People sometimes ask me what my vision of DeFi is. This is a very tough question. DeFi is very messy with thousands of experiments happening. But high level, I think DeFi will go through 2 phases:

1) This will ultimately lead to hundreds of millions of users to install wallets and get uncomfortable with the UX.

2) This will force the tech (especially scaling) to mature.

More from Tech

The 12 most important pieces of information and concepts I wish I knew about equity, as a software engineer.

A thread.

1. Equity is something Big Tech and high-growth companies award to software engineers at all levels. The more senior you are, the bigger the ratio can be:

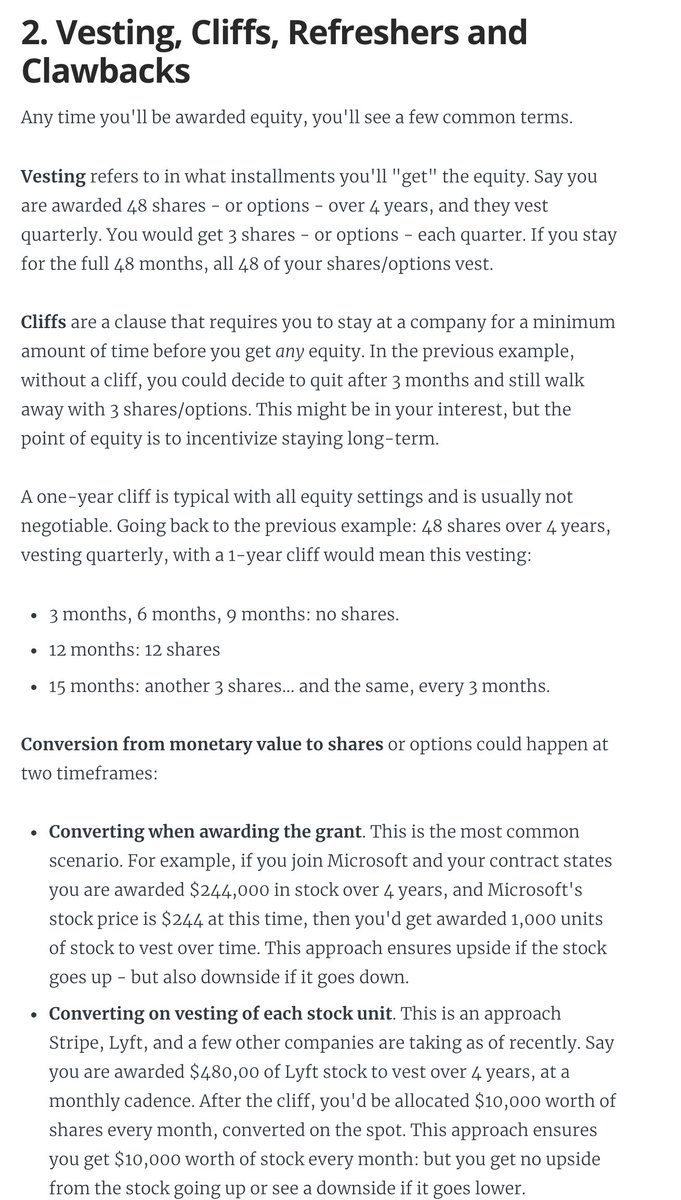

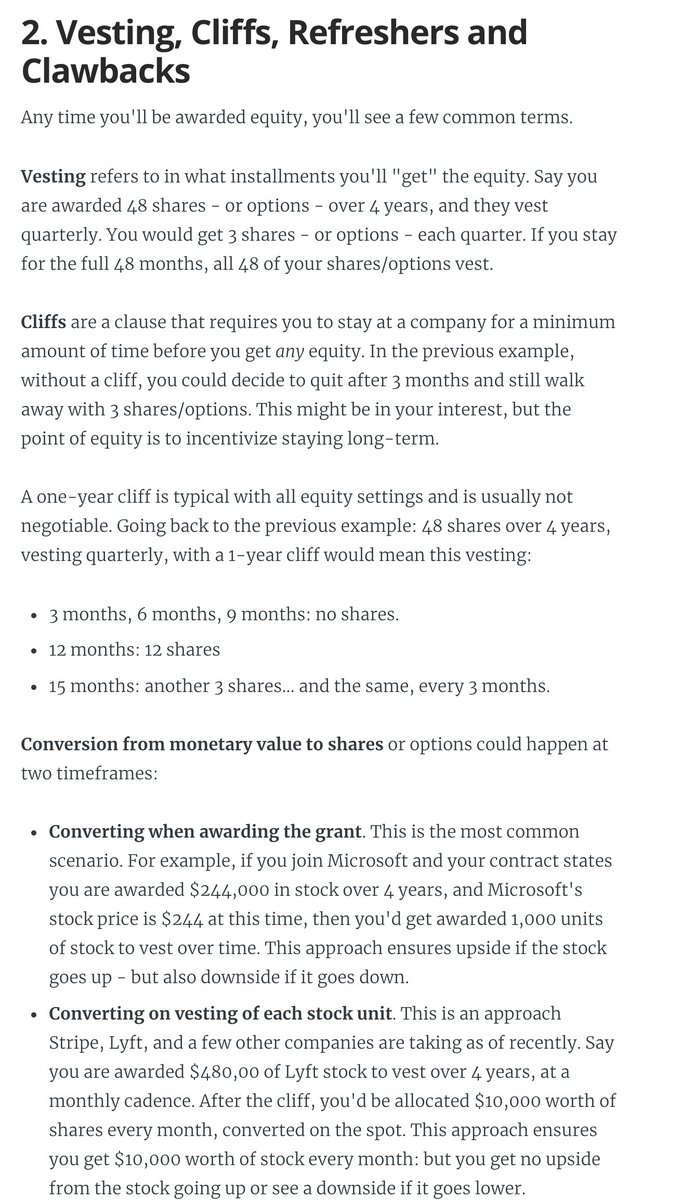

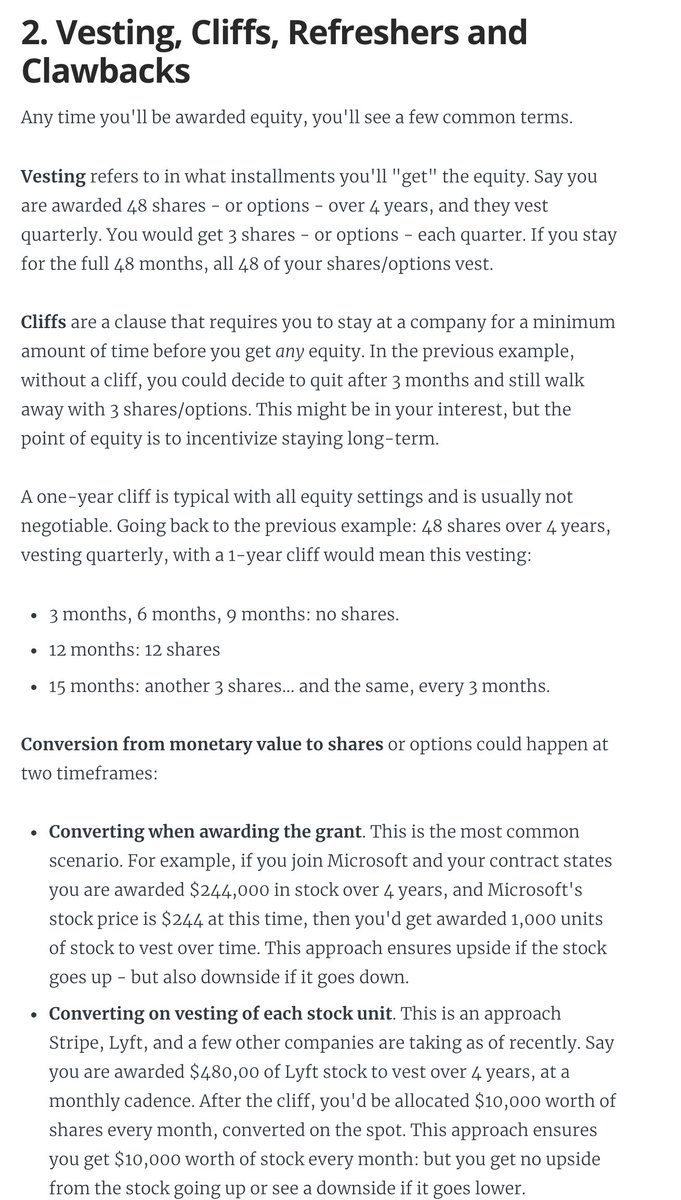

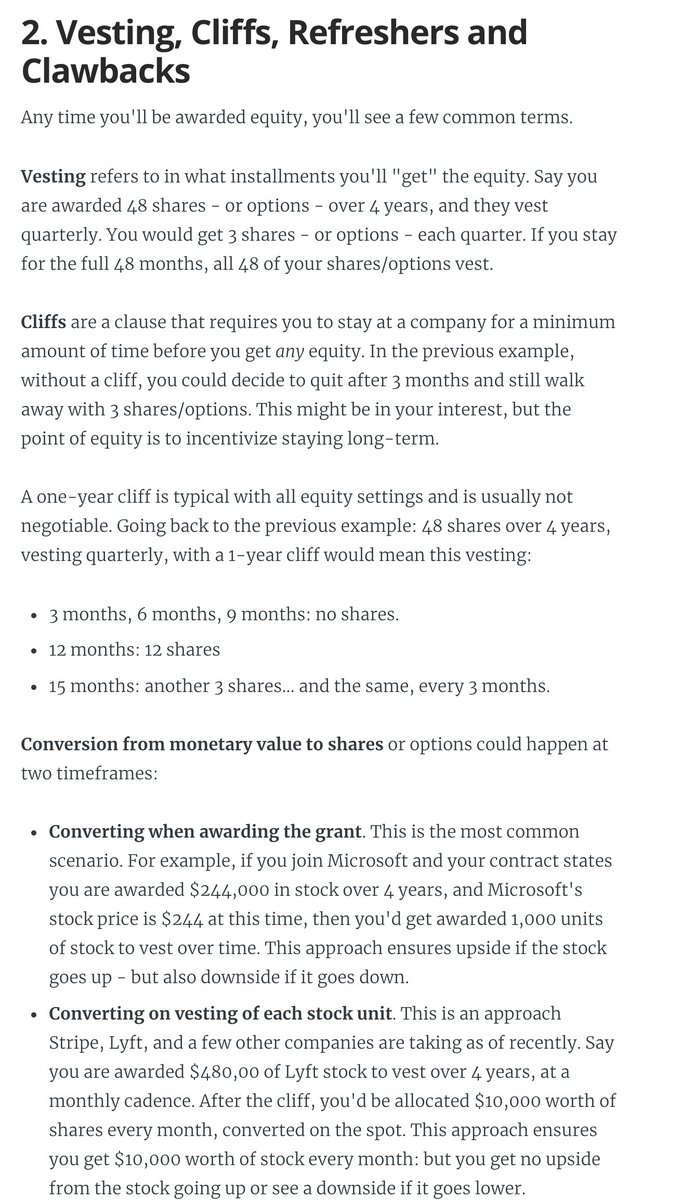

2. Vesting, cliffs, refreshers, and sign-on clawbacks.

If you get awarded equity, you'll want to understand vesting and cliffs. A 1-year cliff is pretty common in most places that award equity.

Read more in this blog post I wrote: https://t.co/WxQ9pQh2mY

3. Stock options / ESOPs.

The most common form of equity compensation at early-stage startups that are high-growth.

And there are *so* many pitfalls you'll want to be aware of. You need to do your research on this: I can't do justice in a tweet.

