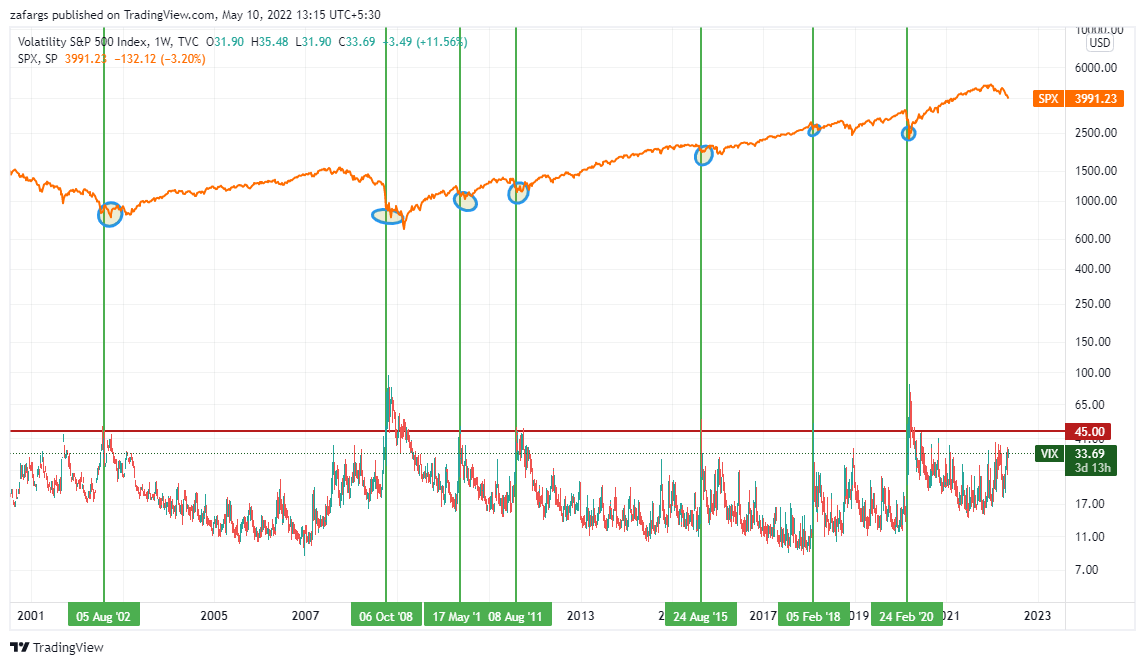

US #VIX vs #SPX

VIX spikes above 30 are common but print above 45 have marked major bottoms

VIX at 33 today, yet to get there

More from Zafar Shaikh

Lot Of People Requested For An Example Of Trend & Pullback System For Directional Trading System Which I Mentioned in Below Tweet. Hence a #Thread.

Simple #System I Follow In Trading:

— Zafar Shaikh (@InvesysCapital) August 20, 2018

1. Strong #Trend On Higher Timframe

2. #PullBack On Current TimeFrame Against Trend

3. #Contraction Of #Volatility During Pullback

4. #Resumption Of Trend On Lower Time Frame

Gives 60-70% Win Rate & 2:1 Reward Risk#Simple Things #Work

2/n

I Use Various Combinations Of Time Frame for Trading / Investing. Generally, Time Frame Selected Decides Holding Period Of Trade. For Investment, Quarterly, Monthly & Weekly Time Frames Are Used, Where Holding Period is Few Months To Years.

