Rioters looting, murdering, vandalizing, and terrorizing our country are supported, praised and funded by the media, politicians, celebrities and corporations.

Big tech allows Inciting violence and targeted harassment if it's against the "right people".

They allow coordination and organization if you're with the "right group"

The media, law makers and celebrities embrace the voices of the unheard (RIOTS) if they're the "right voices"

Rioters looting, murdering, vandalizing, and terrorizing our country are supported, praised and funded by the media, politicians, celebrities and corporations.

Sure there could have been a more productive approach but to demonize them as terrorists and insurgents just proves the double standards.

BLM and Antifa rioters hate this country and are doing so to destroy it.

The people on the right who were rioting yesterday believe they were trying to save it.

One is praised and the other is condemned.

It's sad.

JUST IN - FBI\u2019s digital media team is currently hunting down U.S. Capitol protesters on social media websites. Acting AG Rosen says some participants "will be charged today" and more arrests to come.

— Disclose.tv \U0001f6a8 (@disclosetv) January 7, 2021

Throwback to the Kavanaugh hearings: pic.twitter.com/sOb9z6TFhN

— Mary Margaret Olohan (@MaryMargOlohan) January 7, 2021

I don't recall a task force to identify every person who tried to breach security in front of Lafayette Square and set the guard house and Saint John's church on fire.

https://t.co/9P0rCwYnRX

Sen. Lindsey Graham calls for a joint task force to "identify every person" involved in breach of the U.S. Capitol. "The people sitting in the chairs need to be sitting in a jail cell... sedition may be a charge for some of these people." https://t.co/aZkOVNzOm1 pic.twitter.com/78ZAnASRN0

— ABC News (@ABC) January 7, 2021

POLICE TAKING SELFIES WITH RIOTERS `TROUBLING,' US SAYS

— zerohedge (@zerohedge) January 7, 2021

These display cabinets that used to be filled with historical books of women in politics lay on the ground destroyed. https://t.co/YqufGZQ36I pic.twitter.com/j4tcEIeOXt

— The New York Times (@nytimes) January 7, 2021

More from Tech

Some random interesting tidbits:

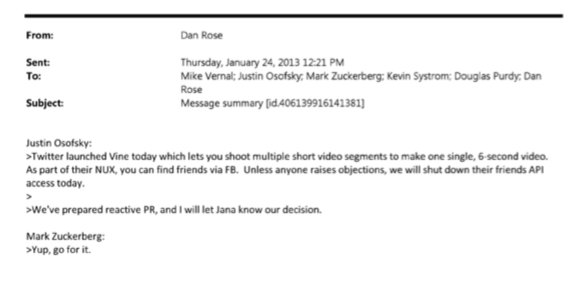

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

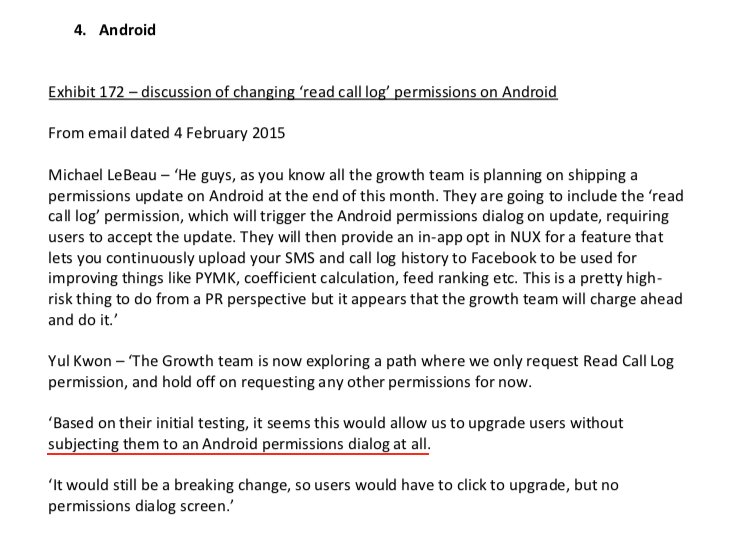

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

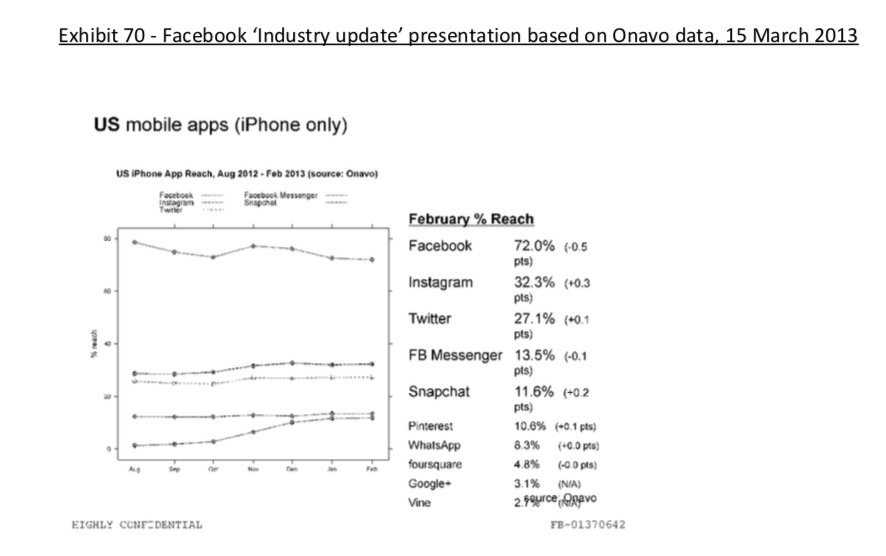

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

A thread.