https://t.co/cudLn3ngqi

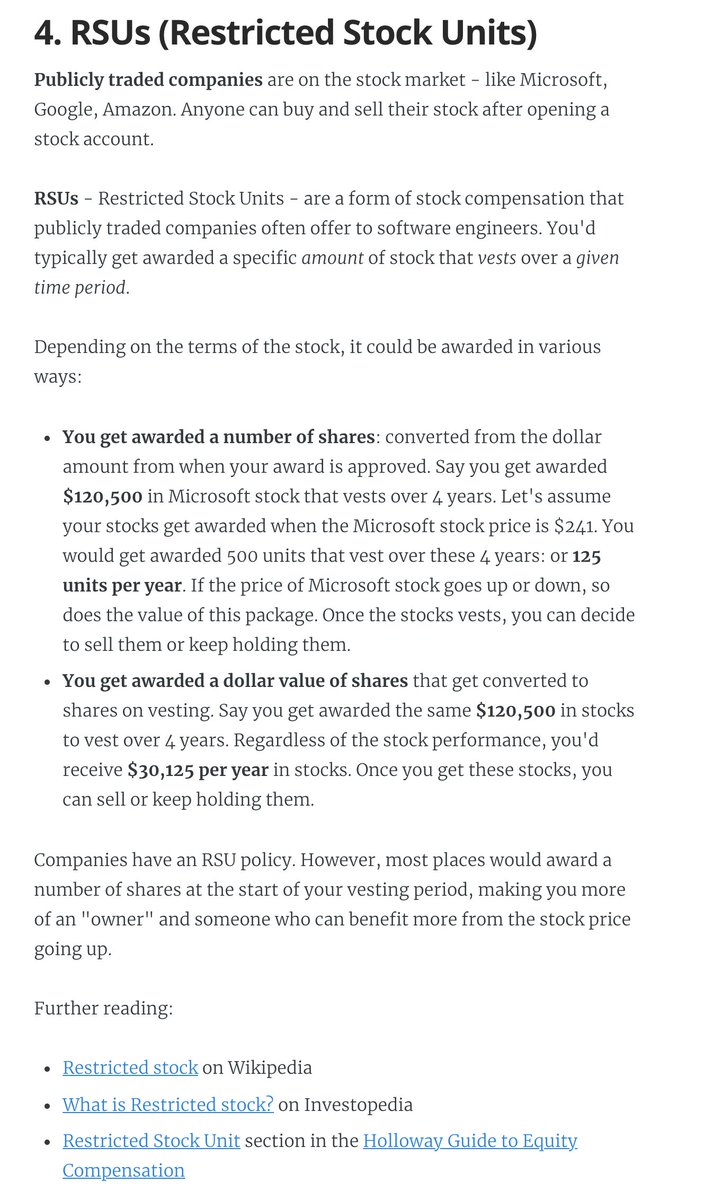

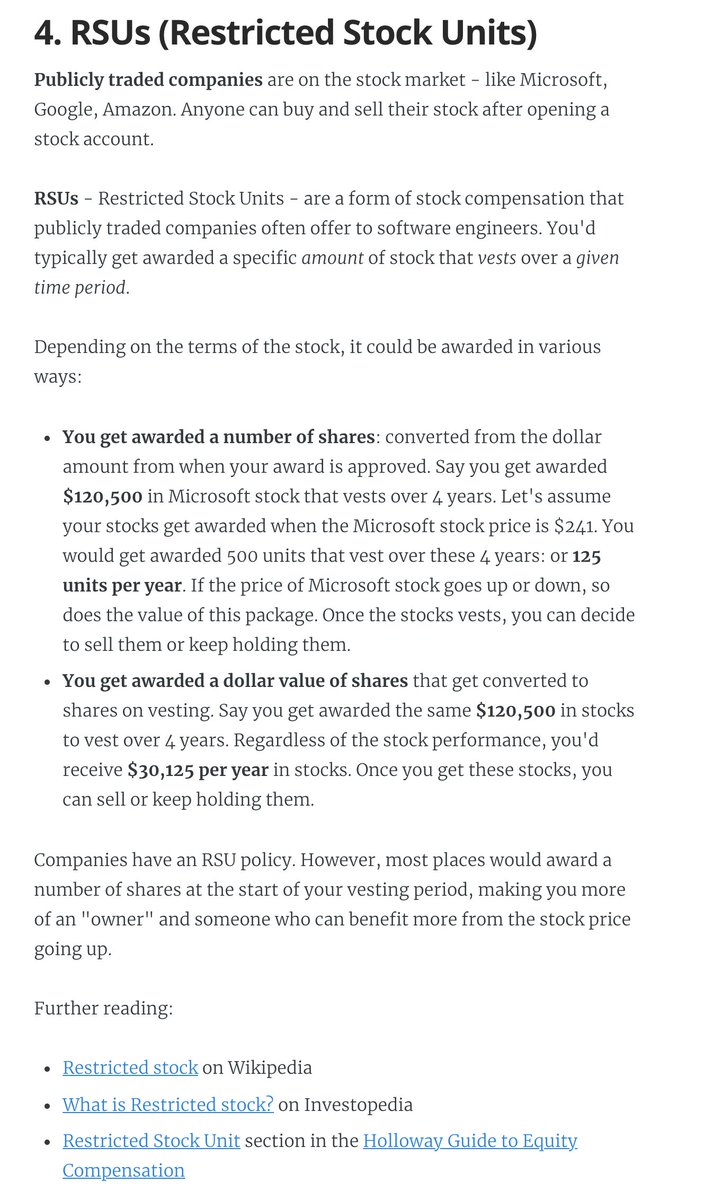

4. RSUs (Restricted Stock Units)

A common form of equity compensation for publicly traded companies and Big Tech. One of the easier types of equity to understand: https://t.co/a5xU1H9IHP

