1) Unsecured Loans

2) Claim Expenses

3) Pvt Company

To drastically lower their taxes.

Have spoken to a lot of CA's and have got this information from them.

Follow these steps to pay lower taxes: ↓

My CA told me, if I form a company to trade then I have to register it as an NBFC. Is this true?

— Aditya Todmal (@AdityaTodmal) January 7, 2022

Whoever trades in company accounts can you dm me, please?

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

@MiteshFan @Mitesh_Engr @Abhishekkar_ MY TRADING SETUP .... I've been using it for a long time .. result good try it \U0001f607 pic.twitter.com/XThUD0ftbl

— itrade(DJ) (@ITRADE191) June 13, 2020

Volume Should always be above 20 pic.twitter.com/CPgxLgpPKF

— itrade(DJ) (@ITRADE191) June 13, 2020

— itrade(DJ) (@ITRADE191) August 25, 2020

— itrade(DJ) (@ITRADE191) October 20, 2020

Screeners helps trader in saving lot of time in filtering best stocks out of 5000+ stocks listed.

— Yash Mehta (@YMehta_) October 28, 2022

Here is the list of top 10 Free Candlestick Pattern based screeners that I use:

Also, last two screeners are my favorite to pick early momentum stocks.

Screeners helps trader in saving lot of time in filtering best stocks out of 1000+ stocks listed.

— Yash Mehta (@YMehta_) September 16, 2022

Here is the list of top 9 Free Price Action based screeners that I use:

Also, last screener is my favorite to pick early momentum stocks.

Screeners helps trader in saving lot of time in filtering best stocks out of 5000+ listed stocks.

— Yash Mehta (@YMehta_) December 9, 2022

Here is the list of top 7 Free Strategy and its respective screeners that I use:

Also, last screener is my favorite to pick early momentum stocks.

There are so many investment strategies, still hardly anyone creates long term wealth in stocks.

— Yash Mehta (@YMehta_) November 25, 2022

Sharing 4 Investment Strategies based on Technical Analysis and Screeners for free (sold as a \u20b9 50,000 course!).

Shared a bonus trading strategy at the end.

A thread \U0001f9f5:

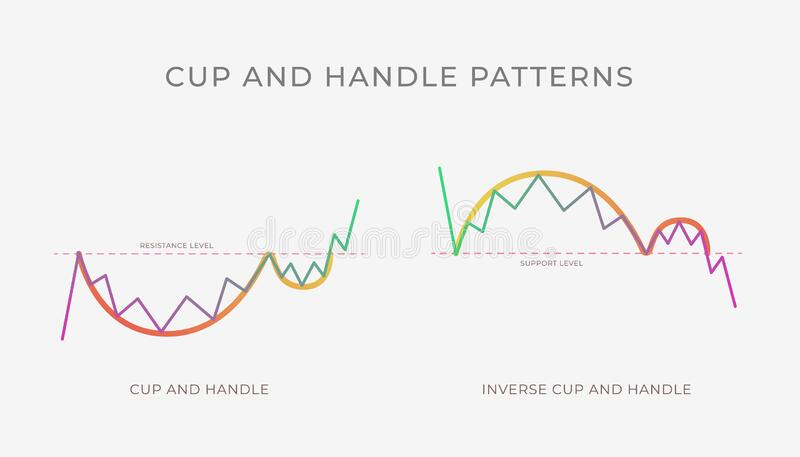

5: When to play directional:

— Nikita Poojary (@niki_poojary) December 18, 2022

Whenever the index is moving in a single direction, its important to go with the trend.

A few weeks ago when BNF broke out of the cup and handle pattern, all we had to do was sell PEs.

Pls note: weekly TF chart is attached to just show the C&H BO pic.twitter.com/z0wgUzJW8t

#VOLTAS Another cup & handle pattern for cash positional pic.twitter.com/Jsc99xJfwY

— Nikita Poojary (@niki_poojary) October 23, 2019