More from 𝓐𝓶𝓲𝓽 𝓢𝓮𝓽𝓱 🇮🇳

In Yesterdays #Sectorstudy, there were Indications that #CNXRealty will give positive returns in the short term:

DLF up 3%

GodrejProperties up 4%

Sobha up 5%

#Sector Leaders are shining😊

DLF up 3%

GodrejProperties up 4%

Sobha up 5%

#Sector Leaders are shining😊

#CNXRealty

— \U0001f1ee\U0001f1f3 \U0001d4d0\U0001d4f6\U0001d4f2\U0001d4fd \U0001d4e2\U0001d4ee\U0001d4fd\U0001d4f1 (@MaverickAmit01) May 23, 2021

Something is cooking in this #Sector. It may give some postive returns in the Short Term!!!#CNXFinance #Looking attractively placed for probable Outperformance!!!#SectoralAnalysis #Nifty #TradingView pic.twitter.com/2umf8XyMvm

More from Sbin

A thread on OI and Options charts for SBI - why it stopped rising at 420 and how one could have identified that.

Why I am talking abt SBI so much?

After the results, almost every brokerage came out with upgrades giving trgts of 500-600-700 on SBI, and it is easy for retail to buy CEs immdly; It might rise later, but the pause in the last 2 days ensured that the CEs fall sharply

For those who missed ithttps://t.co/gb1PpJKQdY

— AP (@ap_pune) May 25, 2021

Why I am talking abt SBI so much?

After the results, almost every brokerage came out with upgrades giving trgts of 500-600-700 on SBI, and it is easy for retail to buy CEs immdly; It might rise later, but the pause in the last 2 days ensured that the CEs fall sharply

