Other timeframe traders (investors) can be visible on micro timeframe data but micro timeframe traders(locals) cannot be visible on other timeframe data(>daily)

Some thoughts on tick data for long to medium-timeframe trading

1/n

Other timeframe traders (investors) can be visible on micro timeframe data but micro timeframe traders(locals) cannot be visible on other timeframe data(>daily)

Theoretically sounds great but practically if you're hunting for a pattern that goes beyond days or weeks in tick data then it requires huge data to evaluate such patterns.

https://t.co/2PjqIfGpoH

More from Trading

Turns out, patterns trading is simple—if you follow these 8 Patterns:

Let's start: ↓

While studying her Twitter profile and with constant talks with her, I found these to be the most important patterns she focuses on always.

Then I wrote a small summary of what each pattern means.

Also attached are some examples from her tweets.

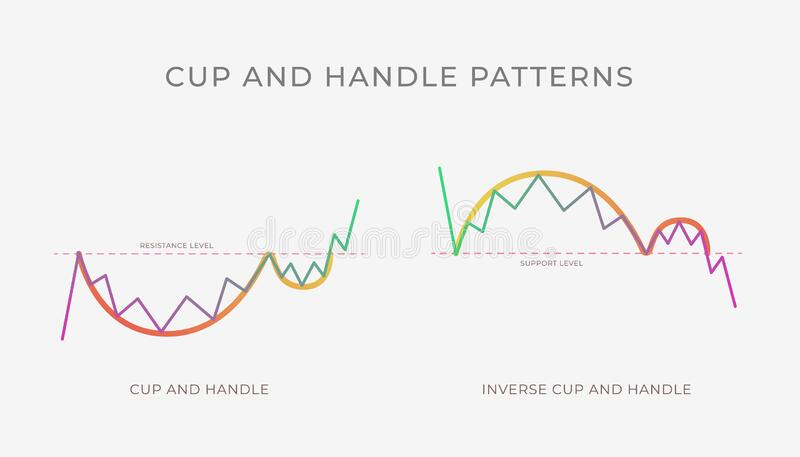

1/ Cup and handle Pattern

Happens during an uptrend.

The cup portion has a U-shaped appearance.

The bears are getting weaker as they are unable to drive the prices below the last low.

Subhasish Pani uses this a lot in stocks to spot bullish trades.

Eg

5: When to play directional:

— Nikita Poojary (@niki_poojary) December 18, 2022

Whenever the index is moving in a single direction, its important to go with the trend.

A few weeks ago when BNF broke out of the cup and handle pattern, all we had to do was sell PEs.

Pls note: weekly TF chart is attached to just show the C&H BO pic.twitter.com/z0wgUzJW8t

Eg

#VOLTAS Another cup & handle pattern for cash positional pic.twitter.com/Jsc99xJfwY

— Nikita Poojary (@niki_poojary) October 23, 2019

You May Also Like

RT-PCR corona (test) scam

Symptomatic people are tested for one and only one respiratory virus. This means that other acute respiratory infections are reclassified as

4/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

...indication, first of all that testing for a (single) respiratory virus is done outside of surveillance systems or need for specific therapy, but even so the lack of consideration of Ct, symptoms and clinical findings when interpreting its result. https://t.co/gHH6kwRdZG

2/12

It is tested exquisitely with a hypersensitive non-specific RT-PCR test / Ct >35 (>30 is nonsense, >35 is madness), without considering Ct and clinical context. This means that more acute respiratory infections are reclassified as

6/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

The neither validated nor standardised hypersensitive RT-PCR test / Ct 35-45 for SARS-CoV-2 is abused to mislabel (also) other diseases, especially influenza, as COVID-19.https://t.co/AkFIfTCTkS

3/12

The Drosten RT-PCR test is fabricated in a way that each country and laboratory perform it differently at too high Ct and that the high rate of false positives increases massively due to cross-reaction with other (corona) viruses in the "flu

External peer review of the RTPCR test to detect SARS-CoV-2 reveals 10 major scientific flaws at the molecular and methodological level: consequences for false positive results.https://t.co/mbNY8bdw1p pic.twitter.com/OQBD4grMth

— Dr. Thomas Binder, MD (@Thomas_Binder) November 29, 2020

4/12

Even asymptomatic, previously called healthy, people are tested (en masse) in this way, although there is no epidemiologically relevant asymptomatic transmission. This means that even healthy people are declared as COVID

Thread web\u2b06\ufe0f\u2b07\ufe0f

— Dr. Thomas Binder, MD (@Thomas_Binder) December 16, 2020

The fabrication of the "asymptomatic (super) spreader" is the coronation of the total nons(ci)ense in the belief system of #CoronasWitnesses.

Asymptomatic transmission 0.7%; 95% CI 0%-4.9% - could well be 0%!https://t.co/VeZTzxXfvT

5/12

Deaths within 28 days after a positive RT-PCR test from whatever cause are designated as deaths WITH COVID. This means that other causes of death are reclassified as

8/8

— Dr. Thomas Binder, MD (@Thomas_Binder) March 24, 2020

By the way, who the f*** created this obviously (almost) worldwide definition of #CoronaDeath?

This is not only medical malpractice, this is utterly insane!https://t.co/FFsTx4L2mw

![Peter McCormack [Jan/3\u279e\u20bf \U0001f511\u220e]](https://pbs.twimg.com/profile_images/1524287442307723265/_59ITDbJ_normal.jpg)