Easy scan. Stocks down the most in a week or a month. Both works.

How do you scan for these stocks Manas?

— K!2 (@iKJce12) March 8, 2022

More from Manas Arora

By your logic, anyone using this concept after 2005 is stealing from here. https://t.co/vWx8GaqrRp

just to be clear he is referring @iManasArora who stole work of @PradeepBonde and did not gave any credit

— Long-Term Equity Trading\U0001f4c8 (@LTE_Trading) April 25, 2022

One of the most successful stock trader with special focus on cash stocks and who has a very creative mind to look out for opportunities in dark times

— Nikita Poojary (@niki_poojary) February 19, 2022

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a \U0001f9f5 to learn the above from @iManasArora

#BroTip

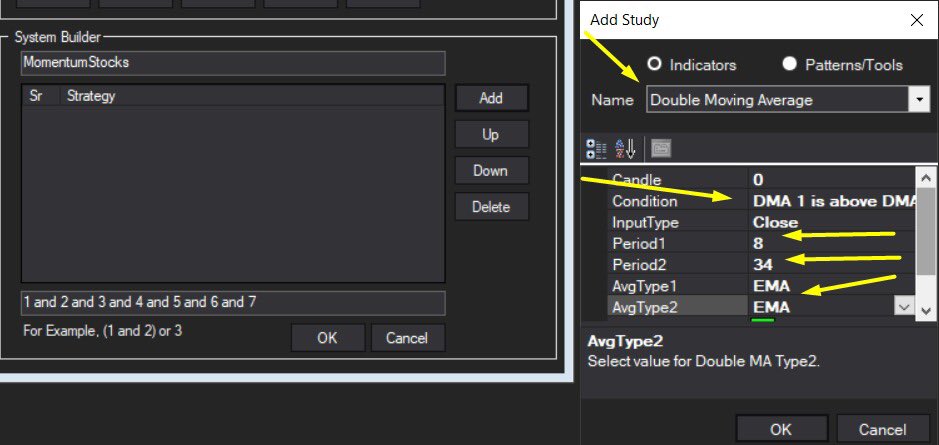

If you want to trade only stocks with established trend/momentum, then you can look for stocks which have never(or barely did) closed below a certain MA (say 50MA) in the last say 50 days.

— Manas Arora (@iManasArora) November 8, 2021

There are countless ways to run scans. Just have to get creative. #BroTip

Notice how strong the trend was, volume pre & post-breakout etc. They have so much in common. This is my bread & butter. I just repeat this day-in & day-out. No rocket science

#BroTip

1/2

https://t.co/AeUkzgVM7S

https://t.co/1znMi5Cjgk

https://t.co/5R1i8ijiUY

https://t.co/VOVTxOdPCv

https://t.co/vhBIwLuk8q

https://t.co/3xcKeJtmYe

https://t.co/PXjWVPVsLz

https://t.co/SBkSALkL3U

https://t.co/NBNSLTaD5O

https://t.co/JS08fLd4PI

2/2

More from Screeners

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K