#SBIN

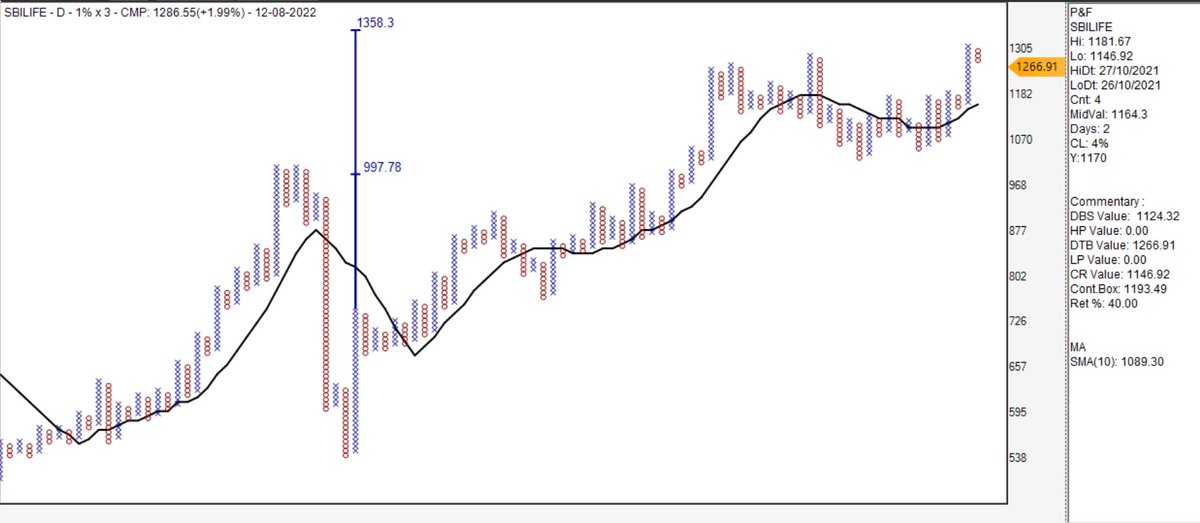

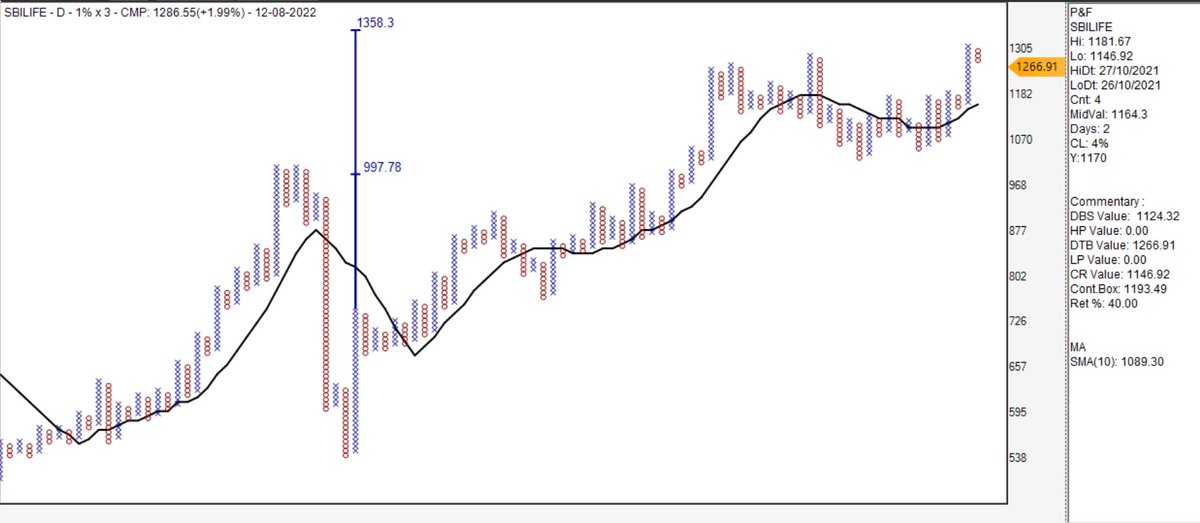

#SBILife

Probable #SuperPattern Bullish

@shivaji_1983 https://t.co/8e8YvbpWW7

#SBILife

Probable #SuperPattern Bullish

@shivaji_1983 https://t.co/8e8YvbpWW7

Multi Chart Scanner #Nifty500

— Vithal (@srvithal388) August 13, 2022

Box 1% EOD

Price Scanner - Probable Super Pattern stocks

Relative Strength Scanner - Price above MA - Moving Average and ST - Super Trend in Relative Strength

