#FreeTip

Finding Strike Prices to sell Options based on #Vix

Eg:

As on 15/06/21,

#Nifty 15869

#Vix 14.61

Days to expiry = 2

Exp Range = 15869 X (1-(14.61% / sqrt(365/2))) to 15869 X (1+(14.61% / sqrt(365/2)))

ie, 15697 to 16040;

Hence pe strike 15700, ce strike 16050;

More from HMK alias MANOJ

Today's move is an example of this tweet. Save this chart for future ref. https://t.co/amUhSLrET3

#FreeTip

— HMK alias MANOJ (@scorpiomanojFRM) June 23, 2021

A general rule to assess if a market is ranging is to look at developing TC and / or developing BC. If either of them is flat, it means market is currently ranging. If you are trading in 5 min, go to a lower tf chart, say, 2 min to have a less lagging assessment.

More from Optionslearnings

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

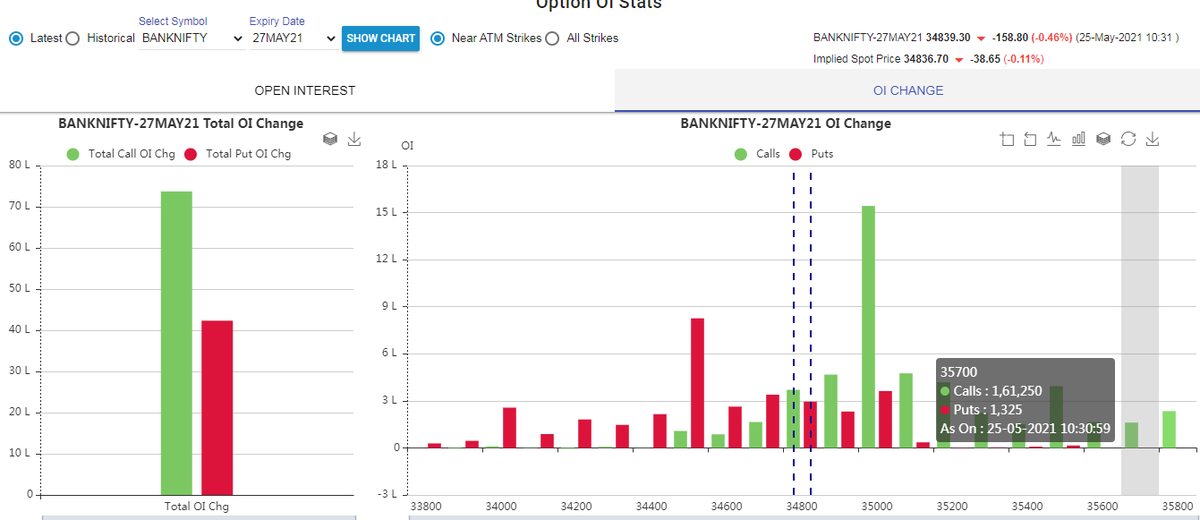

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

Collaborated with @niki_poojary

1. Best Sources of knowledge for a beginner in option selling?

Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

2. Top YouTube Channel for Options Learning?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

3. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high probability trades.

4. Risk Management is a must for option selling

If you don't learn to manage your risk, making money in trading is going to be an extremely difficult endeavor

Have some rules:

1. Risk no more than 0.25% per trade as a beginner

2. Risk no more than 2% in a day for the first year