1/ Having built online trading platforms, I can share insights what is happening with #RobinhoodApp, why their businessmodel is shady and how this $GME 🚀🚀🚀squeeze makes this all a pretty messy affair.

So, a thread 👇🏻

a) from Brazil: "97% of traders lose money" https://t.co/DVEfRkyvuS

b) from Taiwan: "Less than 1% of daytraders consistently earn positive returns"

https://t.co/920redEG3D

The reason is that one active trader can bring fees like 500 passive investors.

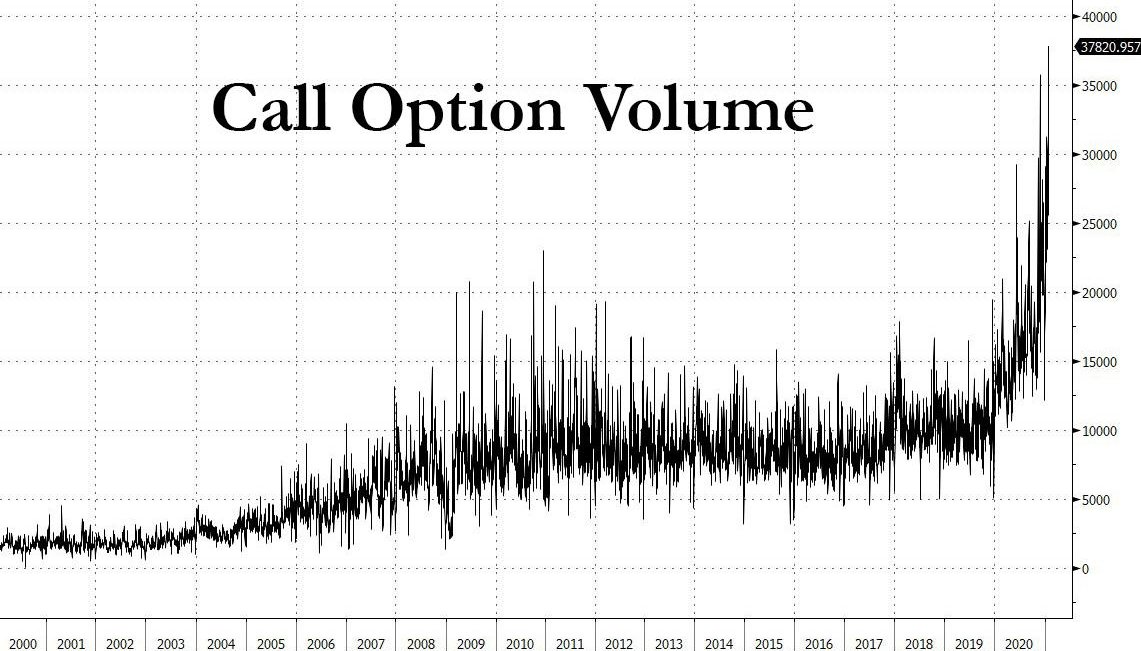

The chart below shows how call option activity in US has made all time records due to Robinhood customers

Last 6 months have been super bullish and therefore r/wallstreetbets has such a big number of active traders.

Citadel can then use flow data to their own benefit and that is very likely totally against the benefit of Robinhood customers.

"Do no evil" still should be a key principle for every startup.

Taleb's take on VaR used by RH and regulators is just not smart at all:

https://t.co/IJwwc244bX

VaR & tools "modern" portfolio theory have been blowing up funds & banks since first use in 1987. Blew up FNMAe & almost all banks in 2009, LTCM in 1998, First Op of Chicago in 1987, AQR in 2020 ....

— Nassim Nicholas Taleb (@nntaleb) January 30, 2021

Yet it is still in use.

They deserve to blow up. Just not with taxpayer funds. https://t.co/FkgMVUnkAs

More from Trading

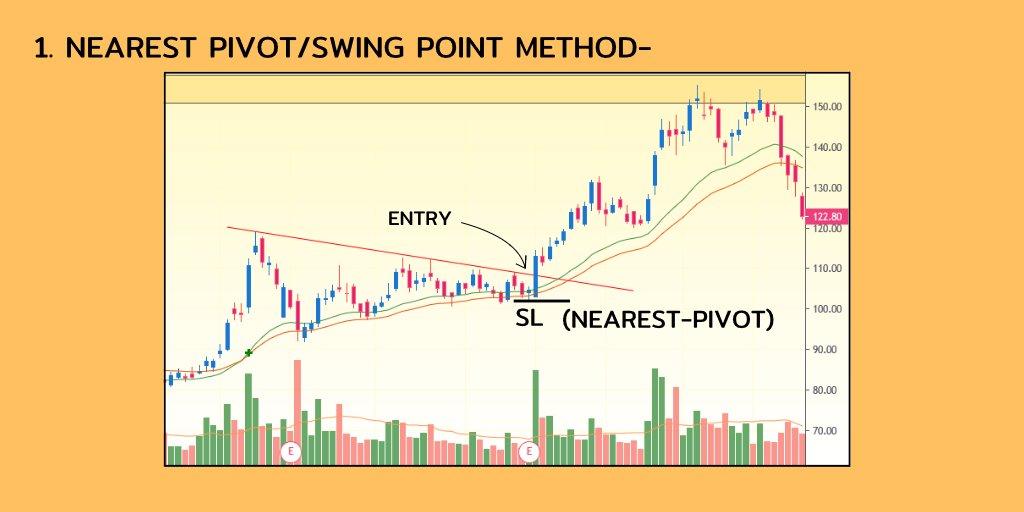

DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

Very quick read.

