This strategy involves finding stocks that are trading near their high in the past 4 months with rising volumes and closing strong, indicating a possible breakout.

• 15-minute stock breakouts —(Intraday)

https://t.co/8Jo6yZUaGH

Options trading is luring a lot of inexperienced traders who are looking for supernormal gains.

— Nikita Poojary (@niki_poojary) August 20, 2022

However, most of them end up losing money as they aren't familiar with the basics yet.

8 basics you must know before placing your next trade \U0001f9f5:

Collaborated with @AdityaTodmal

Twitter is like a free university.

— Aditya Todmal (@AdityaTodmal) July 1, 2022

However, 98.8 percent of users missed out on the best content on this platform.

Here are the top 26 threads from the past 26 weeks of 2022: \U0001f9f5

Collaborated with @niki_poojary

I started at 0 and grew to 109,000 followers

— Aditya Todmal (@AdityaTodmal) July 3, 2022

Here's how we use Twitter and why:

Collaborated with @niki_poojary

THREAD \U0001f9f5 \u2193

Subasish Pani revealed the most simple, yet successful strategy: 5EMA set up!

— Nikita Poojary (@niki_poojary) July 3, 2022

Here is a thread of 23 video clips on the 5EMA set-up that will save you hundreds of hours and available to you for no cost!

5EMA set-up: \U0001f9f5!

Collaborated with @AdityaTodmal

There are so many tools related to trading.

— Aditya Todmal (@AdityaTodmal) July 9, 2022

But very few provide any real value.

Here are 7 of the most valuable FREE Tools you're not using (but should be): \U0001f9f5

Collaborated with @niki_poojary

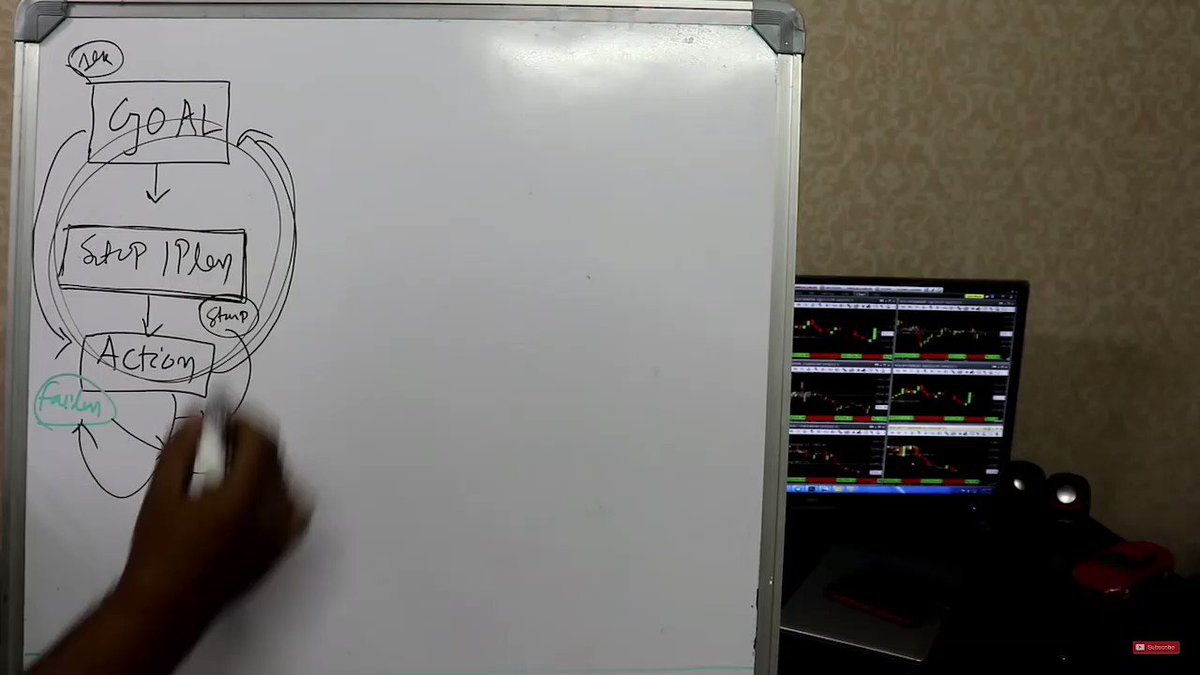

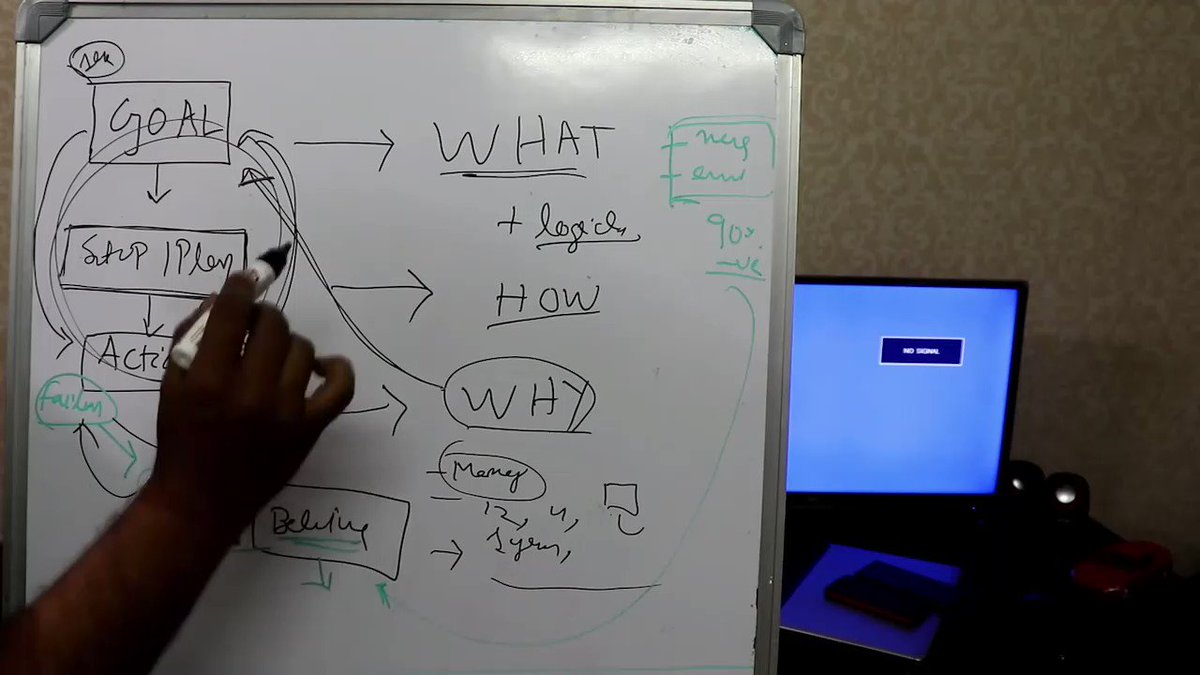

In this thread, I'll walk you through my set up, absorb it as much as you can.

— itrade(DJ) (@ITRADE191) June 27, 2021

The instrument that I trade in are Nifty (NF) options

Thanks to @AdityaTodmal @niki_poojary for contributing in making this pic.twitter.com/BrMrGydb1v

"we don't negotiate salaries" really means "we'd prefer to negotiate massive signing bonuses and equity grants, but we'll negotiate salary if you REALLY insist" https://t.co/80k7nWAMoK

— Aditya Mukerjee, the Otterrific \U0001f3f3\ufe0f\u200d\U0001f308 (@chimeracoder) December 4, 2018

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483