1. Equity is something Big Tech and high-growth companies award to software engineers at all levels. The more senior you are, the bigger the ratio can be:

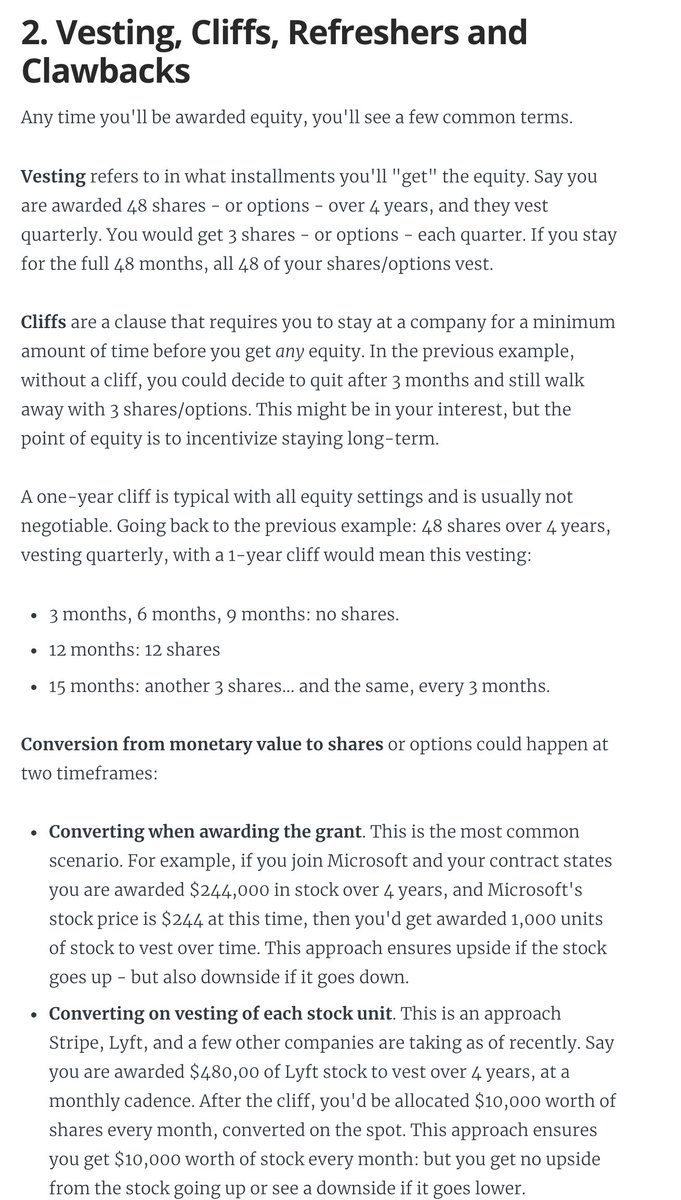

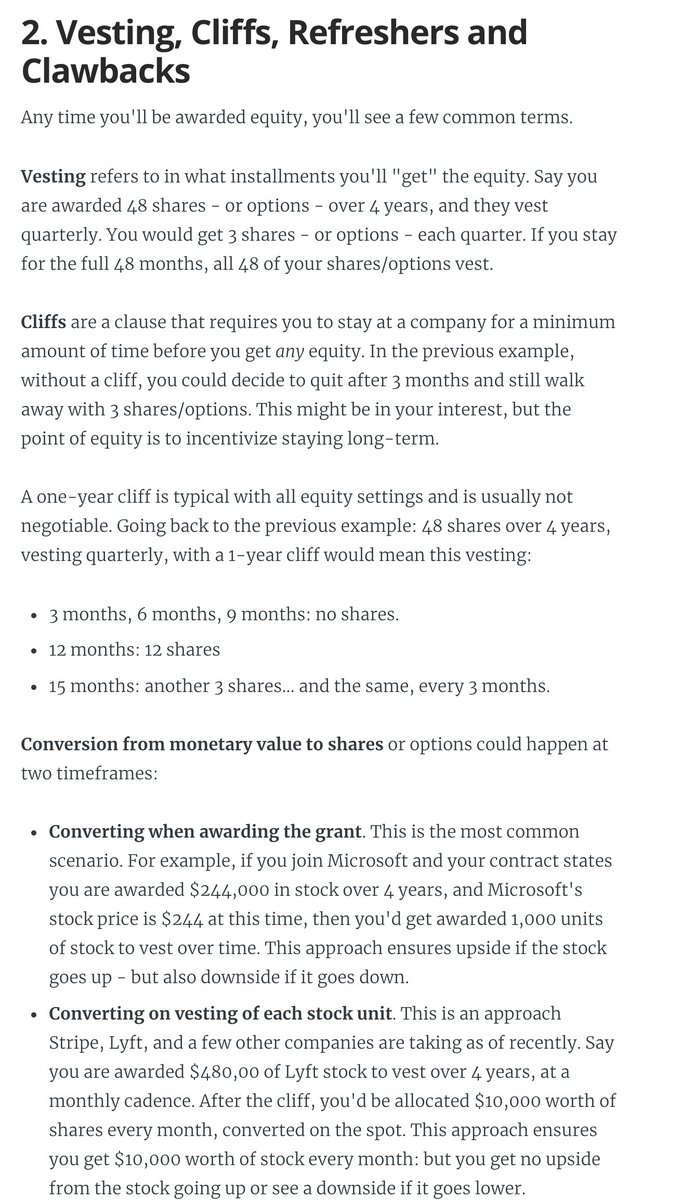

2. Vesting, cliffs, refreshers, and sign-on clawbacks.

If you get awarded equity, you'll want to understand vesting and cliffs. A 1-year cliff is pretty common in most places that award equity.

Read more in this blog post I wrote: https://t.co/WxQ9pQh2mY

3. Stock options / ESOPs.

The most common form of equity compensation at early-stage startups that are high-growth.

And there are *so* many pitfalls you'll want to be aware of. You need to do your research on this: I can't do justice in a tweet.