3/n

Most People Are Generally Interested in Short Term Trading. Hence, Illustrating One System Which I Use For Short Term Stock Futures Trading. Holding Period For These Trades is 2-5 Days. This Example is of Gail Futures Where Taken Long Position Today. Here We Go:-

4/n

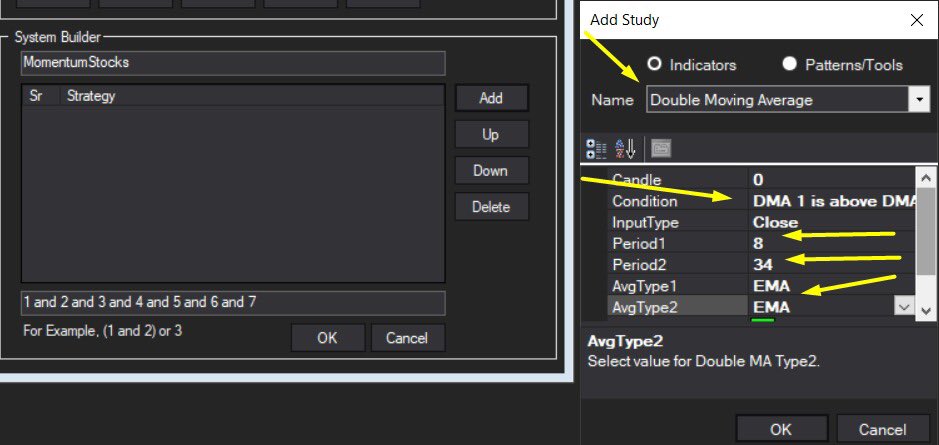

Stock Futures Swing Trading Sysem

Time Frames Used :-

Weekly - Stock Selection

Daily - Pullback

Intraday (75Min) - Volatility & Entry Signal

5/n

GAIL #WEEKLY-

#StockSelection - GAIL Is Trading Near All Time High. Strong Up Trend. No Brainer. We Can Use RSI To Check Strength. RSI Above 60 is Generally Strong Trend.

System says don't buy the dip

Wait for dip of dip of dip at 30500 #Banknifty & 15000 #Nifty

#Banknifty 33900-34100 zone has provided Support & bounce multiple times in last 12 months.

— Zafar Shaikh (@InvesysCapital) May 8, 2022

Watch this level carefully in current week. If 33900 goes, would open up big downside towards 30500 in May series ( Which is confluence of multiple support & AVWAP from Mar20 lows) pic.twitter.com/B7KUNkVVSE

