2/

"Herd immunity is back" may sound grand but I feel it is unnecessarily provocative and such sentiments won't help to engage in a much needed societal discussion. Incidentally, it is inaccurate.

1/

Herd immunity is back. This article quotes its proponents, and then yours truly and @gregggonsalves on why in the absence of a clear way to protect the vulnerable from a raging storm of infection among the less vulnerable, it is a very dangerous idea 1/n https://t.co/5lkhaC34HK

— Bill Hanage (@BillHanage) October 6, 2020

2/

3/

More from Society

- respirator (dubbed "pig snouts" in Cantonese)

- helmet

- eye mask

- heat-proof gloves

- water bottle

- cling wrap

- saline

- traffic cones

- pots and pans

Demonstrators find creative methods to battle police tear gas

https://t.co/kPeUTu9iFh

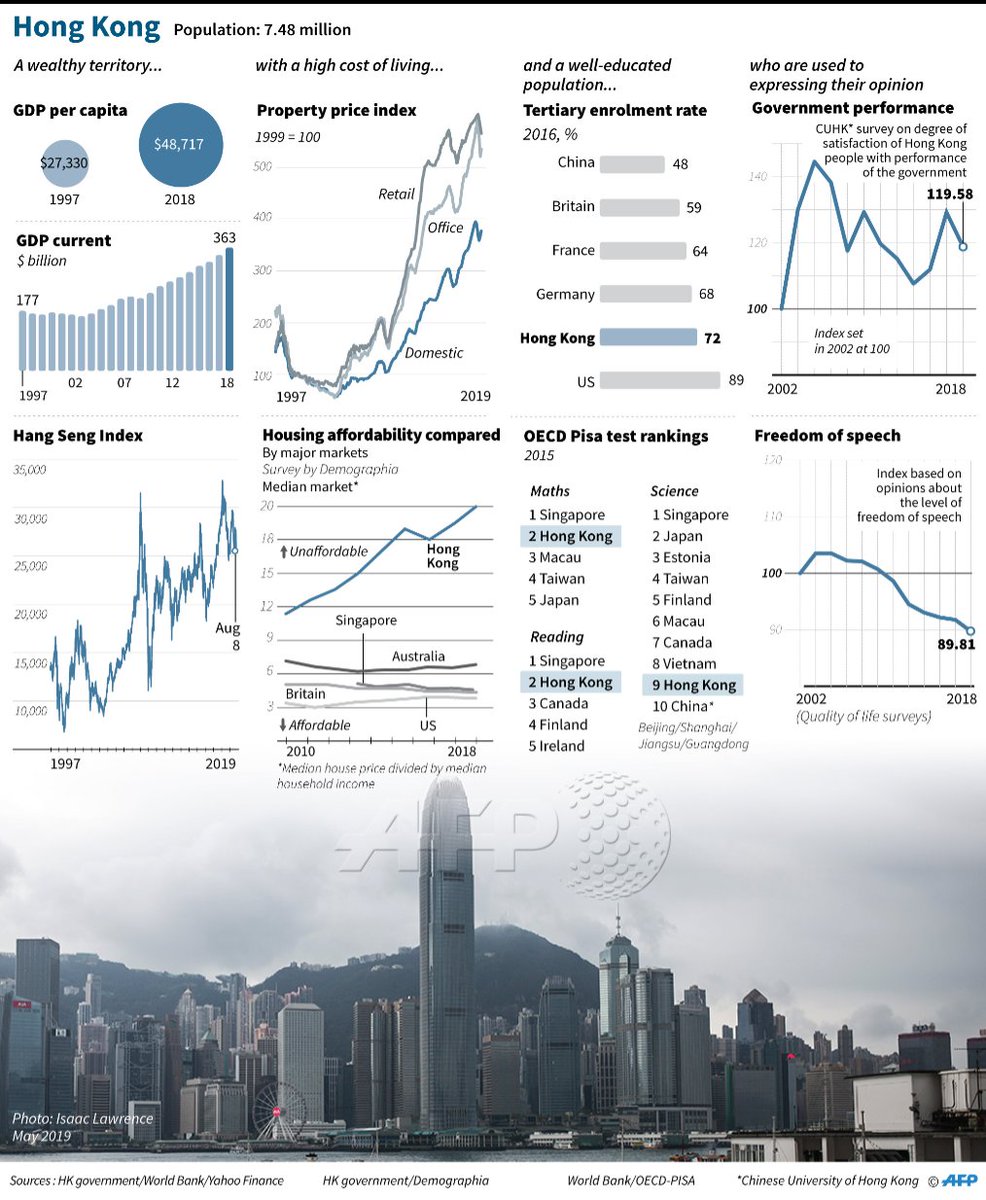

AFP graphic charting Hong Kong's main socio-economic indicators and opinion polls on press freedom and government performance

@AFPgraphics

AFP graphic showing the main equipment used by hardcore pro-democracy protesters in Hong Kong to battle police tear gas, pepper spray and rubber bullets

@AFPgraphics

Frontline first aid.

Nurses, doctors, medical students and ordinary citizens with first aid training have clamoured to join a small volunteer corps helping treat people involved in the Hong Kong protests

@AFP's Yan Zhao reports: https://t.co/uDfYkMeZJf

📸 Anthony Wallace

Pro-democracy activists kick off three days of rallies at Hong Kong airport.

Protesters hope to win international support from arriving passengers. The last demonstration at the airport on July 26 passed off peacefully without causing flight disruptions

https://t.co/jmVqtEd4M2

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.