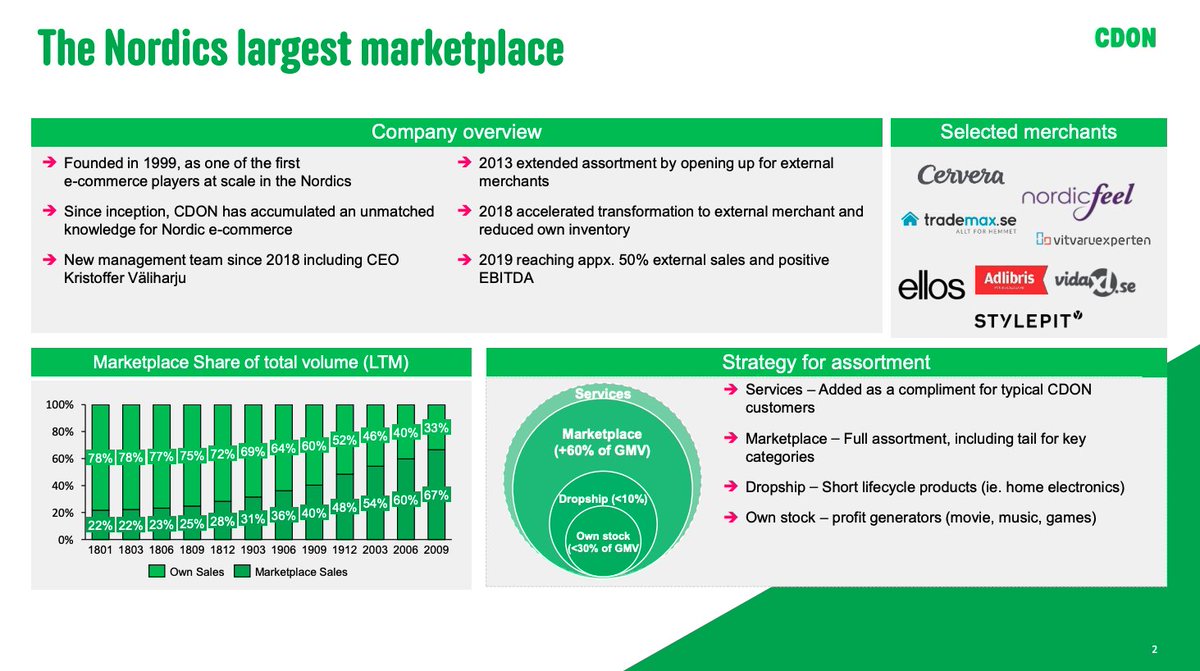

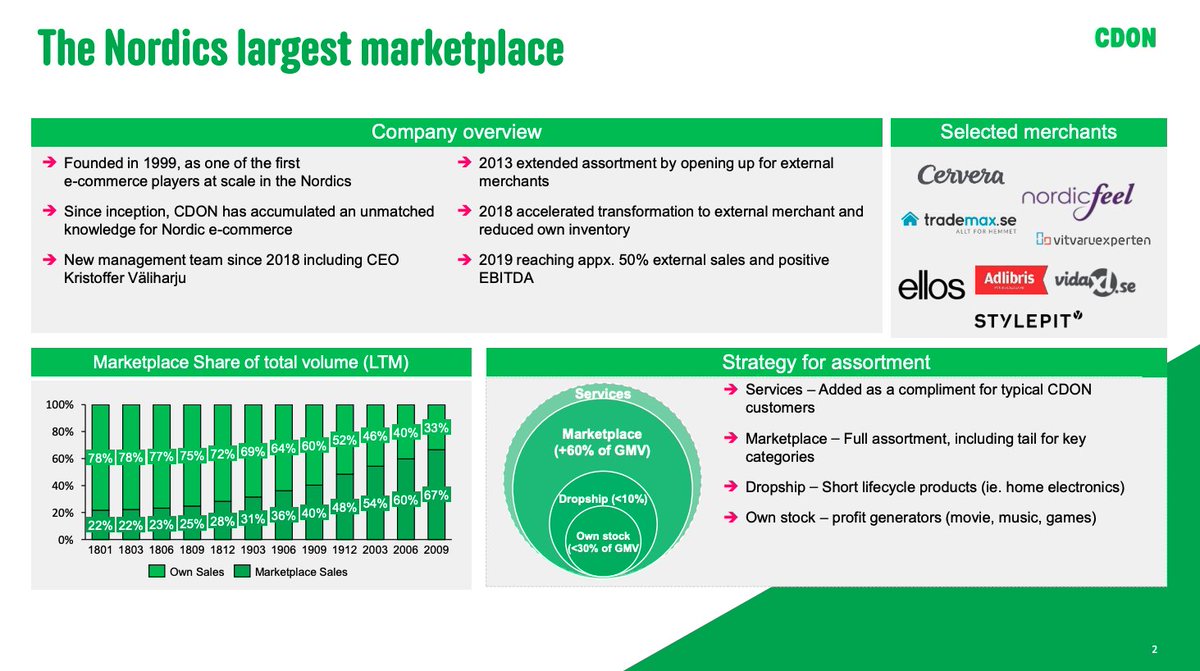

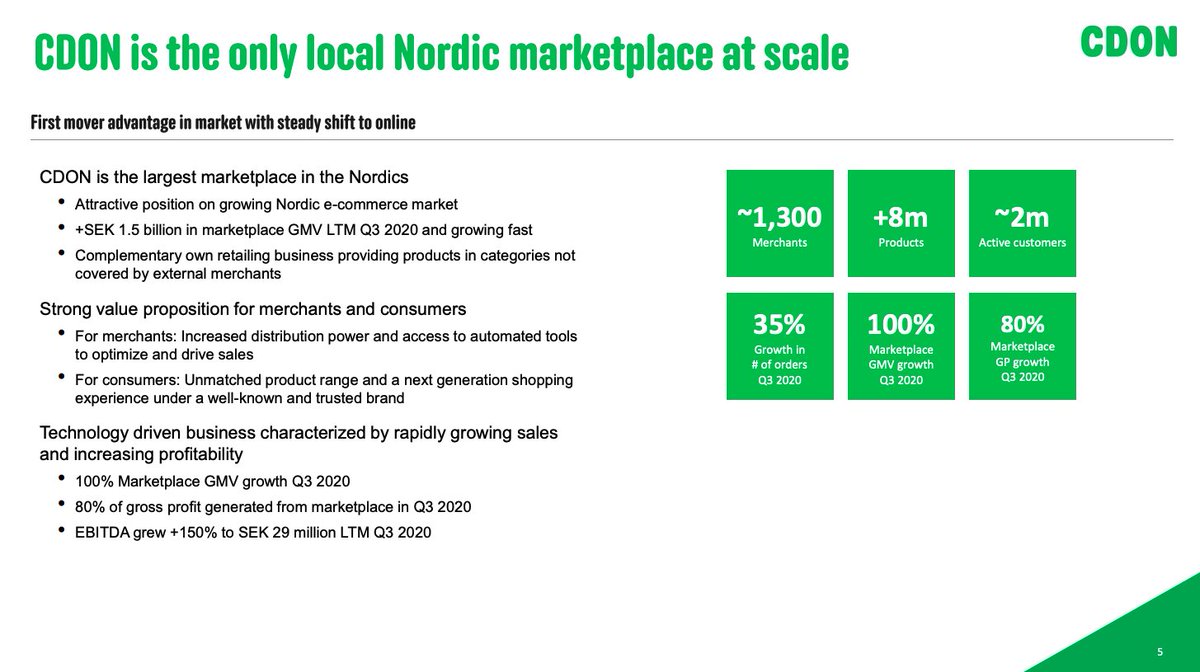

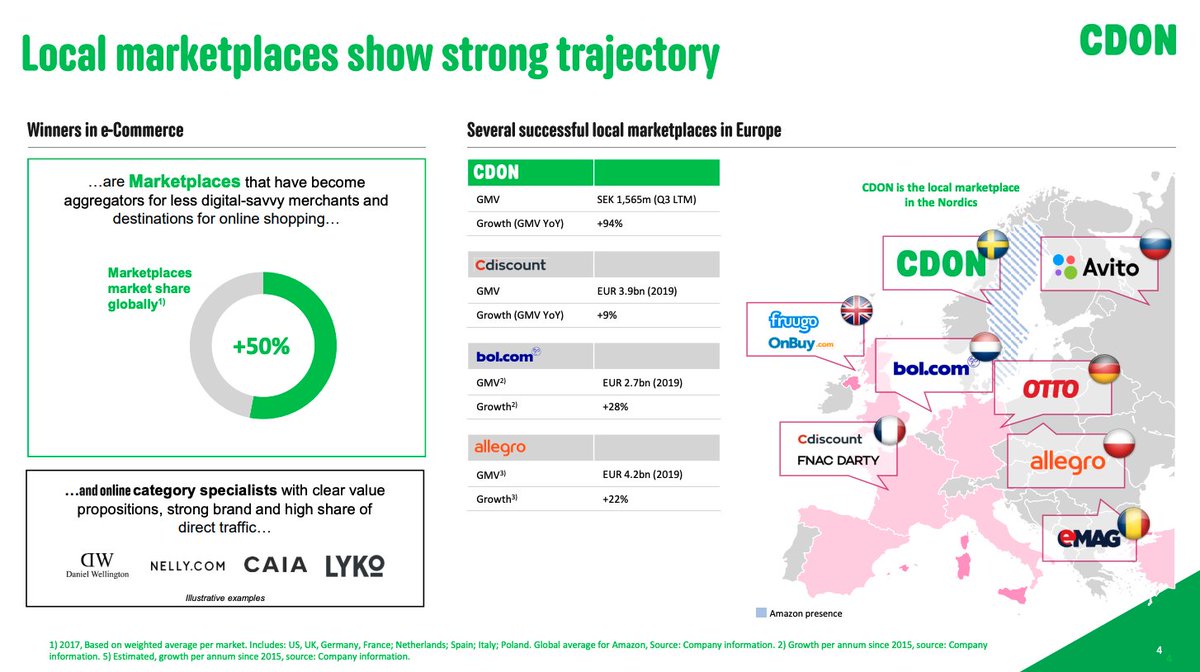

🛍 It is now moving towards an “e-commerce platform” / marketplace positioning where merchants retail products and send these to clients

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Important Concepts from Power of Stocks\u2014 Subhasish Pani

— Aditya Todmal (@AdityaTodmal) August 12, 2022

7+ years of trading experience in 14 tweets\U0001f9f5

Collaborated with @niki_poojary

There are plenty of videos of Subhasish Pani from Power of Stocks.

— Aditya Todmal (@AdityaTodmal) April 17, 2022

You already know those.

Instead, here are 12 concepts from his videos that will make you a better trader\u2013\u2013not worse:\U0001f9f5

Collaborated with @niki_poojary

Subasish Pani revealed the most simple, yet successful strategy: 5EMA set up!

— Nikita Poojary (@niki_poojary) July 3, 2022

Here is a thread of 23 video clips on the 5EMA set-up that will save you hundreds of hours and available to you for no cost!

5EMA set-up: \U0001f9f5!

Collaborated with @AdityaTodmal

A set up which has a minimum Risk/Reward (R/R) of 1:4

— Nikita Poojary (@niki_poojary) October 2, 2022

This set up can be used for intraday, option selling, option buying, as well as investing.

Maximum profit strategy by Subasish Pani.

Bollinger band set-up: \U0001f9f5!

Collaborated with @AdityaTodmal pic.twitter.com/aEIUVQF2XY