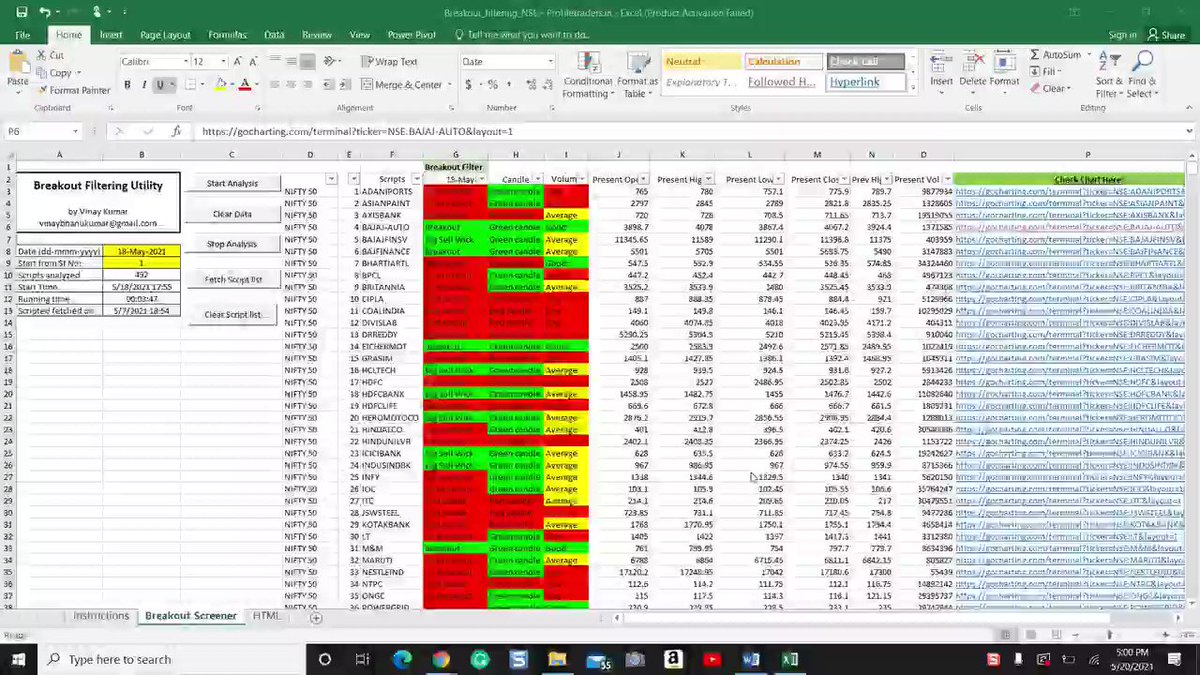

Momentum Stocks Picking:

Result Script + Move more than 1.5ATR move either side.

That's it enter whenever see low risk in direction.

Disclaimer: need to see lower timeframe to enter when risk reward good.

https://t.co/mxRo0P04h1

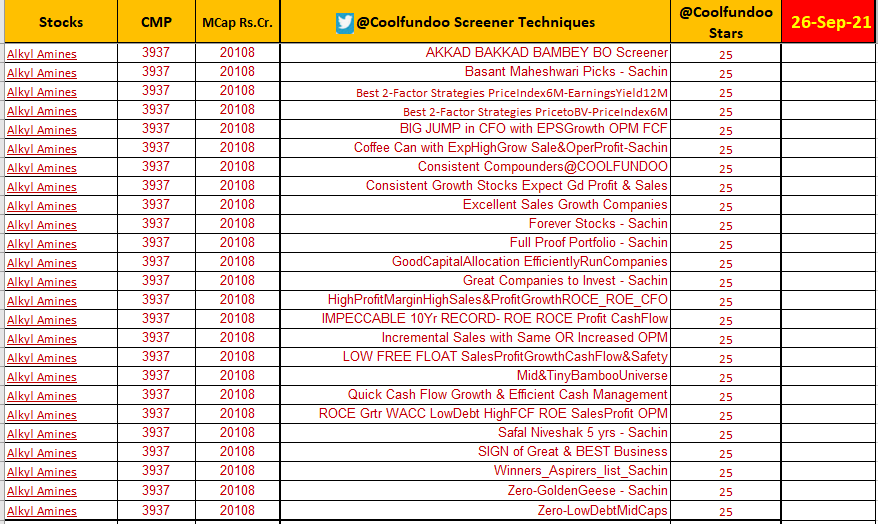

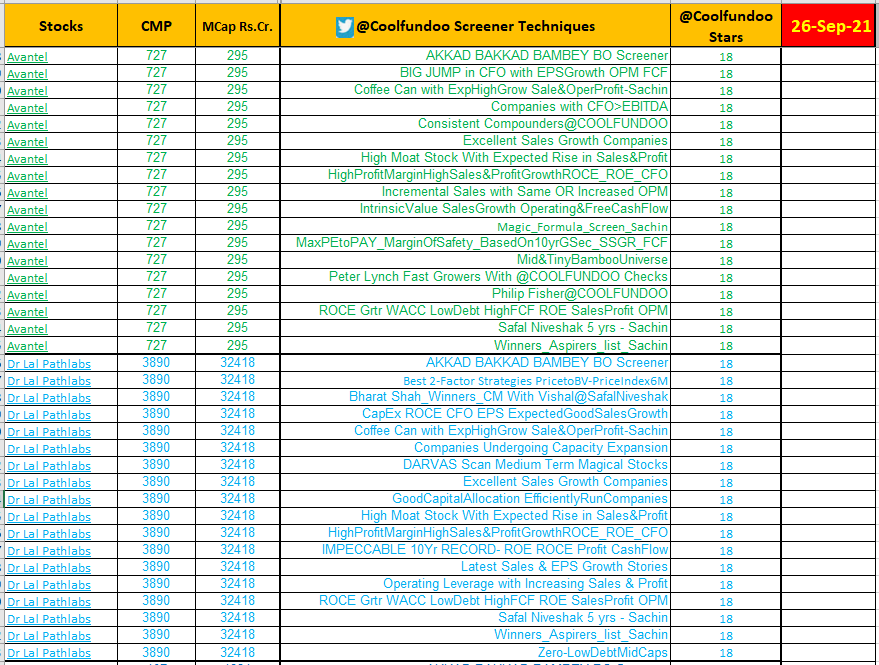

More from Screeners

How was the trap set in USA Small-Cap index

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

TRAPS? In a false breakout, the price breaks out of the range & comes back within the range. A trap is one step ahead, price not only comes back within the range but breaks down in the opposite direction. It traps the initial longs who didn't close their positions

— The_Chartist \U0001f4c8 (@charts_zone) January 22, 2022

Russell 2000 pic.twitter.com/txzjdnStzc

You May Also Like

A brief analysis and comparison of the CSS for Twitter's PWA vs Twitter's legacy desktop website. The difference is dramatic and I'll touch on some reasons why.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.