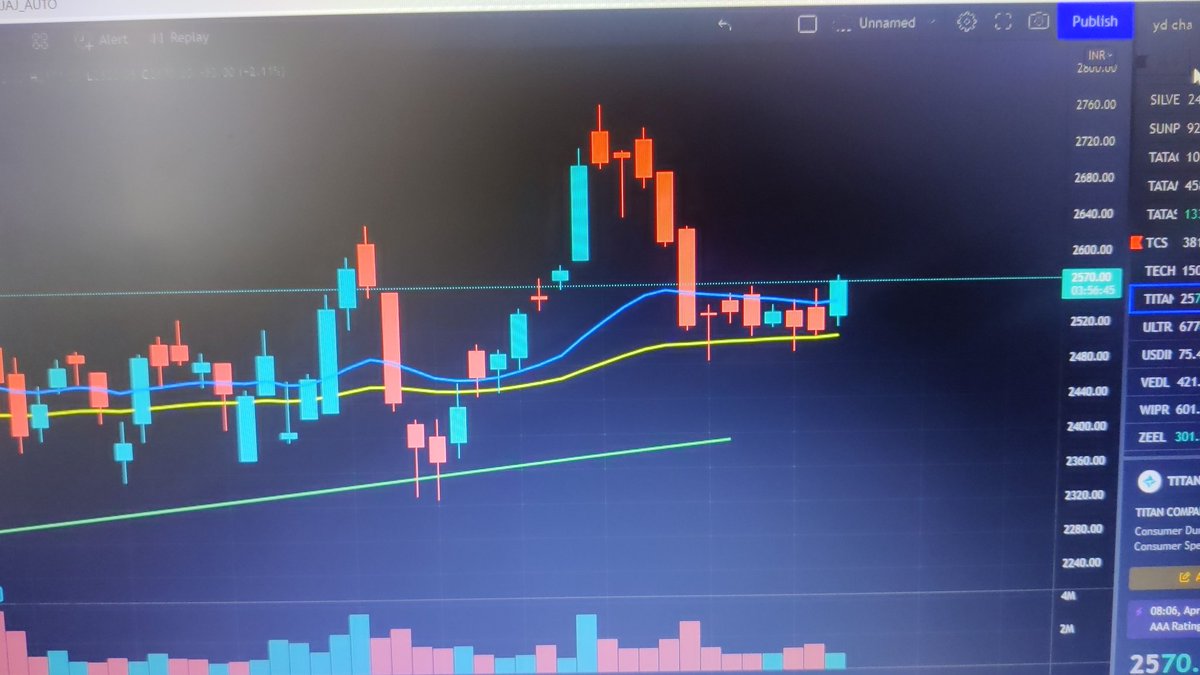

#TITAN looks good as per daily chart but i would not suggest to add at current price https://t.co/ZAUoU9x5zg

