Ex- #sastasundar after breakout 145/155 zone , stocks in 2/3 weeks given 30/40% return.

And in 2/3 months it was double 💞

Same - #balrampurchini

preparing mega thread \U0001f9f5 of

— Vikrant (@Trading0secrets) October 18, 2021

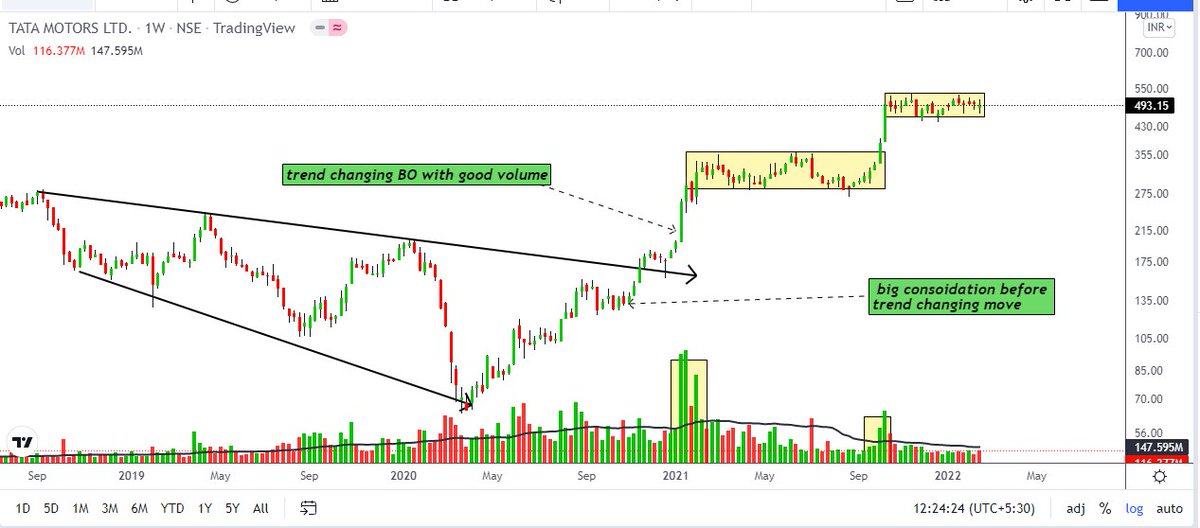

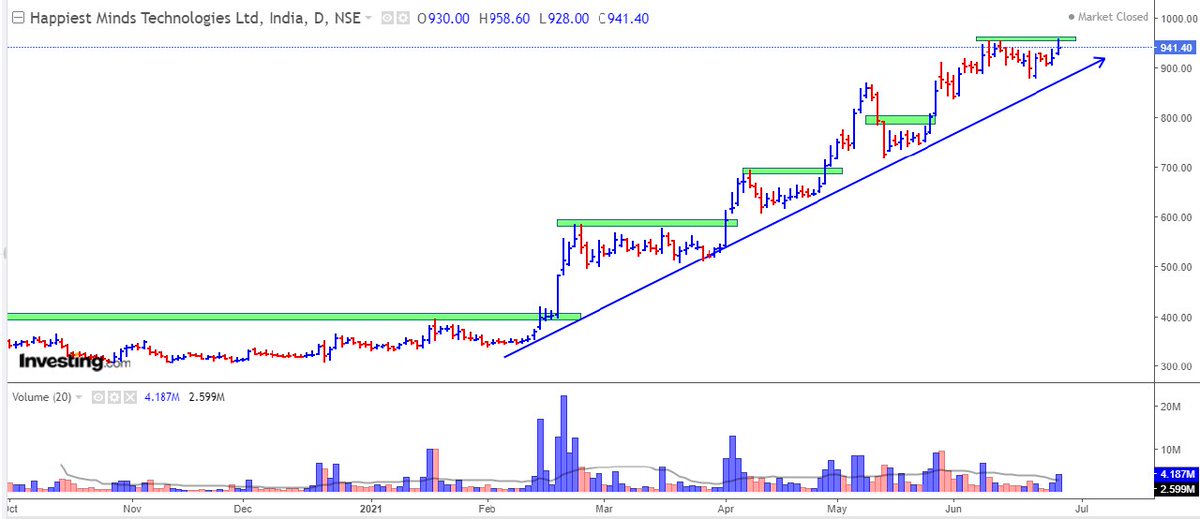

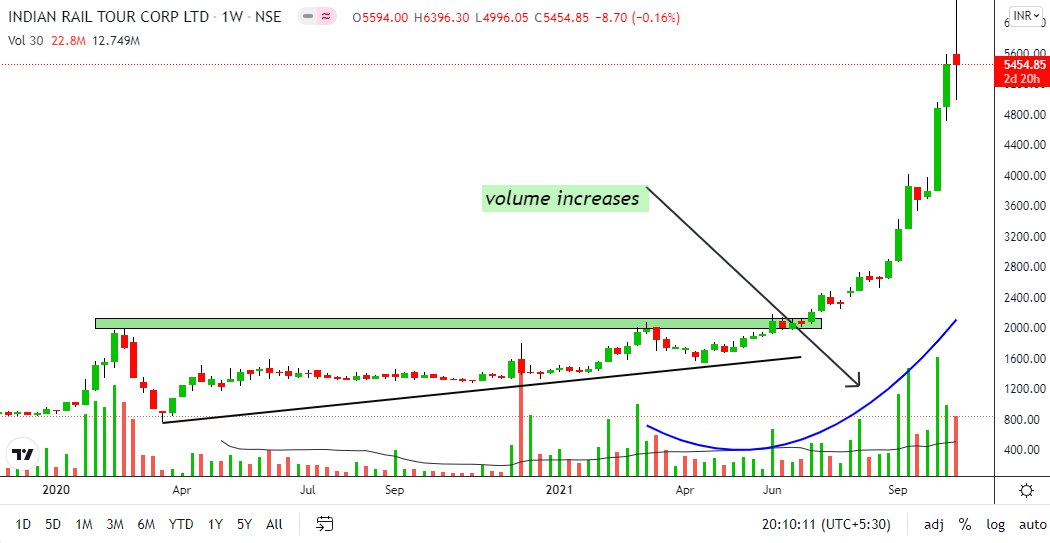

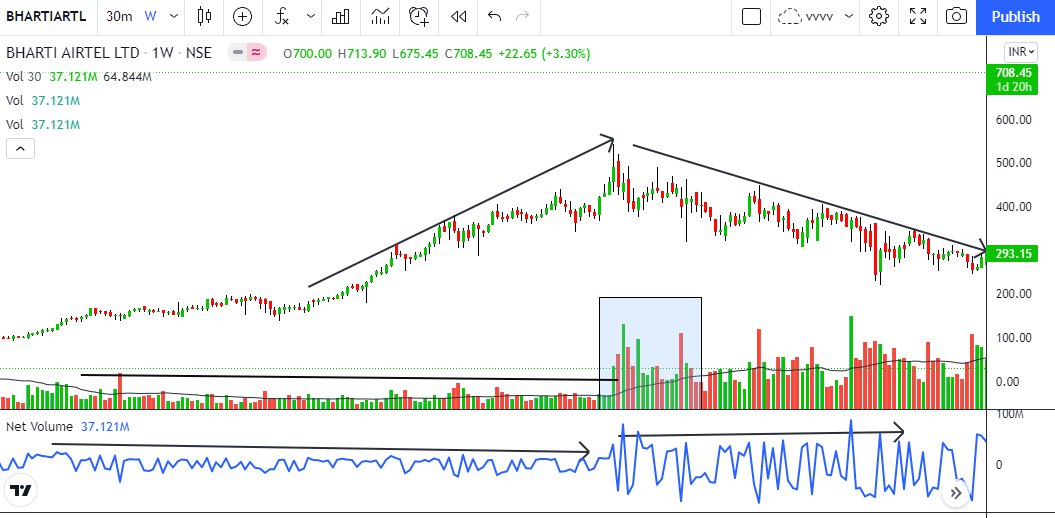

#volume analysis .

Key points \U0001f4cd

1\u20e3How should you interpret volume in different time frame?

2\u20e3how do you get that institution or big guys are accumulating ...

The full learning thread \U0001f9f5 about "VOLUME INTERPRETATION "

Stay tuned . \u0964\u0964\u0964\u0964\u0964

In such volatile market I mainly trading intraday with low risk breakout setup .

— Vikrant (@Trading0secrets) February 18, 2022

Making thread \U0001f9f5 on Intraday breakout strategy.

And how I play & when you should avoid intraday.

Try to explain full BO intraday strategy

With examples

Will share thread \U0001f9f5 after completed\U0001f4af