B) Resistance breakout on weekly,

C) Green Strength candle on weekly.

2/n

Dear Friends,

— SSStockAlerts (@ssstockalerts) May 19, 2021

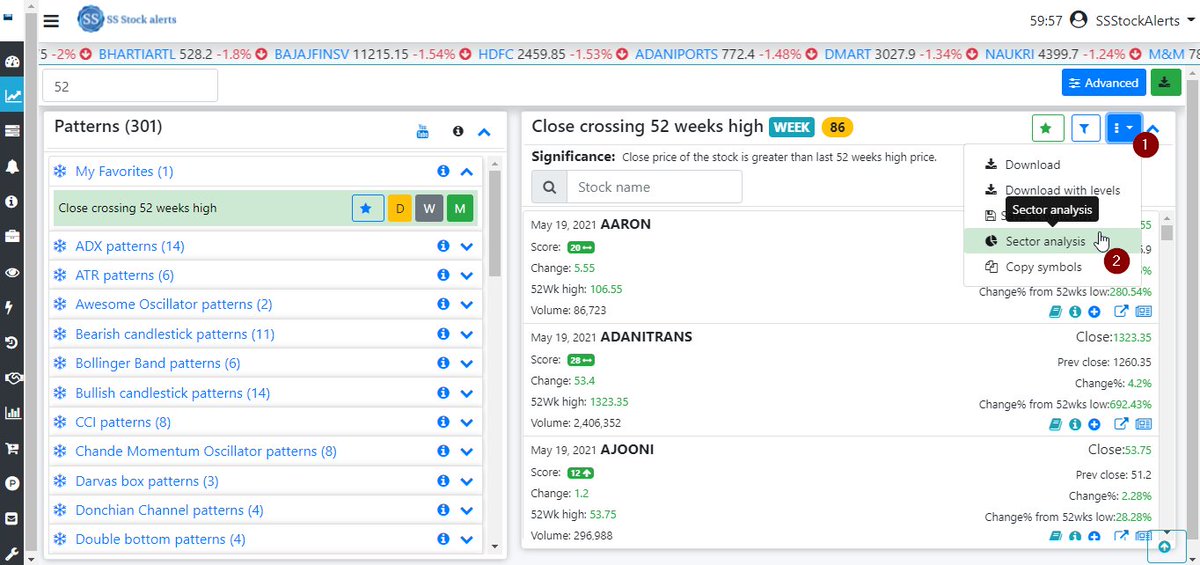

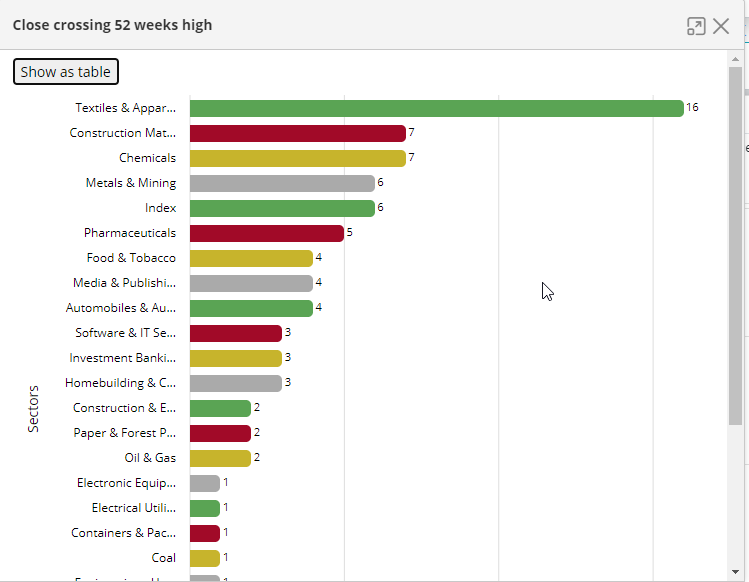

A Sector analysis for scans feature will be added to site.

Eg:- See analysis for 52weeks high breakout, from text tile sector has more breakouts, so concentrate on Textile sector pic.twitter.com/U0cIoEeKDy

#Areaofvalue analysis#CDSL

— SSStockAlerts (@ssstockalerts) May 6, 2021

Buy near 21 SMA support. This stock respects 21 SMA for 84% time. Backtested for last 1 year.

Candle size is getting smaller and volume also less then avg volume.

Any time it can reverse from here.

Help/Supporthttps://t.co/rRCfjf3KIi pic.twitter.com/KGyyAAQ1tV

#Areaofvalue analysis#CDSL

— SSStockAlerts (@ssstockalerts) May 6, 2021

Buy near 21 SMA support. This stock respects 21 SMA for 84% time. Backtested for last 1 year.

Candle size is getting smaller and volume also less then avg volume.

Any time it can reverse from here.

Help/Supporthttps://t.co/rRCfjf3KIi pic.twitter.com/KGyyAAQ1tV