Everything housing is moving now, previously it was mainly the ancillary plays like Pipes, Ceramics, Adhesives and Cement. Now we have the home builders, CGD's, HFC's, MDF, Laminates, Sinks, etc..

The Home Building Theme has just broadened itself and is moving in top gear!

The best ways to play the real estate revival theme instead of buying the home builders :-

— Saket Reddy (@saketreddy) November 21, 2020

1. Ceramics (CERA, KAJARIA)

2. Pipes (ASTRAL, SUPREME, APLAPOLLO)

3. Paints (ASIAN, BERGER)

4. Cement (JKCEM, SHREEC)

5. Construction Chemicals (PIDILITE)

6. Electricals (POLYCAB, HAVELLS)

More from Saket Reddy

Haters are still hating it, time to pyramid once again!

Double Top Buy, T20 Pattern - Bullish & Super Pattern - Bullish above 625.07 daily close on 1% Box Size chart. https://t.co/EDqa7dAAKn

LAURUSLABS

— Saket Reddy (@saketreddy) May 3, 2021

Haters are gonna hate, but IMO, this is the best opportunity to start pyramiding and make it a well sized holding.

A trio of patterns coming together, has one of the highest success rate!

Double Top Buy, T20 Pattern - Bullish & Super pattern - Bullish above 477.81! https://t.co/SqzkTyb9wx pic.twitter.com/hTj7mfAOqy

Plotting sales CAGR for few gems in #chemicals, #pharma and #FMCG

— jeevan patwa (@jeevanpatwa) July 14, 2021

Majority has 20Y CAGR > 10Y > 5Y => growth is decelerating as base becomes big...

only outlier being #Deepaknitrate where

20Y CAGR < 10Y < 5Y => accelerating growth... pic.twitter.com/ewpFeKmxQo

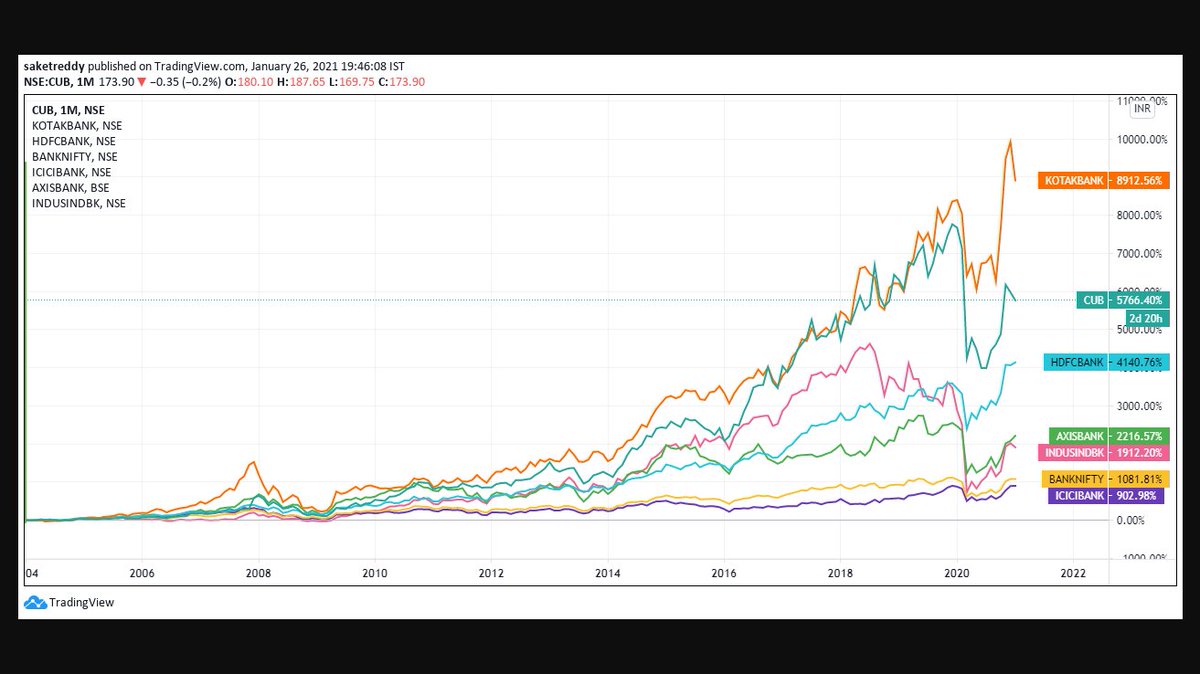

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.

You May Also Like

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.