We've already established that $INTC is about to lose serious market share in the PC market but truth be told, Intel's most important segment is probably what it terms as the "Data Center Group", it's data center business. So what are Intel's prospects there? Let's do a deep dive

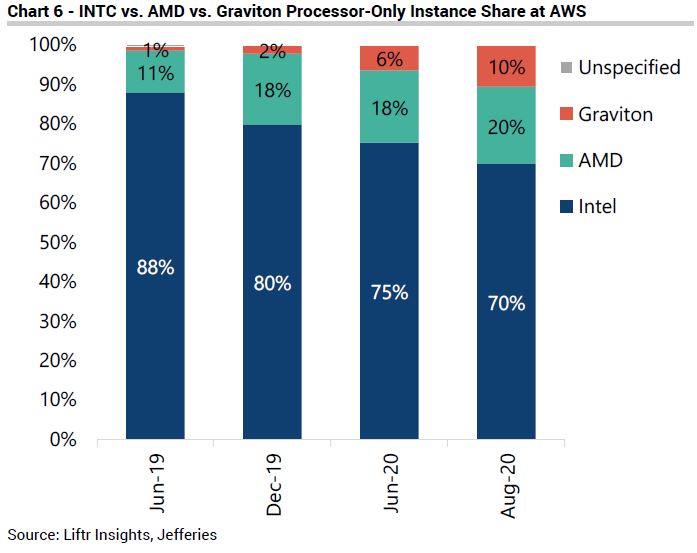

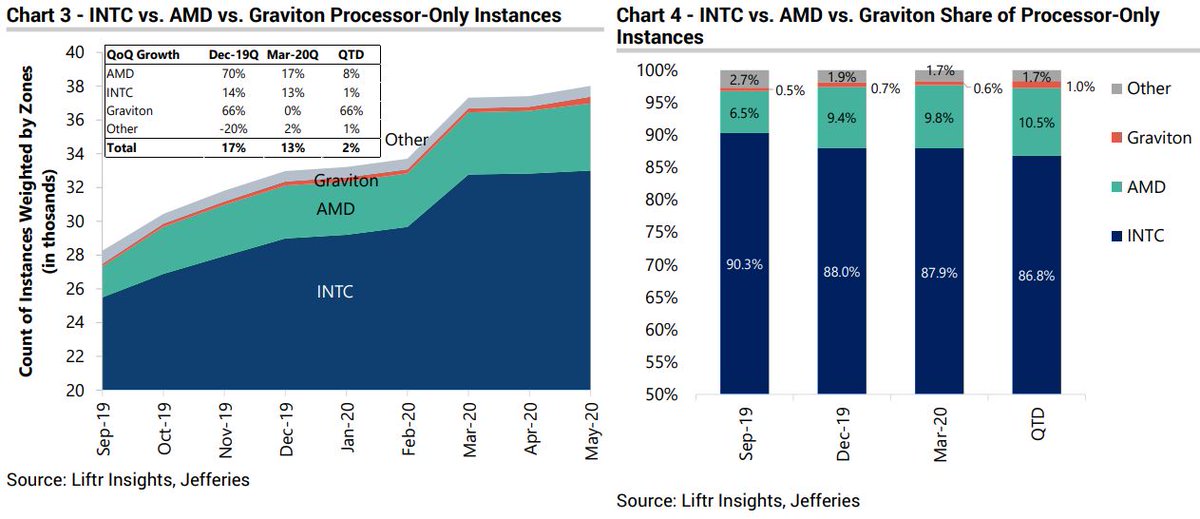

$AMZN AWS NA instances CPU market share. $TSM which manufactures both for AWS (Graviton) and $AMD is the real winner pic.twitter.com/rVPec8TdQ6

— Lucid Capital (@LucidCap) December 13, 2020

It's kind of obvious, isn't it? the CLOUD.

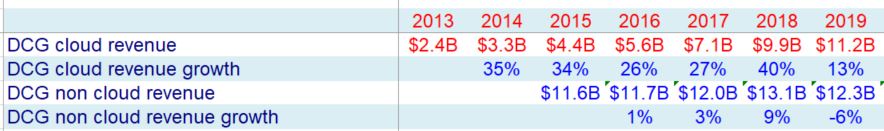

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

One can see that the hypercloud guys basically have 2 options: $INTC & $AMD

https://t.co/oTWxhB1mzL

https://t.co/4W0TO0Km7W

Performance benchmarks have been quite telling - it seems like Graviton2 is on par with x86 performance wise, and is much cheaper

"The cost analysis section describes ‘An x86 Massacre’, as while the pure performance of the Arm chip is generally in the same region as the x86 competitors, its lower price means the price/performance is substantially better"

https://t.co/0vvQnceDfI

https://t.co/zwZhp1XaW6

$INTC might be the best short opportunity since Nokia circa 2008. Why?

