More from Van Ilango (JustNifty)

Remembered it & made entry @ open for the "High rewarding 3rd wave"

Much appreciation🙏 to @ap_pune for his regular sharing of vital info. & wisdom from years of experience.

#auropharma "Hour t/f" for "Traders"

— Van Ilango (JustNifty) (@JustNifty) March 21, 2022

In search of the highly rewarding 2nd wave entry.

Today's & tomorrow's #priceaction would have more clarity for entry either @ 615-620 or above 655 https://t.co/20S0Lvc7ej pic.twitter.com/OFlf9MLkqz

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

Master just one doubt about the re-entry part

— Sunny Singh (@SurendraSinghJi) February 10, 2022

You mentioned to re-enter at 17430 levels.

How to initiate the trade at the lowest point when the candle is in the formation mode.

Is it that when the price touches 21ma we should entry longs till 13ma is above 21ma.

Show path \U0001f64f

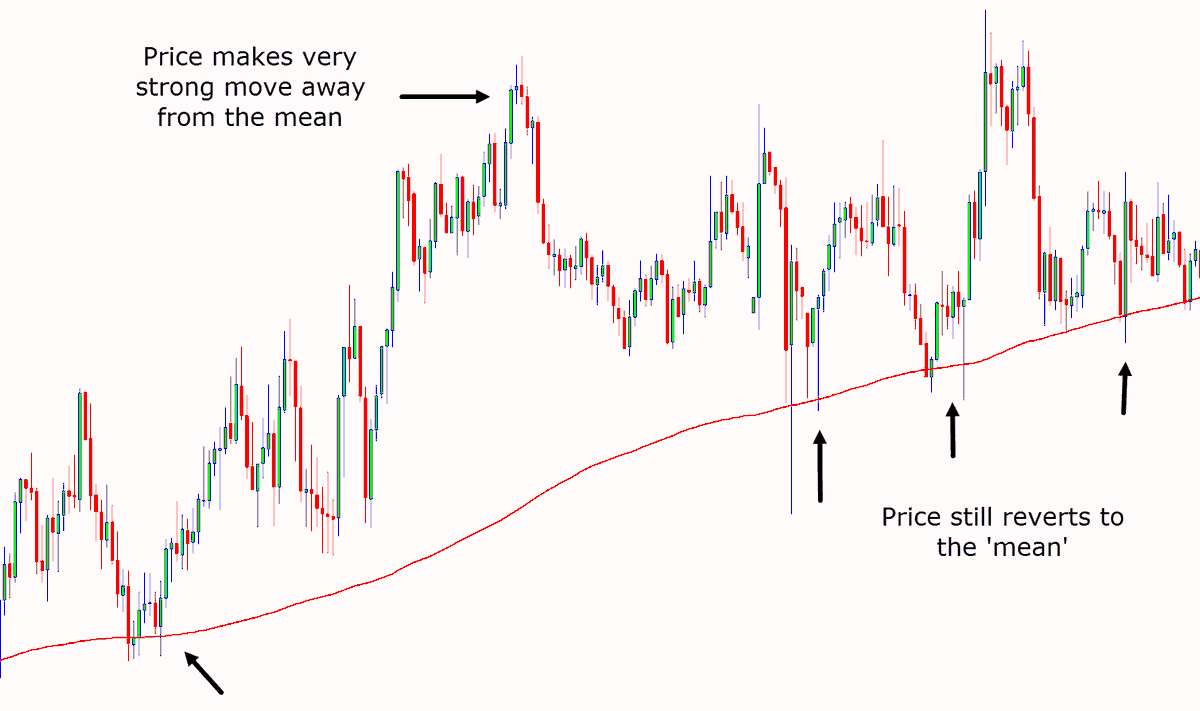

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏

More from Screeners

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you

Positive signs on inflation include fertilizer prices peaking and trending downward. Used Car prices are also down (which led inflation). The recent price break on the $XLE - which emerged almost to the day the market topped, could be an indication that we are close to a low. pic.twitter.com/2MtcKjjmAz

— Mark Minervini (@markminervini) June 23, 2022

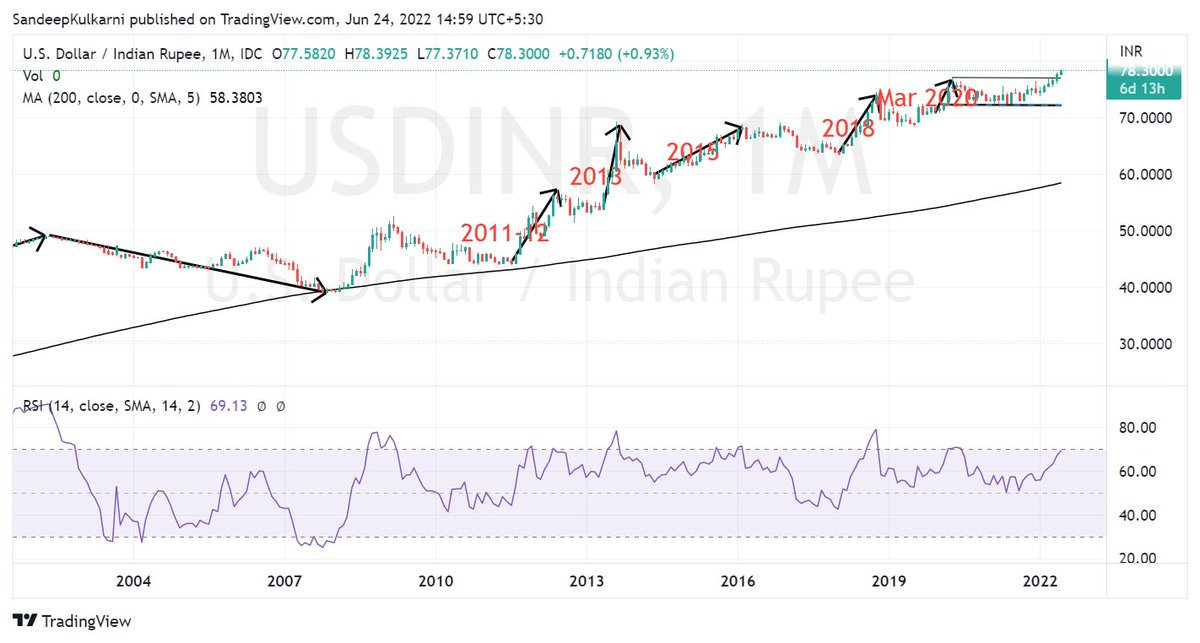

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

We know how our stock market has weathered the FII selling.

— Sandeep Kulkarni (@moneyworks4u_fa) June 10, 2022

But the equally big story is how Rupee has weathered $50bn+ outflows since Oct 2021. Hats off to RBI Governor Das & his team for having the vision of building huge reserves in his tenure. pic.twitter.com/CVuF9dM361