How do you select stocks to invest in this stage of market?

Use 3Bar High on weekly candle to invest with stop at 3Bar Low.. 👇

One of the fairly easy and convenient method for investing is 3 Bar High/Low method on weekly candles.

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) March 26, 2021

Buy when stock price goes above High of previous 3 bars, continue till trend continues week after week, and sell out when Price goes below Low of previous 3 bars. pic.twitter.com/nnVCbMi84C

More from Harsh / 허쉬

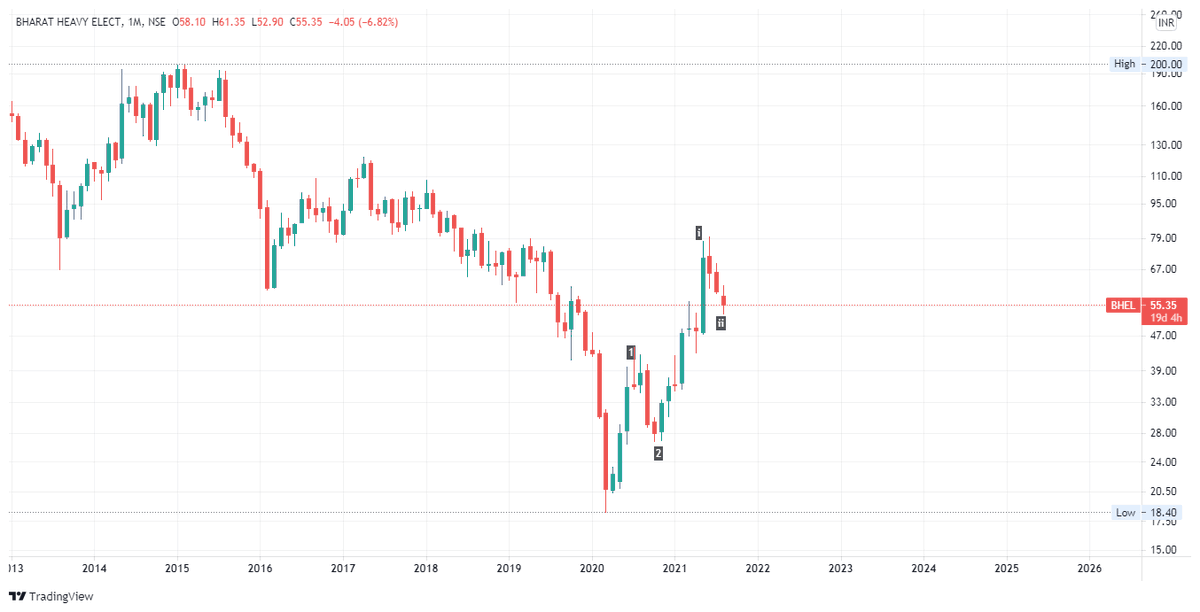

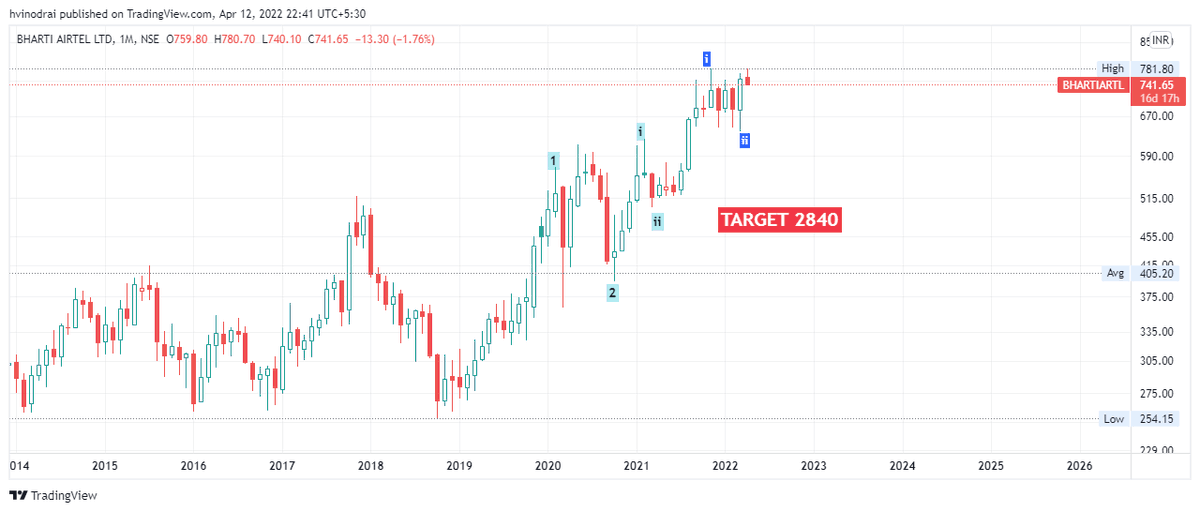

Chart wise labeling for 1,2,i,ii for now - counts invalid if falls further to 38. In that case will take a fresh look.

#Nifty #Elliotwave #Chart https://t.co/2mvKfAs3wA

Holding 29, major wave 2 looks over. Will you believe if I say ATH will come? But let's go step my step - 80-130-200 \U0001f600#Bhel pic.twitter.com/3KPCYeDoDp

— Harsh Mehta (@_Harsh_Mehta_) February 4, 2021

- 5.i done as LD at 16793.

- 5.ii done at 16347 and Nifty rises to 17000+

- 5.ii.a or w done at 16347, irregular correction or complex correction may play out for next 5-7 trading sessions.

Buy the dips. https://t.co/l4Iqp7patS

#Nifty hrly - 2.a done and 2.b should ideally be done tomorrow below the previous high.

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) June 6, 2022

With RBI MPC meeting outcome on 8th (I suppose), sets up perfectly for a 3rd wave in major 5th (considering that my counts are right). https://t.co/LXG2SCg3bY pic.twitter.com/Ya2D35VV8F

Below 640, counts need to be revalidated. https://t.co/1e7hs0ZkxR

#BhartiAirtel #Bharti #Nifty - Chart update - Count wise we are in 5th wave starting from 254.15.

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) May 17, 2021

Breakout from consolidation in 4th wave has come after 13 years, so expect solid move in next 3-5 years. Hold the stock and add on declines. pic.twitter.com/lC3Zsfd8vd

More from Screeners

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

One thing I've been noticing about responses to today's column is that many people still don't get how strong the forces behind regional divergence are, and how hard to reverse 1/ https://t.co/Ft2aH1NcQt

— Paul Krugman (@paulkrugman) November 20, 2018

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote: