This information does not constitute financial advice. You know the drill. Let's get into it.

If you tell me the 15-minute chart shows a bearish divergence, I'll probably tell you I don't give a shit. This thread will teach you why.

Understanding timeframes is crucial in trading and technical analysis.

I'll teach you what they are, how they work and their use.

This information does not constitute financial advice. You know the drill. Let's get into it.

LTF = Lower timeframe

HTF = Higher timeframe

S/R = Support & Resistance

PA = Price Action

This is why if you're trading the 4h chart, you don't care much about a 1-minute bearish divergence. The movements on much lower timeframes take place much faster than on higher timeframes.

Closes constitute confirmation.

This is why many traders get shaken out at HTF levels, as happened in September 2020.

Regardless of your style, I recommend mapping out the HTF levels. Start with monthly, then weekly and daily levels.

Or, if you're truly a chad, trade HTF and also scalp around the levels.

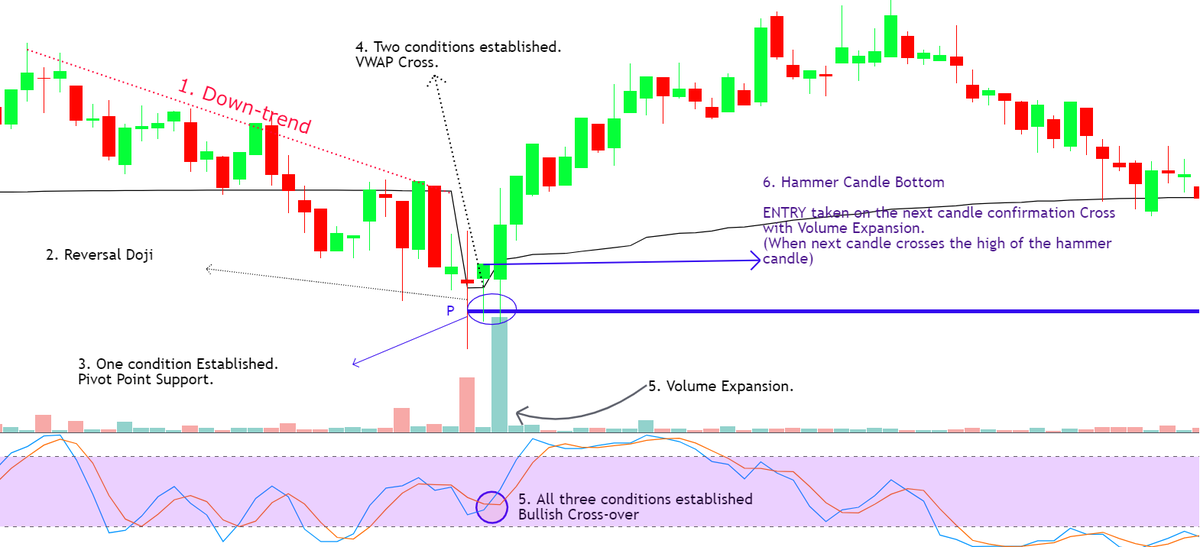

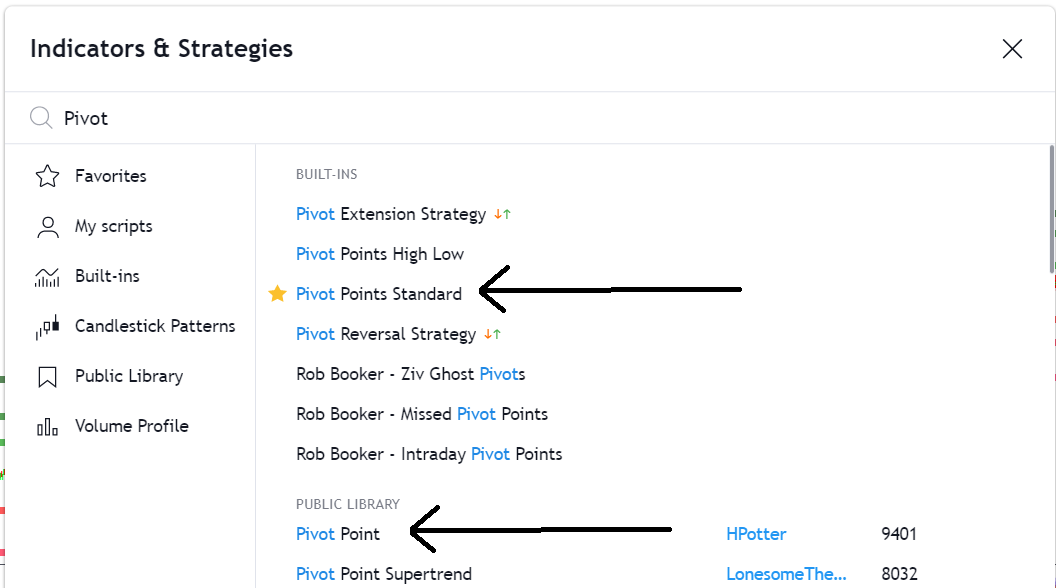

- Map out HTF levels

- Watch LTF PA around HTF levels

- Find a timeframe that works for you.

- Don't let lower timeframes affect your high timeframe thesis.

If you need an exchange, join me on FTX. I got you a 5% discount on fees :)

https://t.co/Sll9nkNsRd