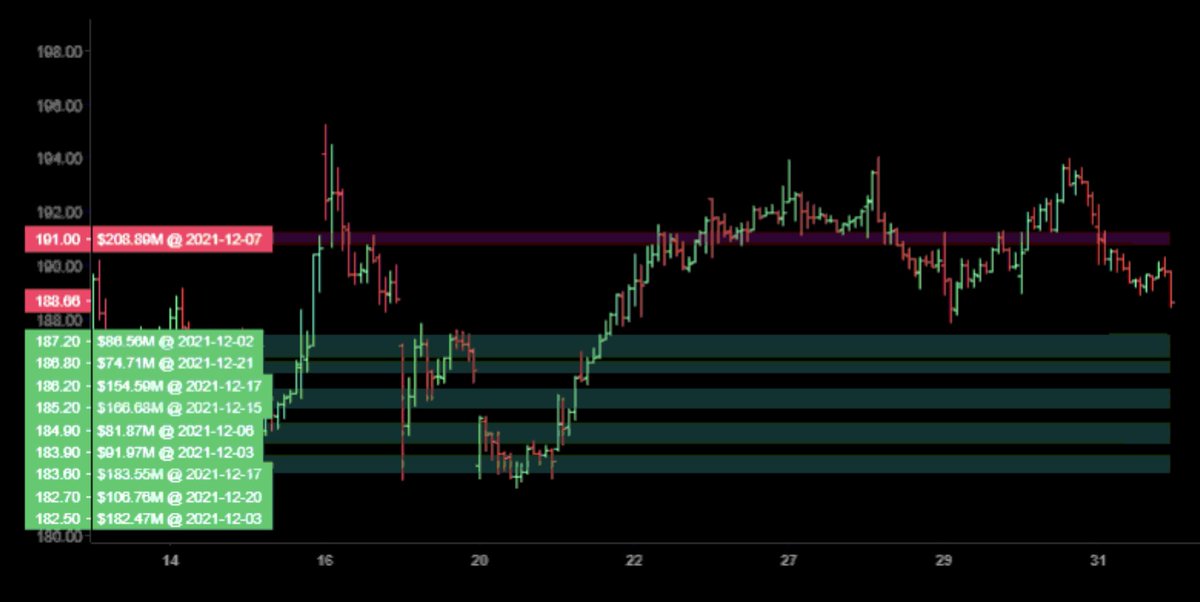

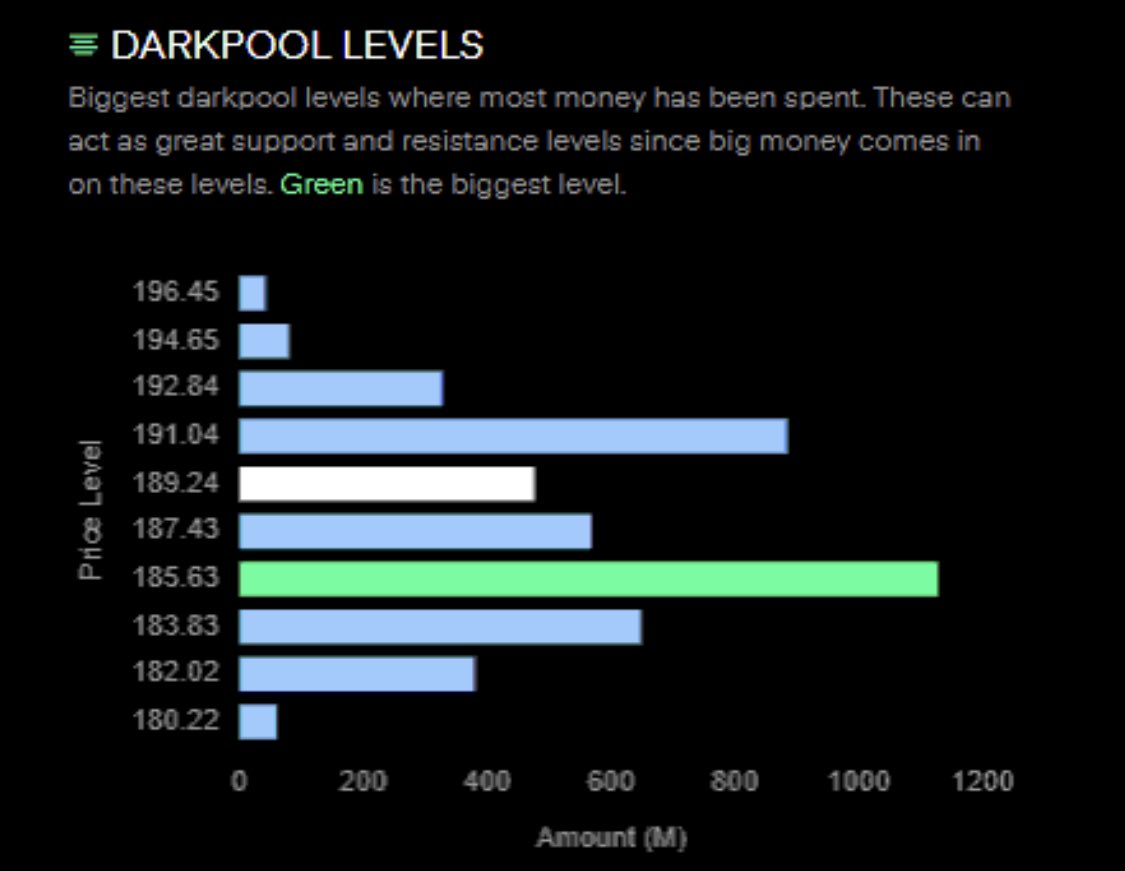

I know how much you guys like these, so here’s a simple breakdown of how I look for short-term swing positions w/ @TrendSpider and @unusual_whales

With these, I’m looking to ride high-volume momentum w/ any actionable signal, as long as there are multiple trend confirmations.

More from Tradingthread

So I'll give you a breakdown on which website I use to check my DD along with mainly using my PLATFORM as the MAIN source of information. But other websites are also used. . Then I will provide you with a youtuber whose name is RILEY ..

his content from the playlist start with "how to read stock charts". It's precise and on point and short enough for you to get through this week even if you did one video tonight .. I like his teaching method .. he's slow and very easy to understand

As for DD. It comes from many factors. Mainly the trading platform itself has updated news posted on the ticker you want to trade.

https://t.co/1f8wQs1LcA

Really liking this website it has breakdown of the financials & summary of SEC filings. (con'd)

Also a whole bunch of other stuff that it focuses on the companies that you search. As for what I look for?

10-K & 10-Q.

Read 8Ks ..company updates

Also look to see if they did an recent Offerings (S-4 filings)

Also look to see S-3 filings for upcoming dilutions.

cont'd

https://t.co/nxP0hAJ4UH (Great place for quick articles on many stocks that are posted by analysts who do very good work digging info)

https://t.co/KsYqlmTlQ8 for quick news info

https://t.co/v5xGZqWhbn For constant world news

his content from the playlist start with "how to read stock charts". It's precise and on point and short enough for you to get through this week even if you did one video tonight .. I like his teaching method .. he's slow and very easy to understand

As for DD. It comes from many factors. Mainly the trading platform itself has updated news posted on the ticker you want to trade.

https://t.co/1f8wQs1LcA

Really liking this website it has breakdown of the financials & summary of SEC filings. (con'd)

Also a whole bunch of other stuff that it focuses on the companies that you search. As for what I look for?

10-K & 10-Q.

Read 8Ks ..company updates

Also look to see if they did an recent Offerings (S-4 filings)

Also look to see S-3 filings for upcoming dilutions.

cont'd

https://t.co/nxP0hAJ4UH (Great place for quick articles on many stocks that are posted by analysts who do very good work digging info)

https://t.co/KsYqlmTlQ8 for quick news info

https://t.co/v5xGZqWhbn For constant world news

Trading view scanner process -

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal

You May Also Like

And here they are...

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!

