More from itrade(DJ)

More from Optionslearnings

17% need workshop. 😂😀

This is my simple trading.

How many are believing only in simple trading system?

— Mitesh Patel (@Mitesh_Engr) April 3, 2021

This is my simple trading.

I don\u2019t have any magic.

— Mitesh Patel (@Mitesh_Engr) January 7, 2021

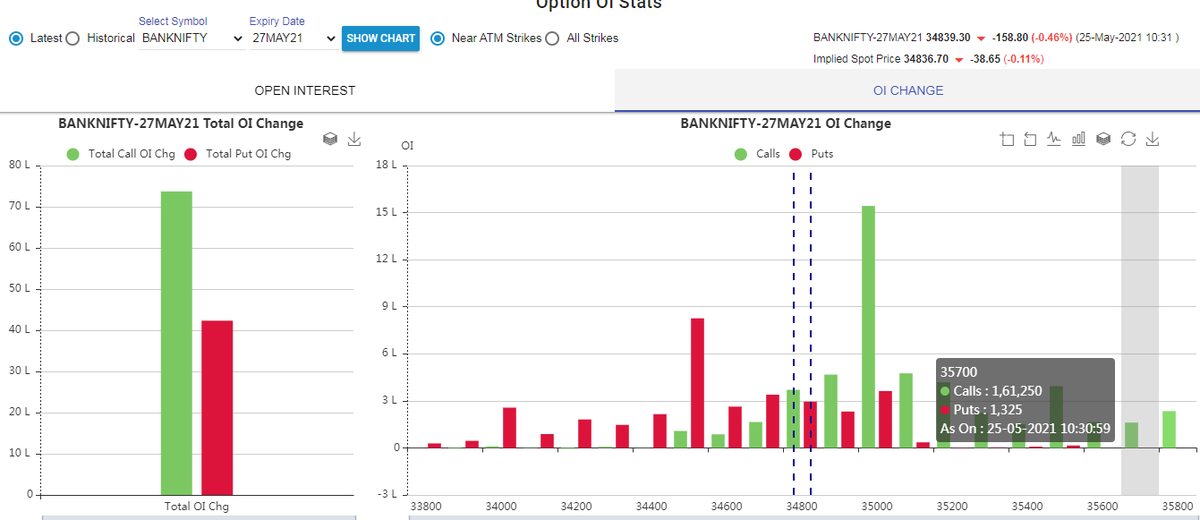

Next week I will prefer to sell put in between strike 30500-31000 as shown in pic. Will manage upto 31000.

If breaks 31000 as first down support then will exit put nearby 31000 strike and will sell

31500 call ( will act as resistance again )

Simple hai na pic.twitter.com/hPLIMq3tSe

A Thread on How to NOT do blunders while selling Options. 🧵🪡

1. Never be Greedy in a High Vix Environment.

Sellers selling OTM get lured by higher premiums and sell near ATM or more than they usually do, this will burn your hand as High premiums also mean that you will end up giving higher premium back than usual as soom as it spikes.

2. Hope

Hope drives a man crazy and this is true for trading the most, hoping for a reversal to cut the pain. Humans have a tendency to avoid the pain and one does not accept the pain by not booking a loss

Tom Hougaard explains this well below.

https://t.co/zDbDT2hdej

3. Not having a setup in non directional Selling

You cannot make money long term if you don’t have a set of rules or adjustments in place already if you are trading long term. Make a plan or a system so that you always know how to survive. Your Position is non D not the market.

4. Getting Egoistic

Many people think they are supreme because they are selling options much likely because of the Trend on Twitter in the community,

You are a trader think like one and remain one trading a certain way does not make you better.

1. Never be Greedy in a High Vix Environment.

Sellers selling OTM get lured by higher premiums and sell near ATM or more than they usually do, this will burn your hand as High premiums also mean that you will end up giving higher premium back than usual as soom as it spikes.

2. Hope

Hope drives a man crazy and this is true for trading the most, hoping for a reversal to cut the pain. Humans have a tendency to avoid the pain and one does not accept the pain by not booking a loss

Tom Hougaard explains this well below.

https://t.co/zDbDT2hdej

3. Not having a setup in non directional Selling

You cannot make money long term if you don’t have a set of rules or adjustments in place already if you are trading long term. Make a plan or a system so that you always know how to survive. Your Position is non D not the market.

4. Getting Egoistic

Many people think they are supreme because they are selling options much likely because of the Trend on Twitter in the community,

You are a trader think like one and remain one trading a certain way does not make you better.