This is so useful. Thank you @heartwon 🙏

On this auspicious day of #GuruPoornima2020

— \u03b1\u043c\u03b9\u0442\u0442 \u0455\u03b1\u03b9\u03b7\u03b9 \U0001f1ee\U0001f1f3 (@heartwon) July 5, 2020

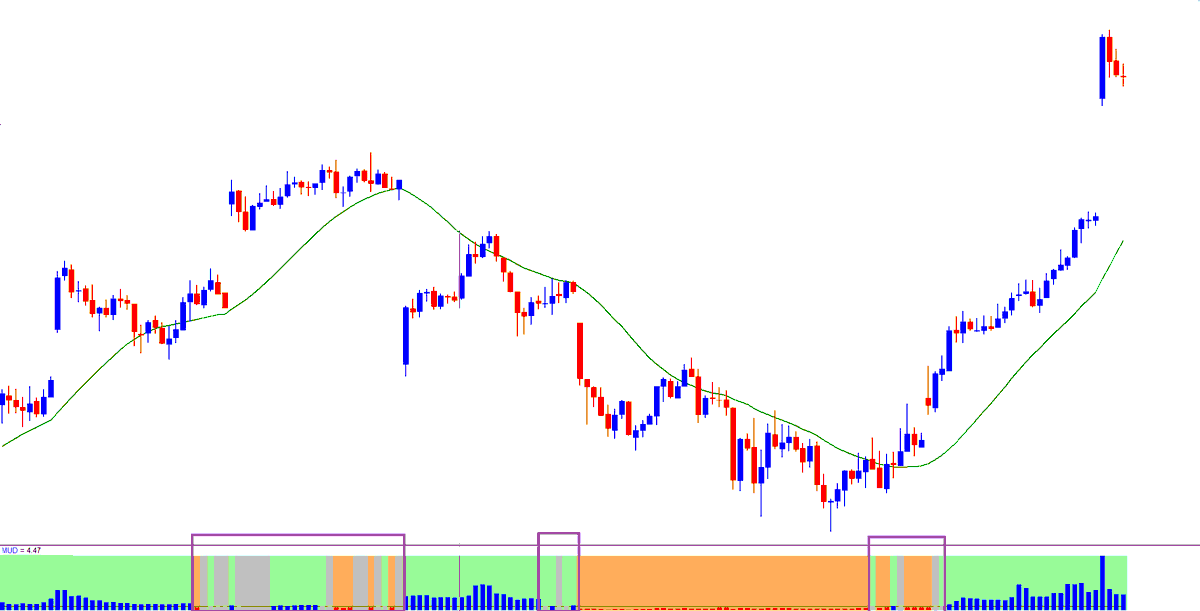

Would like to present a simple yet effective way of understanding and following the TREND of the instrument/stock.

Q: Why I came up with the concept?

A: I wanted to remove noise, keep my chart simple where just a glance, tells the story

More from Anchit Goel

More from Stockslearnings

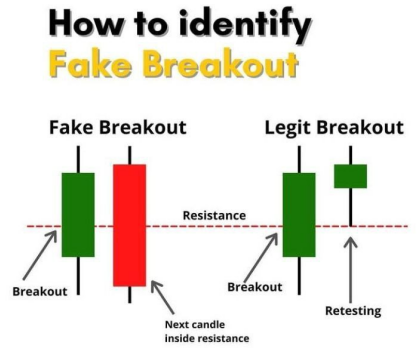

🌟Lesson 1 - weekly /monthly breakout push stock price 30/50% higher in 2/3 weeks.

Ex- #sastasundar after breakout 145/155 zone , stocks in 2/3 weeks given 30/40% return.

And in 2/3 months it was double 💞 https://t.co/9kkc3IV4Lo

🌟Lesson 2 - if stock is making same pattern ( in 2 /3hours chart) after given breakout of (weekly /monthly chart) , then chances of stock going up is much more.

