Also, there are 3 strategies one may deploy according to their risk appetite:

1. Aggressive Traders (1.6%)

2. Moderate Risk Traders (0.93%)

3. Low-Risk Traders (0.6%)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

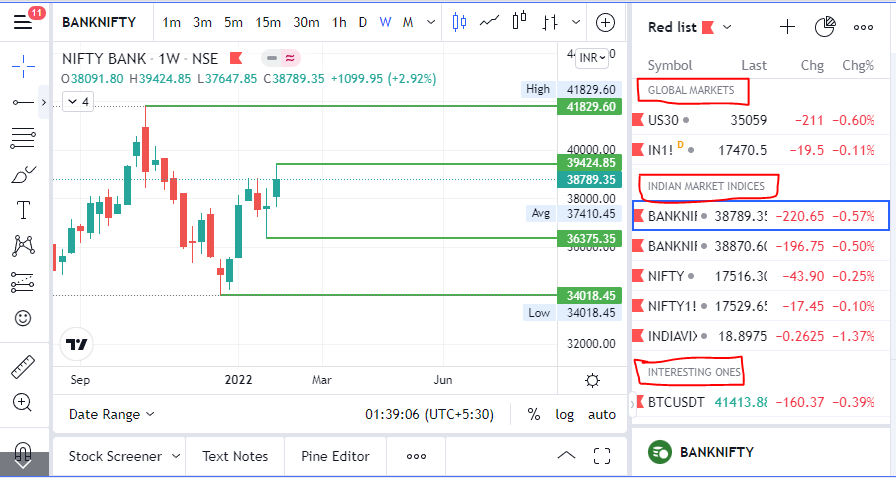

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

A few setups/strategies that can make your intraday trading easy. I follow them personally:

— Sheetal Rijhwani (@RijhwaniSheetal) September 12, 2021

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018