Denominator - #Nifty500 pic.twitter.com/FFIRInUGIs

You May Also Like

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

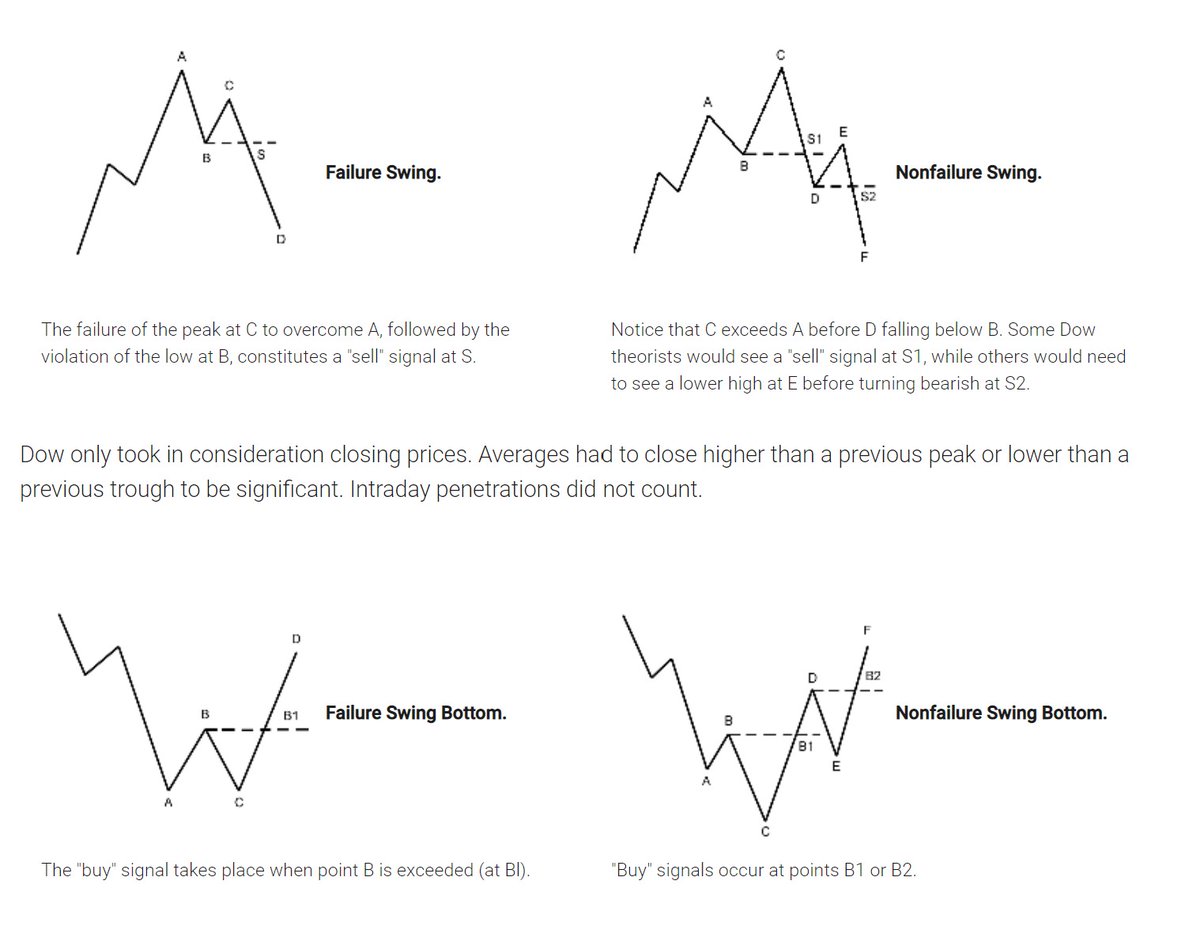

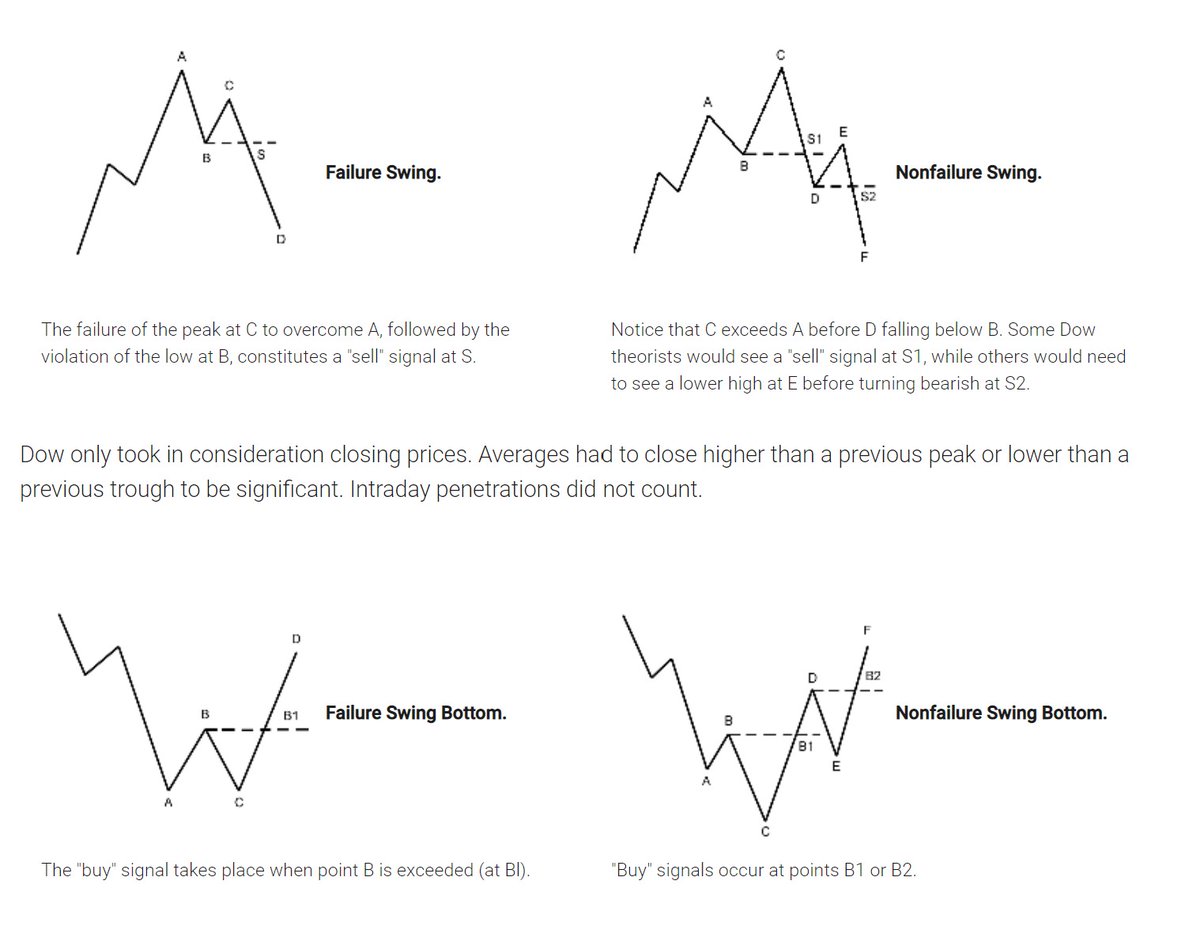

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d