Ex - #HGS after given breakout of Trendline ( range) in monthly chart, again making same pattern 4 hours chart. 💞

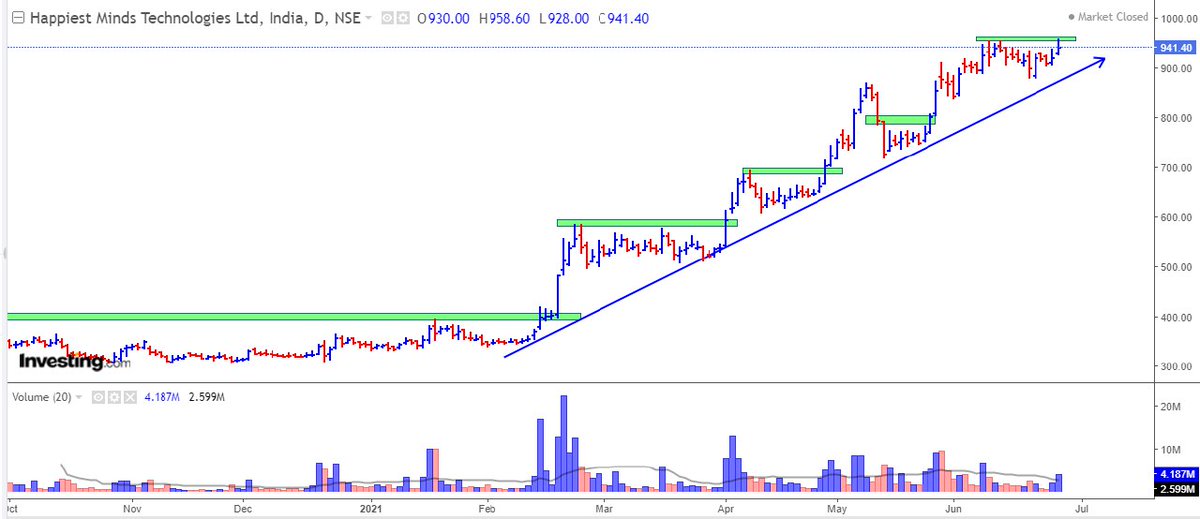

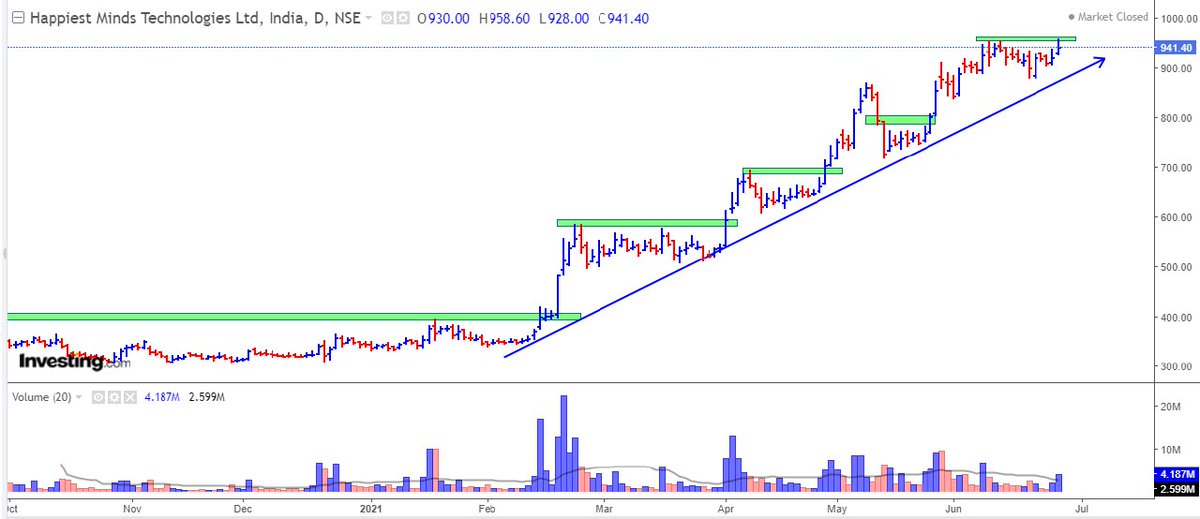