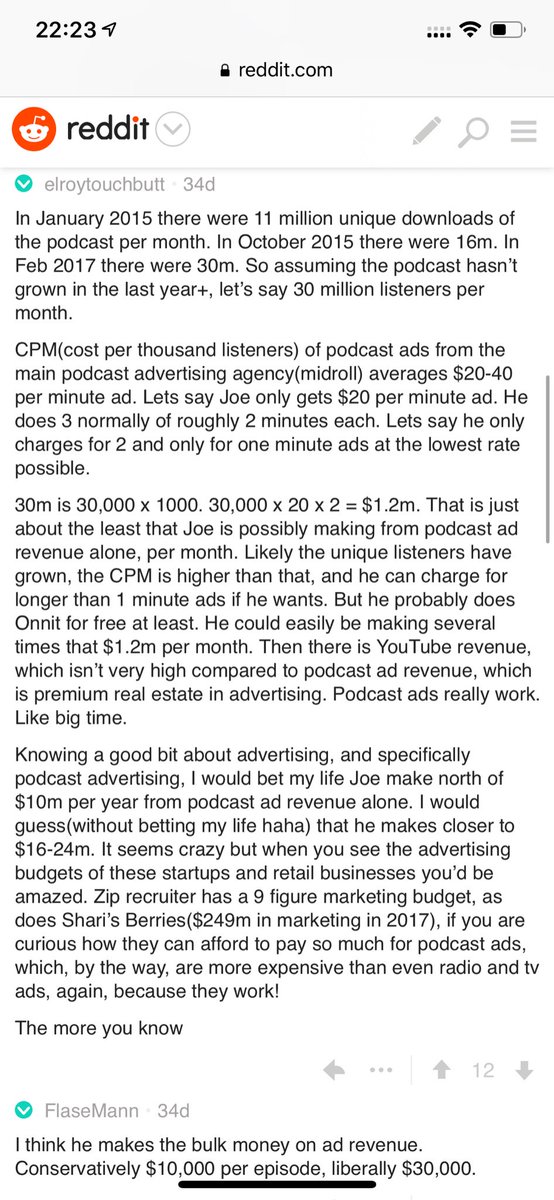

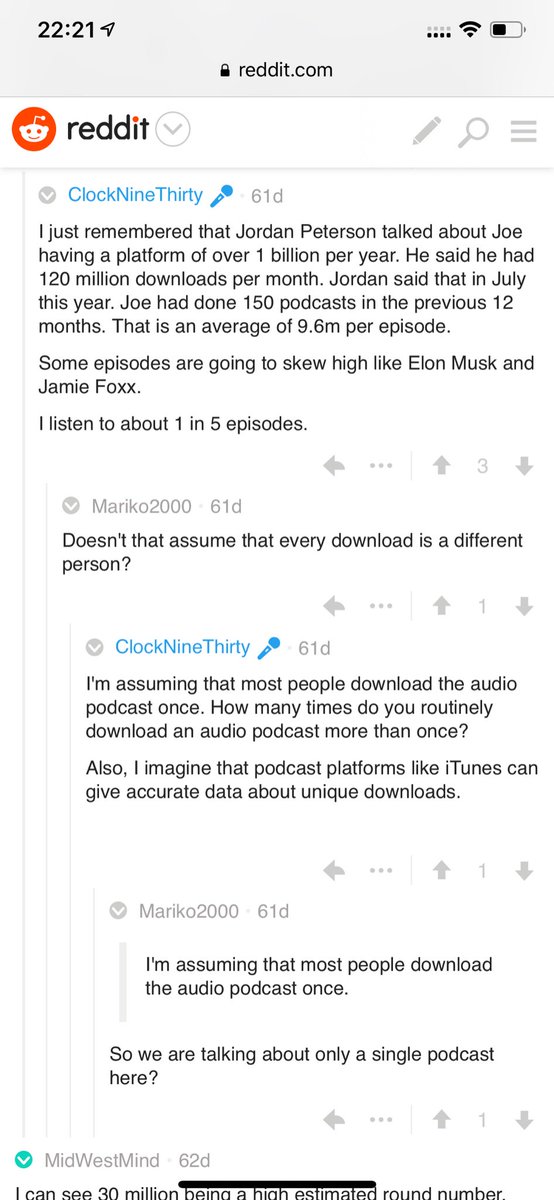

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu