#Belthold : Remember the Sumo wrestler 😅, someone did mention about it recently.

An inverse occurrence is about to witness failure, awaiting for its impact .

#CandleTrading tag would help you understand more of some of these ancient yet effective techniques...

#CandleTrading : #Bullish #Belthold#Pattern #Psychology :Pattern importance could be traced back to the traditional #Japanese sport of \u2018Sumo #wrestling'. The importance of \u2018Mawashi ( Wrestlers Belt) \u2019 & its tactical move for gripping the opponent to throwing him off the ring. pic.twitter.com/lN60xad6Ma

— Sacchitanand Uttekar (@Sacchitananad) August 16, 2020

More from Sacchitanand Uttekar

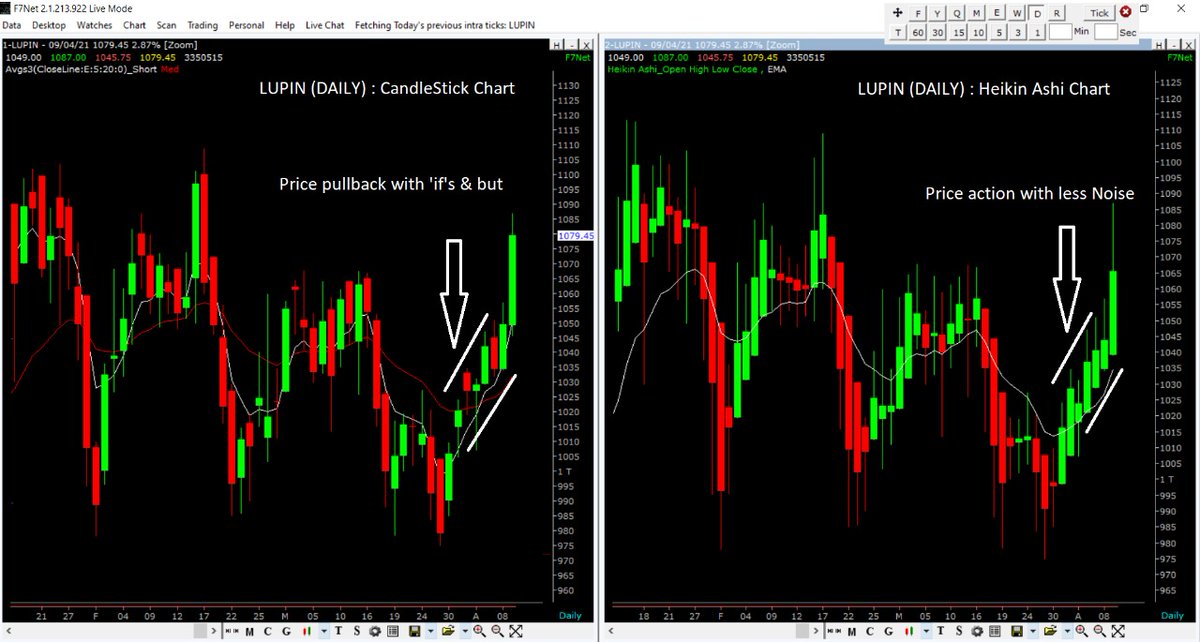

✅ #Candlesticks to spot reversal

+

☑️ #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it 🤗 https://t.co/VSv8lhkAAq

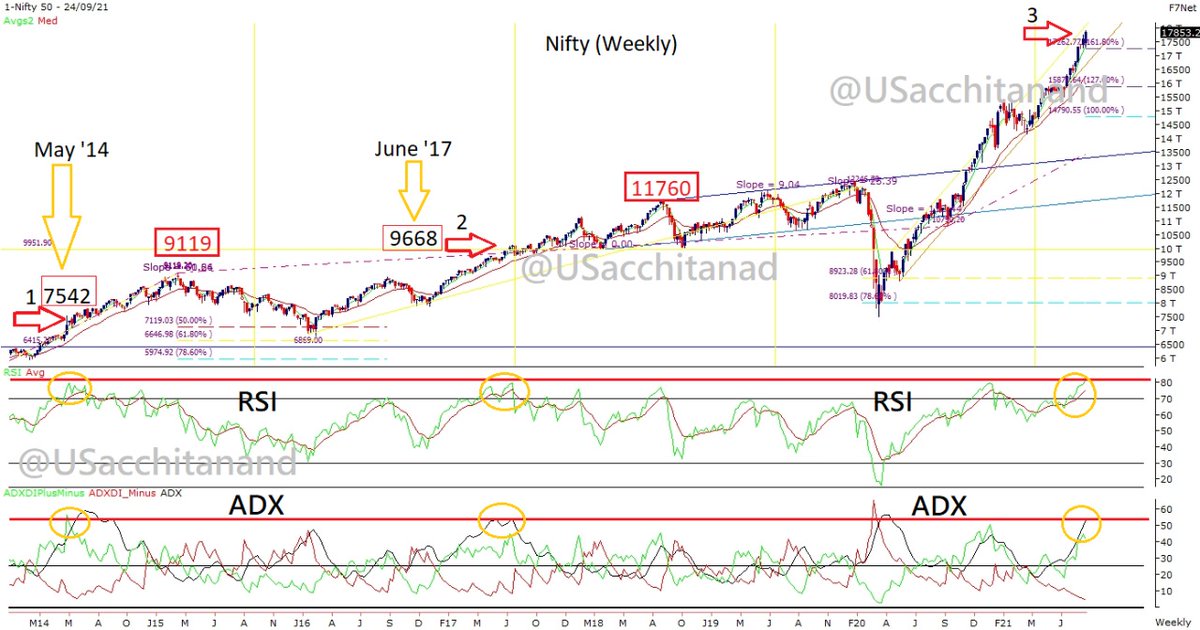

#CandleTrading Mega move

— Sacchitanand Uttekar (@USacchitanand) April 10, 2021

\u2705 #Candlesticks to spot reversal

+

\u2611\ufe0f #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it \U0001f917

#Adaniports #ESCORTS #IOC were some of its recent spots

Latest occurrence getting confirmed #BHEL #BOSCH #CANBK #MGL & #BANKNIFTY ☺️

Watch out for these 🎁

#CandleTrading : #Bullish

— Sacchitanand Uttekar (@USacchitanand) August 24, 2021

'Lord #NarsimhaPattern' in #M&MFinancial \U0001f64f\U0001f64f .Check properties \U0001f60a#Pattern #Psychology :

First long bar depicts the long pillar from which the lord emerges & kills the negativity pic.twitter.com/gF0mu4qHLR https://t.co/Fb2WUq1fJZ