https://t.co/cudLn3ngqi

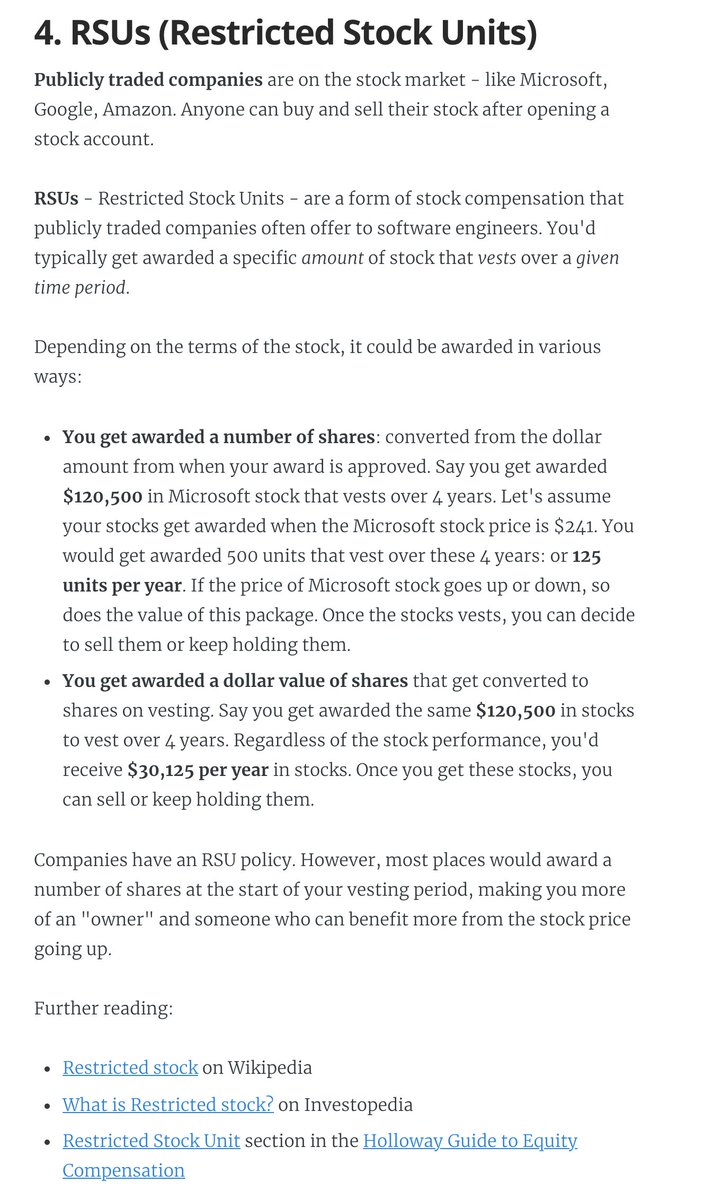

4. RSUs (Restricted Stock Units)

A common form of equity compensation for publicly traded companies and Big Tech. One of the easier types of equity to understand: https://t.co/a5xU1H9IHP

5. Double-trigger RSUs. Typically RSUs for pre-IPO companies. I got these at Uber.

6. ESPP: a (typically) amazing employee perk at publicly traded companies. There's always risk, but this plan can typically offer good upsides.

7. Phantom shares. An interesting setup similar to RSUs... but you don't own stocks. Not frequent, but e.g. Adyen goes with this plan.

You May Also Like

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal