For Black History Month, Vox is publishing a big series on rethinking policy for Black America.

I wrote 3,200 words on eradicating exclusionary zoning.

It's a 3 step formula: Persuade, incentivize, and if all else fails, SUE THE SUBURBS.

Thread

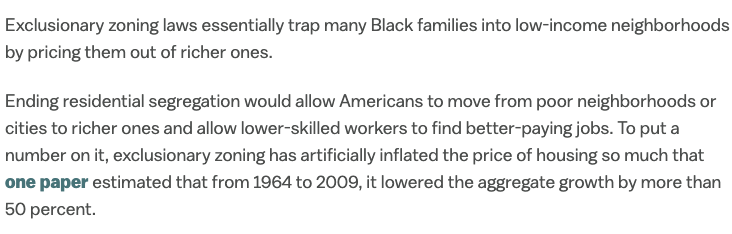

We know that exclusionary zoning is locking millions out of opportunity.

Work by @OppInsights, Richard Rothstein, Ta-Nehisi Coates, @nhannahjones, @RickKahlenberg, Chang-Tai Hsieh, Enrico Moretti and @ProfSchleich details the economic impact of these discriminatory policies.

51 years after the Fair Housing Act, it's never been seriously enforced. It's time to change that.

First things first, Biden has work to do to convince whoever can be convinced that there is a racial, environmental, and economic imperative to undo residential segregation.

Use whatever explanation works!

For sympathetic progressives Biden should link racial and environmental justice to ending exclusionary zoning.

For everyone else, he can simply make an economic

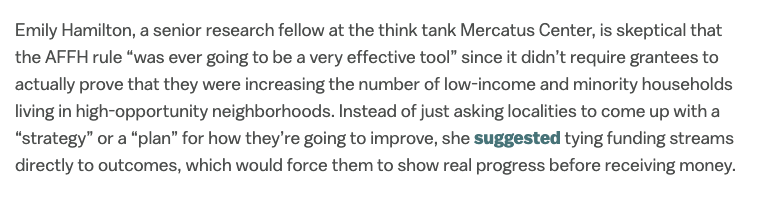

Second, there are many tools to incentivize localities that rely on federal dollars to reform their zoning codes.

There is a ton of federal money that can be conditioned on reforming exclusionary zoning laws. @ebwhamilton has some good ideas on this front.