— Emilgold (@emilio_gold) December 2, 2020

Black. Magic. Fuckery.

Follow me on the path to Intel's destruction and it all starts with the M1https://t.co/w4nMmBgwfq

More from Trading

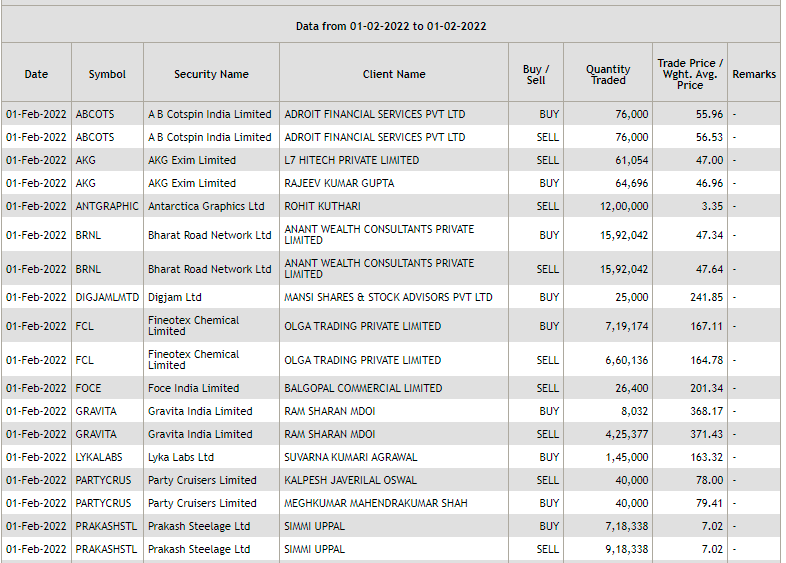

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

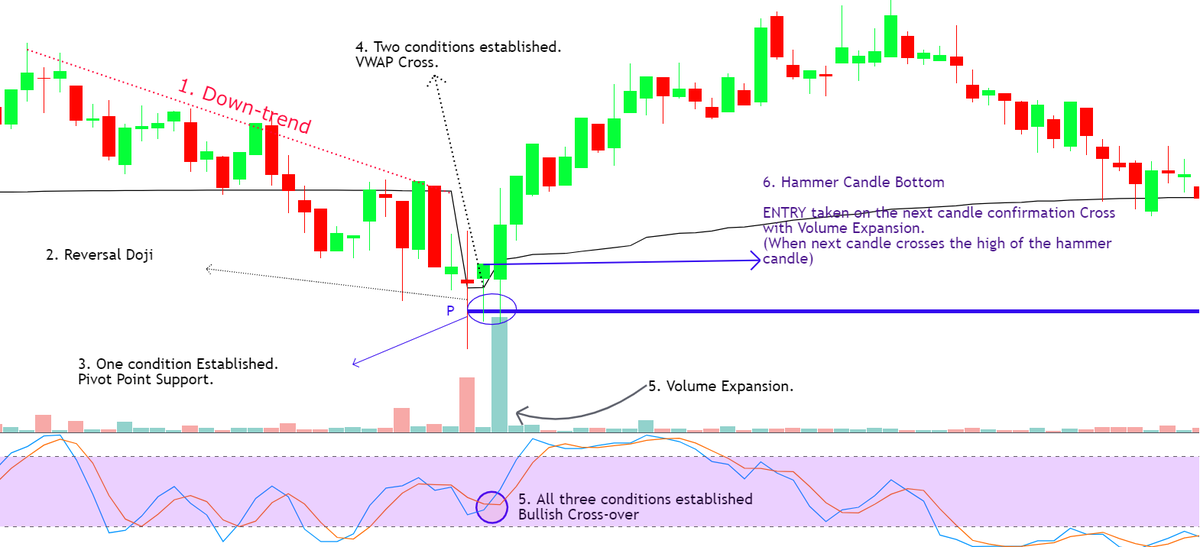

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5