A thread about GameStop:

Big hedge funds made big bets that GameStop’s stock was overvalued. The way these bets work is the hedge fund borrows shares of the stock and sells those borrowed shares.

More from Trading

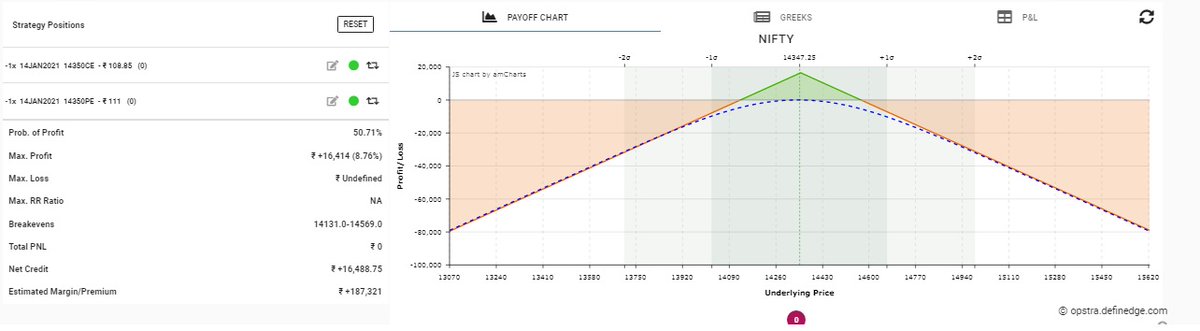

Thread on Short straddle with adjustments:

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

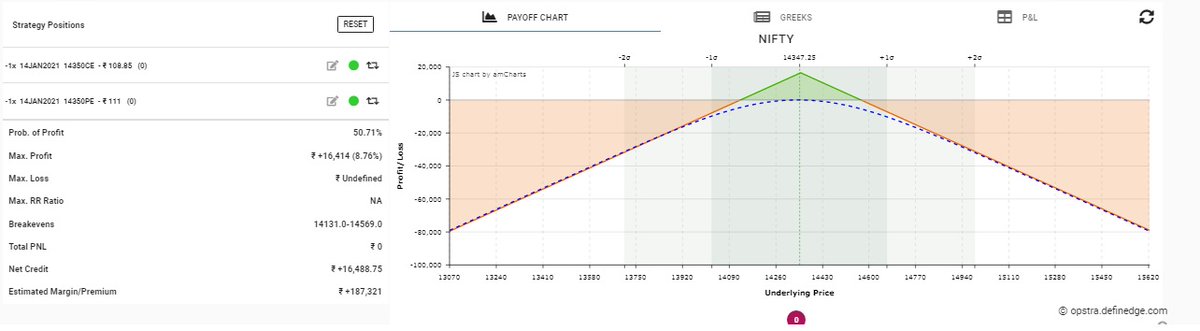

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

I spent over 100 hours studying the best patterns in Technical Analysis taught to me by @niki_poojary.

Turns out, patterns trading is simple—if you follow these 8 Patterns:

Let's start: ↓

While studying her Twitter profile and with constant talks with her, I found these to be the most important patterns she focuses on always.

Then I wrote a small summary of what each pattern means.

Also attached are some examples from her tweets.

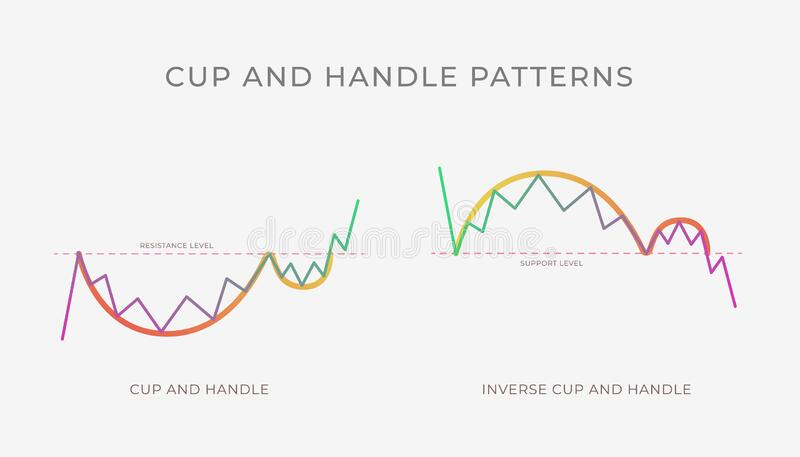

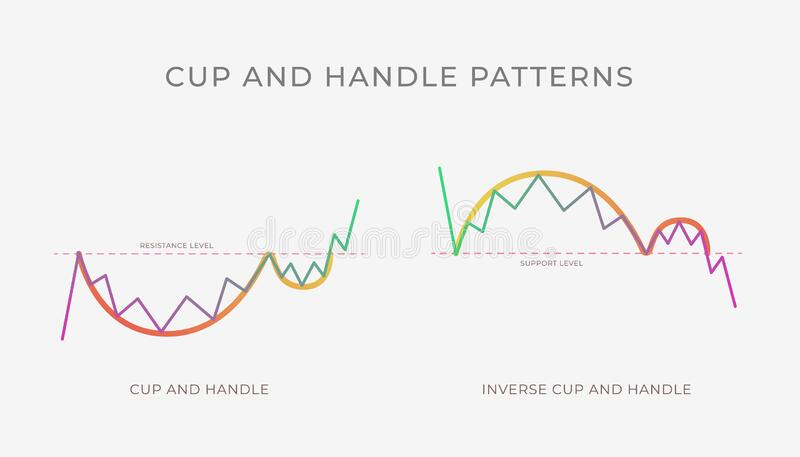

1/ Cup and handle Pattern

Happens during an uptrend.

The cup portion has a U-shaped appearance.

The bears are getting weaker as they are unable to drive the prices below the last low.

Subhasish Pani uses this a lot in stocks to spot bullish trades.

Eg

Eg

Turns out, patterns trading is simple—if you follow these 8 Patterns:

Let's start: ↓

While studying her Twitter profile and with constant talks with her, I found these to be the most important patterns she focuses on always.

Then I wrote a small summary of what each pattern means.

Also attached are some examples from her tweets.

1/ Cup and handle Pattern

Happens during an uptrend.

The cup portion has a U-shaped appearance.

The bears are getting weaker as they are unable to drive the prices below the last low.

Subhasish Pani uses this a lot in stocks to spot bullish trades.

Eg

5: When to play directional:

— Nikita Poojary (@niki_poojary) December 18, 2022

Whenever the index is moving in a single direction, its important to go with the trend.

A few weeks ago when BNF broke out of the cup and handle pattern, all we had to do was sell PEs.

Pls note: weekly TF chart is attached to just show the C&H BO pic.twitter.com/z0wgUzJW8t

Eg

#VOLTAS Another cup & handle pattern for cash positional pic.twitter.com/Jsc99xJfwY

— Nikita Poojary (@niki_poojary) October 23, 2019