I just made a short write up on "INSURANCE IN ISLAM" for my WhatsApp group "HOUSE OF FIQH" and also posted it on Facebook.

My brother @TasiuAl saw it and urged me to share it here, i have to obey him 🤣

INSURANCE IN ISLAM

A SHORT THREAD:

More from Religion

1. A)Yes , monotheism does mean there is one God & all other gods are false.

But your statement that it also mean " that God is my God " is misleading . It depends on the doctrine of that monotheistic religion .

From Islamic monotheism , Allah never said that he is Creator of Arabs . He is Creator if all in creation . So from a doctrinal pov your statement doens't hold up .

B ) how did u write Advaita = hindu philosophy ? Do u want me to mention difference between Advaita and dvaita ?

" There is no concept of shirk in Hinduism " . This is a red hearing , No One claimed Hinduism also has concept of shirk .

2. Tribal God ? In Islamic doctrine . No where it says Allah is Only God of Quraish tribe .

It was always " ilahi n Naas " , not to mention islamic was always about one's belief & not race/ethnicity , So it was never tribalistic in its Nature

& If someone's doctrine is to be Questioned for being tribalistic , It's Hinduism . It's a ethnico religion . Originated on the banks of Indus river , With special mentions to " Aryans " in 4 vedas.

Even after 4000 yrs , 95% of it's followers live in India .

But your statement that it also mean " that God is my God " is misleading . It depends on the doctrine of that monotheistic religion .

\u201cMonotheism\u201d does not mean \u201cGod is one.\u201d It means \u201cthere is one God, that god is MY god, all others are FALSE gods.\u201d

— Sankrant Sanu \u0938\u093e\u0928\u0941 \u0938\u0902\u0915\u094d\u0930\u093e\u0928\u094d\u0924 \u0a38\u0a70\u0a15\u0a4d\u0a30\u0a3e\u0a02\u0a24 \u0a38\u0a3e\u0a28\u0a41 (@sankrant) January 27, 2021

There is no concept of \u201cfalse gods\u201d in Advaita or Hindu philosophy, no concept of \u201cshirk.\u201d

Monotheism is an imperialist ideology of intolerance and erasure. https://t.co/WsDX6pzK5R

From Islamic monotheism , Allah never said that he is Creator of Arabs . He is Creator if all in creation . So from a doctrinal pov your statement doens't hold up .

B ) how did u write Advaita = hindu philosophy ? Do u want me to mention difference between Advaita and dvaita ?

" There is no concept of shirk in Hinduism " . This is a red hearing , No One claimed Hinduism also has concept of shirk .

2. Tribal God ? In Islamic doctrine . No where it says Allah is Only God of Quraish tribe .

It was always " ilahi n Naas " , not to mention islamic was always about one's belief & not race/ethnicity , So it was never tribalistic in its Nature

Most Hindus don\u2019t understand this (Sikhs do even less).

— Sankrant Sanu \u0938\u093e\u0928\u0941 \u0938\u0902\u0915\u094d\u0930\u093e\u0928\u094d\u0924 \u0a38\u0a70\u0a15\u0a4d\u0a30\u0a3e\u0a02\u0a24 \u0a38\u0a3e\u0a28\u0a41 (@sankrant) January 27, 2021

Neither Sanatan nor Sikhi is \u201cmonotheistic.\u201d Monotheism is an ideology of supremacy, the elevation of a petty tribal god to the pretense of the Universal. It is ignorant tribalism universalized.https://t.co/yZkdxr7emP https://t.co/JDhOHnmGIT

& If someone's doctrine is to be Questioned for being tribalistic , It's Hinduism . It's a ethnico religion . Originated on the banks of Indus river , With special mentions to " Aryans " in 4 vedas.

Even after 4000 yrs , 95% of it's followers live in India .

