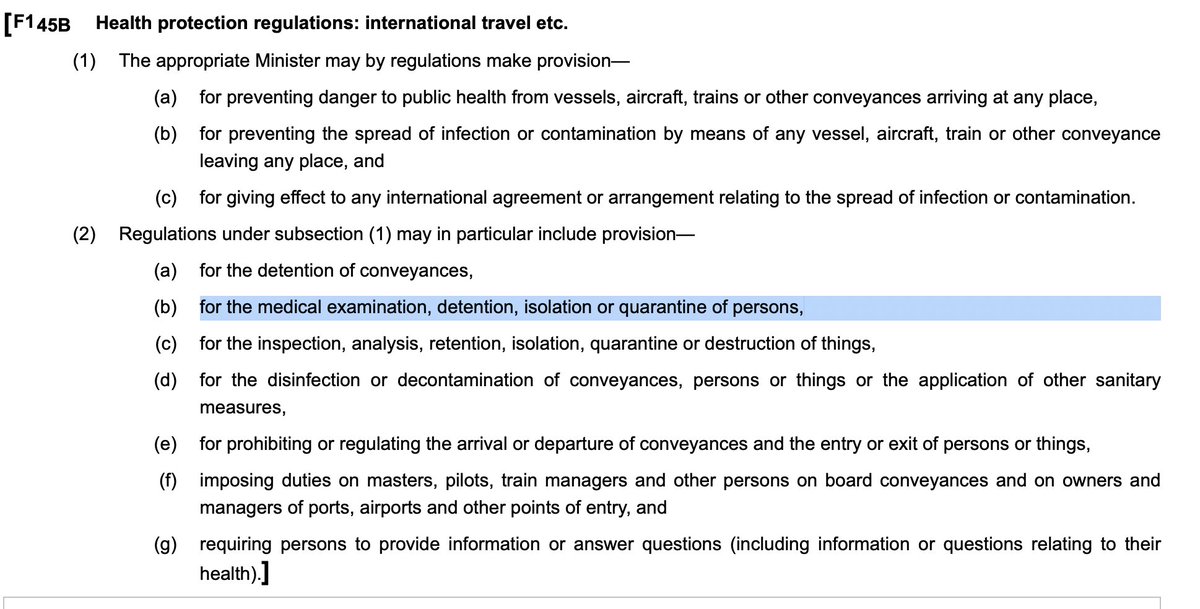

The Quarantine regulations will, I assume, be made under section 45B of the Public Health (Control of Disease) Act 1984

https://t.co/54L4lHGMEr

/4

That gives pretty broad powers but I can't see any power to charge for quarantine. Perhaps it will be inferred from somewhere else in Part 2A?

But...

1/

The UK has signed up to the International Health Regulations (IHA) 2005. These therefore create binding international legal obligations on the UK.

The IHA explicitly prevent charging for travellers' quarantine or medical examinations.

https://t.co/n4oWE8x5Vg /2

International law is not actionable in a UK court unless it has been implemented in law.

But it can be used as an aide to interpretation where a statute isn't clear as to what powers it grants.

See e.g. Lord Bingham in A v SSHD https://t.co/RXmib1qGYD

/3

The Quarantine regulations will, I assume, be made under section 45B of the Public Health (Control of Disease) Act 1984

https://t.co/54L4lHGMEr

/4

That gives pretty broad powers but I can't see any power to charge for quarantine. Perhaps it will be inferred from somewhere else in Part 2A?

But...

Better late than never. Here we go. What does this deal mean for borders, border formalities, customs & trade facilitation?

Long one. TL:DR very little at the moment but has potential

/1

Borders

When compared to no deal the deal changes very little in terms of border procedures. All formalities and checks will still be required.

Reminder - we're not starting from 0 here – both our container ports and our ro-ro ports are already congested

/2

On top of that, all the issues related to border readiness: lack of capacity and space, IT systems not ready, shortages of customs agents, treader readiness – have not been solved.

The deal doesn’t help with that.

/3

Here is where we are:

☑️The UK will phase-in border formalities over 6 months (customs and SPS)

☑️The EU will introduce full formalities in 3 days (customs + SPS)

☑️Irish Sea border also fully operational in 3 days with some short-term SPS easements

/4

Pre-notifications (safety & security declarations) not initially required on the UK side, needed for imports into the EU.

So what's in the deal?

/5

Long one. TL:DR very little at the moment but has potential

/1

Lots of stuff on technical barriers and customs cooperation. See @AnnaJerzewska for more on the latter. pic.twitter.com/3sC5xHD3Z8

— Steve Peers (@StevePeers) December 26, 2020

Borders

When compared to no deal the deal changes very little in terms of border procedures. All formalities and checks will still be required.

Reminder - we're not starting from 0 here – both our container ports and our ro-ro ports are already congested

/2

On top of that, all the issues related to border readiness: lack of capacity and space, IT systems not ready, shortages of customs agents, treader readiness – have not been solved.

The deal doesn’t help with that.

/3

Here is where we are:

☑️The UK will phase-in border formalities over 6 months (customs and SPS)

☑️The EU will introduce full formalities in 3 days (customs + SPS)

☑️Irish Sea border also fully operational in 3 days with some short-term SPS easements

/4

Pre-notifications (safety & security declarations) not initially required on the UK side, needed for imports into the EU.

So what's in the deal?

/5

You May Also Like

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d

THREAD PART 1.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.