In last 10 years there have been 3 upswings in the stock.. if you could use your capital efficiently you would ride most of these upswings and use your capital elsewhere at other times.

Not letting your capital rot is a gainful activity. https://t.co/iYo2SIEPVX

whats cooking in HGS ??

— Alok Jain \u26a1 (@WeekendInvestng) April 1, 2021

Are Hindujas offloading to put more into Indus ?? What's the buzz... the move seems as a precursor to a big news

just a guess..not a reco

More from Alok Jain ⚡

More from Stocklearnings

Found awesome content: ⏬

1. Moneycontrol

2. Bank nifty Strangles/Straddles

3. Learnings

4. Expiry Trading

5. Directional trading

6. Long Term Investing

7. Pivot system

8. DHS pattern

9. Multiple trade management threads/ways.

Moneycontrol article on @sourabhsiso19

@moneycontrolcom did a detailed story on my trading journey.

— Sourabh Sisodiya, CFA (@sourabhsiso19) May 26, 2020

But many couldn\u2019t read it as it needed a pro-subscription.

So here\u2019s a blog on the same :https://t.co/dwN2xieUKd#trading #journey #quant #options #algotrading #markets #OptionsTrading

What Sourabh does and how to trade like him?

Getting many DM\u2019s on how I can learn and trade like you.

— Sourabh Sisodiya, CFA (@sourabhsiso19) January 10, 2020

To be a succesful trader one needs an edge

My edge:

1)focus on selected instruments (Banknifty majorly and few stocks)

2) backtested my strategies historically (for past 10years)

(1)

Why trade multiple systems? ⏬

1. Keeps drawdown at minimum.

2. Strong money management can be applied.

3. Better psychology.

Do I trade only BNF ?

— Sourabh Sisodiya, CFA (@sourabhsiso19) March 4, 2020

Other than BNF intraday , I run few other systems too.

1) Intraday Momentum

2) Positional systems

3) Vol Crush Trade etc

Goal of system trading is to run few non-correlated strategies together so that system drawdown is at the minimum.#trading #systems pic.twitter.com/mS8jFEaLUW

Thread on how options allow you to change your positions in a dynamic manner.

Options Thread

— Sourabh Sisodiya, CFA (@sourabhsiso19) December 7, 2019

How options allows to change and adjust view dynamically.

Let\u2019s understand with a live example.

Example : Nifty is at 11921 and you are bullish on Nifty.

1) Buy Naked 11900 CE(call) at 167

Breakeven : 12068

Max Loss : Rs 12555

Max Profit : Unlimited pic.twitter.com/TXMhh5HWsd

I've covered 6 stocks today and working on 3-4 more Stocks. Though, I've checked each aspect but 👇

** You still need to keep a track of fundamentals every quarter**

#Stock No 1

#BlackRose Ind ( Chemical)

MCAP 829 Cr

Fundamentals 👌🏻

Technical 💪🏻

Already covered Business and Financial previously and can check again below. Stocks hasn't run up in recent

One more addition to the #Multibagger list:#BlackRose Ind: A consistent Performer in Chemical Industry.

— TheMillionaire \U0001f1ee\U0001f1f3 (@BornToBeSucceed) July 8, 2020

Thread 1/1

Primarily in the business of chemical distribution and chemical manufacturing, as well as textile manufacturing and renewable energy generation.

#Stock No 2

#IEX (Platform Business)

MCAP 10,162 Cr

Fundamentals 👌🏻

Technical 💪🏻

This is also covered preciously and can check detailed thread on below

A thread on #IEX and why you should invest..

— TheMillionaire \U0001f1ee\U0001f1f3 (@BornToBeSucceed) March 7, 2021

Business: IEX allows participants to purchase electricity for the same day through intra-day contracts, for the next day through day-ahead contingency, on daily basis for rolling seven days through daily contracts and Weekly

#Stock No 3

#Gland ( Pharmaceutical)

MCAP 39,447 Cr

Stock PE 51.9

ROCE. 30.2%

ROE 23.4%

**Major revenue comes from B2B

**Quality products

**Aim to file 20-25 ANDA each year

** Positive Management & great future outlook

#Stock No 4

#happiestminds ( IT)

