Some key brands of Radico include but are not limited to-

1. Rampur Indian Single Malt

2. Jaisalmer Craft Gin

3. Magic Moments Vodka

4. Morpheus XO Brandy

5. 8PM Whisky

6. 8PM Premium Black Whisky

7. 1965 Rum

8. Old Admiral Brandy

9. Contessa Rum

10. After Dark Whisky

The Company operates 5 own and 28 contract bottling units spread across the country with a combined capacity of 160 Million litres.

3 distilleries in Rampur and 2 in JV RNV in Aurangabad in which they own 36% equity.

The company was started in 1943 and is currently a Fortune India 500 company. Lalit Khaitan & son Abhishek Khaitan are the MD's of the company.

Radico has a strong distribution network and makes sales through over 75,000 retail and 8,000 on-premise outlets.

Product portfolio -

In the super-luxury segment-

1. Jaisalmer Indian Craft Gin has a global footprint in more than 25 countries. Available in 6 metros in India. It will be launched on a pan-India basis over the next year. First mover advantage in the Indian craft gin market.

2. Rampur Indian Single Malt Whisky is available in over 45 countries. Expressions priced b/w US $70 and US $1400. Its success is an affirmation of our R&D expertise. Continue to expand distribution width in these super-premium brands.

Malt distillation and maturation capacity expanded 3 years ago. With this, Rampur will be made available in larger quantities in India in 2-3 years’ time. Both brands will be launched in the defence market in FY2022 and should contribute well to profitability in years to come.

Premium Segment -

3. Magic Moments Vodka - Launched in 2006. India’s largest premium vodka brand with around 60% market share. Several different flavours and sub-brands under Magic Moments like Verve (20% Market Share) and Remix. 1 of 5 millionaire Radico brands (Cases)

4. Morpheus Brandy - India’s largest selling premium brandy. Around 60% market share in the premium brandy category.

5. 8pm premium black - 1.2 million cases volume sales during the financial year 2020-21. The new premium version of 8pm whiskey.

6. Contessa Rum - Highest selling rum brand in the defence segment. Leader in India. Available in parts of Africa, South East Asia, Middle East, USA & Canada.

7. Spirit of History Rum - Launched for the CSD in 2017 and marketed to the Defence. Now available in some civil markets.

8. 8 PM family of brands continued the growth trajectory and achieved sales volumes of 10.7 million cases.

'Our brands have matured. We have plans to take our portfolio to newer heights with the launch of new super-premium brands'

12 new brand launches last decade. 11 in premium

The consolidation phase is complete. Brands have matured. We have plans to take our portfolio to newer heights with the launch of new super-premium brands. The company has a pipeline for the coming year. Strong balance sheet & cash flows to support sustainable &profitable growth.

Some highlights in images - in terms of volumes, revenue breakups, key financial numbers and multiples that would interest investors.

The recent shift in UP's state excise policy had moved from the monopolistic distribution to a free market helped Radico increase market share, given the strong positioning in UP. Premiumisation led transformation has helped us to consistently outperform the industry.

FY2019, the industry grew by 9.2% whereas we grew by 10.8%. In FY2020, the industry grew by 0.4%, we outperformed and grew 12.5%. FY21, because of the pandemic, the industry had degrown by (13.6)% whereas we de-grew by only (8)% and hence continued to gain market share.

Chairman and MD letters combined - Revenues from Operations at 2,418 crores, expanded EBITDA margins by nearly 170 basis points to end the year with 408 crores, up 11%, as compared to the previous year. Reviewed every cost line item, put in place strong credit controls.

Continued to invest in our Ad spend. These have helped increase market share. Since 2016, have reduced debt by 750 crores. With the ban of BIO products in the defence markets, Rampur and Jaisalmer have strong opportunities. Will continue to enhance premium portfolio in thefuture

Vodka currently accounts for <5% of the domestic IMFL volumes compared to around 25- 30% globally. With a favourable demographic profile and changing consumer preferences, believe that Vodka is bound to expand. Premium vodka has grown faster than the overall vodka industry

Flavours are gaining momentum in vodka. More than 50% of our vodka volumes are flavoured. To expand the vodka category- including new flavours, expressions and more premium products. Planning to capitalize on the market leadership & expand the market with more premium offerings

Across all 33 units-

Radico continues to focus on cost optimisation & making operations leaner. ENA & packaging materials are 2 key components of the variable costs. The Company is largely self-dependent for its ENA requirements due to owning a significant distillation capacity

of 160 Million litres. This also provides a cushion against fluctuations in the ENA prices. Undertaken initiatives to optimise cost structure. These include rationalisation of the bottle supplies, diversification of its supplier base and weight optimisation of glass bottles.

By the end of the year, 8/11 top markets that we operate in returned to growth. Against IMFL volume decline of (8.0)%, IMFL sales value decreased by (3.3)%. In value terms, Prestige & Above brands contributed to about 50.6% of total IMFL sales value (vs. 49.5% last year).

IMFL sales value accounted for 79.1% of the total Revenue from Operations of the Company compared to 81.5% last year. Non-IMFL sales value growth was 12.6%.

Radico Khaitan’s exports registered strong growth & contributed over 7% of the total net revenue from operations.

Gross Margin expanded from 48.6% in FY20 to 50.3% in FY21. On a Y-o-Y basis, ENA prices declined by about 4%. Raw material prices overall have been benign during FY21. Towards the end of the year, inflationary pressures on dry goods such as packing materials were seen!

The Company has only one joint venture, namely, Radico NV Distilleries Maharashtra Limited (“RNV”). The Company has a 36% stake in the said joint venture.

The Company’s long-term credit facilities are now rated as CARE AA- (Double A Minus) with a positive outlook.

