Niti Ayog is one of the best places to look at, if you want to learn more about the upcoming reforms, outlook on India for next decade and some of the most pressing economical issues of our generation.

Here is a recent one on EV charging infra.

https://t.co/BGoCTVnlRS

More from Tar ⚡

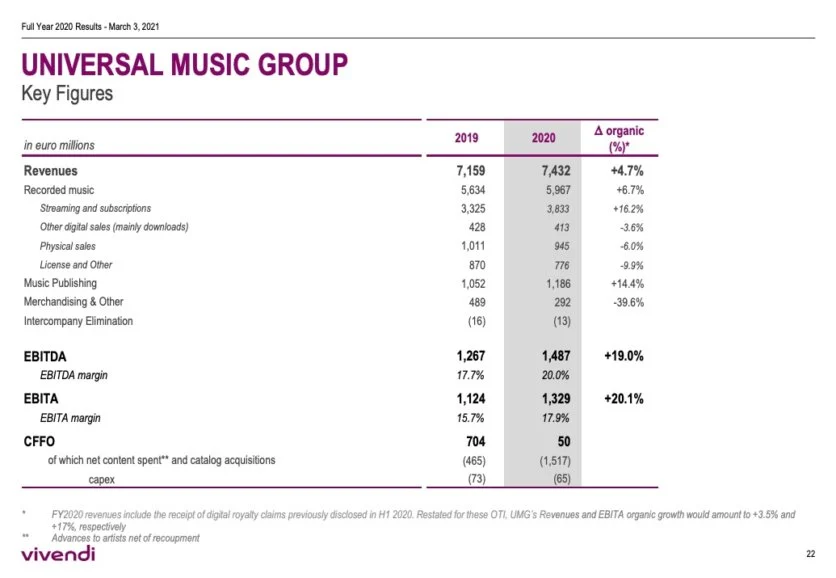

A business like Universal which controls more than 1/3rd of all published music globally is selling for less than 6x FY20 Sales.

Why are Indian businesses like Saregama / Tips selling for 11x, 20x their sales?

If I include all of the revenue generated by entire firm, its selling for ~4.5x FY20 Sales

Universal Listing Market Cap ~ 40 Billion USD

FY 20 Revenues ~ 8.87 B USD or 7.4B EUR

Catalogue of Music includes every international artist you can possibly name

Either Universal is grossly undervalued or Saregama/Tips are grossly overvalued.

https://t.co/aHzWSYtcUt

Homework for all the interested participants here:

— Intrinsic Compounding (@soicfinance) June 27, 2021

Q1.Why 20% and not 50%+ Margins for UMG

Q2. Differences in dynamics between Western&Indian cos?

Q3. Trends in West vs Trends in India in the industry.

Research and find the answers. My job is done \U0001f601\U0001f64f

https://t.co/v0EMoCuYKX

If you see the ebitda of universal music its low 20% compared to our saregama 30% or tips 50%. So when you compare earnings saregama is 40x and tips is 30x and universal music is 30x. Also these type of companies are less( low or no capex with excellent and growinh cashflows)

— Srikanth V (@mynameisnani75) June 27, 2021

250: Electricity in India won't grow

300: It just makes 4paise per trade

350: MBED will erode it's profitablilty

500: Maybe what @itsTarH said about IEX = NSE + Zerodha was right

570: Buys IEX

#JourneyOfAPessimist

Zerodha + NSE = IEX \U0001f4a1\u26a1\ufe0f

— Tar \u26a1 (@itsTarH) June 20, 2021

More from Screeners

Sharing 9 Screeners🧵

1. Swing Trading Techno Funda https://t.co/sV6e8XSFRK

2.Range Breakout

https://t.co/SNKEpGHNtv

3. Stocks in Tight Range :

https://t.co/MqDFMEfj82

Telegram Link : https://t.co/b4N4oPjqm9

Retweet and Share !

4.Stock Closing up 3% Since 3 days

https://t.co/vLGG9k3YKz

5. Close above 21 ema

https://t.co/fMZkgLczxR

6. Days Fall and Reversal

7. 52 WEEK high Stocks.

https://t.co/H6Z6IGMRwS

8. Intraday Stocks :https://t.co/JoXYRcogj7

9. Darvas Box

#bearrun

#BearMarket

Head & Shoulders pattern, double top and bearish RSI divergences fail more often in bull market and generally gives a very good SAR trade. Vice versa is also true for bear market.#bullrun #BullMarket

— Aakash Gangwar (@akashgngwr823) February 9, 2021