MCP 7,675 Cr

Stock PE 53.7

ROCE 42.8%

ROE 83%

**Strong & experienced Management & Promotors

**OPM % has increased from 4% to 27% from Dec'19 to Dec'20.

**Significant improvement in Net cash flow

**Positive Commentry on Future outlook

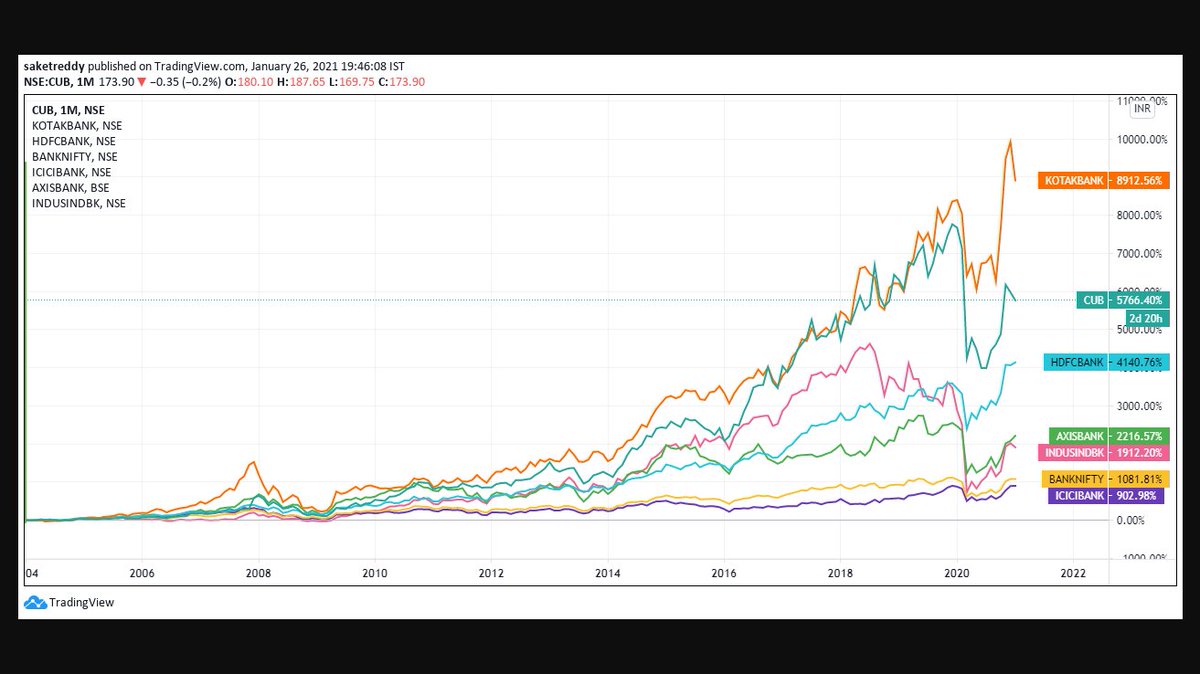

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.

You May Also Like

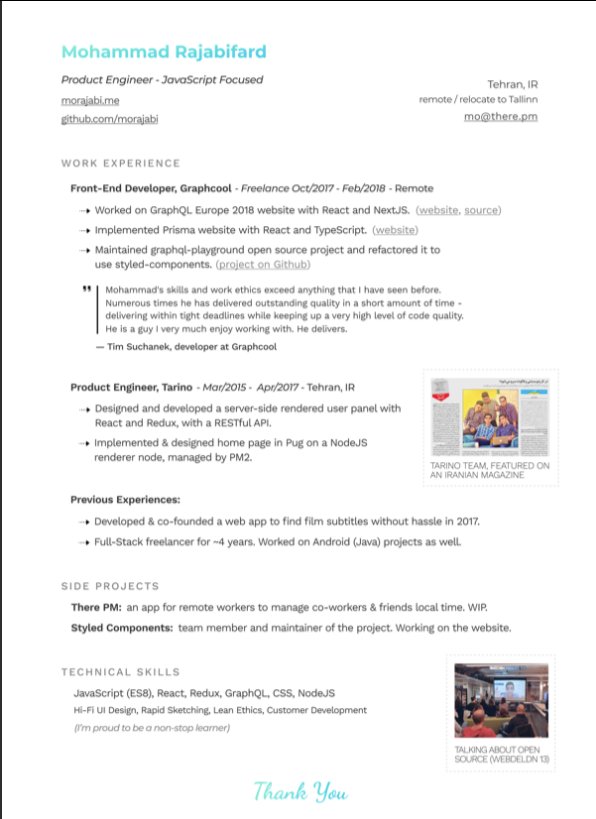

- Forget what you don't have, make your strength bold

- Pick one work experience and explain what you did in detail w/ bullet points

- Write it towards the role you apply

- Give social proof

/thread

"But I got no work experience..."

Make a open source lib, make a small side project for yourself, do freelance work, ask friends to work with them, no friends? Find friends on Github, and Twitter.

Bonus points:

- Show you care about the company: I used the company's brand font and gradient for in the resume for my name and "Thank You" note.

- Don't list 15 things and libraries you worked with, pick the most related ones to the role you're applying.

-🙅♂️"copy cover letter"

"I got no firends, no work"

One practical way is to reach out to conferences and offer to make their website for free. But make sure to do it good. You'll get:

- a project for portfolio

- new friends

- work experience

- learnt new stuff

- new thing for Twitter bio

If you don't even have the skills yet, why not try your chance for @LambdaSchool? No? @freeCodeCamp. Still not? Pick something from here and learn https://t.co/7NPS1zbLTi

You'll feel very overwhelmed, no escape, just acknowledge it and keep pushing.

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.