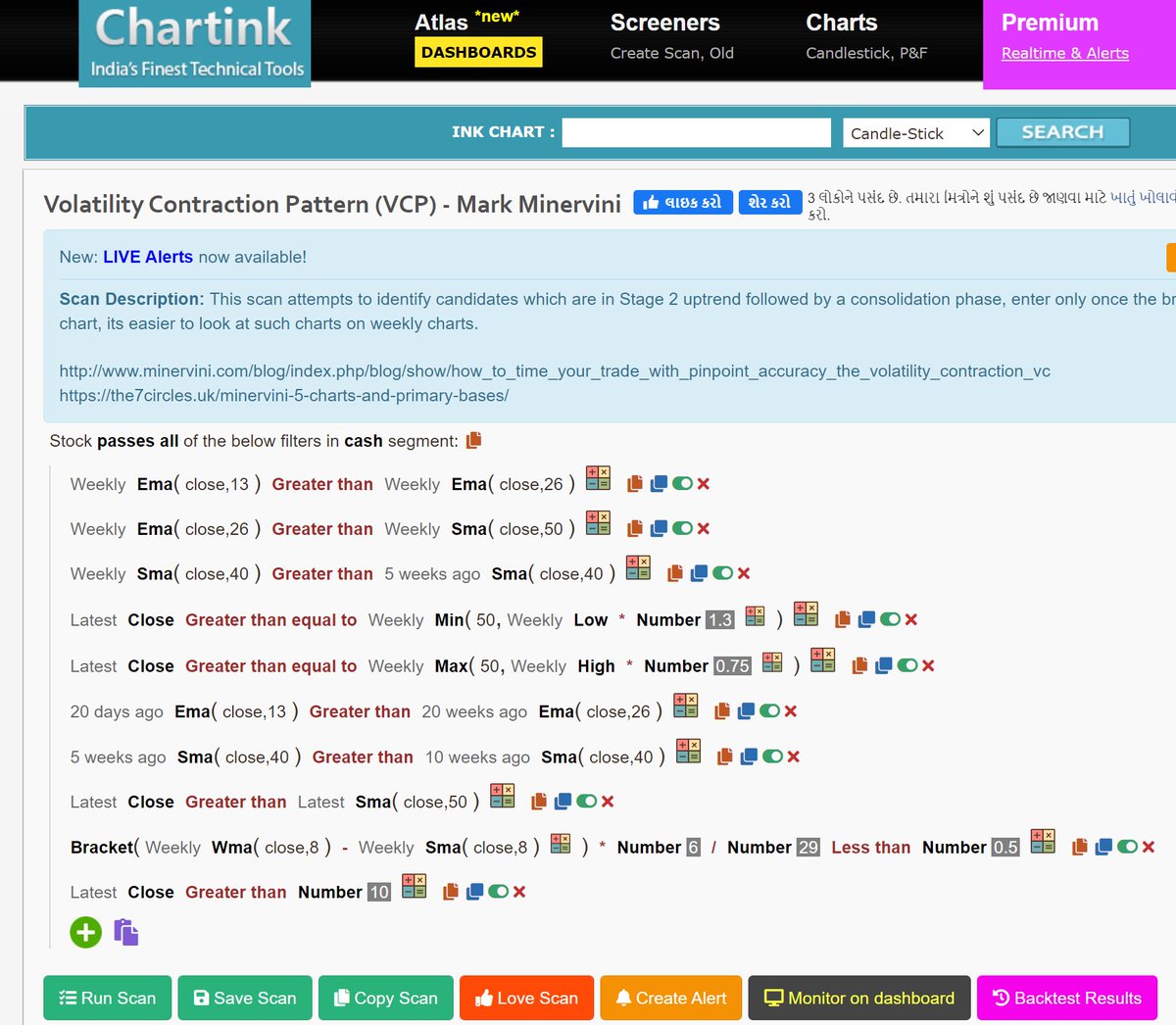

More from Screeners

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

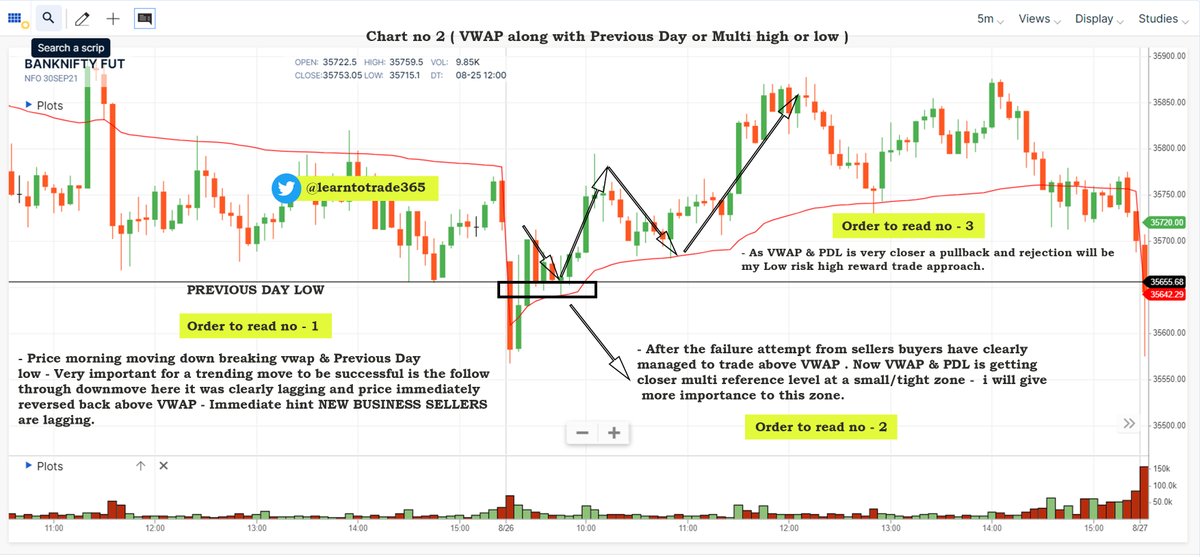

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

Chart 3

Chart 4

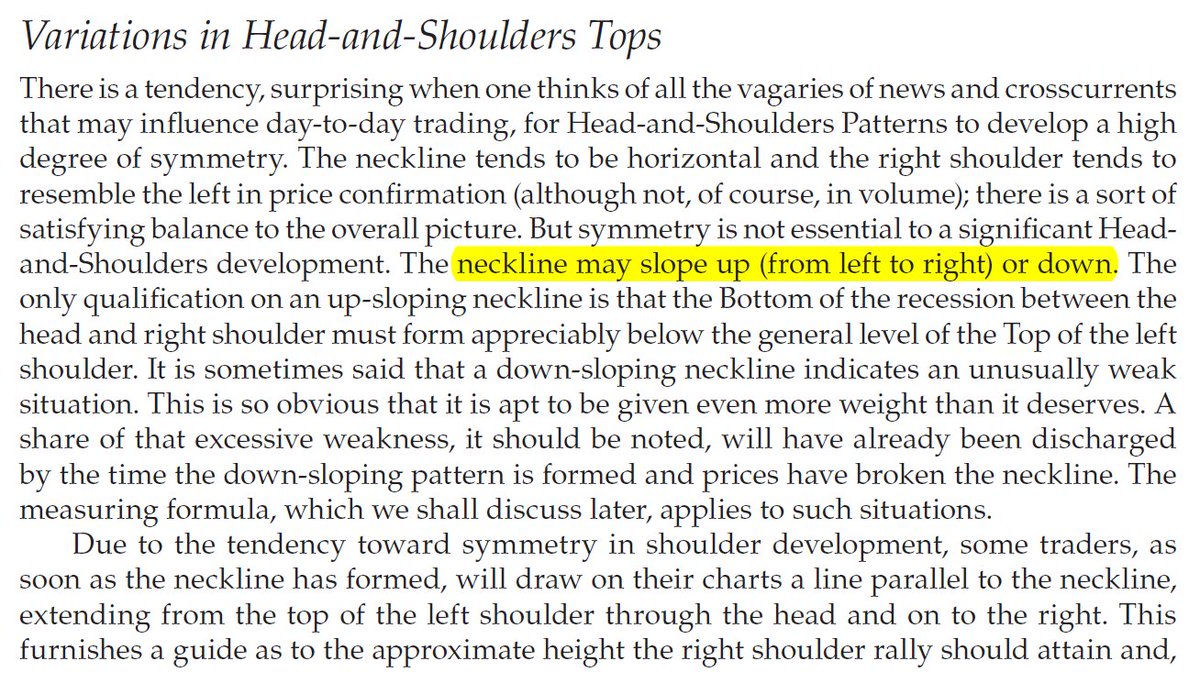

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q

You May Also Like

Please add your own.

2/ The Magic Question: "What would need to be true for you

1/\u201cWhat would need to be true for you to\u2026.X\u201d

— Erik Torenberg (@eriktorenberg) December 4, 2018

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody: https://t.co/Yo6jHbSit9

3/ On evaluating where someone’s head is at regarding a topic they are being wishy-washy about or delaying.

“Gun to the head—what would you decide now?”

“Fast forward 6 months after your sabbatical--how would you decide: what criteria is most important to you?”

4/ Other Q’s re: decisions:

“Putting aside a list of pros/cons, what’s the *one* reason you’re doing this?” “Why is that the most important reason?”

“What’s end-game here?”

“What does success look like in a world where you pick that path?”

5/ When listening, after empathizing, and wanting to help them make their own decisions without imposing your world view:

“What would the best version of yourself do”?