You May Also Like

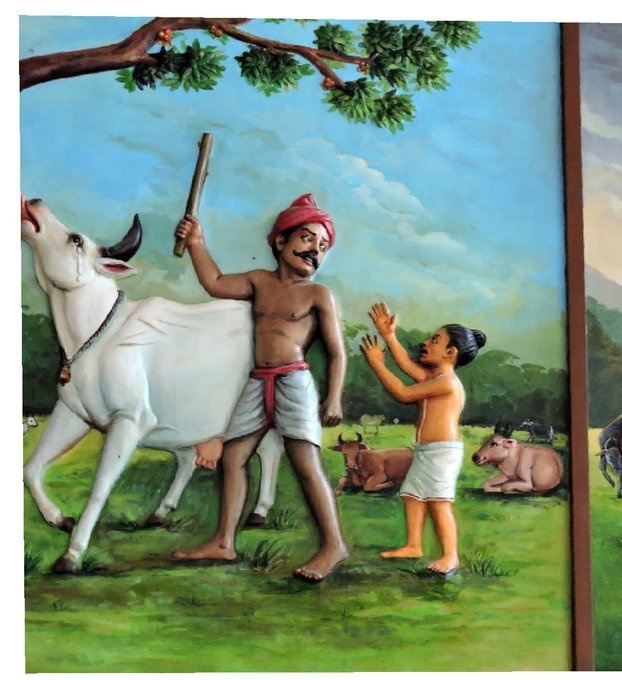

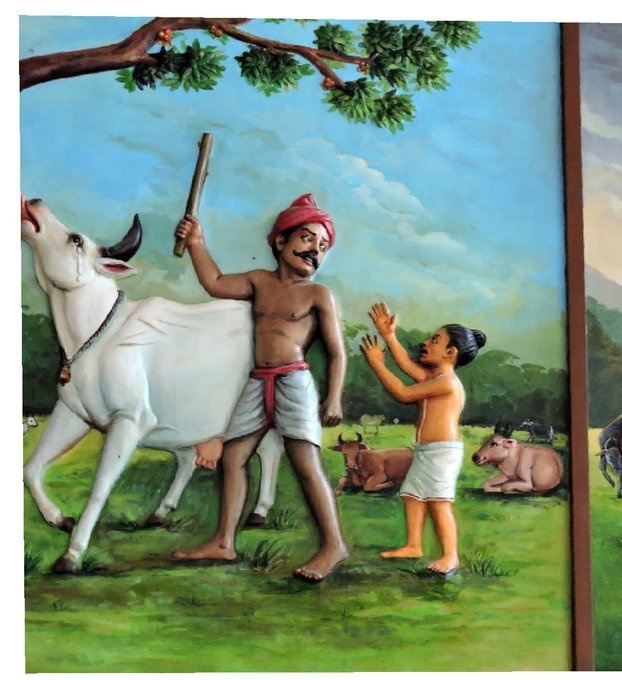

#sculpture #story -

Chandesha-Anugraha Murti - One of the Sculpture in Brihadeshwara Temple at Gangaikonda Cholapuram - built by Raja Rajendra Chola I

This Sculpture depicts Bhagwan Shiva along with Devi Paravathi blessing Chandeshwara - one of the 63 Nayanmars.

#Thread

Chandeshwara/Chandikeshwara is regarded as custodian of Shiva Temple's wealth&most of Shiva temples in South India has separate sannathi for him.

His bhakti for Bhagwan Shiva elevated him as one of foremost among Nayanmars.

He gave importance to Shiva Pooja&protection of cows.

There are series of paintings, illustrating the #story of Chandikeshwar in the premises of

Sri Sathiyagireeswarar #Temple at Seinganur,near Kumbakonam,TN

Chandikeshwara's birth name

is Vichara sarman.He was born in the village of Senganur on the banks of River Manni.

His Parent names were Yajnathatan and Pavithrai.

Vichara Sarman was a gifted child and he learnt Vedas and Agamas at a very young age.

He was very devout and would always think about Bhagwan Shiva.

One day he saw a cowherd man brutally assaulting a cow,Vichara Sarman could not tolerate this. He spoke to cowherd: ‘Do you not know that the cow is worshipful & divine? All gods & Devas reside in https://t.co/ElLcI5ppsK it is our duty to protect cows &we should not to harm them.

Chandesha-Anugraha Murti - One of the Sculpture in Brihadeshwara Temple at Gangaikonda Cholapuram - built by Raja Rajendra Chola I

This Sculpture depicts Bhagwan Shiva along with Devi Paravathi blessing Chandeshwara - one of the 63 Nayanmars.

#Thread

Chandeshwara/Chandikeshwara is regarded as custodian of Shiva Temple's wealth&most of Shiva temples in South India has separate sannathi for him.

His bhakti for Bhagwan Shiva elevated him as one of foremost among Nayanmars.

He gave importance to Shiva Pooja&protection of cows.

There are series of paintings, illustrating the #story of Chandikeshwar in the premises of

Sri Sathiyagireeswarar #Temple at Seinganur,near Kumbakonam,TN

Chandikeshwara's birth name

is Vichara sarman.He was born in the village of Senganur on the banks of River Manni.

His Parent names were Yajnathatan and Pavithrai.

Vichara Sarman was a gifted child and he learnt Vedas and Agamas at a very young age.

He was very devout and would always think about Bhagwan Shiva.

One day he saw a cowherd man brutally assaulting a cow,Vichara Sarman could not tolerate this. He spoke to cowherd: ‘Do you not know that the cow is worshipful & divine? All gods & Devas reside in https://t.co/ElLcI5ppsK it is our duty to protect cows &we should not to harm them.