Share if you liked for the benefit of everyone.

•Main setup of @ITRADE191

He used this setup daily for all trades.

1. EMA crossover 10/20

2. Supertrend 10/3

3. Vwap

4. RSI >

•Volume always greater than

•Candle Rejecting from

•Pivot settings

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

Very quick read.

Share if you liked for the benefit of everyone.

•Main setup of @ITRADE191

He used this setup daily for all trades.

1. EMA crossover 10/20

2. Supertrend 10/3

3. Vwap

4. RSI >

@MiteshFan @Mitesh_Engr @Abhishekkar_ MY TRADING SETUP .... I've been using it for a long time .. result good try it \U0001f607 pic.twitter.com/XThUD0ftbl

— itrade(DJ) (@ITRADE191) June 13, 2020

•Volume always greater than

Volume Should always be above 20 pic.twitter.com/CPgxLgpPKF

— itrade(DJ) (@ITRADE191) June 13, 2020

•Candle Rejecting from

— itrade(DJ) (@ITRADE191) August 25, 2020

•Pivot settings

— itrade(DJ) (@ITRADE191) October 20, 2020

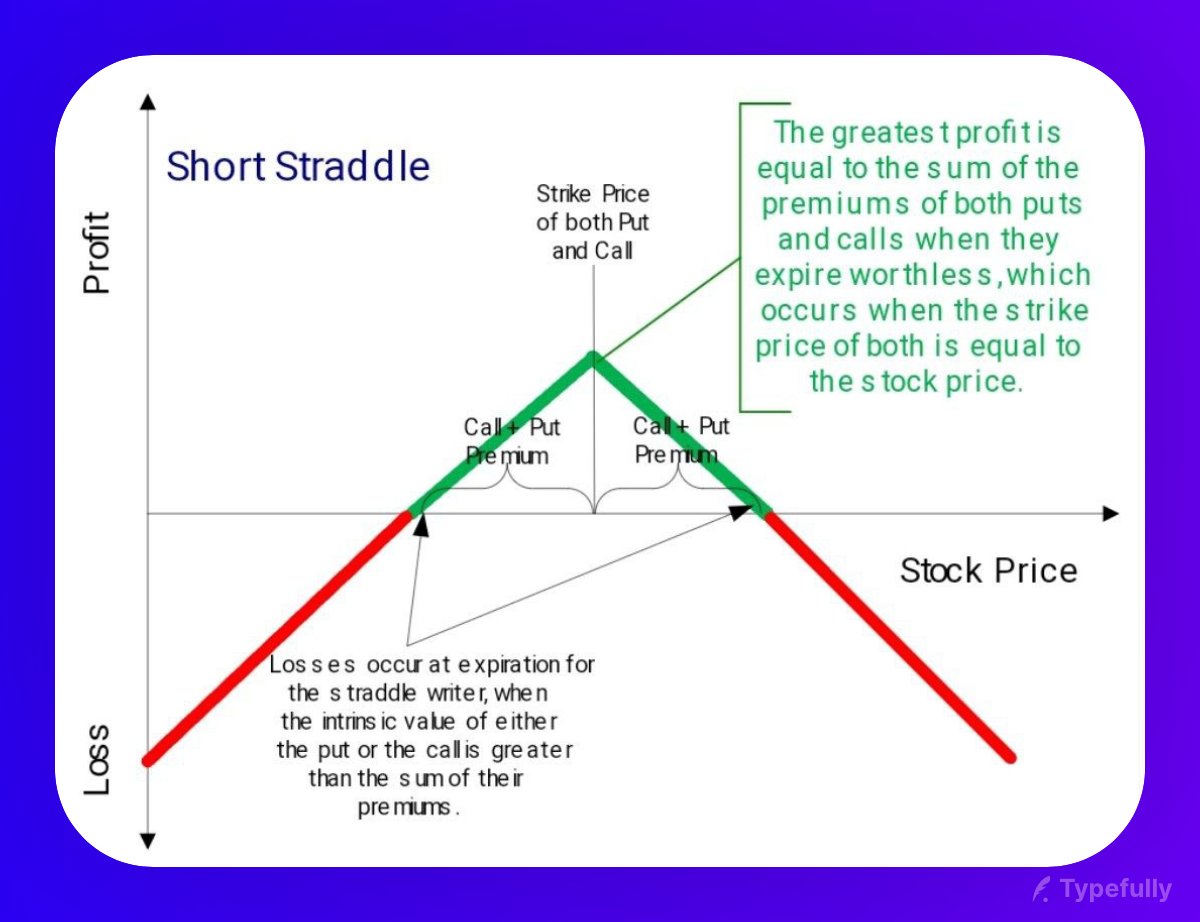

Want to master Option Selling for free?

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

You May Also Like

Recently, the @CNIL issued a decision regarding the GDPR compliance of an unknown French adtech company named "Vectaury". It may seem like small fry, but the decision has potential wide-ranging impacts for Google, the IAB framework, and today's adtech. It's thread time! 👇

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.