5. Double-trigger RSUs. Typically RSUs for pre-IPO companies. I got these at Uber.

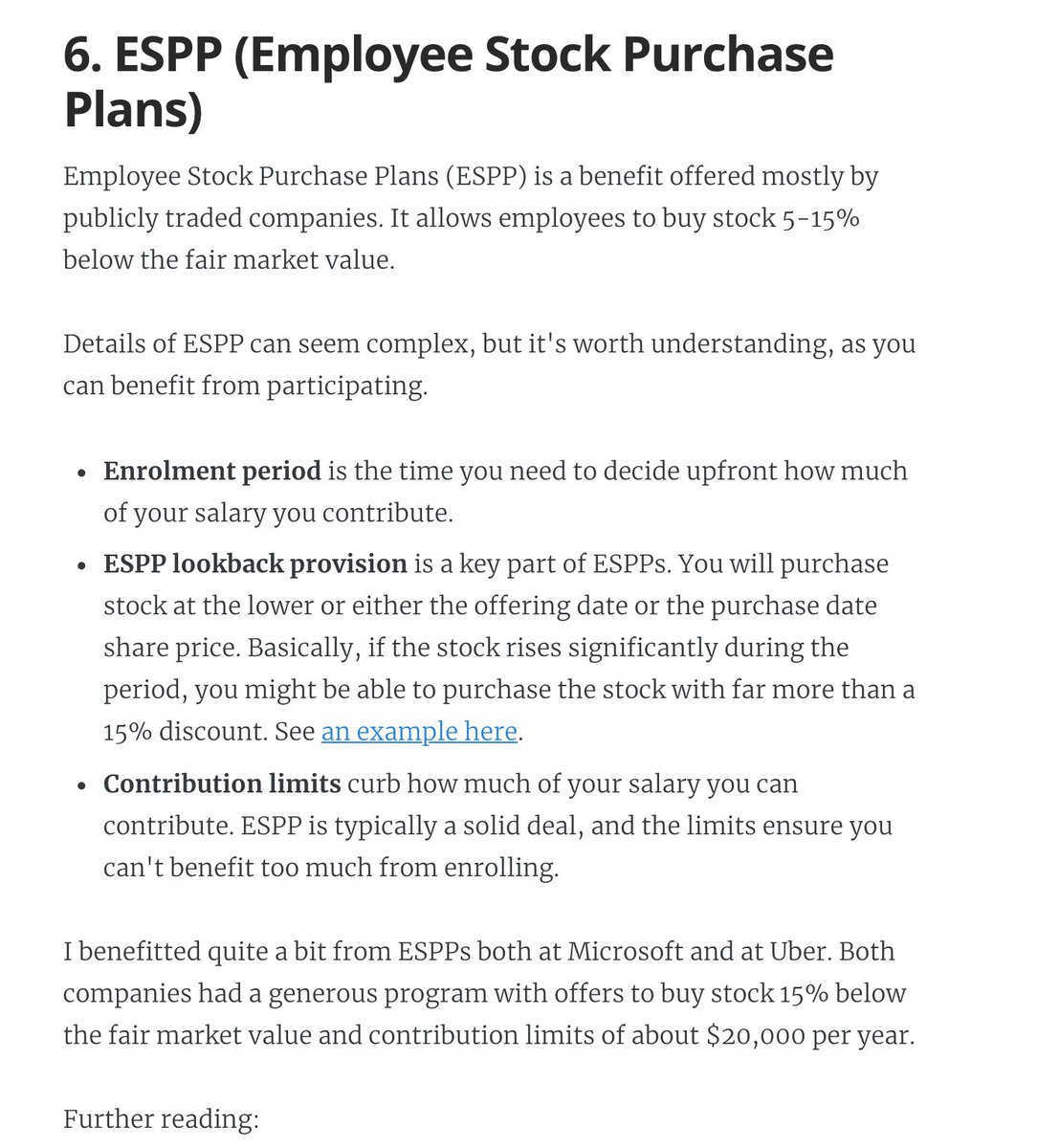

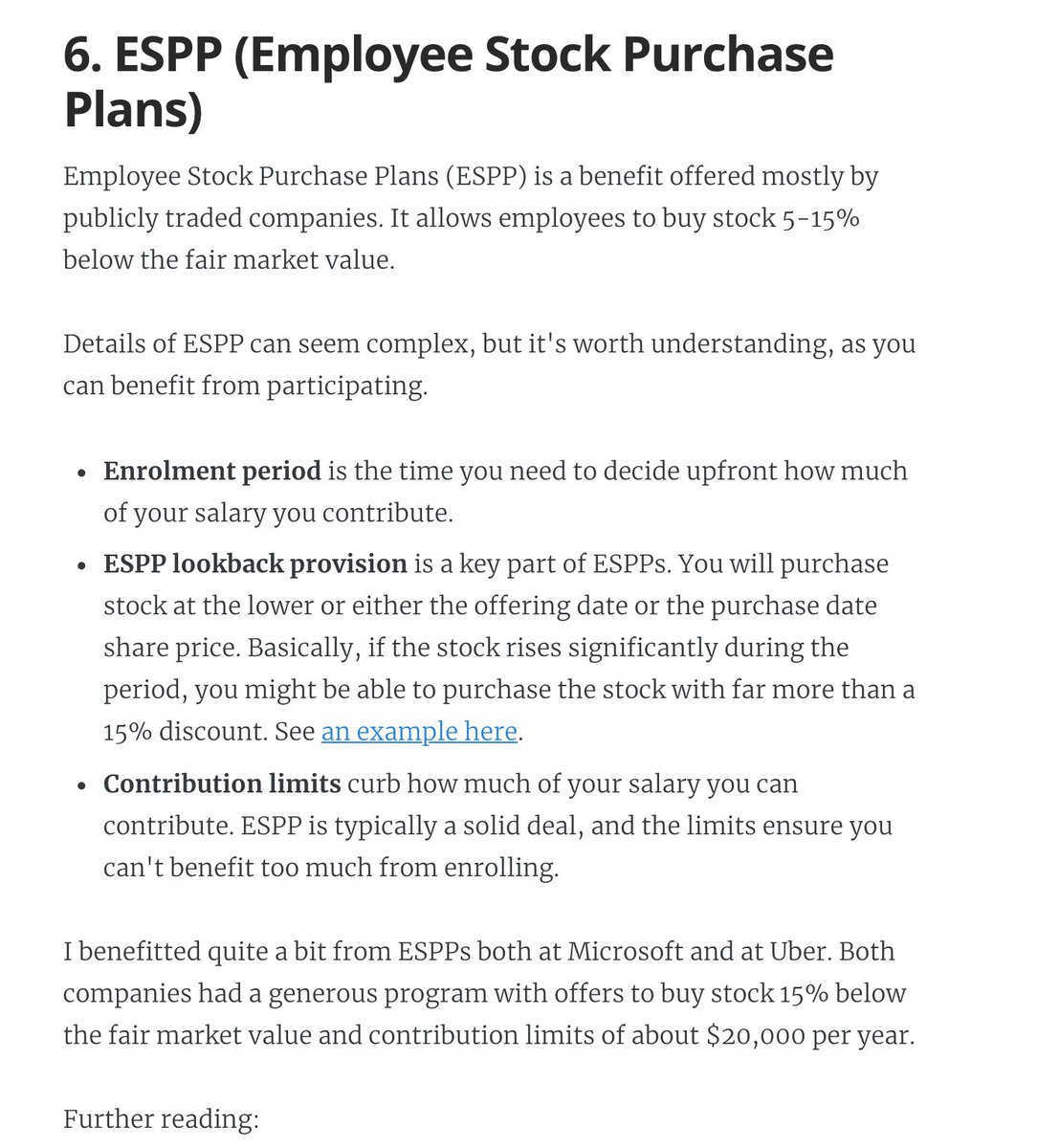

6. ESPP: a (typically) amazing employee perk at publicly traded companies. There's always risk, but this plan can typically offer good upsides.

7. Phantom shares. An interesting setup similar to RSUs... but you don't own stocks. Not frequent, but e.g. Adyen goes with this plan.

A thread.

1. Equity is something Big Tech and high-growth companies award to software engineers at all levels. The more senior you are, the bigger the ratio can be:

2. Vesting, cliffs, refreshers, and sign-on clawbacks.

If you get awarded equity, you'll want to understand vesting and cliffs. A 1-year cliff is pretty common in most places that award equity.

Read more in this blog post I wrote: https://t.co/WxQ9pQh2mY

3. Stock options / ESOPs.

The most common form of equity compensation at early-stage startups that are high-growth.

And there are *so* many pitfalls you'll want to be aware of. You need to do your research on this: I can't do justice in a tweet.