The U.P. State Excise Department has issued a show-cause notice claiming an excise duty amounting to 1,822.77 Lakhs on the alcohol lost in the fire accident. (From statutory reports)

Closure of Sanitizer Business as it was not core business and due to change in demand scenario.

Some states have recently allowed online booking/home deliveries of alcohol. Although at a nascent stage, such developments open up new routes to market opportunities in the long run

🥃🥃🥃🥃

Factors suggest that the price elasticity of demand for alcoholic beverages is still low, particularly for the premium category brands. Demand should continue to rise as supply chains are restored and things return to normal.

Other Industry tailwinds in the next few-

1. A growing upper-middle class & people being pushed out of poverty

2. Currently low penetration rates in rural areas

3. Rapidly rising consumerism

4. Large young demography

5. Appealing to a younger generation through online marketing

Industry data -

Whisky constituted the largest segment with 65.4% of the sales volumes and 74.2% of the value

White Spirits such as vodka and gin account for 3.6% of the total IMFL volumes and 6.8% of the value indicating a premiumization trend

Premium and super-premium category vodka accounted for 68% of total vodka volumes compared to 65% 5 years ago. Overall Premium Vodka 2021-25 value growth of 11%.

Super Premium Vodka industry growth indicates a strong premiumization trend. Flavoured vodka gaining popularity

Single malt scotch and blended scotch are expected to grow with CY2021-25 CAGR of 13.0% and 7.3%,

IMFL volume is expected to reach 353 Million cases in CY2025. CY2021-2025 period, IMFL sales volume is expected to grow at a CAGR of 4.2% and value by 4.6%

Demand for premium brands is less impacted by the industry slowdown due to COVID. The ready-to-drink category, includes hard seltzer, pre-mixed cocktails etc, is transforming across leading global markets, with volume growth outpacing other alcohols

(Electra RTD - Radico Brand)

Industry Headwinds - Focus on ethanol blending, there may be some headwinds in the ENA prices. The government’s ethanol blending policy may put pressure on the ENA prices in the future. Towards the end of the year, commodity prices....

particularly dry goods such as packaging materials experienced a sharp increase.

Short term raw material price increase is not expected to have a significant impact on profitability margins for the companies that are focused on premiumization. Radico is focused on premiumization

For the ESG merchants -

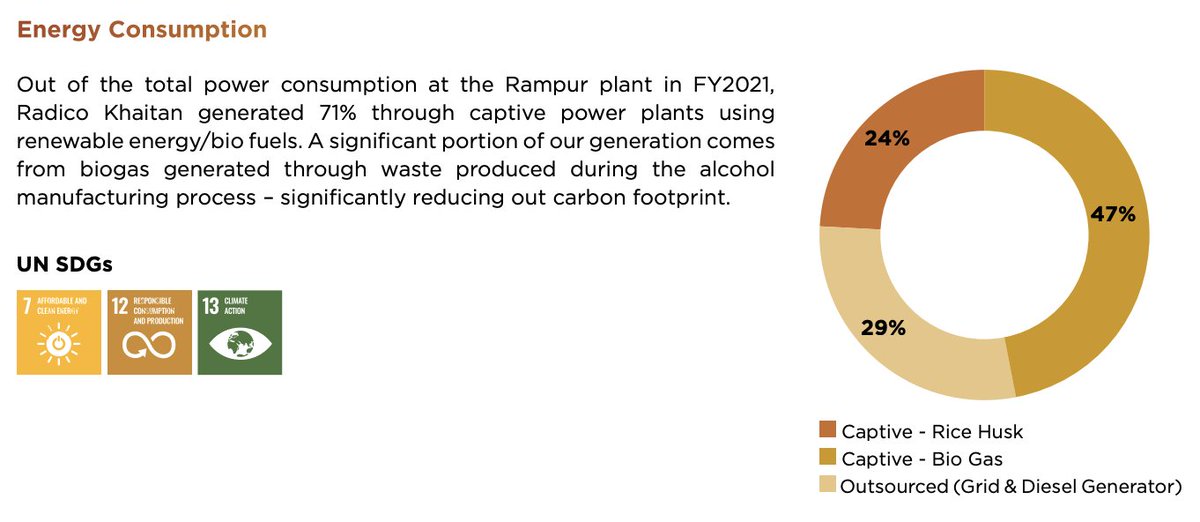

Rampur distillery nearly 70% of the power consumed is from renewable energy sources and around 47% of the renewable power was through biogas generated through waste produced during the alcohol manufacturing process....

We have been ramping up our usage of recycled glass bottles for certain large brands which stands at 14% in FY2021 as compared to 4.5% in FY2019. Other initiatives include water recharging and harvesting around our factories,

Some competitive advantages Radico has -

1. Wide Product Portfolio

2. Strong Distribution Network - 75,000 retail and 8,000 on-premise outlets in the relevant segments in different parts of India. Apart from wholesalers, a total of around 300 employees divided into four zones

3. Distillation Capacity at Manufacturing Units - Strategically located facilities and distribution centres at diff locations provide easy access to key markets. Nationwide presence, strategic location also helps to avoid the high taxes levied on interstate movement of liquor

Some risks and mitigation-

See pictures

Performance review of the company financials and key financial ratios

Salaries - Top 3 honchos at the company.

Cash on the books is substantial. Wonder how they will make use of it? (121 cr vs 10 cr)

Borrowings - These are current liabilities and mostly working capital debt

Trade receivables and inventories are substantial so it's worth having a look at the notes.

Revenues here

Other expenses are substantial so putting the breakdown from the notes here. It will be interesting to see how it plays out this year!

That's all folks! That's the end of the thread! Bloody long but hope it was useful. If it was useful, please show some love and like this. A follow and retweet will go a long way and let me know if you want me to make more of these threads!