Titan \u263a\ufe0f

— Mateen khan (@KhaansKhan) March 19, 2022

More from Pranay Prasun

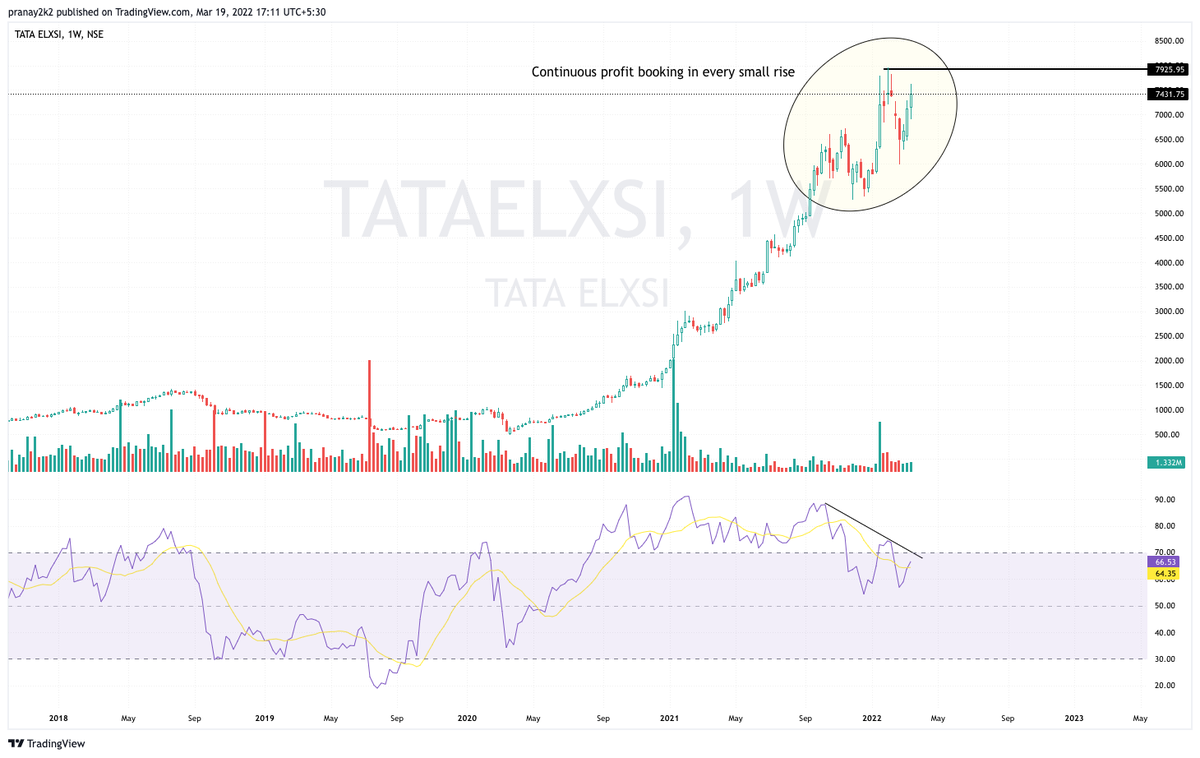

Key points : 👇

~ RSI breakout retest in weekly chart

~ HH &HL pattern ,Price action still bullish

~ Huge support as per ratio chart.

#CNXFMCG #Nifty

#ITC I drilled further by #CNXFMCG index

— Pranay Prasun (@PranayPrasun) July 3, 2021

Keypoints :

~ Near huge support as per weekly chart

~ #RSI Breakout retest #Ratiochart

Conclusion : Bounceback expected

Timeframe : Weekly , So please avoid daily movement .@piyushchaudhry @gogrithekhabri @Deishma @pratyush_rohit https://t.co/PKbi7mdoam pic.twitter.com/MUWBSX2LlB

#Maithanalloys #Publicdemand\U0001f600

— Pranay Prasun (@PranayPrasun) July 4, 2021

Highlighted at 560\U0001f525 level and i'm going to cover all major timeframes \U0001f447

~ What next ?

~ When to add ?

~ Immediate target

~ stop loss https://t.co/v1qWY5TrYQ

#USL #Unitedspirits #DIAGEO Shared daily chart for reference \U0001f447

— Pranay Prasun (@PranayPrasun) May 27, 2022

Here breakout candle is supported by volume https://t.co/MXsPJMNHDF pic.twitter.com/rTLQhfCXfg

More from Titan

Coming out of consolidation. Added more longs. Expecting new high.

#trading

#TITAN - A false breakout at ATH trapping late bulls. In non trending markets its common that strong breakouts fail.

— Yash Dugar (@ydstartupreneur) March 28, 2022

However as per the R:R theory of buy which I shared yesterday will go long abv today's high with low as S.L as reversal at 61.8 retracement with doji.

Views ?? pic.twitter.com/jlCFtXAEiX

Coming out of last 6 days range, consolidation with good volumes till now. More strength on closing abv 2570 👍

Titan - beautifully on track. Rectangle target done. And now one minor saucer target of 1920. https://t.co/t2OQLibJIs pic.twitter.com/tM5hiLg99e

— The_Chartist \U0001f4c8 (@nison_steve) August 22, 2021

You May Also Like

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K