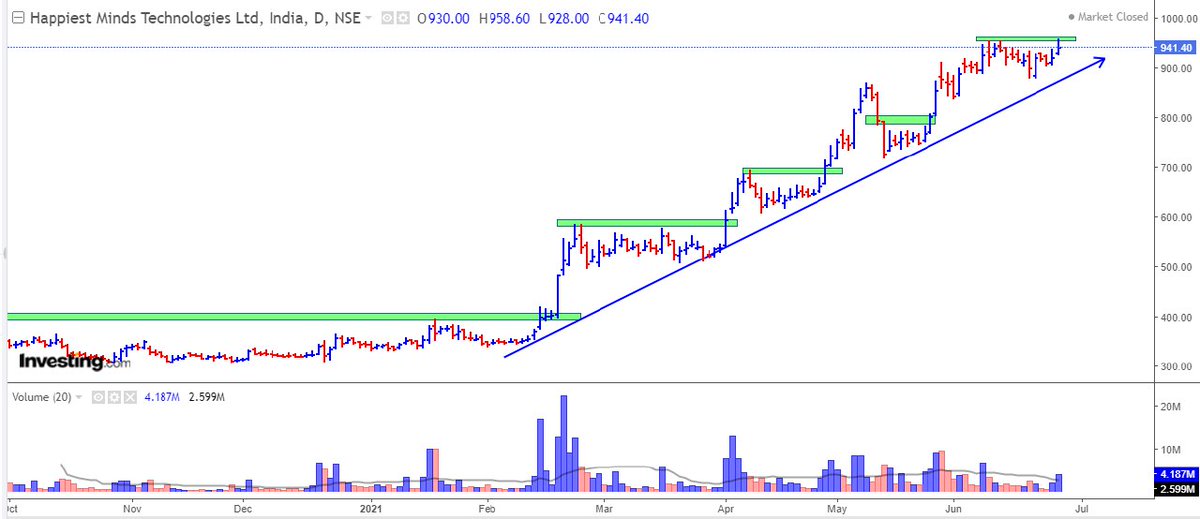

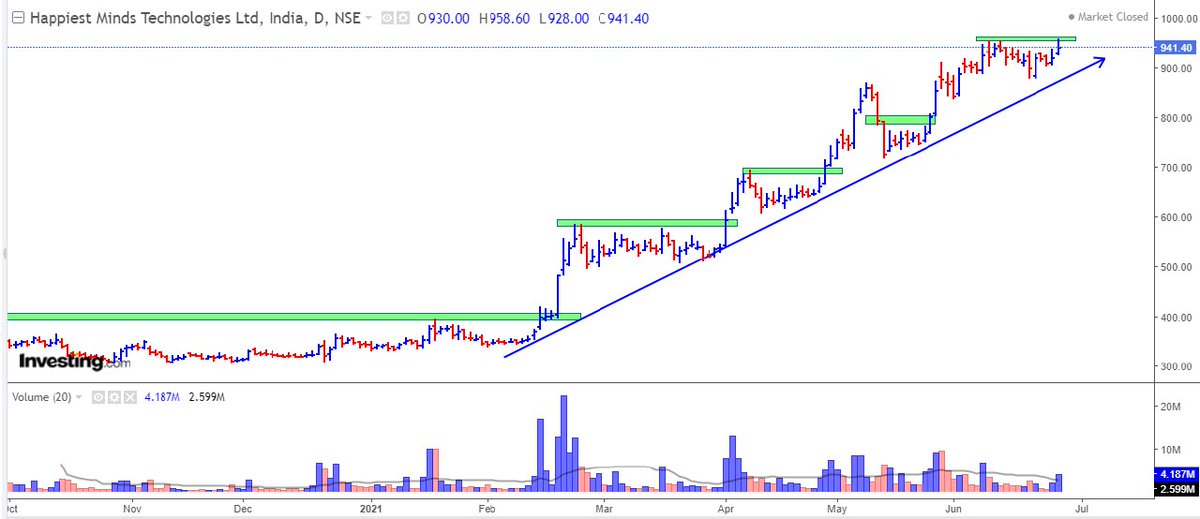

🌟Lesson 3- if stock never come to retest it's weekly & monthly breakout zone then the chances of it's 2x is much more.

