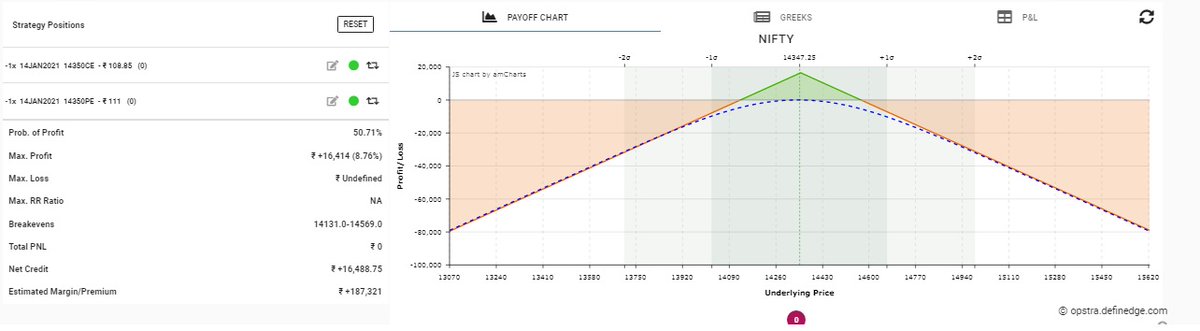

Thread on Short straddle with adjustments:

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)