1. What is an iron fly

2. Perks and Drawbacks

3. What to do when in profit?

4. How to adjust when in loss?

5. Thread on How to keep shifting an iron fly for max credit?

6. Risk-free trades benefits

Let's dive in ↓

THREAD ON IRONFLY

— Sarang Sood (@SarangSood) December 12, 2020

These days the most preferred strategy for option sellers due to improved margins is IRONFLY. It's essentially a short straddle with long strangle. Long strangle acting as 'WINGS', which help in capping the unlimited risk associated with a short straddle.(1/n)

Thread on Iron fly\U0001f447

— Kapil Dhama \U0001f1ee\U0001f1f3 (@kapildhama) August 19, 2021

Many people ask me what is the benefit if we make Iron Fly loss free

last week we made a 35900 Iron fly, and market closed at 35500, if we didn\u2019t make if loss free then we would get max 50 points and if market fall below 35500 then we will book loss

(1/4) pic.twitter.com/8wQ1uO7zCb

Why do you sell an iron fly every Wednesday? What are the perks of doing it versus selling naked?

— Aditya Todmal (@AdityaTodmal) August 29, 2020

I sell strangles 99% of the time. No hedge.

Which one is a better strategy to make more money on Thursday opening? @SarangSood

12 TRADING SETUPS used by professional traders:\U0001f9f5

— Aditya Todmal (@AdityaTodmal) June 25, 2022

Collaborated with @niki_poojary

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

— Harsh (@HarshAsserts) September 11, 2020

When trading,moods will want to influence ur decisions

— Banknifty Addict (Gaurav) (@BankniftyA) December 29, 2019

How to minimize:

-Have a backtested plan/system

-Know yourself(emotion and panic levels)

So trade size is important to keep ur emotions in check

-dont focus too much on pnl

-have a back up plan ready

& last stay positive!!

Backtest the complete expiry and practice again and again till u develop conviction

— Banknifty Addict (Gaurav) (@BankniftyA) November 5, 2020

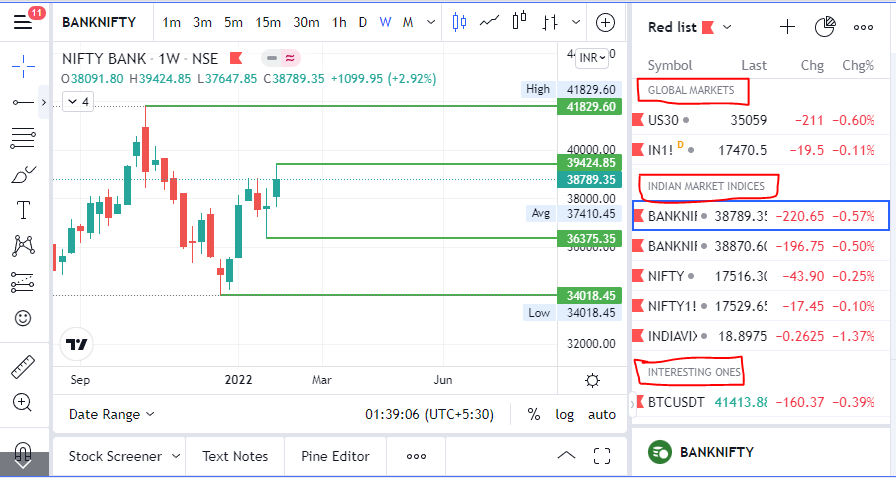

Support and resistance levels based on technical charts on various time frames.

— Banknifty Addict (Gaurav) (@BankniftyA) December 19, 2019

Breaking any of the above, leads to a direction

and then only directional play.

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."