EX - #happiestmind everytime consolidating & making new high. 💞

@chartmojo

@charts_breakout

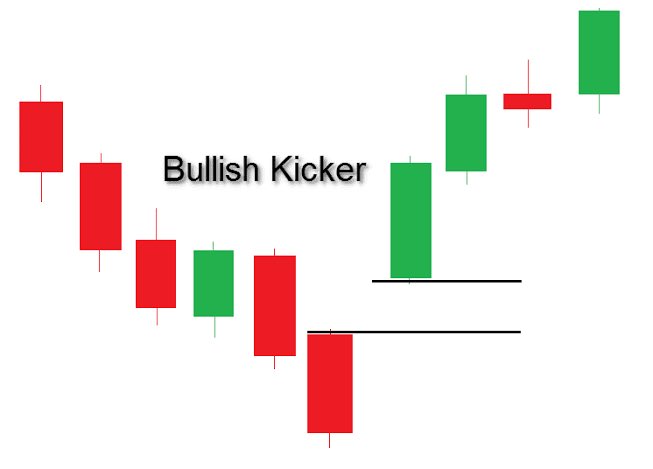

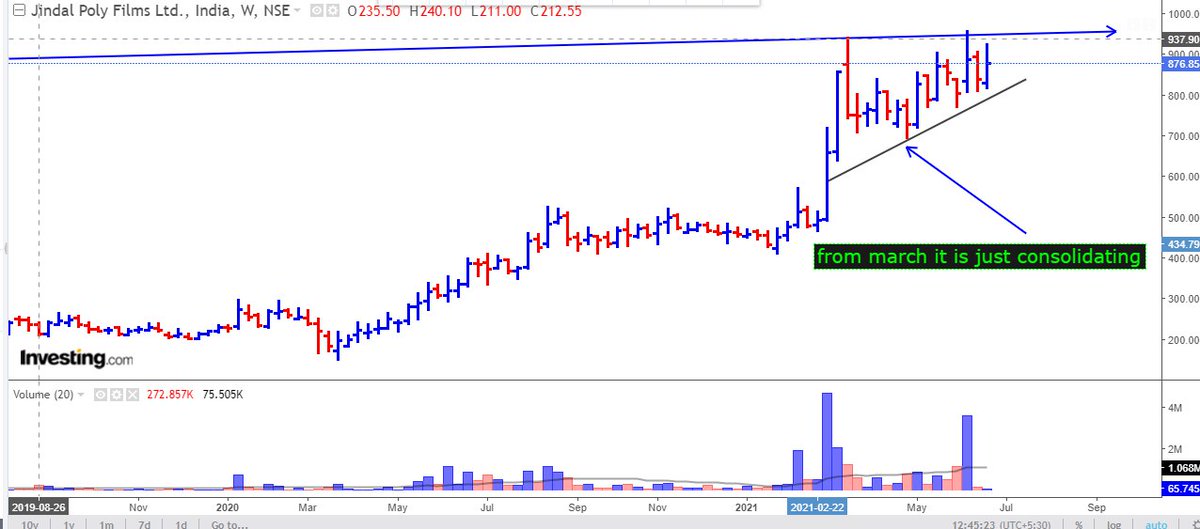

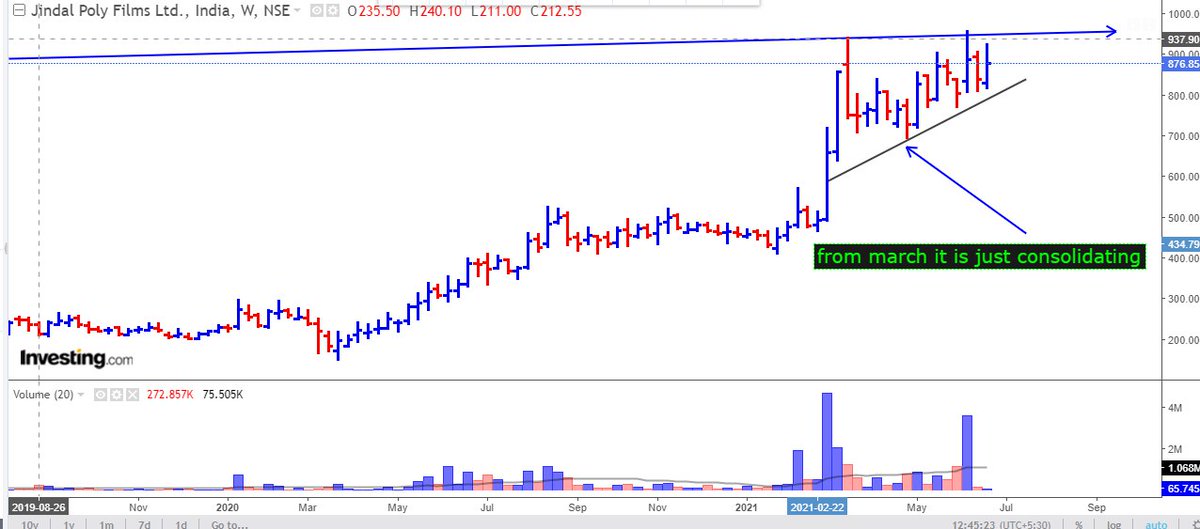

🌟Lesson 4 - when whole market fall still strongest stocks only consolidate or move down very little.

