Categories Screeners

7 days

30 days

All time

Recent

Popular

I have mentioned before too good material on RS

1. A Book written by Sir @Prashantshah267 as attached

2. Research paper by @MebFaber April 2010

3. A book written by Sir Robert A. Levy as attached

4. Webinar by Sir @premalparekh with @vivbajaj

5. Video by @jfahmy on YT https://t.co/xg4fe09ImL

1. A Book written by Sir @Prashantshah267 as attached

2. Research paper by @MebFaber April 2010

3. A book written by Sir Robert A. Levy as attached

4. Webinar by Sir @premalparekh with @vivbajaj

5. Video by @jfahmy on YT https://t.co/xg4fe09ImL

Hi sir ..can u post some articles or write up on relative strength ,how to use same and what is the criteria .. kindly help

— Nanda (@vk_nandagopal) December 11, 2021

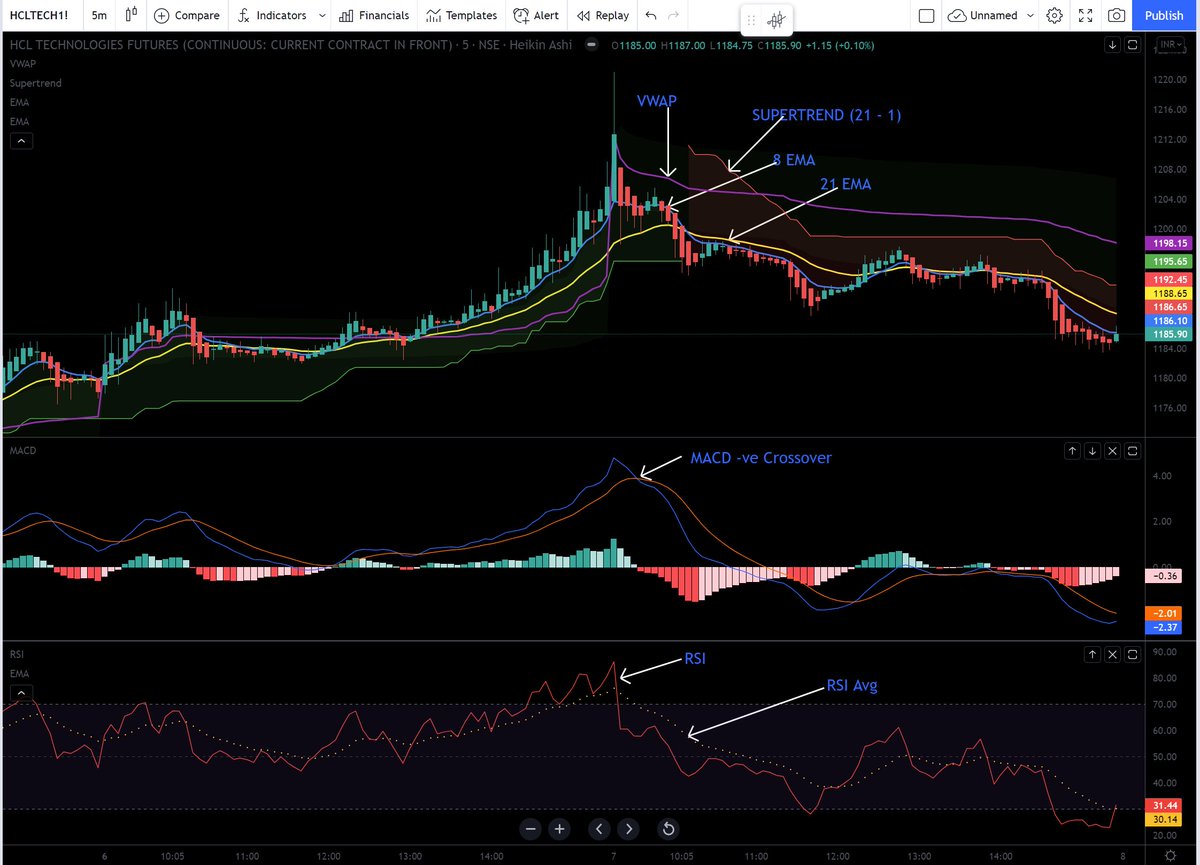

Jubilant Ingrevia - Key learning?

It is important to analyse the strength of the breakout. If the price does not continues the move in 1 or 2 sessions and candles show long upper wicks, it is better to bring the SL closer. Distribution sign.

Will be helpful in next breakouts. https://t.co/AtZOj4bKeT

It is important to analyse the strength of the breakout. If the price does not continues the move in 1 or 2 sessions and candles show long upper wicks, it is better to bring the SL closer. Distribution sign.

Will be helpful in next breakouts. https://t.co/AtZOj4bKeT

Learning: Strong breakout

— The_Chartist \U0001f4c8 (@nison_steve) July 2, 2021

1. Breakout candle will have no upper shadow or extremely less compared to the body

2. Volumes will be high (to avoid retailers to enter & also big hand absorbing all the selling)

3. Pullbacks will be rare/very less

4. Happens after a long consolidation pic.twitter.com/YTHDOnEdxo

Initially we had planned 3 part series on Pharma Sector but now we are adding one more part and making it 4 part series.

Part 1 : Introduction to pharma industry

Link : https://t.co/XZvGKjxo0C

Part 2: Drug discovery process with CRAMS, CDMO, CMO, CSM

Link : https://t.co/MPQm0OXUbL

Part 3 : Generic Drugs (ANDA)

Coming this Saturday at 11 AM

Part 4: Bio-similars

Like & Retweet to support us in the journey to educate investors !!

Part 1 : Introduction to pharma industry

Link : https://t.co/XZvGKjxo0C

Part 2: Drug discovery process with CRAMS, CDMO, CMO, CSM

Link : https://t.co/MPQm0OXUbL

Part 3 : Generic Drugs (ANDA)

Coming this Saturday at 11 AM

Part 4: Bio-similars

Like & Retweet to support us in the journey to educate investors !!

#CHALET 239 . 11% up. Power of Stan Weinstein strategy.

#CHALET

— ScorpioManoj (@scorpiomanojFRM) September 26, 2021

217

A Stan Weinstein strategy scan output.

Stock possibly trying to break to Stage 2 if moves above 220. Huge volume seen in previous week with a strong candle.

30wk MA started sloping upwards and RS sloping upwards.

Fundamentals not good. But huge instnl holdings. pic.twitter.com/PsjwoWbNFJ