𝗧𝗛𝗘 𝗢𝗣𝗧𝗜𝗢𝗡𝗦 𝗧𝗛𝗥𝗘𝗔𝗗-𝟮

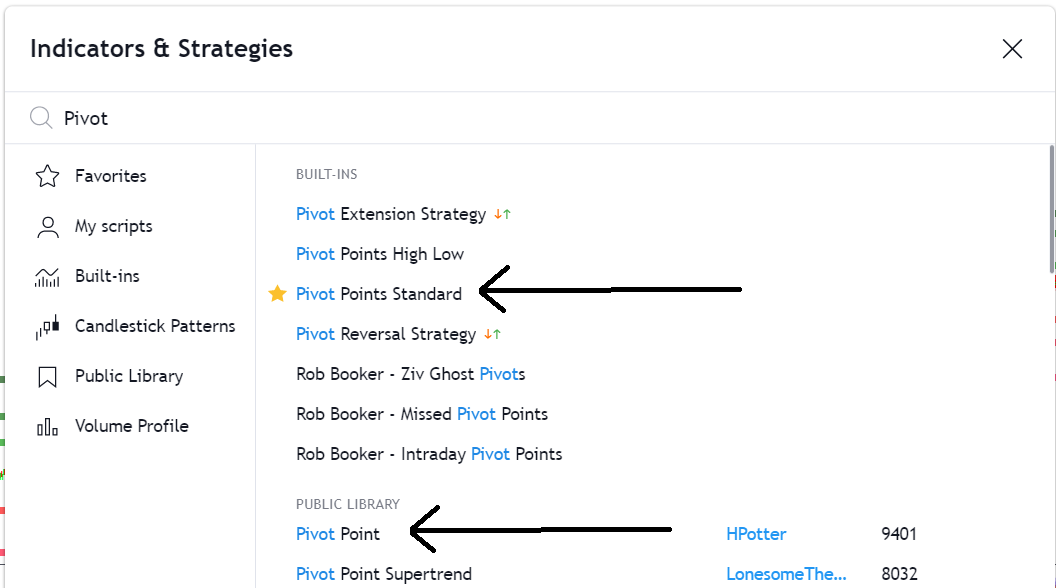

So we had discussed a few pointers in the previous thread about options,its time now we discuss further implications and applicability in this thread which will help you in NEW YEAR.

Let’s go and dive into the world of options trading.

-Everything in trading has a trade off.

-By using portfolio beta weighted delta, you can accurately gauge your overall portfolio risk. If your portfolio is leaning too far in..

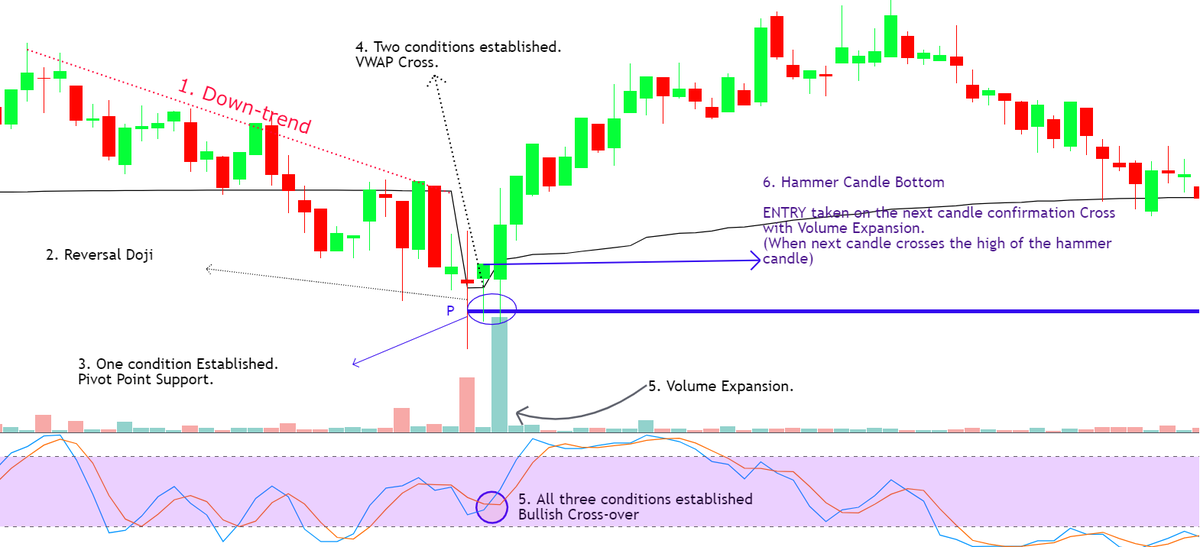

-Iron condors & credit spreads are two defined risk short premium strategies

These strategies involve both selling a closer to the money option..

-When you place our options orders, you need to go in at mid price to get a fair price on your positions. As a retail trader, you never will be able to buy on the bid price or sell on the ask price. That is the job of the market maker

-Hope you gained some insights.

https://t.co/AV8EPWM2Uf

Keep learning

Keep sharing

Keep growing

\U0001d413\U0001d421\U0001d42b\U0001d41e\U0001d41a\U0001d41d \U0001d41f\U0001d428\U0001d42b \U0001d40e\U0001d429\U0001d42d\U0001d422\U0001d428\U0001d427\U0001d42c

— Abhishek Kar (@Abhishekkar_) December 29, 2020

The entire thread will have some quick pointers on options trading. These bullet points are based on experience and learning and even if you are completely new,will help you to build some perspective. So,lets go :