Ex - when this march market took correction 800/1000 points #jindalpoly just consolidating from that time.

Now ready for new high . 💞

🌟Lesson 5 - when market recover the strongest stocks recover very fast & will make new high.

Ex - #happiestmind when market take little correction & again bounce little , then #happiestmind made new high before market .

Ex- #sastasundar after breakout 145/155 zone , stocks in 2/3 weeks given 30/40% return.

And in 2/3 months it was double 💞 https://t.co/9kkc3IV4Lo

I am going to make #priceaction breakout thread with real examples

— V\xb6k\u03c0nT (@Trading0secrets) June 24, 2021

By which u can easily find out blasting stocks.

it is only based on my experience of last 5 years

How many learners are excited \U0001f973

Show your love \u2764 by likes & retweets so that most new one can take advantage.

🌟Lesson 2 - if stock is making same pattern ( in 2 /3hours chart) after given breakout of (weekly /monthly chart) , then chances of stock going up is much more.

Ex - #HGS after given breakout of Trendline ( range) in monthly chart, again making same pattern 4 hours chart. 💞

🌟Lesson 3- if stock never come to retest it's weekly & monthly breakout zone then the chances of it's 2x is much more.

EX - #happiestmind everytime consolidating & making new high. 💞

@chartmojo

@charts_breakout

🌟Lesson 4 - when whole market fall still strongest stocks only consolidate or move down very little.

Ex - when this march market took correction 800/1000 points #jindalpoly just consolidating from that time.

Now ready for new high . 💞

🌟Lesson 5 - when market recover the strongest stocks recover very fast & will make new high.

Ex - #happiestmind when market take little correction & again bounce little , then #happiestmind made new high before market .

You May Also Like

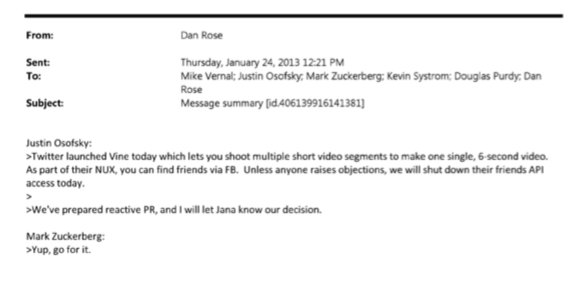

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

Some random interesting tidbits:

