Jab tak ki meri book nahi aati, ye kar lo:

1. Go through Zerodha Varsity chapters on Technical Analysis at least 2 times.

2. Then read 'Technical Analysis Explained' by Martin Pring

3. Finally read 'Price Action bar by bar' by Al Books (Not for casual reader).

Sir @DillikiBiili , could you please suggest a book for technical analysis ?

— Pawan Yadav (@pawan_yadav86) March 25, 2022

More from Professor

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Sadda Haqq ! Aithe Rakhh......... pic.twitter.com/IH5q3v2gw9

— Professor (@DillikiBiili) October 5, 2021

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

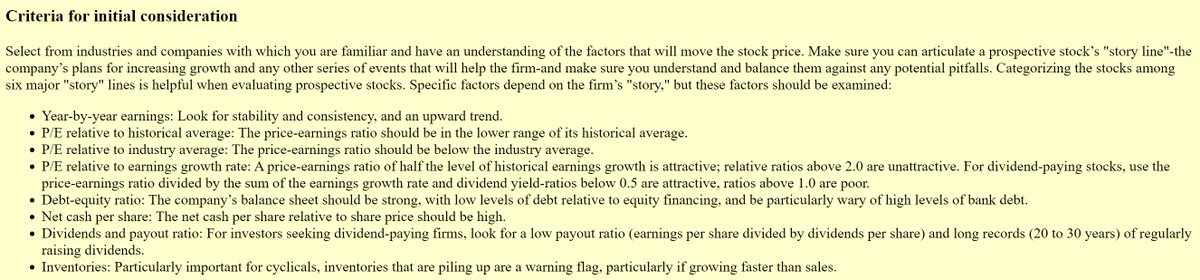

Here is a preliminary checklist by the legendary investor Peter lynch

More from Screeners

Positive signs on inflation include fertilizer prices peaking and trending downward. Used Car prices are also down (which led inflation). The recent price break on the $XLE - which emerged almost to the day the market topped, could be an indication that we are close to a low. pic.twitter.com/2MtcKjjmAz

— Mark Minervini (@markminervini) June 23, 2022

You May Also Like

As a dean of a major academic institution, I could not have said this. But I will now. Requiring such statements in applications for appointments and promotions is an affront to academic freedom, and diminishes the true value of diversity, equity of inclusion by trivializing it. https://t.co/NfcI5VLODi

— Jeffrey Flier (@jflier) November 10, 2018

We know that elite institutions like the one Flier was in (partial) charge of rely on irrelevant status markers like private school education, whiteness, legacy, and ability to charm an old white guy at an interview.

Harvard's discriminatory policies are becoming increasingly well known, across the political spectrum (see, e.g., the recent lawsuit on discrimination against East Asian applications.)

It's refreshing to hear a senior administrator admits to personally opposing policies that attempt to remedy these basic flaws. These are flaws that harm his institution's ability to do cutting-edge research and to serve the public.

Harvard is being eclipsed by institutions that have different ideas about how to run a 21st Century institution. Stanford, for one; the UC system; the "public Ivys".

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

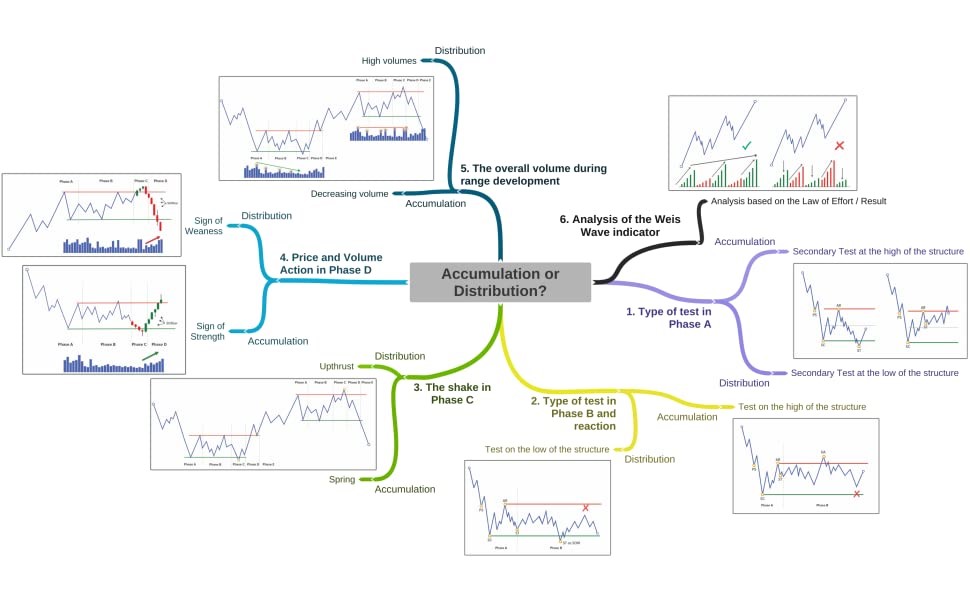

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d