https://t.co/cudLn3ngqi

4. RSUs (Restricted Stock Units)

A common form of equity compensation for publicly traded companies and Big Tech. One of the easier types of equity to understand: https://t.co/a5xU1H9IHP

5. Double-trigger RSUs. Typically RSUs for pre-IPO companies. I got these at Uber.

6. ESPP: a (typically) amazing employee perk at publicly traded companies. There's always risk, but this plan can typically offer good upsides.

7. Phantom shares. An interesting setup similar to RSUs... but you don't own stocks. Not frequent, but e.g. Adyen goes with this plan.

You May Also Like

Tip from the Monkey

Pangolins, September 2019 and PLA are the key to this mystery

Stay Tuned!

1. Yang

2. A jacobin capuchin dangling a flagellin pangolin on a javelin while playing a mandolin and strangling a mannequin on a paladin's palanquin, said Saladin

More to come tomorrow!

3. Yigang Tong

https://t.co/CYtqYorhzH

Archived: https://t.co/ncz5ruwE2W

4. YT Interview

Some bats & pangolins carry viruses related with SARS-CoV-2, found in SE Asia and in Yunnan, & the pangolins carrying SARS-CoV-2 related viruses were smuggled from SE Asia, so there is a possibility that SARS-CoV-2 were coming from

Pangolins, September 2019 and PLA are the key to this mystery

Stay Tuned!

1. Yang

Meet Yang Ruifu, CCP's biological weapons expert https://t.co/JjB9TLEO95 via @Gnews202064

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) October 11, 2020

Interesting expose of China's top bioweapons expert who oversaw fake pangolin research

Paper 1: https://t.co/TrXESKLYmJ

Paper 2:https://t.co/9LSJTNCn3l

Pangolinhttps://t.co/2FUAzWyOcv pic.twitter.com/I2QMXgnkBJ

2. A jacobin capuchin dangling a flagellin pangolin on a javelin while playing a mandolin and strangling a mannequin on a paladin's palanquin, said Saladin

More to come tomorrow!

3. Yigang Tong

https://t.co/CYtqYorhzH

Archived: https://t.co/ncz5ruwE2W

4. YT Interview

Some bats & pangolins carry viruses related with SARS-CoV-2, found in SE Asia and in Yunnan, & the pangolins carrying SARS-CoV-2 related viruses were smuggled from SE Asia, so there is a possibility that SARS-CoV-2 were coming from