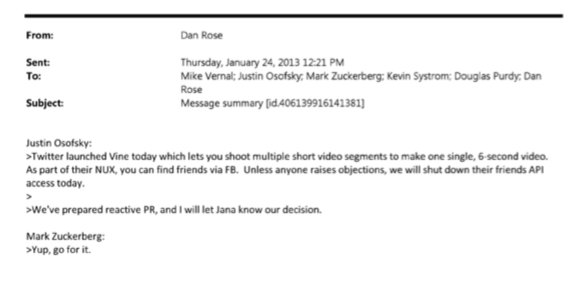

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

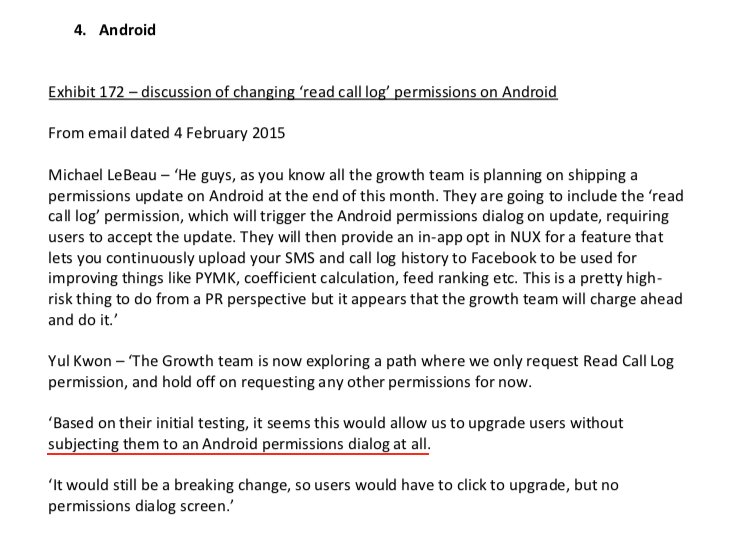

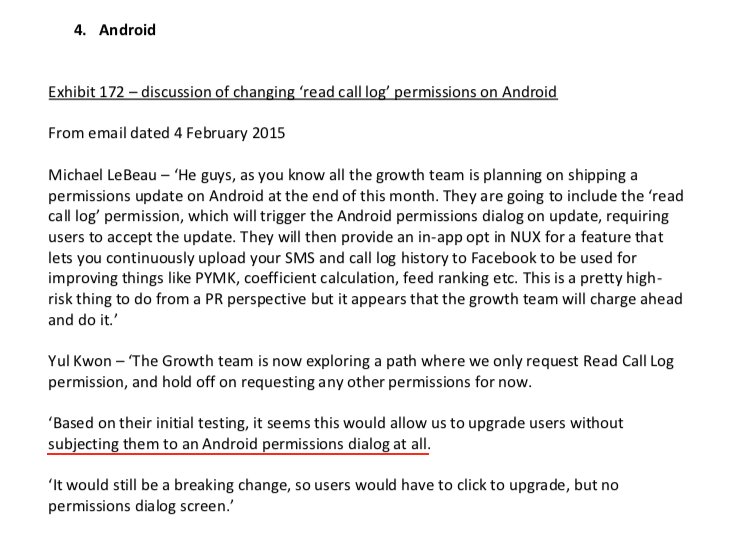

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

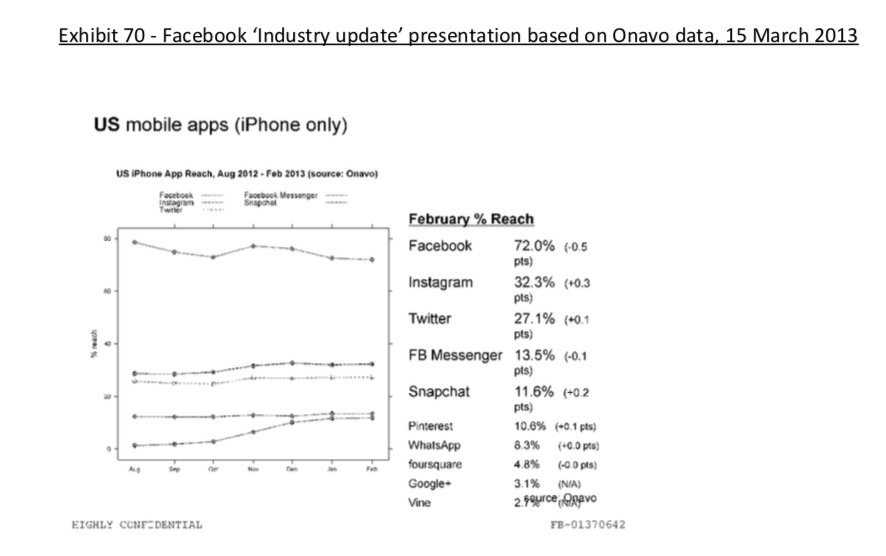

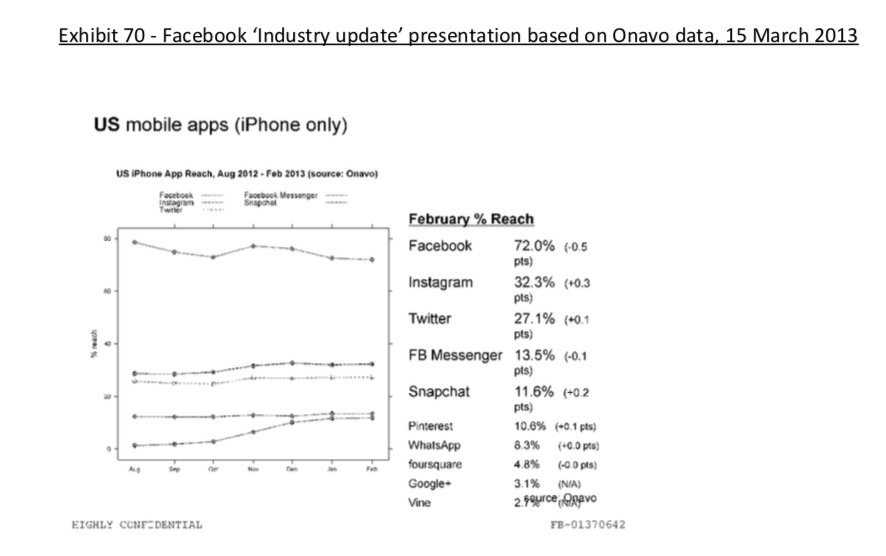

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x